What does it mean to trade countertrend (or reversal) and why is this approach so popular?

In this guide, we’ll explain how to exploit a market retracement using practical examples. We’ll also show you the markets best suited to this approach.

What Are Countertrend/Reversal Strategies?

As the name implies, “countertrend” or “reversal” strategies involve trading a market opposite to the current trend.

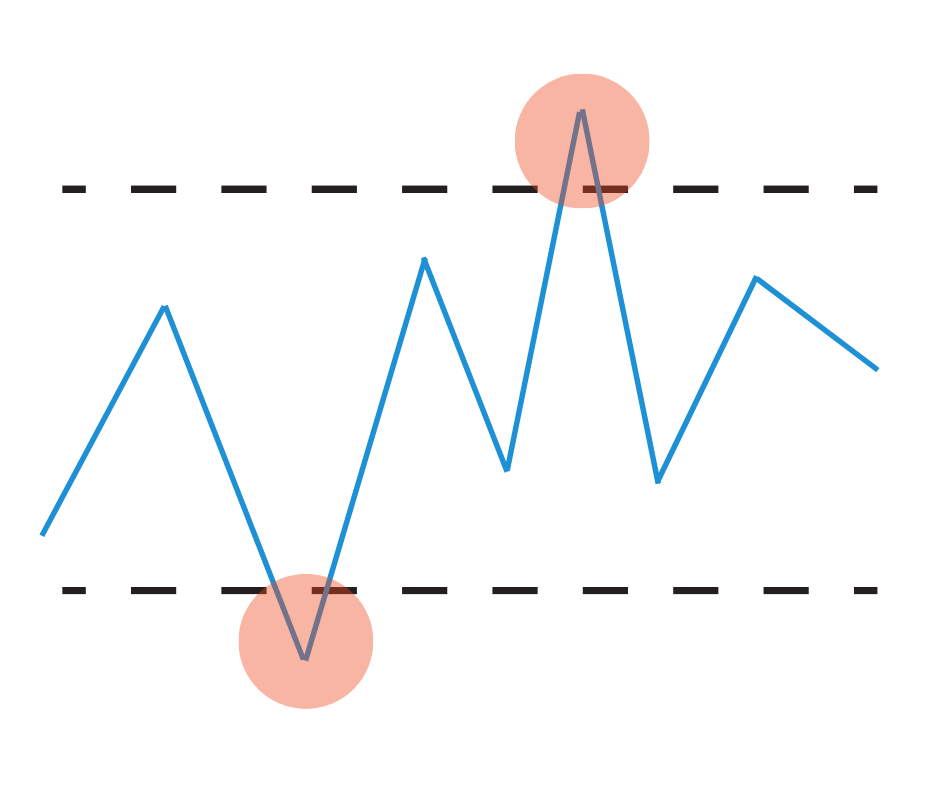

Counter trend strategies contrast the traditional “trend-following strategy” in which a trader rides trends like a surfer on a wave. Rather, they enter at peaks and valleys, expecting the price to return to a mean value.

The idea behind this approach is that the highest or lowest prices in a market are temporary and that, over time, each movement will tend to return to its mean value. It’s as if there is a center of gravity around which prices fluctuate.

The difficulty for countertrend traders lies in identifying the market reversal point. This is the point at which a trend begins to lose strength and change direction from bullish to bearish or vice versa.

But how can one identify a new movement to enter a countertrend? Let’s look at this together.

How a Countertrend/Reversal Strategy Works

A countertrend strategy is based on a search for reversal points, or the points at which a trend weakens and begins to change direction. Trends which reverse towards their mean value are called retracements.

To identify reversal points it’s first essential to understand trends and how they work (you can find all the information you need in this article).

Once the existence of an uptrend or downtrend is established, the right time to exploit the retracement must be identified. The peculiarity of countertrend systems is that they enter at points where there is an assumed reversal of the trend.

Why Do Trend Retracements Occur?

Generally, this occurs because of an imbalance between supply and demand that can generate a situation of high price inflation (overbought) or price deflation (oversold).

This causes the price to reverse once overbuying or overselling has occurred. In essence, countertrend traders try to identify the most likely resistance levels to enter short and the support levels to enter long.

Based on this principle, there are two ways to operate a reversal strategy:

-

Try to anticipate a trend reversal, for example by entering with Limit orders;

-

Enter only after the market has shown a trend reversal signal, for example, with Market orders, or by entering with Stop orders at breakout after reversal patterns.

If the differences between the various types of orders aren’t clear to you, we recommend you read our guide.

Indicators and Technical Countertrend Signals

The difficulty, as we said before, is to choose the right moment to enter the market. Specific indicators and technical signals can be used to facilitate this decision. Let’s look at them together.

Without going into any undue technicalities, several indicators and technical signals can be used to detect trend reversals, such as:

-

Trend line breakouts

-

Channel edge breakouts or envelope channels (such as Bollinger Bands)

-

Reversal patterns and models (such as double or triple highs/lows, head and shoulders, wedges, diamonds, failure, and non-failure swing patterns)

-

Momentum and volume oscillators (such as RSI, ROC, CCI, Stochastic, Williams %R, MACD)

-

Crosses between price and moving averages.

More extensive information can also be obtained by combining several instruments. Reversal signals never give certainty but suggest the probability that a trend is about to reverse. In addition, there can be false reversals before the trend changes.

In some cases, a sharp collapse (for example, in the price of a stock) may indicate a more serious situation that is unlikely to lead to a trend reversal.

Therefore, with risk management in mind, we suggest that you always set stop losses to protect yourself in case the trade doesn’t evolve as desired.

The Markets on Which to Use Reversal Strategies

Countertrend strategies apply well to markets with mean-reverting characteristics. These are markets that tend to rapidly change direction, oscillating around the mean. Typical examples are highly liquid and efficient markets such as equity indexes, the Bund, the TY and the ES.

Our suggestion is to always analyze the specific characteristics of the market you wish to trade before investing your money. Indeed, there may often be markets that respond well to different types of logic, such as Crude Oil or the Dax, which, as we’ll show you in these links, can be traded either with reversal, trend following or bias strategies.

In many cases, choosing which strategy to adopt primarily depends on your risk profile. Never underestimate this aspect of trading, as risk management is critical in any trading strategy.

Market Examples

As we’ve seen before, countertrend strategies apply well to all markets characterized by high efficiency and liquidity, such as the S&P 500.

In the video below, one of our coaches at Unger Academy shows two intraday and multiday reversal strategies in our portfolio that have performed very well by exploiting a well-known pattern in the S&P 500. By watching the video you’ll discover the rules of our strategies as well as their real performance. Don’t miss it!

Conclusion

Countertrend or reversal strategies, as the name suggests, trade the market in the opposite direction from the current trend. The idea behind these strategies is that prices always tend to return to their mean value. Therefore, if there is an uptrend or downtrend, countertrend traders will expect a rebound in the opposite direction.

The difficulty in this type of strategy is choosing the right entry point. A variety of indicators and technical signals can be used to determine entry points. Remember, however, that no indicator can give you the certainty of how the market will move but only the probability of a new movement.

The only way to protect yourself, therefore, is through wise risk management and good money management.