Are you starting from scratch and wondering whether systematic trading is the right fit for you? Before diving in, it’s important to understand that trading is a complex discipline that requires study, strategy, and solid risk management. Among the different approaches available, systematic trading is often considered the best solution for those who want to trade with structure and discipline.

But is it really the best choice for a beginner? In this article, we’ll explore how systematic trading works, compare it with discretionary trading, and introduce the method developed by 4-time World Trading Champion Andrea Unger. This way, you’ll have a clearer picture and be able to decide which approach best suits your situation.

What Is Systematic Trading and How Does It Work?

Systematic trading is an approach based on codified strategies and predefined rules to make buy and sell decisions. This method minimizes the influence of emotions and intuition.

In simple terms: you set the rules of your trading today, and the computer executes them for you.

The main advantages:

-

Eliminates emotions: Decisions are driven by data and testing, not panic or excitement.

-

Testable strategies: You can verify strategies using historical data before investing real money.

-

Operational efficiency: Automation saves time and helps avoid overtrading.

Need a complete overview to start trading with a method? Download our introductory guide now!

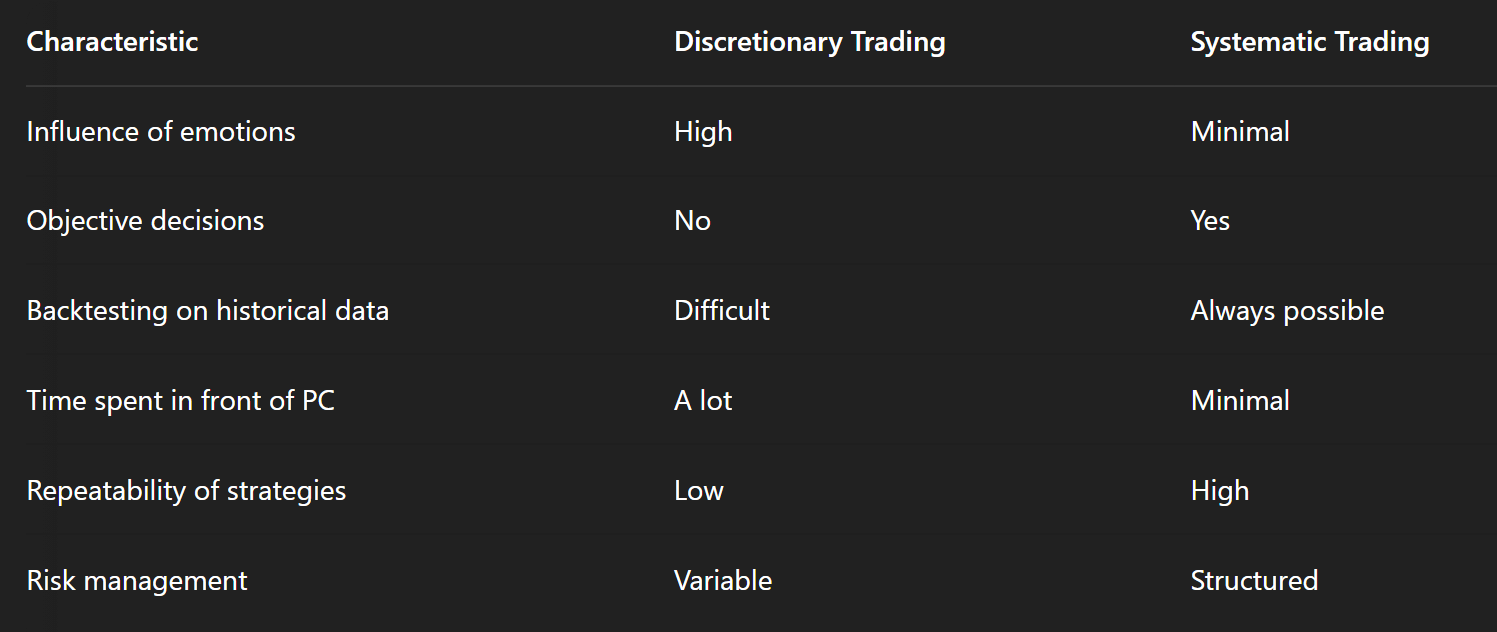

Systematic vs. Discretionary Trading: Which Is the Better Approach?

In discretionary trading, every decision is made manually based on intuition, experience, or gut feeling. While this may seem more “human,” it comes with significant downsides:

As Andrea Unger points out, “Even the most effective strategy, if not automated, will force the trader to spend hours in front of the screen.” With systematic trading, on the other hand, you can manage your time—even while on vacation.

Is Systematic Trading Ideal for Beginners?

Now that we’ve explored the differences between systematic and discretionary trading, the question remains: which approach is safer?

If you’re a beginner, the systematic approach offers you the greatest security, control, and long-term sustainability.

Here’s why:

-

You can test before you risk: Know if a strategy works BEFORE using it with real money.

-

It saves time: The systems work automatically, freeing you up for other things.

-

Teachable and repeatable: Ideal for beginners since it doesn’t rely on previous experience.

-

Limits emotional impact: A critical factor when you’re just starting out.

DOWNLOAD THE FREE GUIDE!

Start building your solid foundation for trading—all you need in one PDF.

Want to Start Systematic Trading Like a Pro? Discover the Unger Method!

As we’ve seen, automating many processes allows traders to focus on diversifying their portfolio—a key aspect of risk reduction. This is exactly what we teach at our academy through the Unger Method, developed by Andrea Unger, the only trader in the world to have won the Robbins Cup® four times.

Let’s take a look at how it works—and why it can make a real difference, especially for beginners.

The Story Behind the Unger Method

The Unger Method stems from the direct experience of Andrea Unger, a professional trader who has made discipline and systematic analysis the core of his market approach.

In 2008, Andrea decided to put his method to the test by entering the prestigious World Cup Trading Championships—a real-money competition where the best performance over a year wins.

The result? A +672% return and a first-place finish! But that was just the beginning… Andrea also won in 2009, 2010, and 2012—making him the only trader in history to win the title four times.

Why the Unger Method Works

If you’re wondering, the Unger Method isn’t based on luck or gut feelings. It relies on precise rules, numerical analysis, and automation. This approach works because it’s grounded in key principles that are essential for effective algorithmic trading.

Here are the pillars of the Unger Method:

-

Data-driven decisions: No impulsive choices—only tested strategies.

-

Automation: Let the computer handle execution, reducing errors and emotions.

-

Advanced risk management: Protect your capital with effective strategies.

-

Position optimization: Know exactly when to enter and exit the market.

-

Use of advanced software: Simplifies trading—even for those with no programming experience.

With the Unger Method, you can build a diversified portfolio that works autonomously 24/7, freeing you from spending countless hours glued to charts. It transforms trading into a real opportunity—without becoming a full-time job.

Ready to Start on the Right Foot?

The first step is simple: get informed the right way. That’s why we’ve created a free guide to help you:

-

Understand the core concepts of systematic trading

-

Avoid the most common mistakes

-

Discover if this approach is truly right for you

It’s completely free and includes everything we wish we had known when we started.