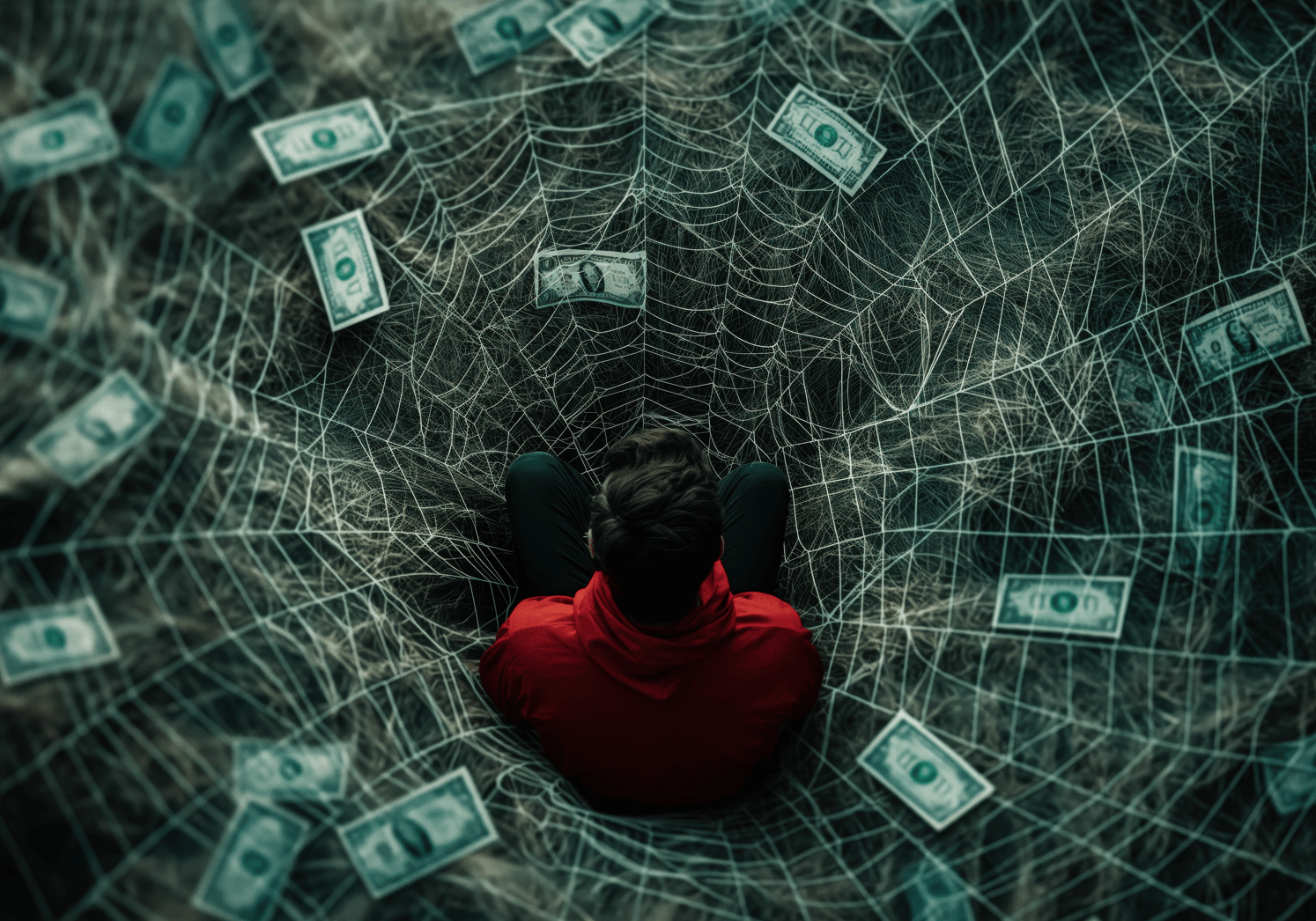

“Start making money fast, with just a few hours a day…” Sounds tempting, right? But guess what? This is exactly the kind of promise that often leads straight into one of the most common financial scams out there!

Financial scams are becoming more sophisticated every day, targeting people of all ages and financial backgrounds—no one is exempt. With the rise of new technologies and online transactions, scammers have a broader reach and new ways to trick unsuspecting victims. They’ve honed their methods to prey on people’s trust and lack of financial know-how.

In this article, we’ll take a close look at the most common financial scams, like phishing, Ponzi schemes, credit card fraud, and bogus investment opportunities. But before we dive in, here’s a quick reality check: anyone can fall victim. Scammers don’t care who you are, as long as they can pull off their scheme. That’s why this guide will arm you with the knowledge to recognize a scam and shut it down before you become the next target.

What Exactly Is a Financial Scam?

A financial scam is any fraudulent scheme designed to deceive people out of their money or personal information. These scams can take many forms—fake investments, bogus loans, credit card fraud, phishing attacks, or pyramid schemes.

Scammers often take advantage of a person’s trust, naivety, or lack of financial knowledge, promising quick profits or other unrealistic benefits. Unfortunately, technology has also made it easier for scammers to operate, keeping them one step ahead and making it harder to spot their tricks.

Our advice? Always stay alert for red flags, even the subtle ones. Be skeptical of promises like high returns with zero risk, pressure to invest quickly, or unsolicited requests for your personal information.

4 Types of Financial Scams You Should Know About

As we mentioned earlier, financial scams come in many different shapes and sizes, but some are more dangerous than others. Here are four of the most common types of scams that could cost you a lot of money if you’re not careful.

Fake Companies Offering Phony Investments

The first scam we’ll cover involves fraudulent companies that create fake investment opportunities, promising fast and high returns. These scammers usually use names or websites that look just like legitimate financial institutions, making it easy to fool people who aren’t paying close attention.

Once they have your money, they vanish without a trace, making it nearly impossible to recover your lost funds. These scams often succeed because people fail to verify the legitimacy of the company. That’s why it’s essential to always double-check the credibility of anyone offering you an investment.Società regolari che agiscono in modo truffaldino

Legitimate Companies with Shady Practices

Next up are legitimate companies that operate fraudulently. These businesses are legally registered but engage in deceptive practices, like offering financial products with false promises.

They often lure clients by guaranteeing high returns on “safe” investments, but in reality, they manipulate funds or sneak in hidden fees. These scams can be tricky to identify because the companies seem legitimate, which is why it’s crucial to verify their transparency and reputation before doing business with them.

Post-Scam Recovery Schemes

After someone falls for a scam, they may become a target once again—this time by companies promising to recover their lost money, often asking for an upfront fee.

In this scenario, scammers prey on the victim’s desperation. Once they receive the payment, they disappear without delivering any real service. These scams are especially cruel because they compound the victim’s loss, leaving them even more vulnerable.

Bitcoin “Unlocking” Scams

The last scam we’ll cover involves promises to “unlock” or recover lost Bitcoin. In this case, scammers ask for an upfront payment to retrieve cryptocurrency that, in reality, was never blocked in the first place.

The victims, hoping to recover their digital assets, pay the fee but receive nothing in return. This scam preys on people’s lack of technical knowledge about cryptocurrencies and their desire to recover what they believe to be lost.

How to Protect Yourself from Financial Scams

Now that we’ve covered the most common financial scams, you’re probably wondering how you can protect yourself. In this final section, we’ll share a few tips to help you stay safe.

First and foremost, always verify the credibility of anyone offering an investment or financial service. Make sure the company has the proper licenses, and read reviews from other users to confirm its legitimacy. Be cautious of promises that sound too good to be true, like easy profits or risk-free investments—these are often red flags signaling a scam.

These tips are simple steps you can start using today to spot and avoid scams.

If you want to dive deeper into understanding the various types of financial scams and how to defend yourself, download our free guide on financial scams and arm yourself with the financial awareness you need to protect your money!