For most of us, holidays like Christmas and Easter represent moments of leisure and relaxation, family time, and activities we love.

But as Gordon Gekko, star of the Hollywood blockbuster, Wall Street, said, “money never sleeps.”

The purpose of this article is to learn if we can exploit the markets even during the holidays. We will explore the so-called “Long on Holidays” setup, how we can set it in a systematic trading strategy, and what advantages it offers.

What is the Long on Holidays Setup?

The Long on Holidays setup is, in a sense, a type of rally, that is, a phase in which the price of an asset grows sharply.

This setup suggests going long (buying) during a holiday period, expecting a bullish market behavior.

This bullish behavior is due to the approaching holidays, as the holidays tend to increase market consumption.

As a result, the performance of many companies traded on the stock exchange gets boosted. What we are trying to do is to see if it is possible to take advantage of this sort of acceleration by applying the Long on Holidays setup to the stock market.

Is the Long on Holidays Setup Really Effective?

The best way to test the effectiveness of a given theoretical strategy is, as always, to test it.

In the video below Andrea Unger shows you step by step an example of the Long on Holidays setup applied to different markets and explains the advantages and disadvantages associated with using this strategy.

Andrea first considers the Mini S&P 500, the first market on which the Long on Holidays was tested.

As you can see in the video, the only recurrences that show interesting results are Christmas and Easter, the most significant Western holidays. We see that between December and January, and then in April, the setup produces noteworthy profits, while the results are not that interesting in the other months.

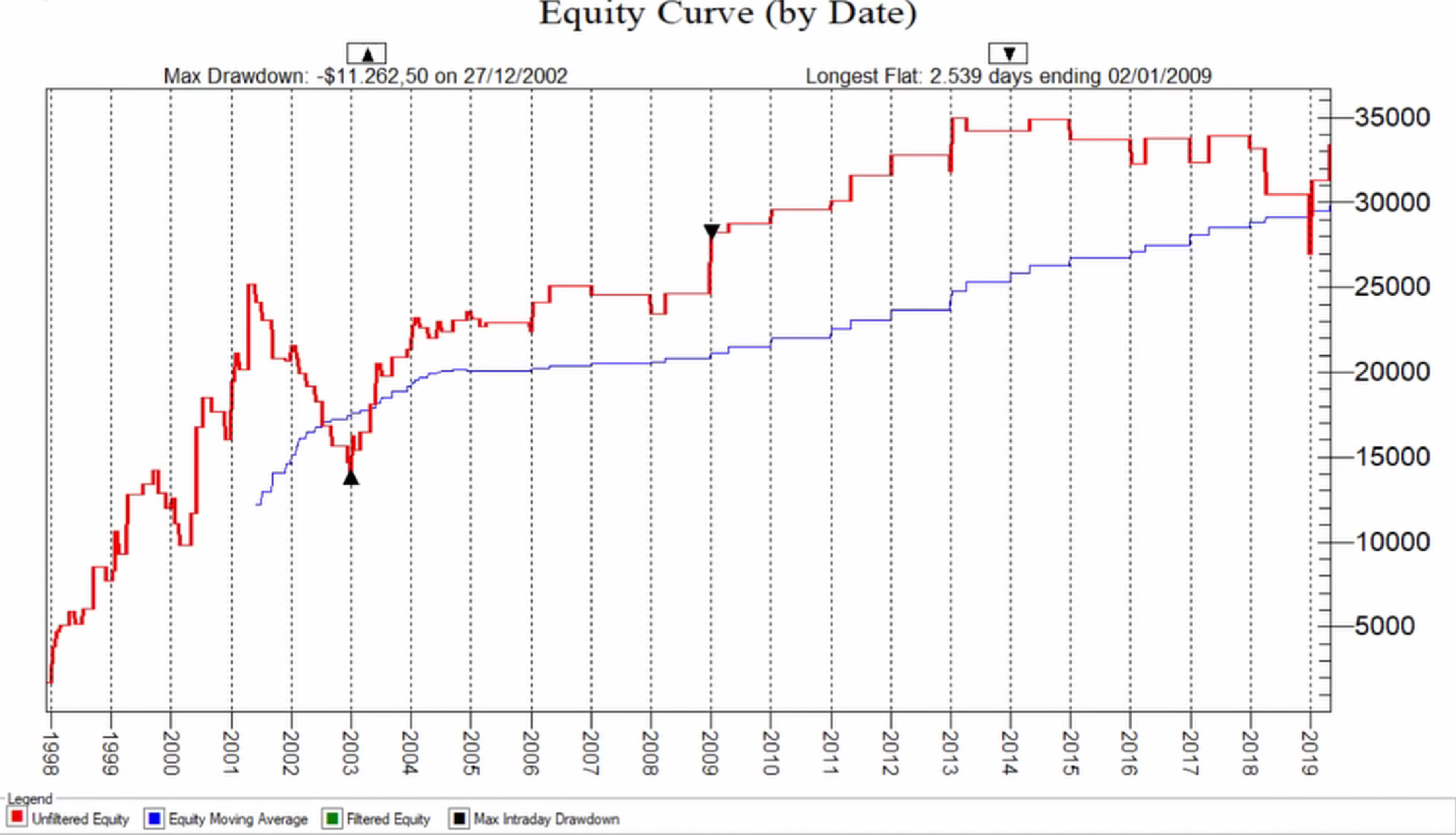

Below you find the equity line generated by the setup shown in the video.

As you can see, it is not an amazing equity line. In fact, there are some significant drawdown moments.

At this point, Andrea reasons on the fact that, if some holidays are decidedly better than others, perhaps it might make sense to trade only within these time windows.

Furthermore, he observes that adding a filter based on the moving average makes the results of the strategy more attractive. The gains are lower, which we expect since we are making fewer trades. However, the drawdown is greatly reduced, almost completely disappearing.

Using the moving average helps to avoid ‘counter-trend’ entries by preventing us from buying in those periods when the price is below the moving average.

So the first conclusion that we can draw is that a basic Long on Holidays setup can work on the American index, but that by using a filter based on the moving average we can get better results in terms of drawdown.

The Best Markets to Apply the Long on Holidays Setup

Let us now try to answer a second question, that is, whether the Long on Holidays pattern can work on other markets outside American equities.

Germany

Let’s start by considering one of the most important European markets, the German stock exchange. Specifically, the Dax Future.

As you can see in the video, starting at 6:30, the German market behaves in a way that is very similar to the American one. The most significant peaks correspond with the major holidays (Christmas and Easter).

Andrea also takes into consideration important German national holidays such as German Unity Day on October 3rd, but even in this case, the setup does not produce particularly interesting results.

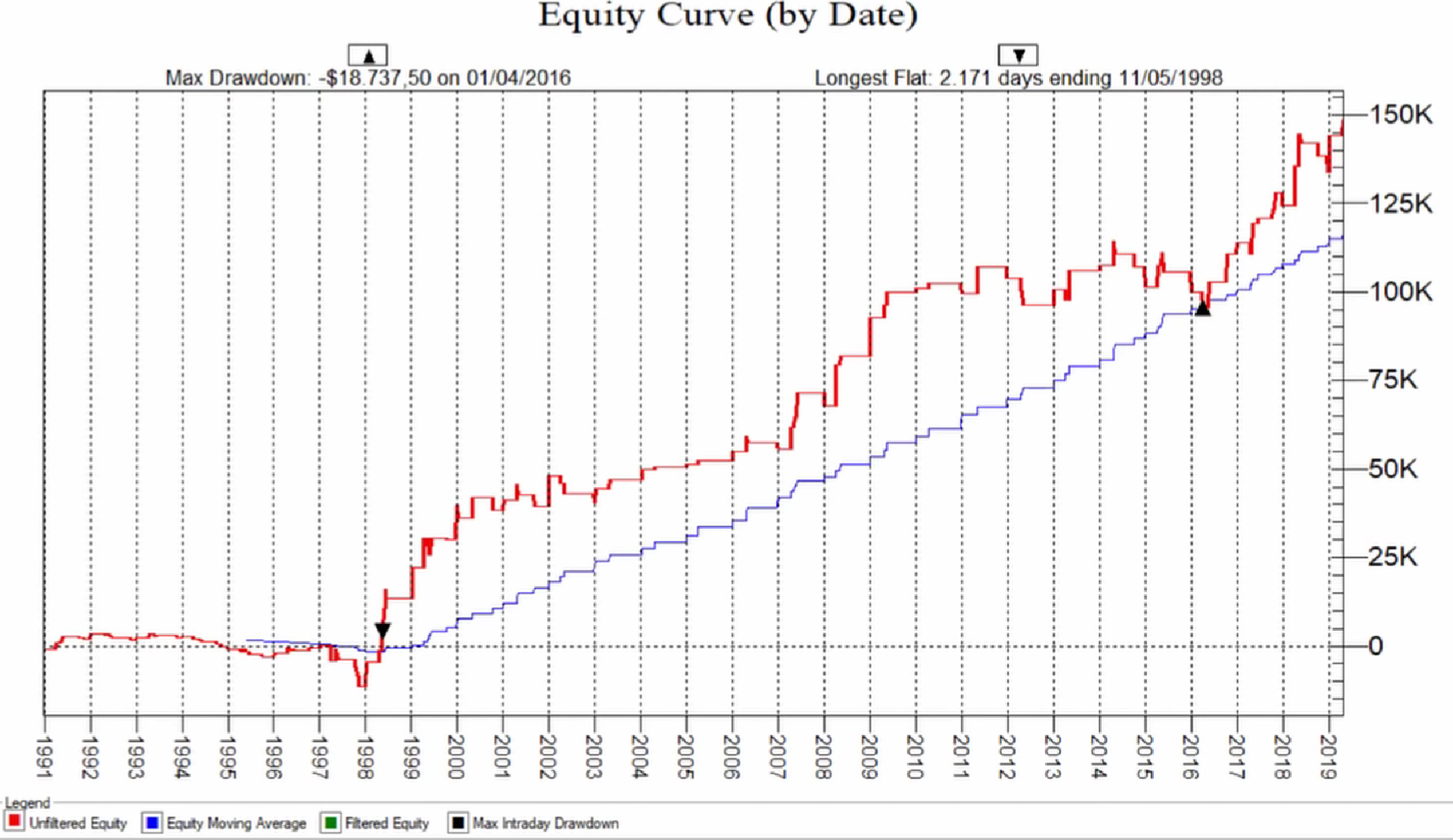

Below you find the equity line produced by the Long on Holidays setup applied to the Dax Future.

Also in this market, it is interesting to see what happens if you try to remain in the market less time, taking advantage of the highest peaks and avoiding the phases with lower performance. And indeed, similar to what we saw with the Mini S&P 500, the results become more interesting.

Italy

By applying the Long on Holidays setup to the Italian FTSE MIB (formerly FIB), we get the best performance during Christmas and Easter, in line with what happens in the rest of the world.

Starting from minute 8:45 of the video you will find an analysis of what happens by applying the Long on Holidays setup to Ferragosto, a very important Italian holiday on August, 15th. Also in this case, the results we get with the unfiltered setup are quite unattractive, while the ones obtained with the moving average filter lead to better performance.

In case you want to take advantage of the price hike that usually takes place on the FTSE MIB in August, make sure you keep the trade open for a short time and close the position immediately after the holiday.

Other markets

A market that is somewhat of an exception is that of Hong Kong, in the sense that no particular benefits are seen even around the most important holidays. In this case, it is simply best not to use the Long on Holidays setup at all.

Remaining in Asia, we see that Japan behaves in a similar way to the European and American markets. In Australia we see similar performance.

Conclusions

Now that we have seen how the Long on Holidays setup performs on different world markets, we can try answering our initial question. Is it worth spending our time and energy in this setup?

In our opinion, the answer tends toward “no.” Given the limited profits, using this setup can expose us to excessive risks.

In fact, it should be borne in mind that Stock Exchanges remain closed during the holidays. This means that open positions cannot be closed either manually or with automatic exits set in trading systems because stop orders would be executed only when the markets reopen.

In conclusion, the setup itself works, especially with the addition of filters that limit our time on the markets. However, we feel that the game is probably not worth the trouble.