Cryptocurrencies are one of the hottest topics in the investment world in 2025.

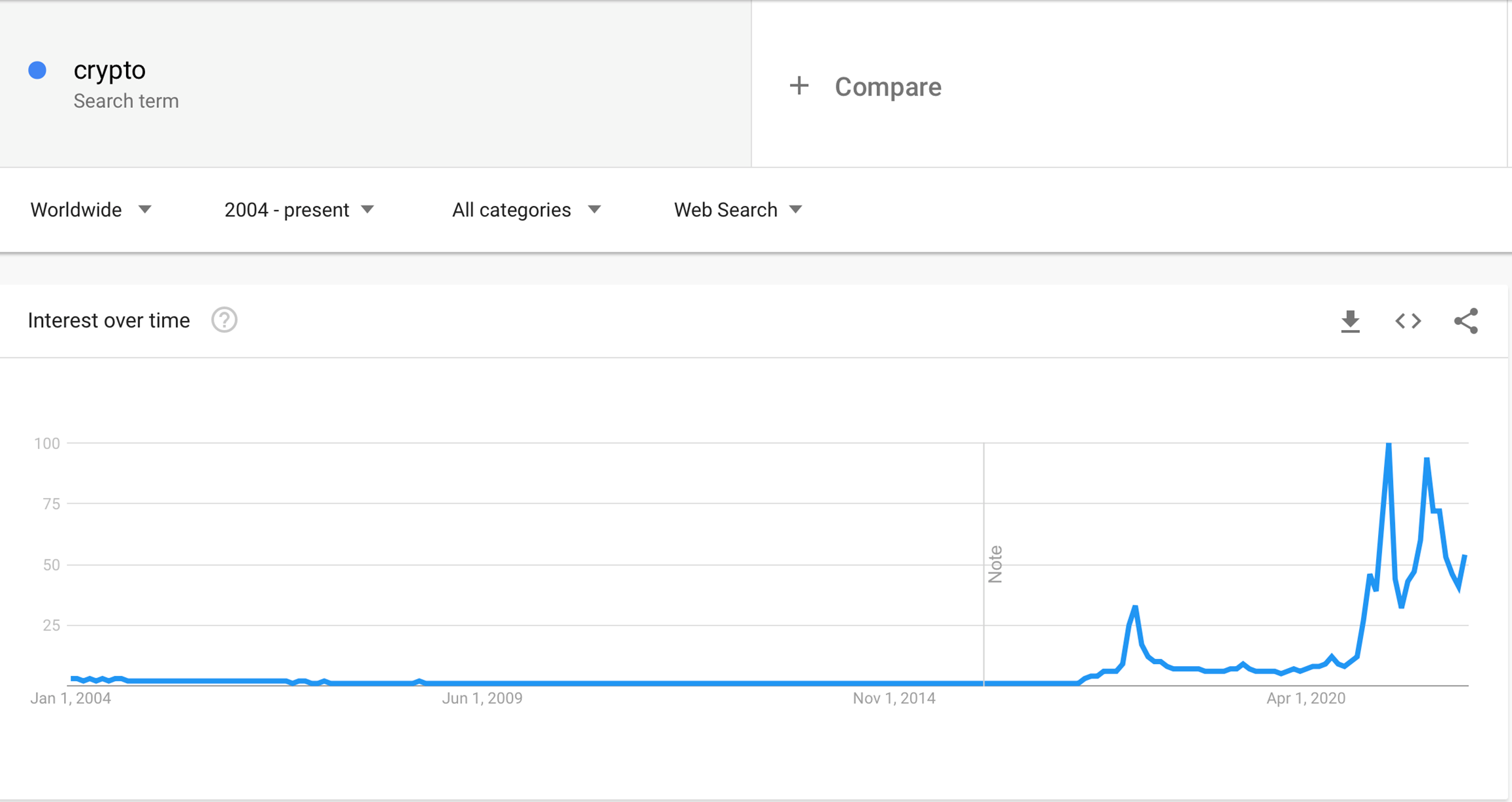

This image alone shows that interest in the topic has exploded over the past few years:

As shown in the chart, prior to 2018 crypto was in the domain of computer experts, nerds, and enthusiasts, while recently it’s become a topic of interest for many people.

Facilitating this impressive growth in popularity is the promise of wealth to anyone who invests in crypto.

Stories of “crypto-millionaires” still abound in 2025. Ordinary people suddenly accrued extreme wealth thanks to the skyrocketing value of their Bitcoin portfolio. Inevitably, many wonder if it would be worth investing in these new financial instruments.

The truth is, while the cryptocurrency market is full of possibilities, it presents several pitfalls.

In this article, we’ll delve into how you can make money with cryptocurrencies. We’ll focus on the potential gains offered by cryptos, the correct approach to investing in these markets, and how to move more consciously and safely into this new world.

First of All, What Are Cryptocurrencies?

Despite their great popularity, cryptocurrencies remain a rather obscure topic for many people. So, let’s try, in a few words, to explain what cryptocurrencies are and how they work.

A cryptocurrency (also referred to as crypto) is a digital currency that uses cryptography to protect and validate transactions through a network of ‘nodes’ (or computers) that guarantee the validity of the transactions.

Cryptocurrencies, to date, aren’t regulated or issued by a central authority but instead use a decentralized system to record transactions and issue new currency. This system is called blockchain and is intended to enable secure transactions without the need for intermediaries such as banks.

Some cryptocurrencies are part of DeFi (Decentralized Finance), which is a set of financial services offered through decentralized structures, as opposed to services offered by traditional banks and institutions.

Another very important thing to consider when approaching the world of cryptocurrencies is that it is an unregulated market.

Unlike futures, stocks, or other assets listed on traditional exchanges such as the CME or COMEX, there are no authorities to guarantee the safety of investors. Therefore, it’s extremely important that you do the research yourself before you start trading in this market.

An Amazingly Vast World

In addition to Bitcoin, the queen of the crypto world, there are more than 10,000 altcoins (i.e., cryptos different than Bitcoin). The best known and most capitalized is undoubtedly Ethereum, followed by Tether, USD Coin, BNB, Ripple, and Cardano.

To invest and trade in these instruments, you need to go through a cryptocurrency exchange, which is an intermediary that performs the dual function of broker and crypto trading exchange.

There are many exchanges, the most notable of which are Binance and Kraken. In this article you can find a list of the best exchanges and some useful tips for choosing the exchange best suited to your needs.

In addition to enabling you to trade spot cryptocurrencies, or real digital currency markets, exchanges also offer derivative products such as futures and options.

If you’re interested in trading these derivatives (for example, to implement complex investment strategies such as Cash and Carry) keep in mind that these products have different characteristics depending on the exchange on which they are listed. This means that, for example, Binance’s Ethereum futures might have different characteristics, costs, and margins than Kraken’s Ethereum futures.

Lastly, we’d like to point out that there are also some regulated crypto futures listed on the CME. Specifically, futures on the two largest cryptocurrencies by capitalization: Bitcoin and Ethereum.

If you want to learn more about the wide variety of instruments offered by the cryptocurrency market and which ones to choose based on your investment and trading goals, we’d recommend you watch this interview with Andrea Unger and Debora Rosciani, journalist and host for Radio 24 (IlSole24Ore group), Italy’s top financial radio station.

Earning with Cryptocurrencies: Is It Really Possible to Get Rich?

Given the many stories (real or purported) of people who’ve gotten rich with cryptocurrencies, you might wonder if you can do the same. If it is possible, how would one go about making money with crypto?.

Let’s start by saying that most of the “crypto-millionaires” we hear about are people who invested in the early days of coins such as Bitcoin and, years later, found themselves with millions of dollars (suffice it to say that in October 2010 a Bitcoin was worth $0.10).

This leads us to highlight two important points. First, it’s impossible to predict which of the more than 10,000 cryptos currently present on the market will undergo a Bitcoin-like price surge, making millionaires of its investors.

Second, even if we were lucky enough to detect a hot crypto, we’d hardly be able to keep the investment open for years without withdrawing our earnings.

Suppose you invest $1,000 in an altcoin that increases its value 50 times in five years: would you be able to avoid cashing in on your gains when they reach $10,000, $20,000, or $30,000?

If you want to learn more about easy gains with cryptocurrencies, we’d recommend you watch this interview between Andrea Unger and journalist Debora Rosciani.

How to Make Money with Crypto

As you may have guessed, investing in crypto isn’t as easy as it sounds, especially if your goal is to do it seriously and consciously, and not as a form of betting or speculation.

Investing a large sum of money in a supposedly promising cryptocurrency is more of a gamble than a conscious investment.

Just think of the Luna/Terra case, the crypto that lost all of its value within 48 hours. Anyone who invested their savings in this altcoin saw their money evaporate in a matter of hours. The damage was so severe that Reddit hosted a hotline to support those who lost everything as a result of this collapse.

If you intend to invest consciously in cryptocurrencies, then you just don’t want to bet on what you think is the winning horse.

You’ll have to do some research, study the crypto world and opt for an investment mode that allows you to make money regardless of the trends in these instruments.

In our opinion, this mode is obviously trading. While Buy and Hold (buying and holding crypto until the price goes up) exposes you to market crashes and drawdowns, by adopting proper trading strategies you can ride the crypto price movements while considerably limiting drawdown and losses in case of price crashes or reductions.

In this interview, once again with Radio24’s Debora Rosciani, Andrea Unger proposes an effective trading approach to crypto:

Conclusion

Cryptocurrencies are an incredibly vast market, and can offer many income opportunities for those who wish to study, do the research, and start investing consciously and attentively.

Moreover, since it is now a full-fledged asset on par with futures, stocks, bonds, and commodities, cryptos are an excellent option for increasing the diversification of one’s investment portfolio.

If you’d like to learn more about cryptocurrency trading, don’t miss the webinar prepared on the topic by one of the coaches at Unger Academy: How to Build Trading Systems for Crypto That Have 45-Degree Equity Lines.

This is a free video in which our coach talks about the crypto approach that gave him a 277% return on crypto markets in 10 months.