Proper risk management should be a priority for every trader. However, market volatility can often be a problem. One solution is to adopt spread trading strategies. As we will explain in this article, spread trading provides excellent risk management and lets you create “market neutral” positions. In addition, we will show you how to code a spread trading strategy on two related bond futures.

What Is Spread Trading

Spread trading is a trading method that consists of opening two opposite positions, a long (buy) and a short (sell) on two related assets with predetermined amounts.

This way, your market position remains neutral, and potential profits depend only on the price difference (the spread) between the two assets. These positions are therefore not affected by market trends.

For this reason, spread trading techniques are particularly suitable for those who want greater risk control.

In technical jargon, the two assets are called “legs”. Each asset is fundamental to the outcome of the strategy, which is why spread trading is also called “pair trading”.

Assets can be made up of different types of instruments, such as options or futures on commodities, stocks, currencies, or stock market indexes. In fact, spread trading allows you to earn regardless of the market trend.

How To Do Spread Trading

In finance, the term “spread” indicates the difference in price or return between two financial instruments. Spread trading exploits the difference in return between two related instruments.

In practice, you must buy and sell two related assets at the same time, for the same amount.

To give an example, we could create a spread trading strategy by going long on Apple’s shares and, at the same time, short on Samsung’s. To have a neutral position, it is essential that the positions are opposite and of equal amount.

As we mentioned, you can use any type of asset. The important thing is that the two instruments belong to the same sector.

In this video, we show you how to apply a spread trading strategy to a portfolio made up of four pairs of correlated futures:

-

American 30-year bond and American 10-year bond (bond market)

-

Mini S&P 500 and Nasdaq (stock indexes)

-

Crude Oil and Heating Oil (energy)

-

Gold and Silver (metals).

Types of Spread Trading

There are three main types of spread trading:

-

Intermarket spread trading

-

Intramarket spread trading

-

Inter-exchange spread trading

Intermarket is the most widespread type and consists in opening opposite positions on two related financial instruments in the same period. To take the example above, we could go long on Apple and short on Samsung. Between the two correlated instruments there will always be one that will perform better than the other. This difference represents the profit of the spread trader.

Intramarket spread trading, on the other hand, consists in opening opposite positions on the same asset at different maturities. For example, we could go long on the January expiration of Crude Oil, and at the same time go short on the March expiration of the same asset. Generally, this method works for commodities that tend to be more subject to seasonality.

The third type is inter-exchange spread trading. It is a more complex approach that consists in opening long/short positions on an asset and going short/long on the same asset but listed on a different exchange (in the same period or in a different time frame).

For example, we could open a long position on the Wheat Future listed at the Chicago Board of Trade and, at the same time or in a different period, go short on the same future listed at the Kansas City Board of Trade.

Spread Trading Techniques

Without getting into excessive technicalities, from a practical point of view, we can use two spread trading approaches:

-

divergent

-

convergent

The divergent approach is the more common and consists in making a profit when the strongest stock, on which we go long, performs better than the weakest, on which we are short.

In the convergent approach, we do the opposite. You go short on the strongest instrument and long on the weakest one. The principle underlying this approach is that, at certain times, the relationship between two financial instruments can be altered because one of the two becomes overbought/oversold.

Those who adopt the convergent approach exploit the mean-reverting properties of an asset and point to the fact that, over time, the spread of the two instruments will tend to return towards its average value (the so-called “fair value”).

Which Markets Are Best Suited for This Strategy?

Spread trading strategies are particularly suited to commodities due to their seasonality. Forex spread trading, which is done on currency pairs, and futures spread trading are also quite common.

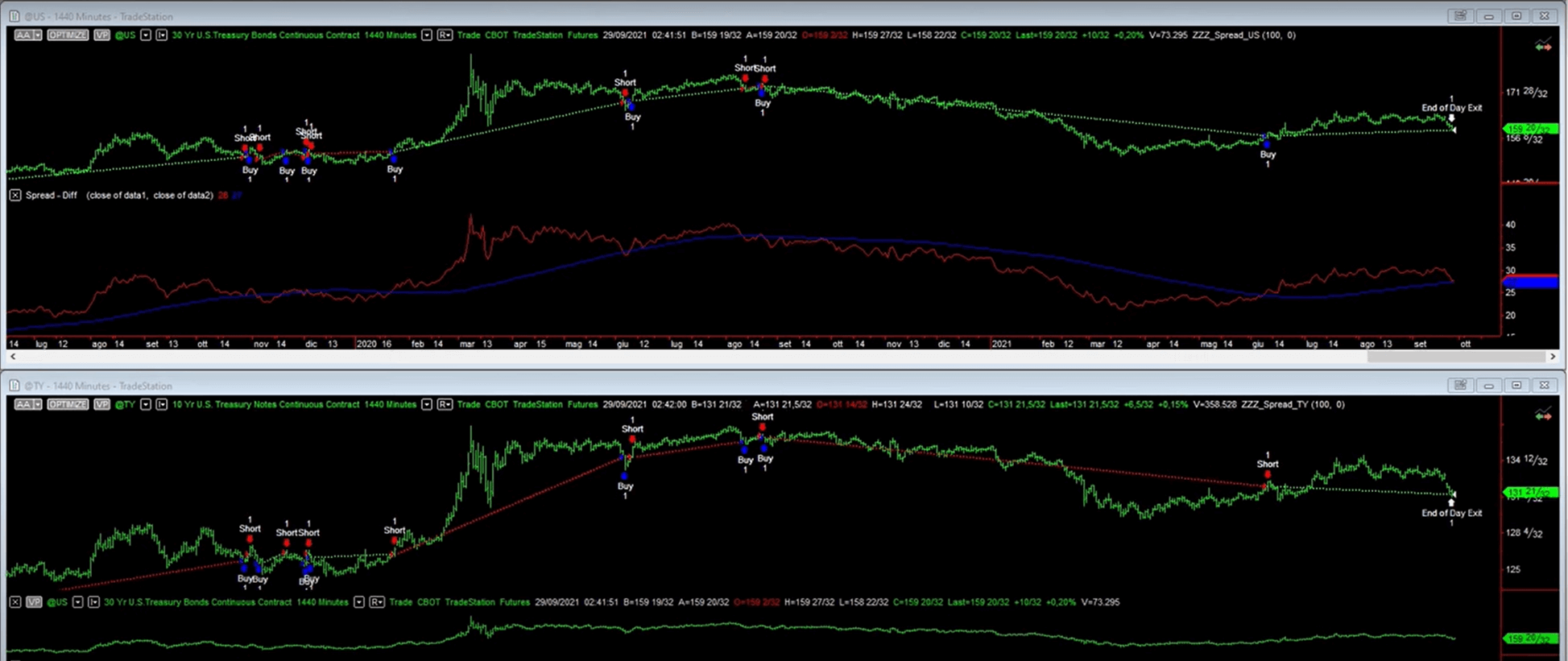

In the following video, one of our coaches shows you how to develop an automated strategy capable of spread trading on two correlated bond futures with different duration: the 30-Year T-Bond and the 10-Year T-Note. Don’t miss it!

Conclusions

Spread trading, or “pair trading,” is a strategy that consists of operating on pairs of correlated financial assets, going long on one asset and short on the other.

The goal is to exploit the inconsistencies between two instruments belonging to the same market by opening opposite positions. In fact, through spread trading, it is possible to take a neutral position and increase your profits regardless of the direction of the financial markets.

As it is easy to guess, this type of approach allows for better risk management and the creation of a portfolio that is less subject to the volatility and fluctuations of the financial markets.