If you are familiar with this blog, you probably noticed that our articles focus 95% on trading.

We aim to help our followers improve their trading performance and accrue more profits in financial markets.

In this article, we’ll focus instead on investing, which is the another method we can use our capital to profit from the markets.

Together we’ll learn about investing, how it differs from trading, and the basics you need to know to start investing successfully.

The Difference between Investing and Trading

Both investors and traders try to make money through their involvement in financial markets. But while a trader attempts to identify and take advantage of short-term fluctuations, an investor aims to make money in the long run.

Therefore, weekly, daily, hourly, and even minute time frames are intended for traders rather than investors.

This is because the essential ingredient of effective investment strategies is time, or rather, the interest in investments accumulating over time.

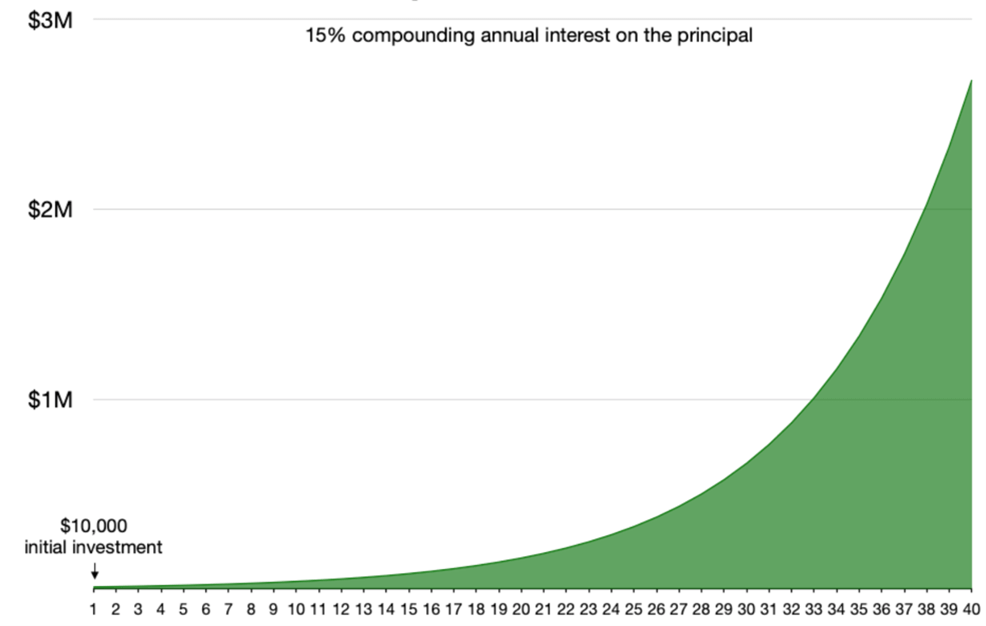

Consider, for example, the picture below, which shows the path of one’s earnings over 40 years, considering a compound annual interest rate of 15%.

As you can see, the return on your investments is not linear but exponential. This is because of compound interest, that is, the continuous reinvestment of profits earned because of the interest.

Opportunities and Risks in Investing

The investment world is characterized by uncertainty because no one knows which direction the market will go in the future.

Consider this statement by Warren Buffett, a billionaire investor regarded by many as the most significant investor of all time: “I don’t believe anyone knows what the market is going to do tomorrow.”

Because of this uncertainty, many people refrain from investing in the stock market, preferring to remain liquid or investing instead in instruments considered foolproof, such as U.S. or German government bonds.

Are these well-founded worries, or irrational fears?

Uncertainty and risk are a constant in the financial world, both in trading and investing. However, there are strategies and tools in the investment world to limit risk and maximize one’s chances of success.

Moreover, it’s good to keep in mind that not investing at all entails hidden costs.

Consider, for example, inflation. If you hold $10,000 in your checking account right now, and if we consider a 7% inflation in 10 years, that amount will be worth half its actual value. That means you will still have $10,000, but your real purchasing power will be only $5,000.

Investing in financial markets in a structured and intelligent way is the best solution to protect yourself from inflation and preserve your purchasing power.

The Importance of Diversification

What does it specifically mean to invest intelligently?

Countless volumes could be (and have been) written on this topic. Still, one of the most critical concepts of investment is diversification, a risk management strategy of including a wide variety of investments within a portfolio.

Diversification can be of 4 types:

-

by investment class: consists of investing in different financial instruments, like stocks, bonds, real estate, commodities, etc.

-

by country: consists of investing in different geographical areas, for example, North America, Europe, and Asia.

-

by investment style: plans to invest in different types of companies, such as balancing between “growth” investments (with high growth potential but higher risk) and “value” investments (lower risk but lower growth margin).

-

by sector: the most well-known companies of recent years are in the tech sector (Facebook, Google, Amazon, Apple, etc.), but it’s essential to invest in other sectors as well, such as the energy sector, real estate, health care, etc.

Types of Investment

There are three main types of investments to be aware of:

Shares: When you buy a share in a company, you effectively become a partner in that company. You’ll often hear of two types of shares: common and preferred. The latter rank higher in the collection of dividends or the distribution of residual capital if the company goes bankrupt.

Exchange Traded Funds (ETF) are investment funds traded on an exchange just like a single stock. ETFs can closely replicate all investments, from stocks to commodities or bonds. ETFs are an excellent investment tool because they allow investors to diversify their assets effectively.

Mutual funds allow the pooling of funds to in specific sectors or industries. Again, the advantage is reduced portfolio volatility through proper diversification.

The Best Time To Start Investing

A proverb in the investment world says, “The best time to plant a tree was ten years ago. The second-best time is now.”

Time is the most potent ingredient in making our investments pay off. The best time to invest would have been 10 or 20 years ago. But since we can’t go back in time, the best time is right now, and not 1 year or 10 years from now.

Many people want to wait for a suitable time to start, for example, trying to guess when the time of maximum decline will be so that they can buy many stocks at discounted prices.

The problem with this strategy is that, as mentioned earlier, no one knows how the market will behave. It’s possible to get lucky and spot the perfect moment, but the chances of making it are tiny.

If by bad luck you decide to start investing when the market is at its highest, your investments may go down in the short term. However, in the long run, if you have patience, steady nerves, and continue to invest intelligently, these losses will most likely be more than compensated for.

Conclusion

Investing is one of the most researched topics in the world. This article aims to provide you with an initial primer that may be useful in continuing your education on your own.

In general, keep in mind that investing in the financial market is a strategy to protect your wealth and not to get rich. In the long run, you can accumulate attractive sums, but except for vast strokes of luck, you won’t get rich from investing.

Lastly, remember that, regarding diversification, it might also be a good idea to combine investing with trading so that you invest your money with different approaches and over different time horizons, enabling you to reduce the risk of loss under various scenarios.

In this regard, we recommend you look at our article on the Permanent Portfolio Strategy, which involves a portfolio composed of U.S. stock indexes, U.S. government bonds, cash and precious metals.