More and more traders are abandoning discretionary trading in favor of algorithmic trading. But why is algorithmic trading so advantageous? In this guide, we’ll give you a concise overview of the main features, operations, and advantages of the algorithmic approach. In addition, we’ll show you how to start from scratch by creating a very simple system to send orders automatically on the Mini S&P500.

What Is Algorithmic Trading?

Algorithmic trading, or “algo trading,” is a type of trading in which, as the name suggests, strategy instructions are coded through an algorithm. It’s also referred to as “quantitative” or “systematic” because the execution of orders is done automatically through computerized systems and codes called ‘trading systems.

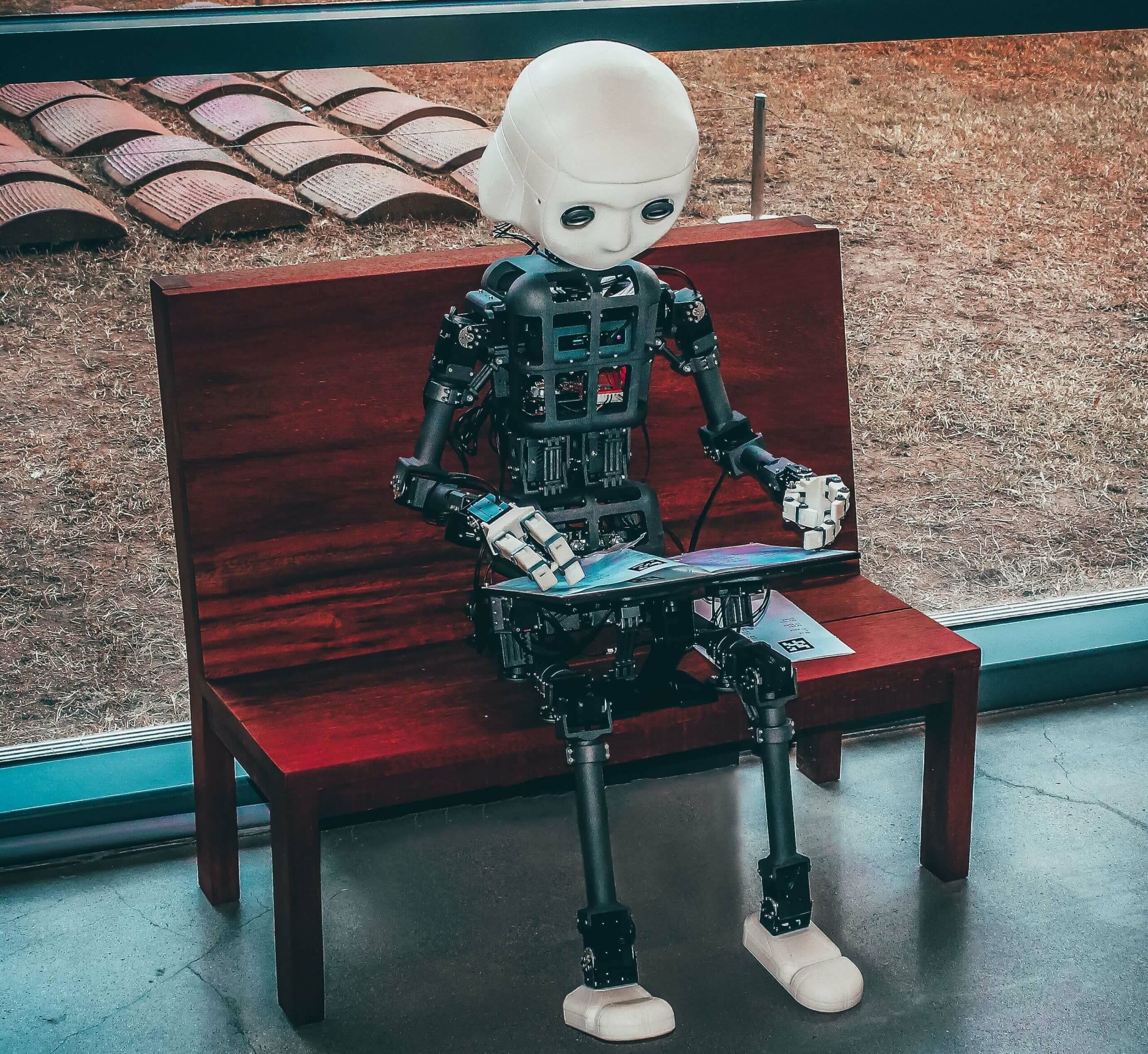

In this approach, daily trades are delegated almost entirely to the computer that executes instructions encoded by the trader.

We can imagine a systematic trader as a captain who sets up and supervises an airplane on which he has engaged the autopilot. The captain’s knowledge and skills are critical to properly set the path of the plane, just as it’s critical for a trader to have the right training to properly develop and manage their trading systems.

How Algorithmic Trading Works

Algorithmic trading is based on codes and systems called “trading systems”.

A trading system is a set of rules that determine when and what orders to send to the market to open or close a position based on precise parameters (such as price patterns) preset by the trader.

The moment the specific conditions of a market meet the predefined criteria, the algorithms automatically execute the buy/sell order. This means that traders don’t need to stand in front of their computers 24/7.

As you can guess, this greatly increases the ability to trade on a variety of markets simultaneously, and reduces fatigue, stress and human error.

Algorithmic trading allows one to significantly increase the diversification of one’s portfolio, which is much more difficult for a discretionary trader.

Your choice of software is essential to the success of your trading strategy. If you don’t know how to do this, click here to learn how to choose and install the software from scratch.

7 Advantages of Algorithmic Trading

Algo trading offers many advantages over discretionary trading, including:

-

1. Frees the trader from screen slavery: A discretionary trader is forced to spend hours in front of a monitor, which results in physical and mental fatigue. In algorithmic trading, on the other hand, the operational part is left to the machine.

-

2. Reduces human error: Stress, fatigue and distraction can lead the discretionary trader to make mistakes that are often serious. Algorithmic trading, if done correctly, greatly reduces the chance of error and allows for better money and risk management.

-

3. Has less emotional impact: The discretionary trader acts and reacts in real-time to market stimuli, making instinctive decisions, often dictated by fear or greed. In contrast, in algorithmic trading, everything is planned in advance, which allows for better execution of the trading plan.

-

4. It’s objective, quantifiable and codifiable: Discretionary trading is based on the individual trader’s instinct, so it can’t be translated into rules. In contrast, algorithmic trading is objective, quantifiable and codifiable into a series of machine-executable orders.

-

5. It’s extensible: Algorithmic trading is based on a scientific method that can be applied to different markets and timeframes.

-

6. It’s transmissible: While discretionary trading relies on the intuition and personal talent of the individual trader (gifts that cannot be “transferred”), the algorithmic approach relies on a method that can be taught, transmitted, and learned.

-

7. It’s testable: Systematic strategies are based on a method that can be tested and verified, while discretionary trading can’t be tested.

Main Types of Trading Systems

The main types of trading systems include:

-

Trend following: This type of system exploits the strength/weakness of a market and consists of riding an ongoing trend, as a surfer does with a wave. In trend following, one follows the direction the market takes, whether bullish or bearish and tries to exploit the market’s movement as much as possible.

-

Countertrend / Reversal: In these systems you enter against the direction of the market, assuming a reversal of the trend.

-

Bias: These systems rely on statistics and historical data to exploit certain repetitive behaviors of a financial instrument. Bias systems are particularly well suited for markets like commodities that are greatly affected by seasonality.

-

Swing Trading: In this type of system, an attempt is made to exploit the “elastic” movements of the market. In other words, having identified a particular movement, it is assumed that there will be a shift (in technical terms a “pullback”) and then a return to the initial direction. These types of systems work very well in extremely volatile markets.

Which Platforms Are Suitable for Algorithmic Trading?

There are several platforms for creating trading systems, each with different features and functions. The choice, therefore, depends on the goals, characteristics and needs of each trader.

Here are the main platforms:

-

MultiCharts: easy to program, great at real-time management and allows you to choose different brokers.

-

TradeStation: extensive historical data library of its own, easy to program, and a large community. It doesn’t, however, cover all markets.

-

Pro Real Time: very simple programming language, a large community, and easily accessible online. To date, however, it doesn’t allow the import of external data.

-

Python: fast and inexpensive. However, it wasn’t designed for trading, and the programming language can be complex.

In the following video, one of the coaches at Unger Academy explains how to set up and integrate TradeStation, MultiCharts, and Interactive Brokers’ TWS. Plus, he shows you all the steps to put an automated trading system on the Mini S&P to market via a very simple code. Don’t miss it!

Conclusion

Algorithmic trading represents a scientific approach to trading. It’s based on the use of precise algorithms that encode instructions entered by the trader and automatically send orders to the market.

In this way, the trader isn’t forced to stand 24/7 in front of a screen as is the case in discretionary trading. Thanks to algorithmic trading, it’s possible to trade simultaneously on a multitude of markets, with different approaches, strategies and timeframes.

This makes it possible to greatly improve one’s portfolio diversification and risk management.