Options trading can be a great way to diversify and protect one’s portfolio. Options are highly flexible instruments used in speculative strategies and risk management to hedge one’s positions.

In this guide to options trading, we’ll discover the basics, some pro tips, and the best markets to trade. In addition, we’ll show you the backtest of a strategy that performed very well in periods of high volatility thanks to a “black swan” protection mechanism.

What Is Options Trading?

Before approaching the topic of options trading, it is necessary to clarify the financial definition of “options.” “Options” are contracts that allow you to trade on the future price of a financial instrument, giving you the right, but not the obligation, to buy or sell the underlying asset by a specific expiration date at a predetermined price.

These are, therefore, derivative products, but unlike others, such as CFDs, they have an expiration date.

We can imagine the maturity of an option like a car lease. When entering the contract, one does not buy the asset but defines the price that may be paid at maturity to redeem the asset.

Similarly, a trader can decide whether or not to exercise the buy/sell option on the chosen asset.

How Options Trading Works

In options trading, the option “holder” or “buyer” enters into a contract with the seller (“writer“) that gives them the right to buy (“Call option“) or sell (“Put option“) an underlying asset at a particular price (the “strike price“) within a certain time limit. When that time limit is reached the option is “mature.”

It’s important to point out that buying an option doesn’t mean buying the asset. If, for example, you buy an option on Microsoft stock, you won’t have any stocks in your portfolio, but you’ll option the right to buy/sell at the strike price at maturity.

For the trader, the strike price represents the threshold above or below which a profit can accrue: should it be cheaper at expiration than the market price, then the holder can make a profit by exercising their Call or Put option.

If, on the other hand, the strike price is less convenient, the holder will have the option of letting the contract expire. In either case, the holder will have to pay a “premium” to the writer.

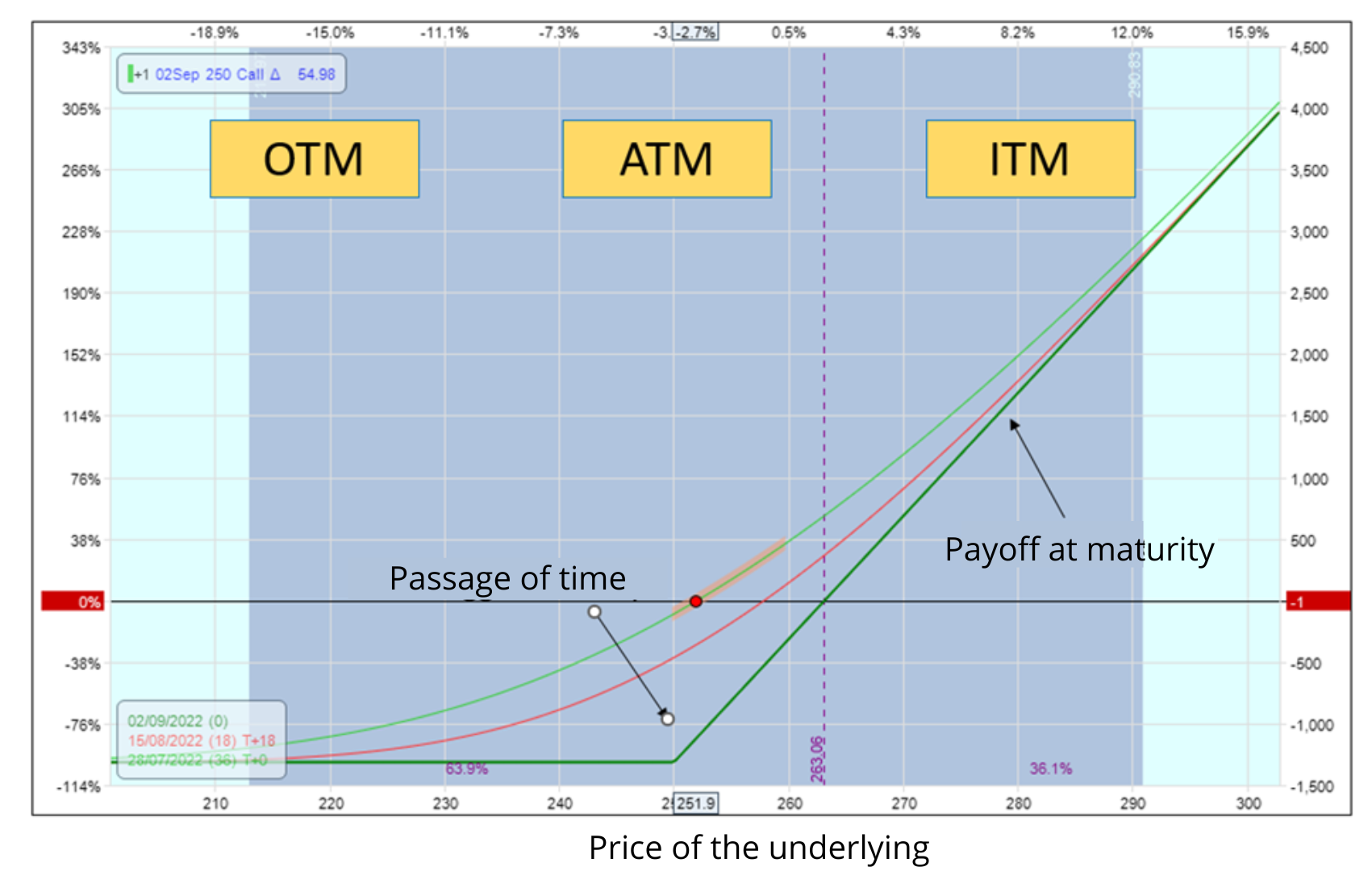

In technical terms, the amount the holder would earn if he/she exercised the contract is called the “payoff.” The difference between the strike price (K) of the option and the market price (P) of the underlying asset is called the “moneyness”.

Depending on the ratio of K to P, three different situations may occur:

-

“In the money” (ITM): K is cheaper than P, so the buyer can make a profit by exercising his call/put option.

-

“Out of the money” (OTM): K is less convenient than P, so the buyer is better off letting the option expire.

-

“At the money” (ATM): K and P are almost the same, so the choice depends on the individual buyer’s strategy.

The “convenience” of the strike price relative to the market price depends on the type of contract. In the case of a Call option, you’ll make a profit if P is greater than K (so you’ll buy at a lower price), while in the case of a Put, you’ll make a profit if P is less than K (so you’ll sell at a higher price than the market price).

Let’s take a closer look at how the two options work.

Call Options

A call option gives the right to buy an underlying asset at the strike price by or at maturity. This type of option is entered into when a bullish movement is expected: the higher the market price, the greater the profit for the trader.

Imagine, for example, that we buy a call option on Microsoft stock at $100 each with maturity at one month. If at maturity (or, in some contracts, by maturity), the P of Microsoft shares exceeds the strike price, we’ll make a profit; vice versa, we can let the option expire.

Put Options

A put option is a contract that gives the right to sell an underlying asset at a strike price K by or at maturity. This option type is entered into when a bearish market trend is expected.

Returning to the example above, we could sell our Microsoft stock at the K price of $100 when P is below that threshold; otherwise, we’ll let the option expire.

Type of Options

There are different options, such as American, Asian, European, barrier, binary, and many more. According to a 2018 ESMA regulation, the latter has been banned for non-professional traders.

Binary options are very risky instruments, which, as you can find out here, are more like gambling, as they are mathematically disadvantageous.

From a time perspective, you can choose from daily, weekly, monthly, or quarterly options.

Options Trading: in What Markets?

It is possible to do “options trading” in many markets, such as bond options, stock options, Futures, Market Indexes, Forex, commodities, and even options themselves or other derivatives.

Generally, those who choose to trade options seek to exploit the volatility of the markets. For this reason, it’s often said, “trading options means trading their volatility.”

This is especially true for the sale of naked options, which is extremely profitable when volatility is high.

Options Strategies: “Income” and “Hedging”

Most traders use options for speculative purposes. In addition to income strategies, options can also be used to diversify and protect one’s portfolio.

Options allow one to hedge a position as a parachute. Should the forecast be wrong, it’s always possible to let the contract expire by only paying the premium.

Therefore, these are also beneficial instruments for hedging.

In the following video, we show you the backtest of the Iron Shark strategy.

It’s a delta-neutral options strategy with a protection mechanism against “black swans”.

As you’ll see, in 2021 (a particularly turbulent year for the markets), this strategy realized a return of over 80%. Don’t miss it!

Conclusion

Options are extremely attractive instruments that can be used to make more profit and hedge your positions. When you buy a call or put option, your risk is limited to the premium you have to pay to open the position. This allows you to increase the diversification of your portfolio without risking overexposure.

It’s essential, therefore, to be familiar with these instruments to make the most of their full potential.