Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.

Welcome to our regular portfolio systems analysis session. Today, we’re spotlighting the energy futures market, with a particular focus on the Gasoline Future @RB, traded on the NYMEX.

This market stands out for two compelling reasons: its high volatility and its hefty contract size. To give you an idea, a single price-point move equals $42,000 in value. With current prices near $2, the notional value of this contract soars above $80,000.

Clearly, this isn’t a market for every portfolio, especially since there are no liquid mini or micro contracts available to make it more accessible.

Now, let’s break down the two strategies we’re highlighting today.

Strategy #1: Multiday Trend-Following on Gasoline Futures @RB

This strategy uses a 15-minute time frame and runs during the standard 23-hour session from 6:00 PM to 5:00 PM (exchange time). It’s a breakout strategy designed to ride trends by entering trades when the highs or lows of the previous session are surpassed.

Figure 1 – Trade example from the trend-following strategy on Gasoline Futures @RB.

The entry setup is rounded out by two patterns sourced from our proprietary libraries. The cornerstone of this trading system, however, lies in its robust risk management and exit strategies. These include key elements such as stop loss, exit after a predetermined number of sessions, a breakeven stop, and a trailing stop. The trailing stop is specifically designed to secure partial profits once the trend starts to reverse.

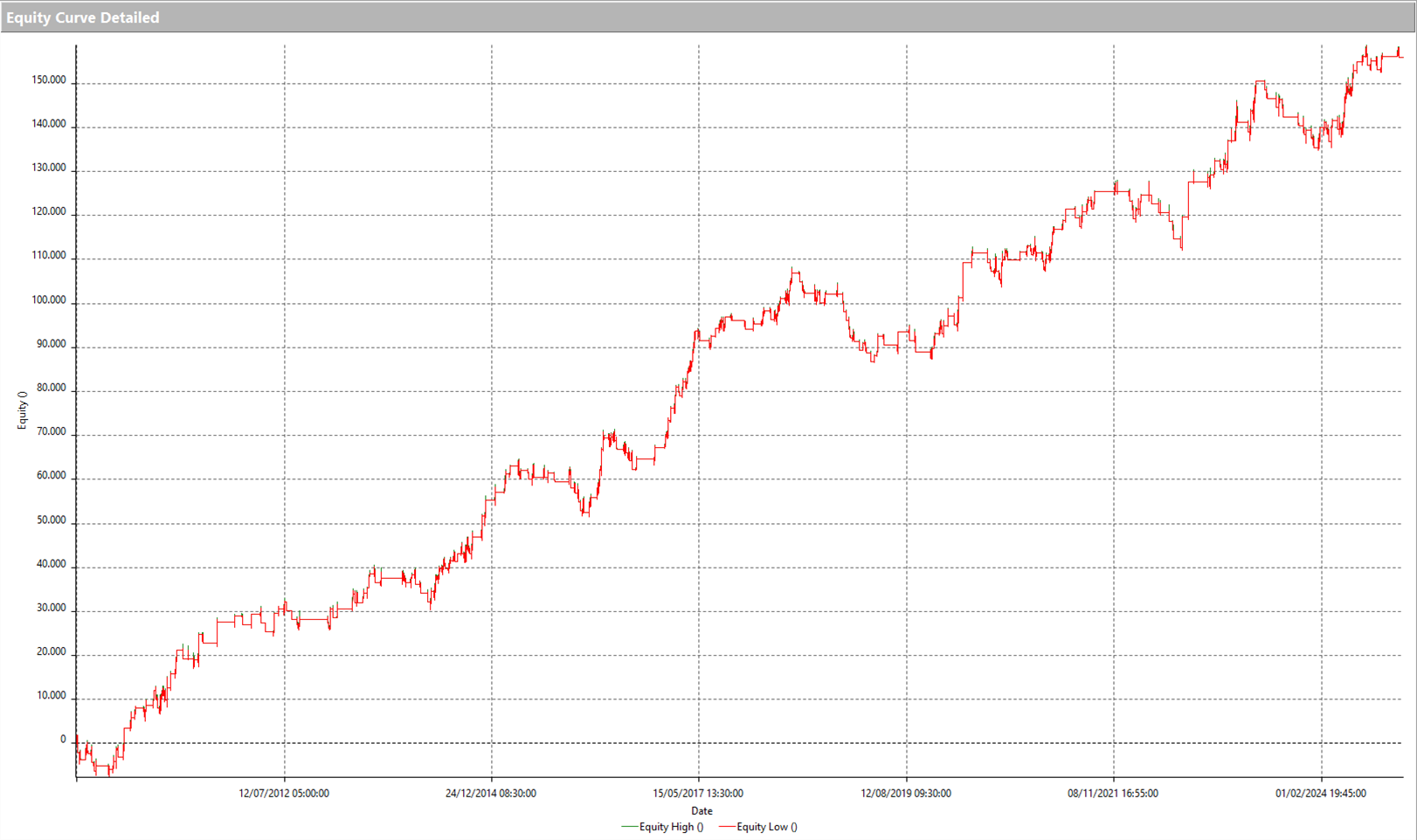

Take a look at the system’s equity line from 2010 to today. You’ll notice the curve’s consistent upward trajectory—a vital characteristic when dealing with such a large underlying contract.

Figure 2 – Equity line of the trend-following strategy on Gasoline Futures (@RB).

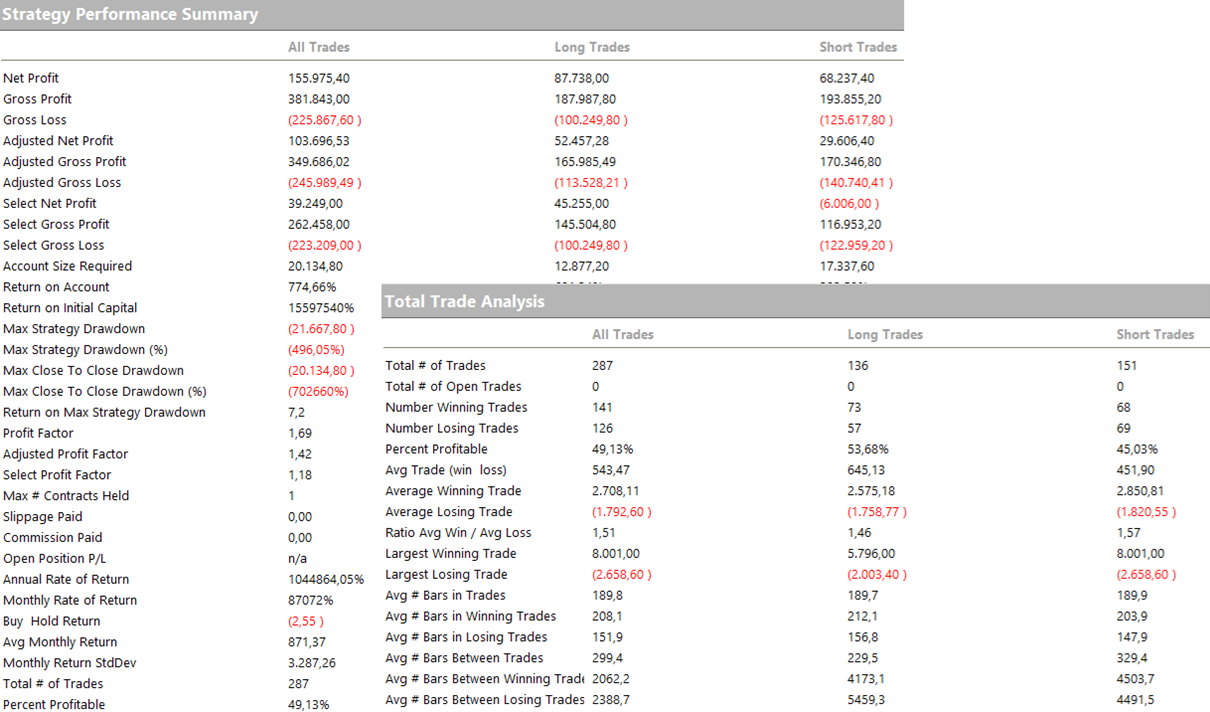

To gain deeper insights, let’s examine the system’s overall metrics. With a robust net profit of $155,975 and a maximum drawdown of about $22,000, the system shows remarkable efficiency considering the size of the underlying asset.

Even more impressive is the average trade, which exceeds $500. This comfortably offsets operational costs and accounts for the potentially higher slippage typical of volatile futures.

Figure 3 – Performance metrics of the trend-following strategy on Gasoline Futures (@RB).

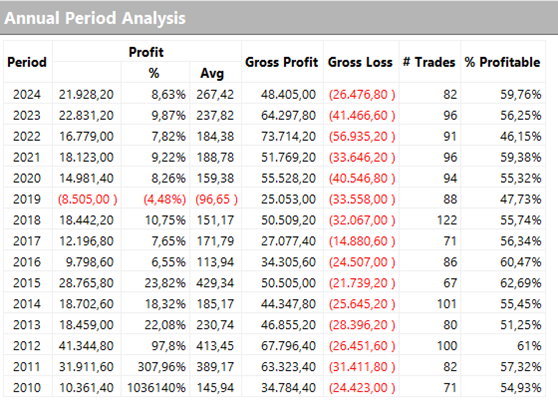

Lastly, the annual performance breakdown is equally impressive. The current year alone has delivered profits exceeding $18,000. While there were three years with marginal negative results, the system consistently delivered strong positive returns overall.

Figure 4 – Annual performance distribution of the trend-following strategy on Gasoline Futures (@RB).

Strategy #2: Intraday Bias for Gasoline Futures (@RB)

Let’s dive into the second strategy, which operates on a 60-minute timeframe and follows a logic we call "Bias."

In trading, "Bias" refers to a repetitive market pattern that can form the backbone of a systematic trading strategy.

For Gasoline Futures (@RB), we’re exploiting a fascinating trend: prices tend to climb starting in the midday hours and drop during the nighttime.

If left unfiltered, this system would execute trades daily. To refine it, we’ve incorporated two specific patterns and a trend filter, ensuring trades are executed only under the most favorable and profitable conditions.

Figure 5 – Example trade from the intraday bias strategy on Gasoline Futures (@RB).

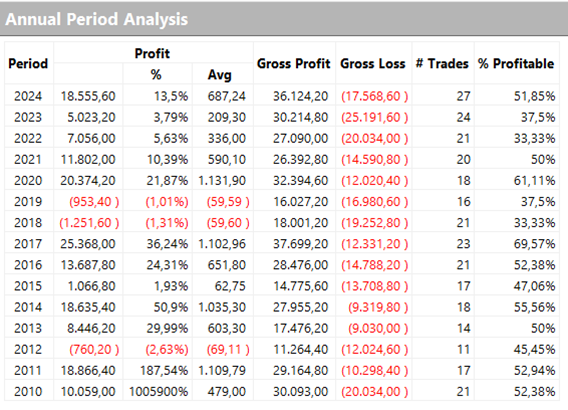

Now, let’s talk results. The equity line for this strategy is nothing short of impressive, with a steady upward trend across the historical data analyzed. And the last few years? Simply outstanding. In fact, the strategy hit its all-time equity peak, earning more than $20,000 annually in both 2023 and 2024.

Figure 6 – Equity curve of the intraday bias strategy on Gasoline Futures (@RB).

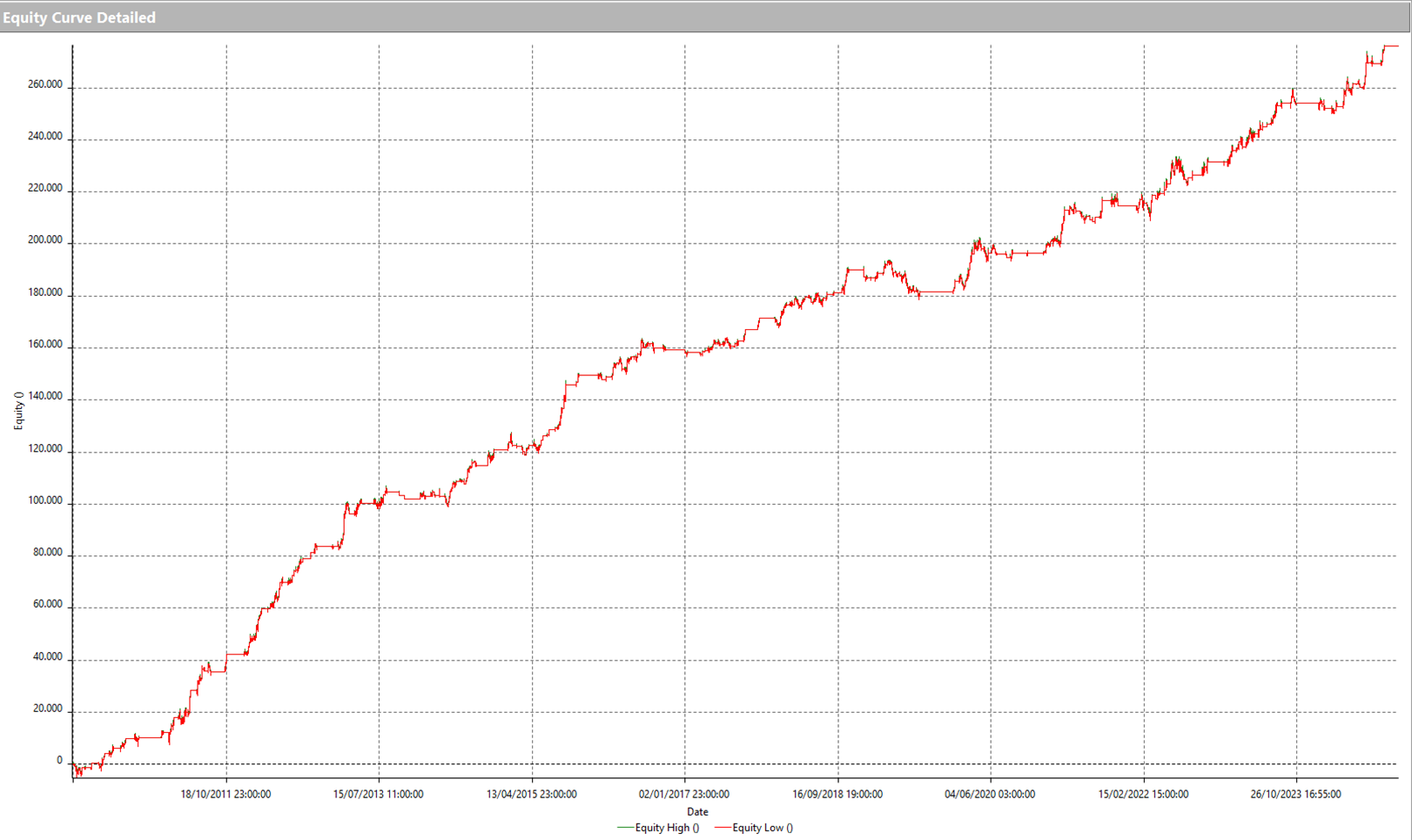

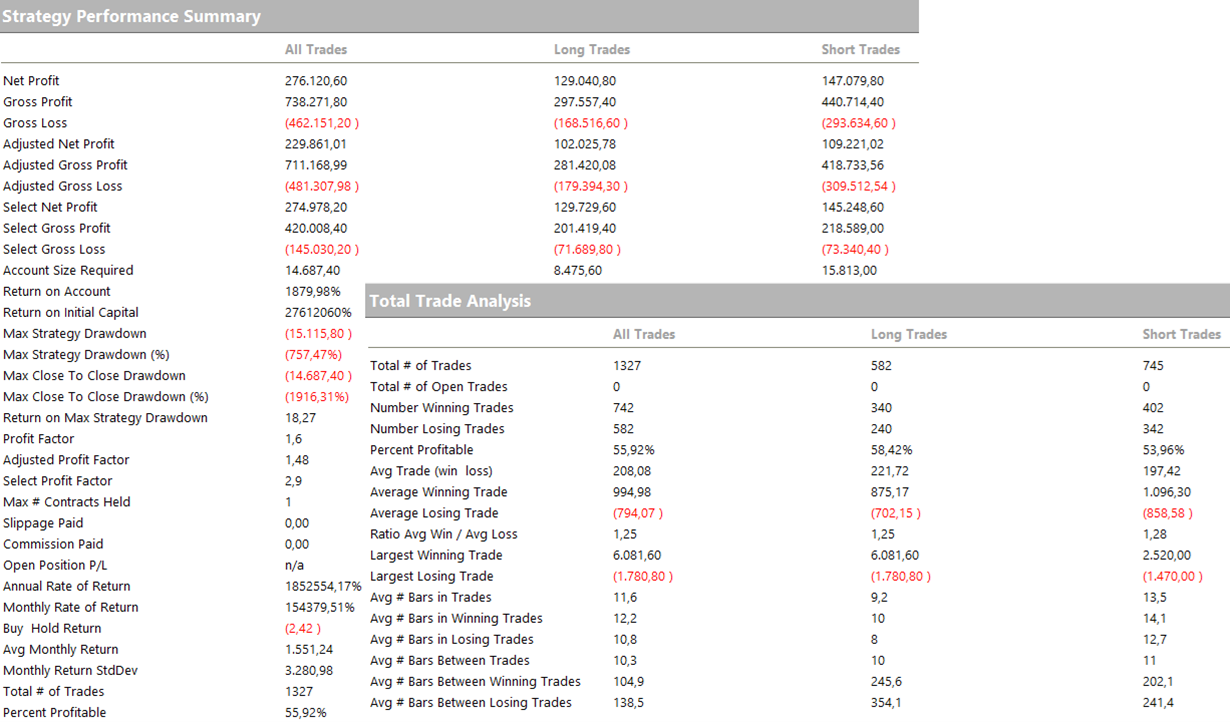

Diving deeper into the metrics, this system boasts a total net profit of approximately $276,000 from 2010 to today, paired with a maximum drawdown of just $15,000—a remarkably low figure given the volatility of this asset.

While the average trade profit is slightly lower than the previous strategy due to its intraday nature, it’s still substantial enough to trade with real money.

Figure 7 – Performance metrics of the intraday bias strategy on Gasoline Futures (@RB).

Figure 8 – Annual performance metrics of the intraday bias strategy on Gasoline Futures (@RB).

Wrapping Up: Two Proven Strategies for Gasoline Futures (@RB)

To sum it up, these two Gasoline Futures strategies showcase the unique strengths of complementary trading approaches.

The multiday trend-following strategy excels at harnessing sustained directional moves, delivering robust performance metrics and an appealing risk-reward ratio—even amid the inherent volatility of this market.

Meanwhile, the intraday Bias strategy demonstrates how a keen understanding of market behaviors can drive consistent, profitable outcomes on shorter timeframes.

Both strategies highlight the importance of disciplined risk management and a methodical, thoroughly tested framework.

Whether you’re an experienced trader or looking to level up your systematic trading game, these strategies can add valuable diversification to your portfolio.

That’s a wrap for today!

Until next time—happy trading!

Transcription

Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.