If you want to start trading forex, crypto, or other financial instruments, it is essential to choose the right broker. But it isn’t always easy to figure out which broker to choose from the many options available.

This article will give you all the information you need to choose the best systematic trading broker for you.

How to Choose the Right Broker?

First, a little background. In the trading world, a broker is an intermediary that buys and sells financial products on behalf of clients in exchange for commissions.

There was a time when only real people were brokers, such as the Venetian merchants who were involved in buying and selling financial instruments as early as the 1300s. Nowadays, when we talk about brokers, we mainly refer to digital platforms and systems.

As mentioned before, choosing the right broker is crucial to successful trading. However, there are hundreds of brokers available, and it isn’t easy to figure out which option is best for you.

To help you choose the best systematic trading broker, there are 3 parameters that you should always keep in mind.

Parameter 1: Reliability

The most important thing is to choose a reliable, serious, and transparent broker. As you can imagine, you shouldn’t trust your money to a shady and dishonest broker.

Now, this is easily said, but how do you verify the reliability of a broker?

Our first tip is to check whether or not the broker is licensed and registered with international regulatory bodies. You can quickly check this online at the relevant websites.

Second, we suggest that you be very cautious when brokers try to lure in you with enticing offers, such as welcome bonuses or very low commissions. No one ever gives anything away, and unprofessional people may hide behind such tempting offers. Choosing a broker based on a few euros of welcome bonuses isn’t a winning strategy.

Another issue to consider is: if you wish to withdraw your money, does the broker give it back to you immediately and without any problems, or do they stall by offering alternative solutions to withdrawal?

It may also be useful to check where the money used for trading is deposited. If you smell a rat during this research phase, it may be best to choose a different broker.

Summary: Choose a reliable broker, and be wary of those who lure you with promises of money.

To learn more about how to choose a reputable broker and avoid scams and hoaxes of various kinds, watch this video by Andrea Unger:

Parameter 2: Market Coverage

You’ll obviously need to choose a broker that covers the markets where you wish to trade. For example, if you’ve decided to trade futures in the Asian market, you’ll want to choose a broker that covers that market and that type of financial instrument.

Also, always keep in mind that diversifying is very important. A broker that covers fewer markets and fewer financial instruments may expose you to greater risk. Therefore, it may also make sense to choose a broker based on the degree of diversification he or she offers you.

Summary: Choose a broker that covers the instruments and markets on which you want to trade.

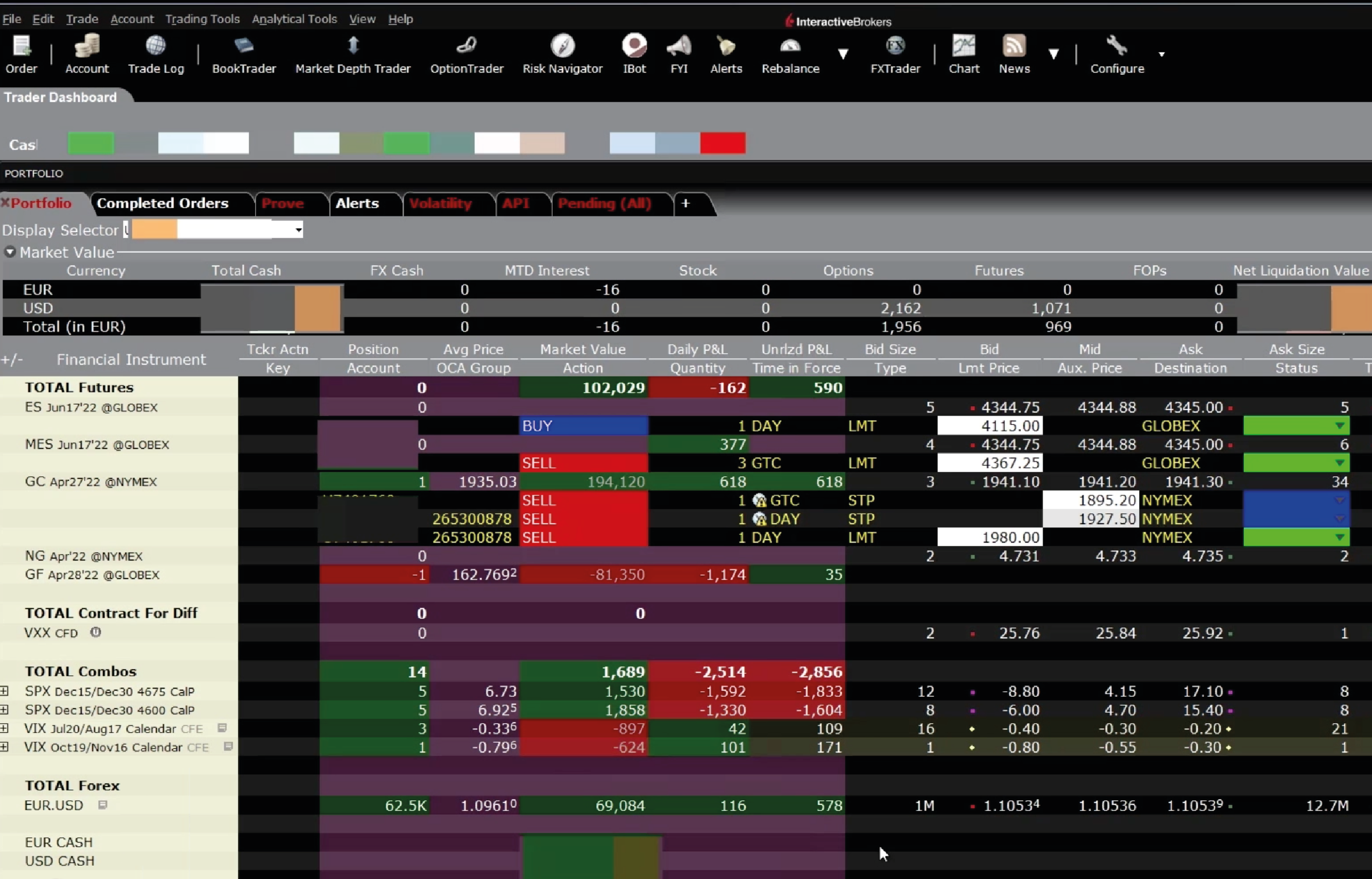

Parameter 3: High-tech Services

A good broker must guarantee you excellent high-tech services. This is especially true for those who work in automated trading. A broker with frequent technical issues will negatively affect your trading.

In addition, it’s essential to choose a broker that provides connectivity with the necessary platforms. For example, if you work primarily with automated systems developed and managed through the MultiCharts platform, it’s very important to choose a broker that can interface with that platform.

Finally, depending on your trading strategies, it may be best to choose brokers who also offer a historical database over a certain time frame. In short, there is a wide range of technical details that need to be carefully examined.

Summary: choose a broker with excellent high-tech services and technical features suitable for your trading.

Additional Tips for Choosing a Good Broker

The 3 suggestions listed above are essential, but we would like to propose 5 more quick “tips” for you to keep in mind during your research:

Learn more

Nowadays, we’re very fortunate to have so much information at our fingertips. Before entrusting your money to a broker, read reviews left by other users and consult relevant forums, such as EliteTrader or TradingQ&A.

In short, do your due diligence to verify that you are choosing the best broker for your specific needs.

Don’t underestimate the language barrier

Don’t choose a foreign broker if you don’t have mastery over their language. It’s important to choose a broker with whom you can fluently speak, otherwise, you’ll risk making mistakes due to trivial misunderstandings.

Well-known names offer greater guarantees

Several years ago, Andrea Unger experienced a big loss in a single day (during the case of the Swiss franc). Without going into detail, the bottom line is that his broker was responsible for this disaster.

Fortunately, this was a very big and serious broker. After appealing to an entity suggested by the broker himself, a few years later Andrea was able to receive a full refund of his loss, along with an 8% interest and a few hundred euros as a token of apology.

This is to say that mishaps can always happen, but brokers with a significant history behind them are likely to be more reliable.

Consider tax obligations

When you compile your tax declaration, always remember to check if your broker applies a substitute tax on profits, as this can make a difference in the declaration procedure.

Beware of promises of easy gains

As a final tip, always keep in mind that if something seems too easy or too good to be true, it usually is. Indeed, there are brokers who offer turnkey solutions, where all the trading work is done for you without you having to worry about anything. In such cases, it’s always wise to be very cautious.

If you’re looking for more helpful tips on choosing the best broker for your systematic trading, check out this video by Andrea:

Conclusion

We hope this article has given you some useful tips to help you choose a broker you can trust. If you’d like to discover what brokers we consider to be the best, check out this guide we wrote on the topic.