“Trend is your friend” is a famous saying, but what are market trends and how can they be recognized and exploited to create effective trading strategies?

In this article, we’ll answer these and many other questions to give you practical advice that can seriously affect the outcome of your trading strategies.

What Are Market Trends?

A trend is a general tendency towards a particular value. Market trends are the tendency of prices to shift in a certain direction. These trends can be evaluated in order to predict future market behavior and develop trading strategies.

As we’ll see, a trend can be identified by analyzing its highs and lows and can take several directions.

Based on the type of trend, we can have three macro market categories:

-

Trending: These are markets with pronounced and prolonged trends. In this type of market, there are often prolonged increases or decreases in prices along rising (uptrend) or falling (downtrend) lines. These are markets that rarely trend sideways (such as commodities) and are suitable for trading using trend-following strategies.

-

Counter-trend: These are markets with strong mean-reverting features. In these markets, we often find trend reversals within predefined time intervals. The movement is mostly zigzagged, as opposed to linear, and the market is much more liquid (such as Bund and S&P500). These markets are well suited for counter-trend strategies.

-

Volatile: These markets are characterized by sharp, fast movements and rapid price rebounds.

How to Identify an Ongoing trend?

To verify the presence of a trend, it’s necessary to analyze, based on a precise logic, the high/low price levels of a market.

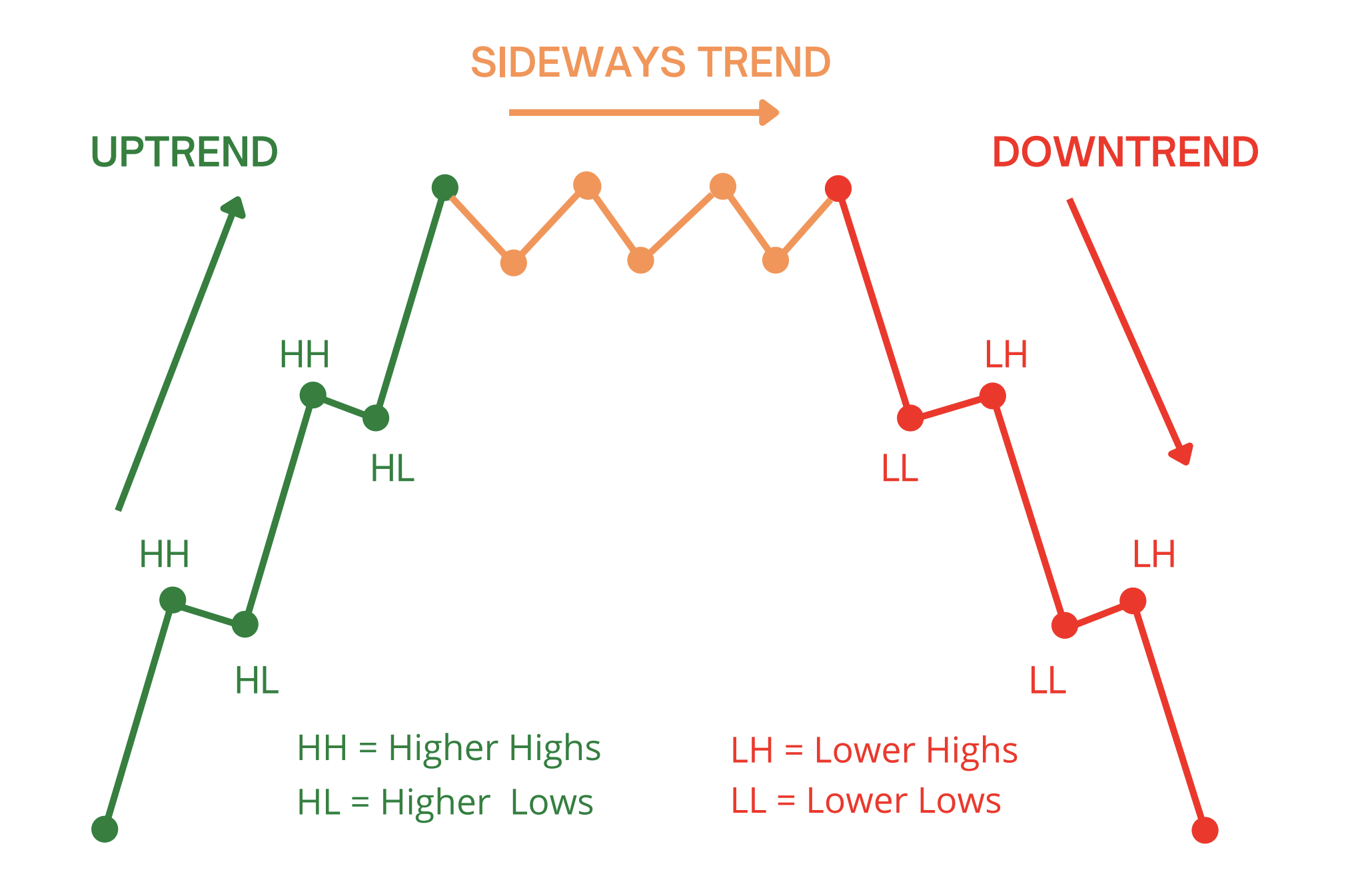

Contrary to popular belief, a trend can move in one of three directions:

-

Uptrend, if highs and lows are increasing

-

Downtrend, if highs and lows are decreasing

-

Sideways trend, if highs and lows are consistent or horizontal.

A trend can be long, medium, short, or very short-term. Long-term trends are classified as ‘primary trends,’ medium-term are ‘secondary’, and short-term trends are ‘tertiary’.

It’s important to keep this concept in mind because the same market price can manifest multiple simultaneous trends when analyzed at different time horizons.

Let’s look at an example.

Suppose that over 3 years the market price we’re monitoring has steadily increased. In this case, the primary trend is undoubtedly bullish (uptrend). In the 3 years, however, there may have been months when there was a secondary bearish trend (downtrend) and days when there were alternating bullish and bearish tertiary trends.

To better explain this concept, the metaphor of a tree is often used where the primary trend is the whole plant, the secondary trend is the branches, and the tertiary trend is the leaves, each with its own direction.

Technical Analysis and the Use of Indicators

Among the most widely used tools in trading to check the presence, strength, and direction of trends are indicators, which are instruments specifically used in technical analysis to examine price trends.

Here are some useful indicators for assessing market trends:

-

Simple moving average

-

Exponential moving average

-

MACD

-

ADX

-

Parabolic SAR

Among these indicators, the 100-day and 50-day simple moving averages are undoubtedly the most widely used. These are two lines that – as the name suggests – indicate the average price value at 50 and 100 days. The use of these lines is very simple: if the average at 50 days intersects the average at 100 days from above, then there is a potential bullish trend; conversely, if the intersection occurs from below, then it could mean that the trend is reversing, so it would be better to exit the position.

Other widely used technical analysis instruments are continuation and reversal patterns, and so-called channel breaking, which can be useful especially for markets with mean-reverting features.

It should be pointed out that the use of indicators provides no mathematical certainty because, as we know, it’s impossible to predict the future.

Although indicators are typically associated with discretionary trading, they also find use in systematic trading, where they can be used both as entry triggers and as operational filters.

To learn more about how to use indicators in systematic trading, check out this article: Indicators in Trading – What They Are and How to Use Them.

Why Do Trends Develop: Macroeconomic and Social Factors

Contrary to what you may think, a trend doesn’t develop only for economic reasons. Indeed, there are some factors that we might call “social” that can influence the life of trends.

The three most common factors are:

-

Herd effect: Many traders tend to ride a trend when many traders are already trading it. This reinforces and prolongs the trend.

-

The need for validation: Many investors buy assets that are already performing well or sell those that are experiencing declines. This causes trends (bullish/bearish/sideways) to develop further.

-

Risk management: Those with a low-risk profile tend to sell in downtrend markets (also due to stop losses) and buy in uptrend markets, affecting the persistence of the trend. Conversely, those with a higher risk profile tend to move in the opposite direction, leading to the development of counter-trend movements.

Conclusion

Trend identification and analysis are the basis of any trading strategy. Indeed, the characteristics of trends and asset price movements are what determine the nature of different financial markets.

This is why knowing how to recognize a trend is so important.

It is only by thoroughly understanding what market trends are, how they develop, and how they can be intercepted that you will be able to build trading strategies that are truly effective and suitable for the market you want to trade.