Rollover is a process of keeping a trade open in the market even after the instrument you’re trading on has reached its maturity. A rollover can be performed on various financial instruments, including futures.

Rolling over on futures involves closing trades on contracts that will mature soon and simultaneously opening trades on contracts that have the same underlying asset but whose maturities are further out in time.

Usually, a rollover on futures is performed through a broker a few days before the maturity of the original contract.

One of the advantages associated with this extension is that you keep an open position on the same underlying asset. When a contract matures, not only can it no longer be traded, but depending on the type of futures, problems may arise related to the physical delivery of the asset.

Why Managing Rollovers Can Be Complicated

Rollover management creates several potential problems for traders. The difficulties arise mainly from the fact that there are no universal rollover rules for all futures.

Contracts usually have different maturity dates; some mature three months apart, others only one month apart, etc.

In addition, let’s not forget that futures are listed on many different exchanges, which means that one must regularly consult the websites of the various reference exchanges (CME, ICE, Eurex, etc.) where the specific futures are listed in order to manage your futures rollovers manually.

Finally, keep in mind that the dates on which rollovers can occur are different for different types of futures. Some futures have a rollover date that is one month before the maturity date of the contract, while other futures may roll the day before maturity. For example, European futures have rollover dates very close to maturity, while the same cannot be said of many U.S. livestock futures.

Our Solution for Easily Managing Your Futures Rollovers

As you can imagine, keeping track of so many variables effectively can prove to be quite complicated. If you had to do everything by hand, armed only with spreadsheets, you would inevitably lose track of important information.

The good news is that we asked Francesco Placci, our R&D Manager, to find a solution to this problem. Per usual, Francesco did not disappoint.

The instrument he suggested for easily tracking rollovers on futures is Interactive Brokers’ TWS platform.

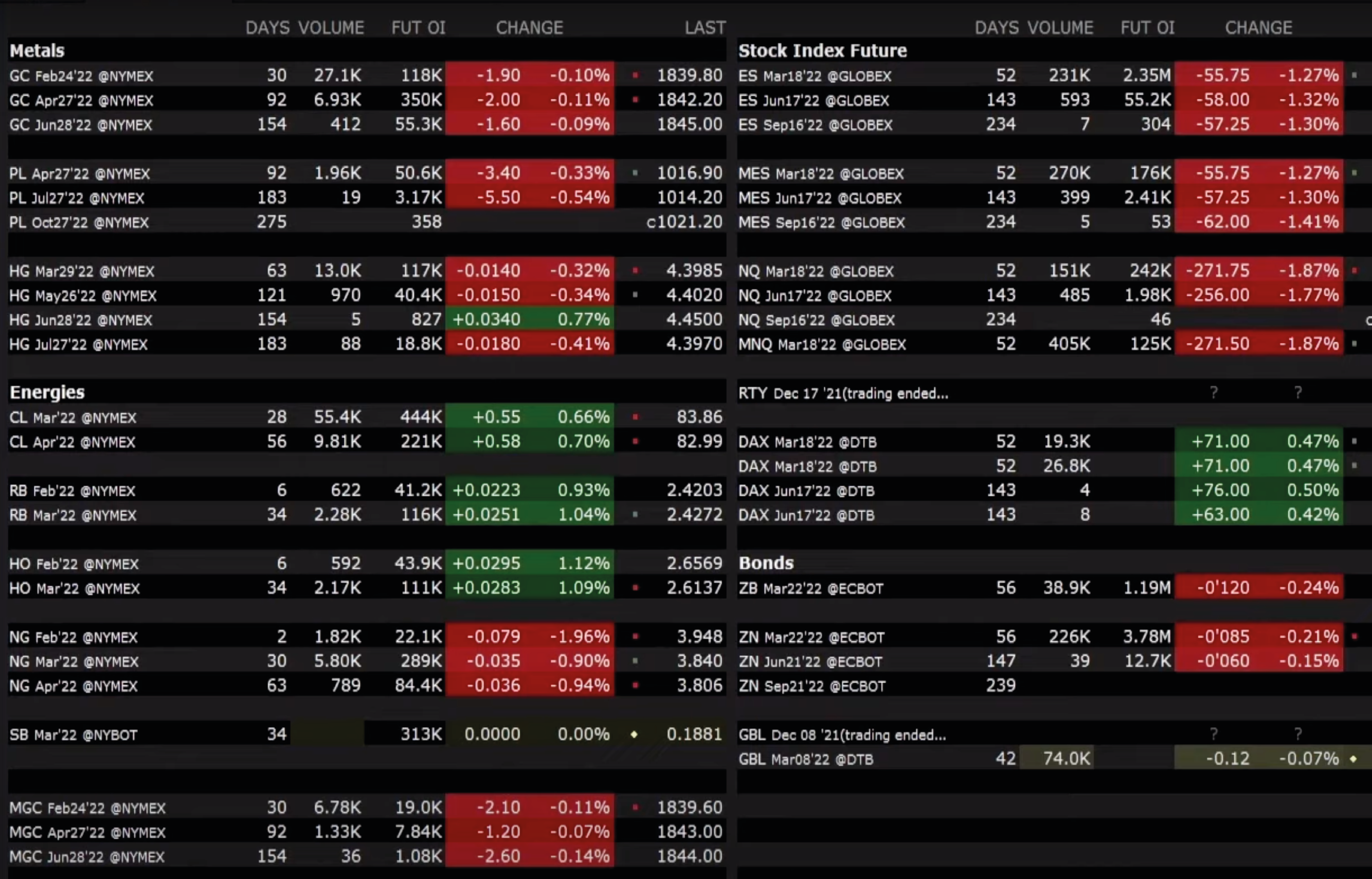

One of the great advantages of the platform is the simple and intuitive layout, which allows us to manage all the futures we want to trade on, and helps us track which ones are close to their rollover dates.

To benefit from this instrument, you simply need to properly set up your workspace; in the video below, starting at minute 3:30, Francesco shows you exactly how to do this.

How to Create a Watchlist to Manage Your Rollovers

As explained in the video, all you need to easily manage your futures rollovers is a well-organized watchlist.

Specifically, you need to monitor three main points of data:

-

the days to maturity, or how many days are left before the contract matures and the trade is closed out

-

the volumes traded daily on a specific contract

-

the open interest, which is the number of open and not yet closed contracts in a given period

The first piece of data is crucial, as it signals the approach of the contract’s maturity, and therefore the rollover date. The other two data points help identify the best time to roll your futures.

Open interest and trading volumes help indicate which of the two contracts has more liquidity, either the current expiring contract or the next one. As Francesco explains in the video, a rollover should be performed only when there is more liquidity on the new contract than on the contract approaching maturity.

Conclusion

As you can see, managing rollovers doesn’t have to be complicated. On the contrary, all it takes is the right instruments and a little organization to manage your futures rollovers quickly and easily, while always having the contracts to be rolled in front of you.

If you’re looking for more information on futures rollovers, don’t miss this video where we’ll show you step-by-step how to rollover a future on MultiCharts. From adding the symbol to the platform to transferring open positions from one contract to the next, you’ll find everything you need to know to properly rollover futures while avoiding any mistakes.