Finding short strategies that work on U.S. stock indexes, such as the Mini S&P 500, isn’t easy.

Because of the underlying bullish trend of these markets, which has persisted for about 10 to 15 years, it’s very difficult to find approaches that work well in the bearish direction. For this reason, most stock index strategies take strictly long positions.

However, there are benefits to shorting stocks. In this article, we’ll look at examples of short strategies on the Mini S&P 500 that can give a portfolio more balance during periods of significant crashes or drawdowns.

Why It Can Be Useful to Short the Indexes

Before turning to the actual strategies, let’s try to understand why operating short on indexes could be beneficial.

The main reason is that in bearish periods, such as the 2020 COVID pandemic or the 2022 war in Ukraine, some short strategies can offset the losses that are common among long-only strategies.

A Practical Example of a Short Strategy on Indexes

In this video, one of the coaches at Unger Academy will show you an extremely interesting example of a short strategy on the Mini S&P 500.

As you can see, this is a fairly simple system. Simply calculate two levels, one for Long and one for Short, starting from the opening of the session, then from the midnight bar, and add or subtract a certain number of times the value of the Average True Range. Nothing particularly complex, but if you have any questions, listen to the explanation in the video.

This system isn’t meant to accrue astronomical gains; it remains a strategy that goes against the underlying bullish trend that has dominated these markets for a long time.

Instead, the goal is to improve the level of diversification of the portfolio to offset the losses that might occur by trading only long in bearish periods.

And indeed, as you can see in the video, it’s a system that seems to work quite well. Particularly in 2008, it would have helped to contain the damage following the sudden collapse of the markets.

On the other hand, it wouldn’t have helped much in the negative 2020 period caused by COVID.

Overall, the strategy seems to achieve the goal we set out to achieve, as it helps in bearish phases but doesn’t cause damage when the market rises again.

Example of Long-Short Strategies on Indexes

You can also create Long-Short strategies on indexes.

In this video, you’ll see two of these strategies that were able to exploit the downtrends that occurred during the Russian-Ukrainian conflict.

The first strategy is a trend-following, long-short, multiday strategy (you can find an analysis of it starting at 2:42).

The entry point for long trades is identified by subtracting 10-20 points from the previous day’s high. The short entry is calculated by adding 35 points.

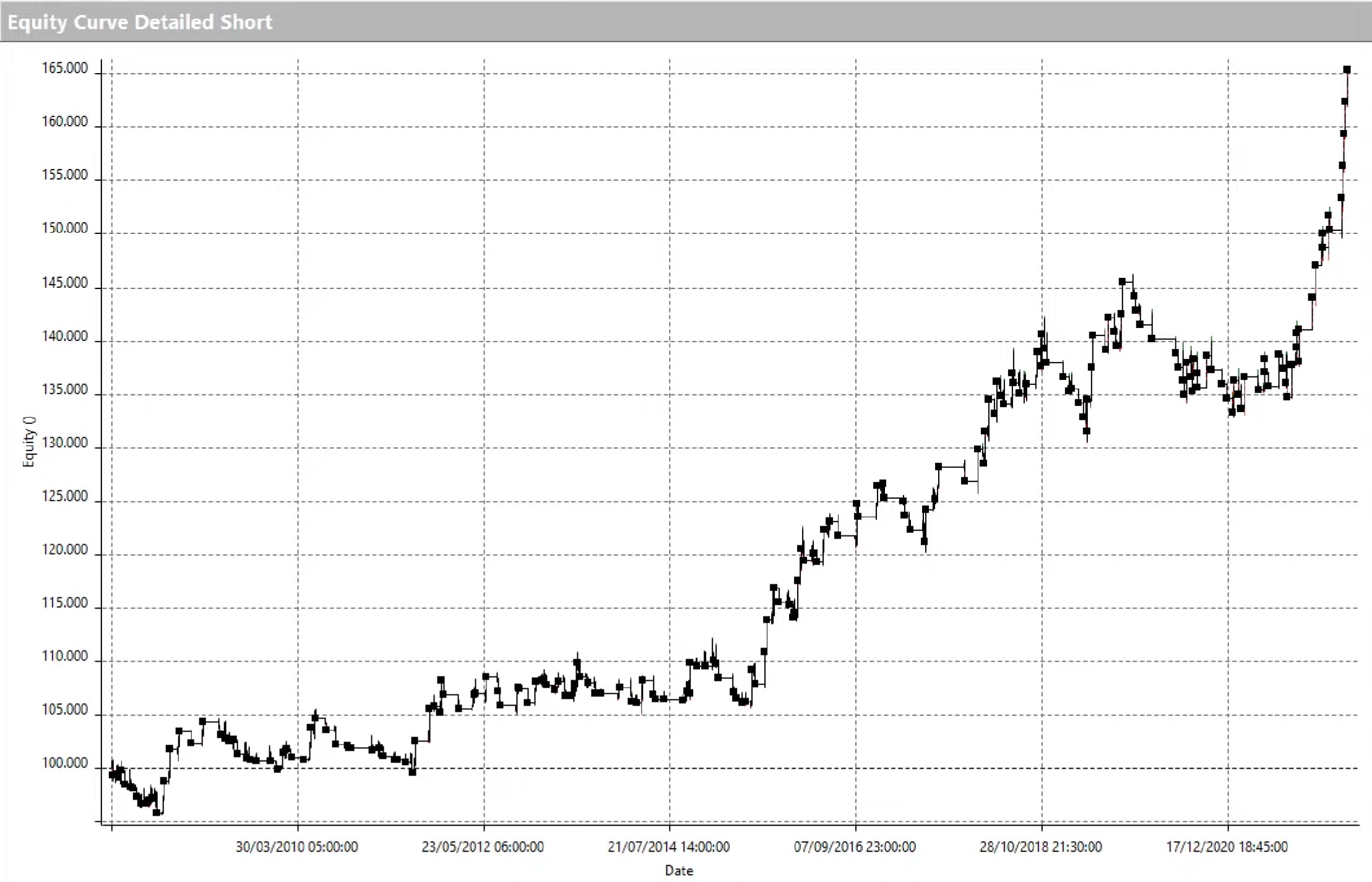

On the Long side, the results are good, as we had expected. However, the results on the Short side are particularly interesting, as highlighted by the equity line below.

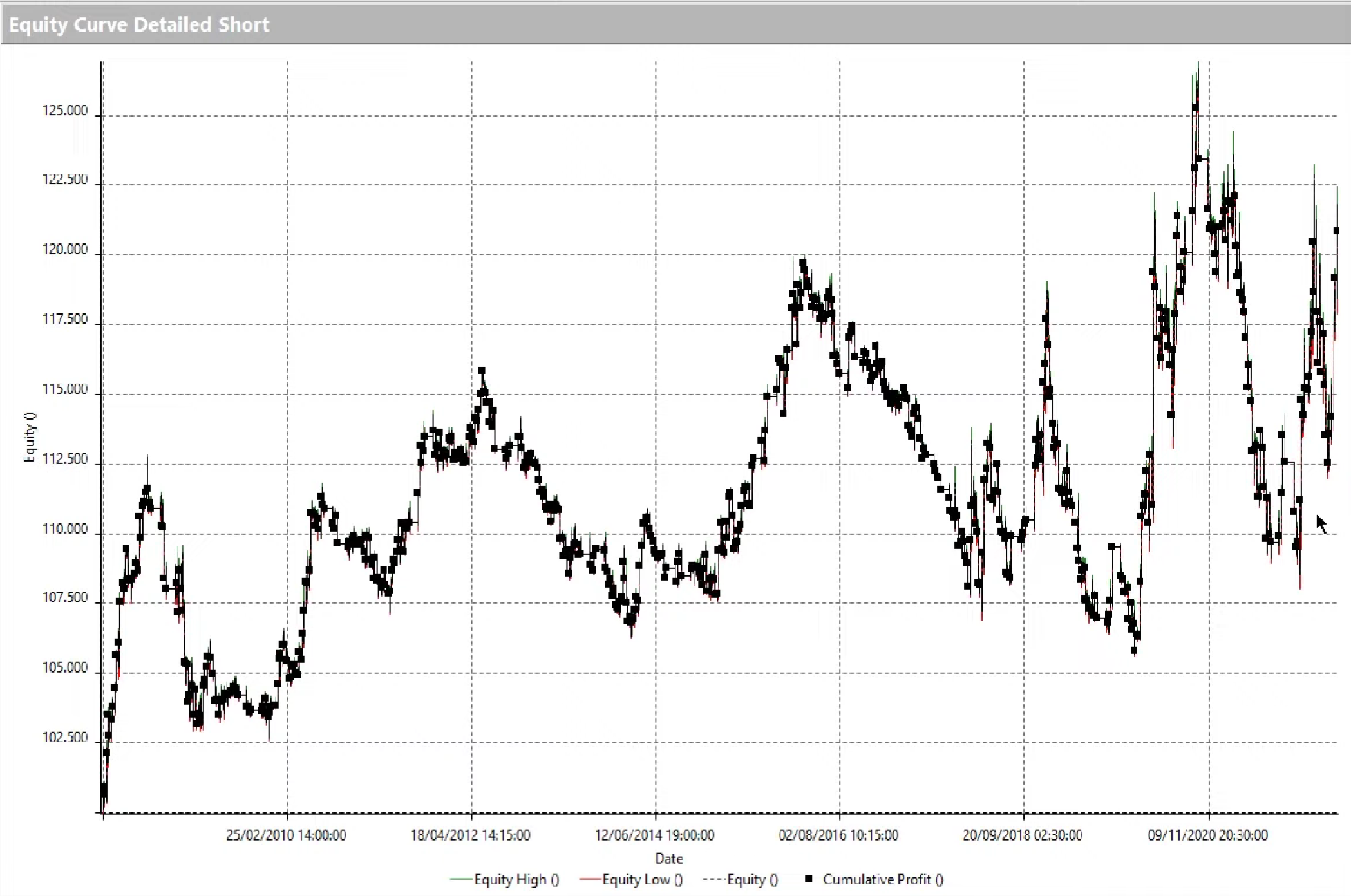

In the second strategy (starting at 5:28) the Long entry occurs in the evening on Monday, while the Short entry occurs on Friday. Below you’ll find the real equity line generated by the system:

Conclusion

In this short article, we hope you gained useful insights into how to use strategies that involve shorting stocks.

We don’t expect enormous profits from these setups, but prevent losses during bearish market periods.

If you have any doubts left, watch the two videos found in this article. And let us know if you use short strategies!