Many people think that the secret recipe for trading success lies in the use of an infallible indicator that can guarantee outstanding performance in any market. This is evidenced by one of our most frequent questions: “What is the single most effective indicator designed to improve your trading performance?”

In reality, this belief is far from reality. Indicators can be useful instruments to support trading, but they are unlikely to guarantee noteworthy results on their own.

That said, in this article, we’ll look at ADX, one of our favorite indicators, and explain why we consider it the best indicator in trading.

What Are Indicators in Trading

Let’s start with a brief review of what indicators are and what they are used for, without going into too much detail. If you’re interested in learning more, you can read this article we wrote on the topic.

Indicators are basic formulas of technical analysis based on mathematical concepts (moving averages, standard deviations, etc.). These formulas are used to draw lines on price charts so that current trends can be identified, the presence of any patterns can be recognized, and the appropriate times to enter and exit a position can be determined.

In other words, they’re tools that analyze historical data, and, by a series of mathematical calculations, capture an idea of how the price of a financial instrument might behave in the future. The moment certain market conditions are met, indicators send specific signals to the trader.

This is why indicators are so popular with many traders. However, as mentioned above, it’s good to keep in mind that indicators aren’t a magical key that will suddenly improve your trading performance.

At best, they’re instruments that, in some cases, can help identify patterns or market conditions that would otherwise go unnoticed. Here at the Unger Academy, where we practice systematic trading, we use these tools primarily as operational filters to limit trading to certain market conditions.

Are Some Indicators Better Than Others?

Having established that indicators are not a magic pill, is there a single indicator capable of outperforming all others?

Unfortunately, it isn’t easy to provide a straightforward answer to this question. In general, to understand the real effectiveness of an indicator, it’s necessary to put it to the test. At the Unger Academy, we perform this kind of testing by creating automated indicator-based strategies and testing them on a carefully selected historical data series.

Systematic trading (and in particular the trading method developed by Andrea Unger called The Unger MethodTM) is an excellent way to perform such tests; they show that there are indeed indicators that seem to perform better than others.

Among these, the indicator that we consider to be the most effective is the ADX, or Average Directional Index, whose purpose is to detect the strength of a trend.

The value of the ADX is always between 0 and 100, where 0 represents the complete absence of a trend, and 100 reveals a very strong trend.

We won’t go into too much detail here, however, in this article we’ll thoroughly explain both the mathematical formula for constructing it and how to use it within a trading system.

What we’re interested in right now is to understand why the ADX indicator might constitute one of the most effective indicators.

Application of ADX in a Trading System

In this video, Andrea Unger explains in detail why ADX is so important to him and shows how it’s applied in two different scenarios.

In the video, you can see that while we believe ADX is effective, we’ll only use it as a filter for entries and exits, rather than as an entry trigger.

In the first example we apply ADX to a portfolio containing several instruments, from futures to currency pairs.

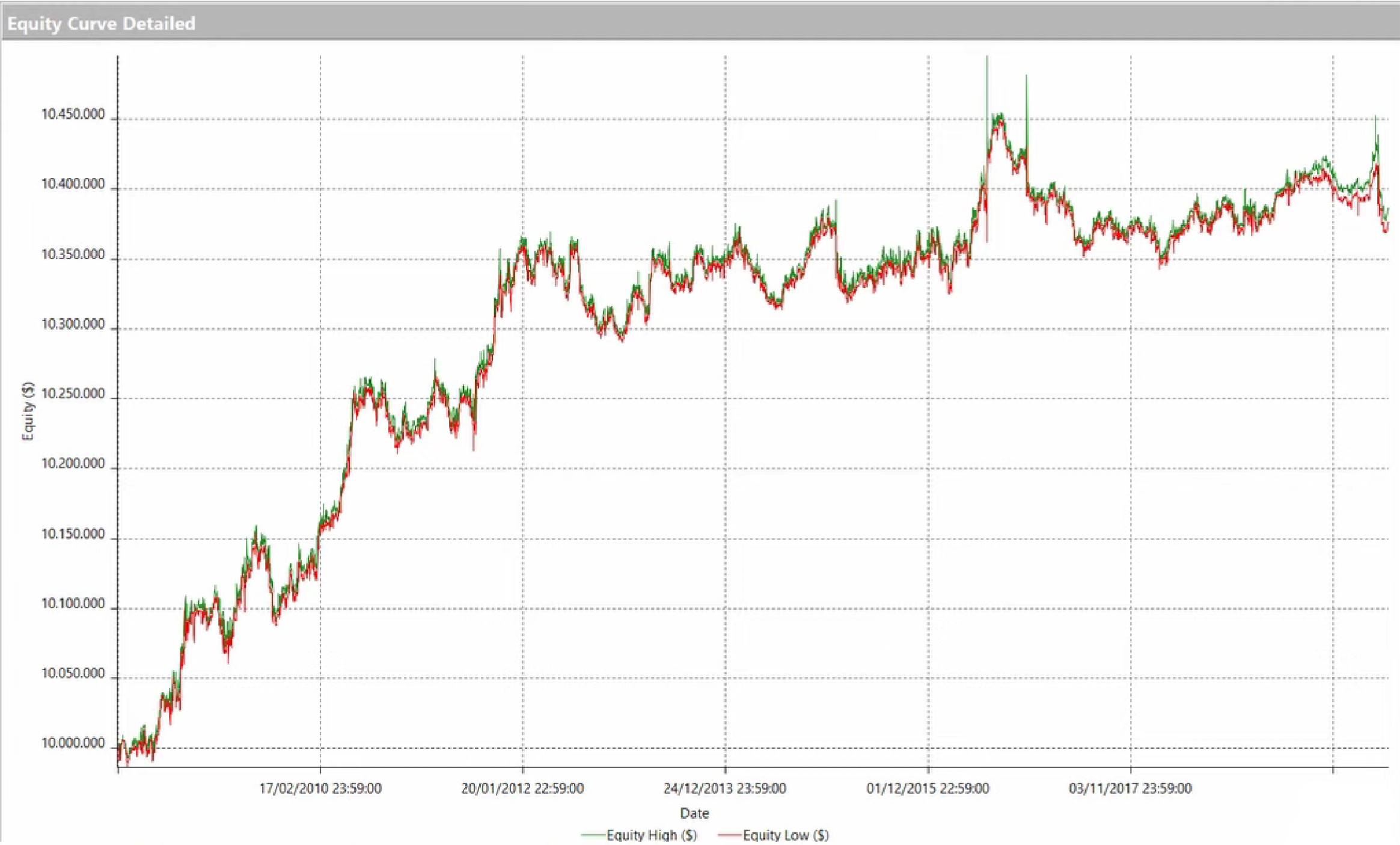

Below you can see the equity line of the raw trading system, without a filter.

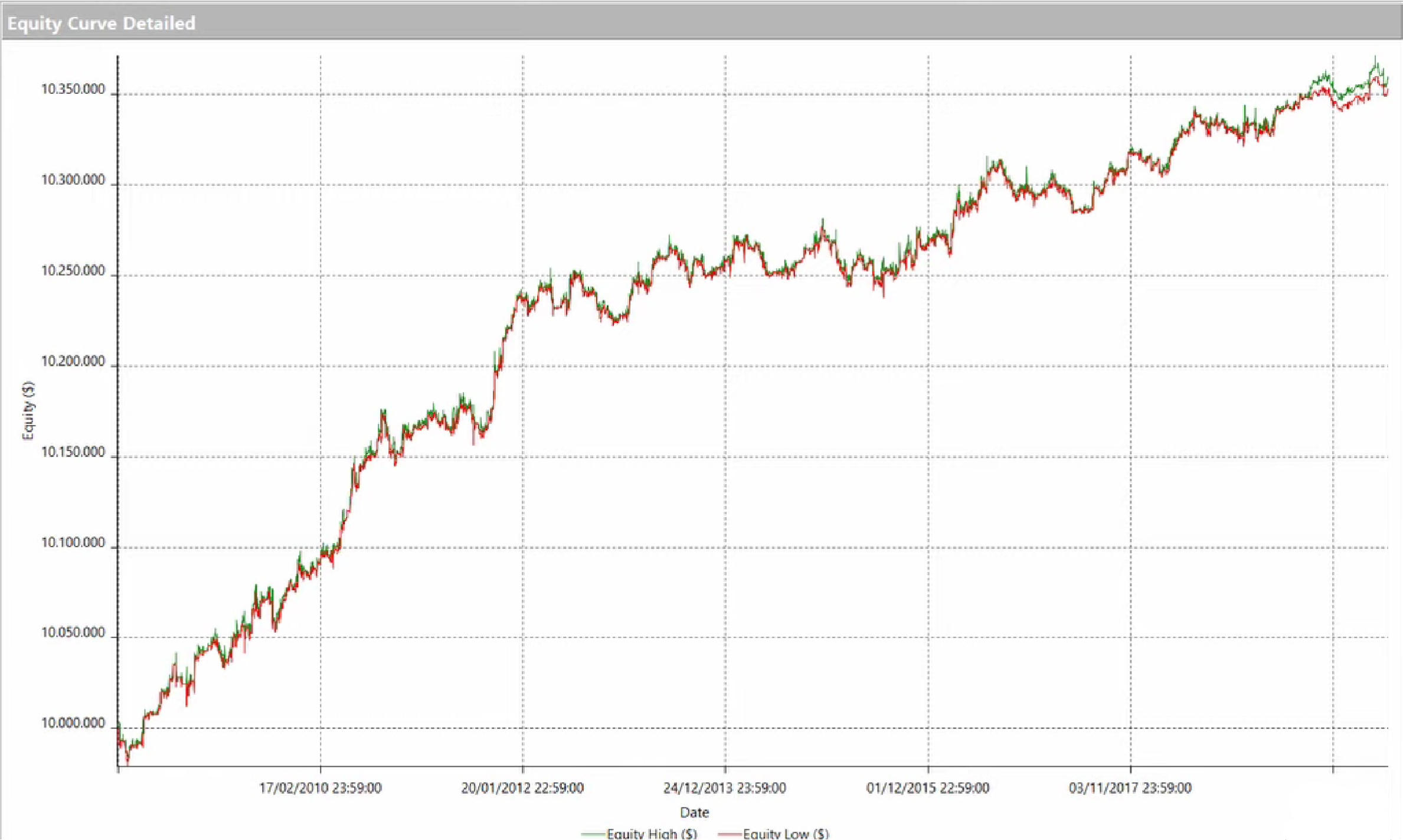

By applying ADX as a filter, there is a noticeable impact of the indicator on both drawdown and the number of trades, as you can see from the equity line:

Moreover, as shown in the video, using an ADX value of 35 can achieve a dramatic reduction in drawdown for only slightly lower profits.

The strategy featured in the video wouldn’t be applicable in reality. Unfortunately, the average trade amounts to only $44, which wouldn’t be enough to cover trading costs.

So, this trading approach would certainly need to be refined, but it’s interesting to see that ADX represents an important step forward.

If you’re interested in learning more about the details of this strategy, we recommend watching the video above.

Starting at 9:25, you’ll also find a second strategy applied exclusively on the Gold Future. Once again, the drawdown improves considerably with the application of ADX, and the strategy would even appear to be applicable in live trading.

Conclusion

Through systematic trading, we can see that some indicators deliver better results than others. While there is no single indicator that stands out over others under any circumstances, the ADX proposed by Andrea Unger is certainly one of the best.

In general, whatever the indicator, we still recommend using them more as filters than as entry triggers and always testing the performance of your strategies before live trading.