Having a well-diversified portfolio is essential to keep risk under control and avoid overexposure. Such a portfolio should contain strategies based on different approaches, working on various time horizons, and trading different underlying assets.

Sometimes, however, it is not possible to activate many different strategies at the same time, either due to budget limits or to IT infrastructure problems. In this article, we explain the criteria that will help you choose the best strategies for live trading.

Why It Is Important to Choose the Right Strategies to Activate

One of the first questions that most traders ask themselves is how to choose which strategies to use in real trading among all the ones they coded.

In many cases, due to either capital limitations or limits in the IT infrastructure, it is not possible to trade all the systems in a portfolio.

That is why identifying the right strategies to activate is so crucial, especially in terms of money and risk management.

It is only by choosing the right strategies, that we can consistently trade in the long term without overexposing ourselves.

Contrary to what many people believe, however, the economic criteria alone is not enough to choose the systems to activate and those to keep “on the sidelines”.

In addition to the capital, other elements must be taken into account including:

- Your risk tolerance

- Possible correlations between different markets

- Correlations between different systems

- The time horizon of your portfolio.

The goal is to build a well-balanced portfolio that includes systems working on different financial instruments, approaches, and time frames.

A trading portfolio should not be a static and random set of strategies but a diversified and dynamic mix in which every element is carefully chosen and calibrated to maintain an overall balance and an appropriate exposure to risk.

But how do you identify which strategies to put live and which to leave on the sidelines?

One method is to work on the equity curves of the strategies.

How to Choose the Strategies to Activate: Equity Filters

A practical and effective solution to choose which strategies to activate is to apply filters on the equity lines.

There are three main ways to proceed:

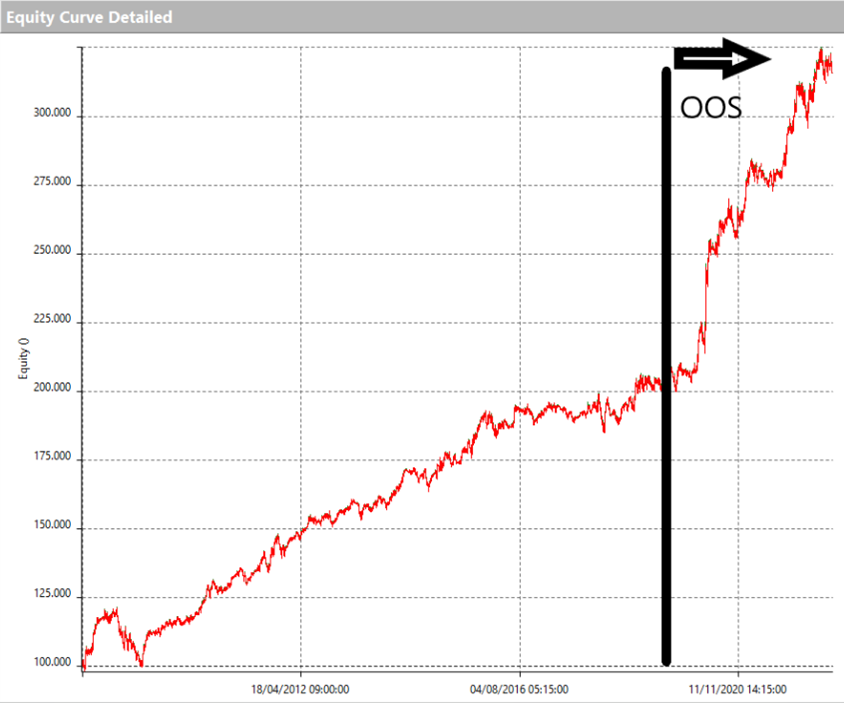

- Analyze the out-of-sample performance

- Use the standard deviation

- Use the equity peak as a filter

Out-of-sample Performance

A first method is to analyze the out-of-sample performance. You can carry out an analysis on the short-medium term by selecting the equity lines of the last 2/4 months, or you can proceed with a long-term analysis, taking into account the last 9/12 months.

The choice is subjective and depends on the time horizon and the objectives of each trader. Analyzing the historical performance of a strategy gives you a statistical idea of its behavior and can provide you with useful indications to decide whether to activate, modify, or close a position.

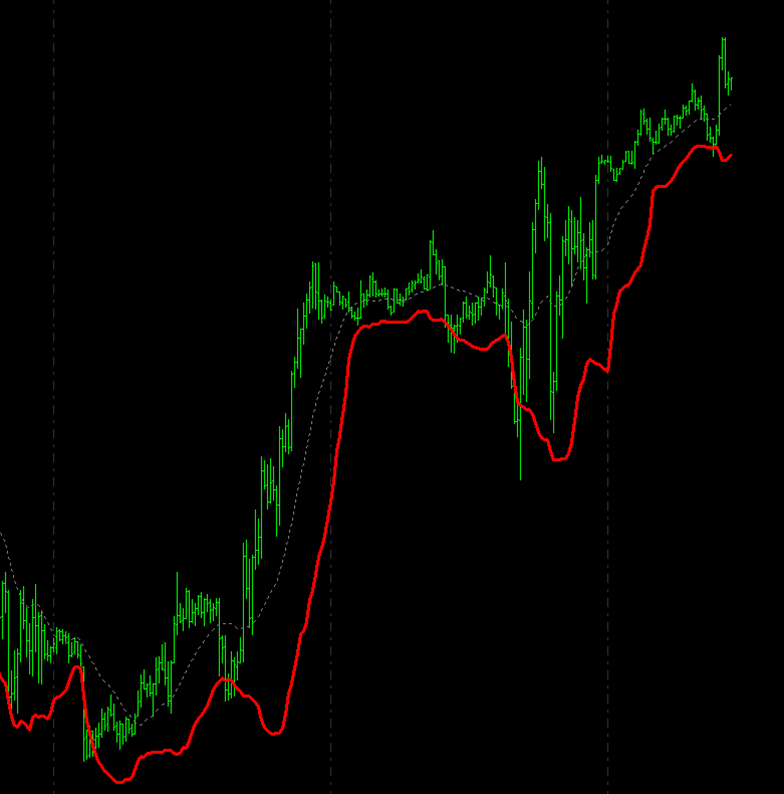

Standard Deviation

Second negative standard deviation.

An alternative way to choose the strategies to activate is by applying the standard deviation as a filter. Deviation is a very useful tool in the category of volatility indicators; it allows you to see how much the price of an asset is deviating from its average value.

When you use this type of filter, only the systems that are above or below n deviations from their average value will be activated, while the positions that do not fall within the chosen parameters will be modified or closed.

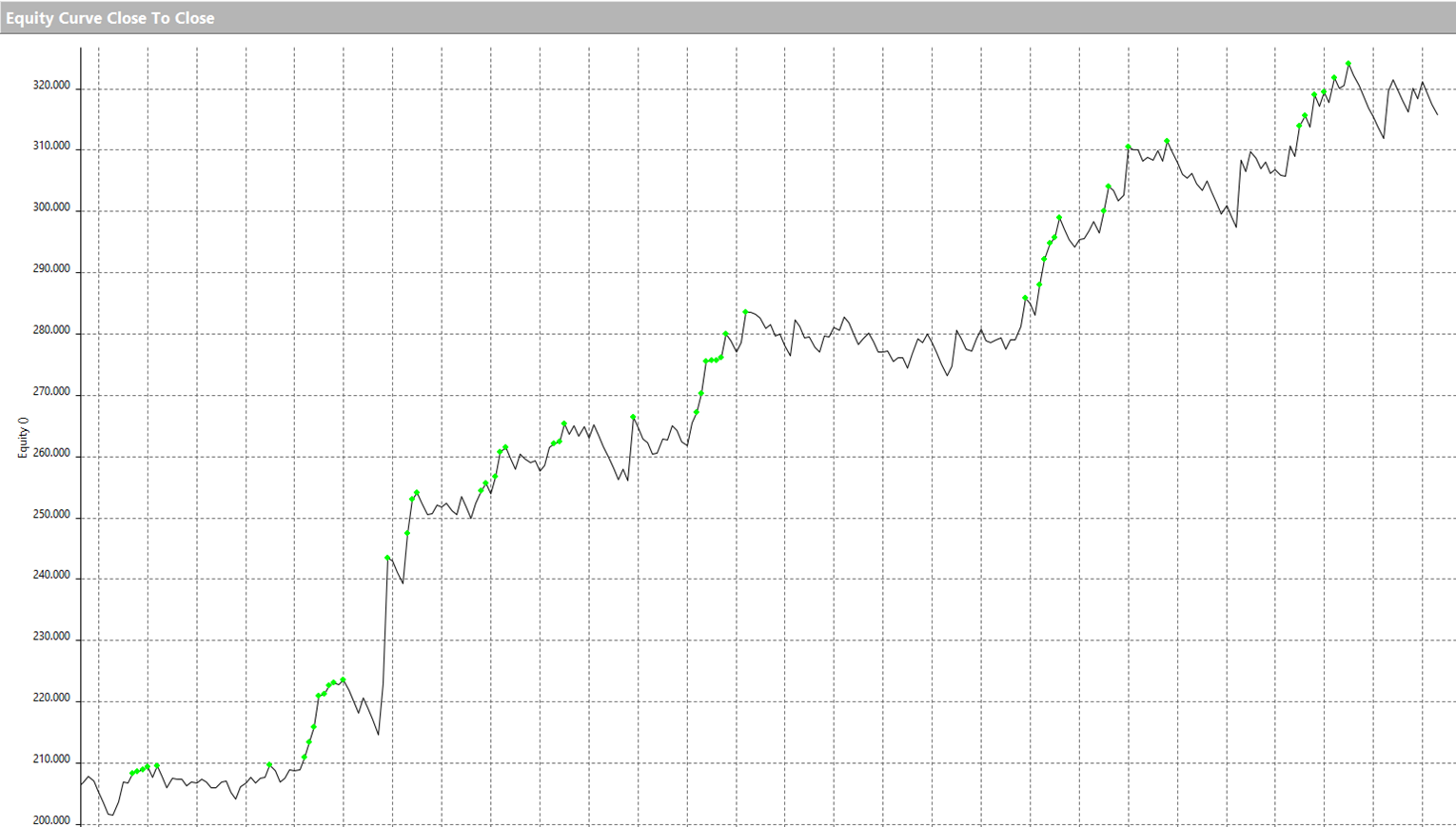

Equity Peak

A third possibility is to use the equity peak as a filter and activate only the systems that are able to reach this value in a given period of time.

The analysis of the equity peak can provide valid indications both for trend-following strategies (assuming a continuation of the trend) and for counter-trend/reversal strategies (aiming at a retracement).

Once these filters have been chosen and set, other parameters can be added. For example, you can set a capital limit in order to have a more complete overview of the most promising strategies.

This operation, however, can hide several pitfalls so it must be done correctly, setting all the parameters with the utmost care.

If you have any doubts or do not know how to proceed, we recommend that you watch the video below, where we explain the process of choosing portfolio strategies step by step.

In the video, you will also discover an example of automated portfolio management through our proprietary software called TitanTM, which helps us manage over 300 strategies every month! Watch it now to find out how we choose the systems to use in live trading!

Dynamic Portfolio Management and Strategy Rebalancing

As anticipated, the trading portfolio is a dynamic and interrelated mix where every strategy has a weight in the overall calculation of risk exposure.

Over time, however, the level of risk and profitability of a strategy can vary and even the most promising system can stop working.

For this reason, in addition to choosing the right strategies to activate, it is also important to monitor the profitability of strategies in a portfolio over time.

In this perspective, it is important to periodically check your portfolio by rebalancing, or in the most serious cases, deactivating the systems that stop performing adequately.

Rebalancing can occur on a time basis, for example every n weeks or months, or based on some qualitative parameters, for example, volatility increases, changes in asset weights, or the loss of profitability of a system.

Remember that monitoring the effectiveness and validity of your portfolio is essential to always keep yourself in line with your trading objectives and your risk profile.

Conclusion

One of the first goals of each trader should be to build a diversified and well-balanced portfolio. Utilize a mixed bag of strategies based on different approaches, working on multiple time horizons, and trading various underlying assets.

This lets you reduce the risk of overexposure and enables you to continue trading for a long time.

However, choosing the right strategies to activate is not always easy. As we have seen, the most common criteria based on the available capital are not enough to make a good choice.

Other parameters must be taken into consideration such as one’s risk profile and the time horizon of one’s investments.

It is also important to remember that over time, even the most promising strategies can lose their profitability. That is why it is so important to periodically check your portfolio by rebalancing or, in the most serious cases, closing the positions that are no longer profitable.

A possible solution is to apply filters on the equity lines of the strategies. This can help you choose the systems to use in real trading among all those you have coded and let you preserve the balance of your trading portfolio.