Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.

In this article, we dive into the performance of two well-performing strategies from our database. Both systems focus on the DAX futures contract, the benchmark for European equity futures, and have been out-of-sample for several years.

We’ll walk through the core principles of these strategies, with a spotlight on their entry logic and recent performance metrics. Our goal is to spark new ideas and provide actionable insights for developing your own trading systems based on this underlying asset.

What’s especially noteworthy is that both strategies rely on reversal logic, and they’ve been performing exceptionally well in recent months. This suggests they’re well-tuned to current market dynamics, even though they faced tougher conditions in previous years when trend-following approaches had the upper hand.

DAX Futures Multiday Reversal Strategy No. 1

Strategy Logic and Rules

The first strategy uses a 30-minute time frame for both data1 and data2, with trading sessions running from 8:00 AM to 10:00 PM exchange time. It capitalizes on short-term market excesses, leveraging the tendency of prices to revert toward the mean after these excesses occur—a classic mean-reverting approach.

To pinpoint these excesses, the strategy relies on Bollinger Bands applied to data2.

Additionally, it uses two distinct operational filters for long and short positions, optimizing the identification of favorable trading days. As a multiday system, it typically holds positions across multiple sessions.

Figure 1 – Trades executed using the strategy on the DAX future (above) and application of Bollinger Bands to the chart (below).

Performance and Metrics of the Strategy

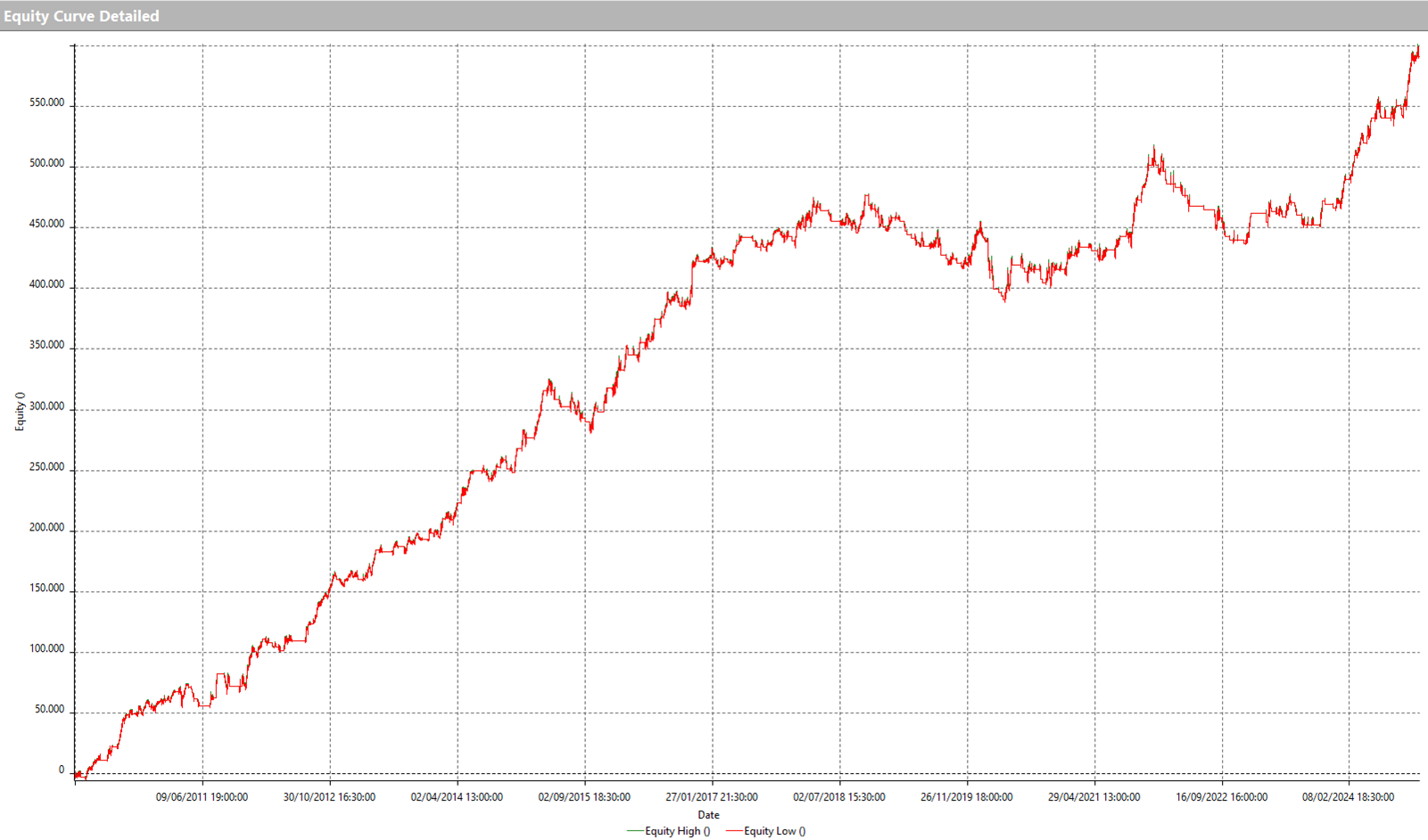

Let’s dive into the equity line, which showcases the strategy’s historical performance from 2010 to today. Over the past year, the results have been remarkable, standing out after a few less impressive years. For instance, in 2022, the strongly bearish market made countertrend trading less effective.

Figure 2 – Equity line of the DAX Future reversal strategy no. 1.

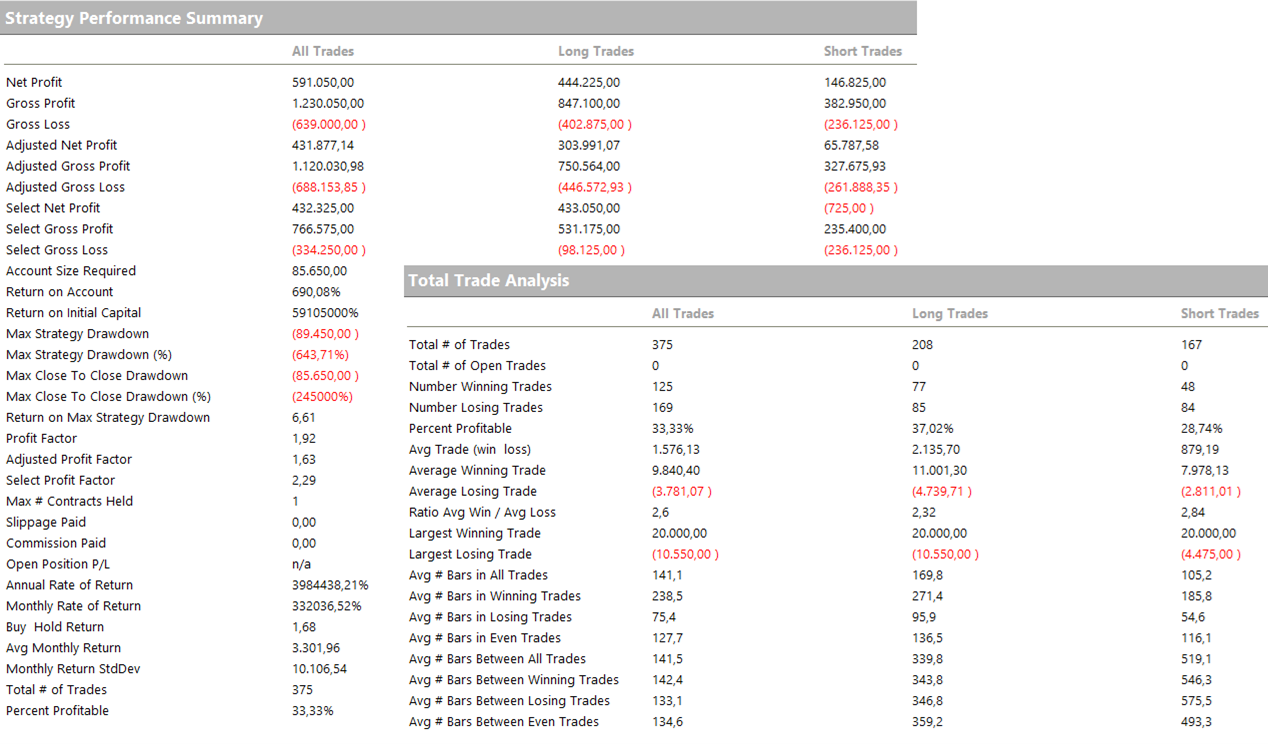

Examining the key metrics, we see an impressive average trade value of around €1,600, along with strong performance on the short side—a notoriously difficult area to master when trading stock indices.

The DAX future stands out as an incredibly versatile instrument. It works well with a variety of strategies, including Trend Following, Mean Reverting, and bias-based approaches. Even better, it is also accessible to traders with portfolios of all sizes.

There are three contract types to choose from: the full-size DAX future, featured in this article and our portfolio reports; the mini-DAX, sized at one-fifth of the full contract; and the micro-DAX, introduced a few years ago, which is just one-twenty-fifth the size of the full contract.

All three contracts offer excellent liquidity, enabling traders to select the option that best matches their portfolio needs.

Figure 3 – Performance Summary and Trade Analysis of the Multiday Reversal Strategy on the DAX Future No. 1.

Multiday Reversal Strategy on the DAX Future No. 2

Strategy Logic and Rules

Next up is the second strategy, which runs on a 15-minute time frame for both data1 and data2. The core logic is straightforward: a long position is triggered when the price crosses above the previous session’s low and closes above it after dipping below. For the short side, the process is inverted: the price must break below the previous session’s high before a short position is activated.

Figure 4 – Examples of Trades from the Multiday Reversal Strategy No. 2.

Like the first strategy, this one includes some custom operational filters designed to boost the average trade value.

Performance and Metrics

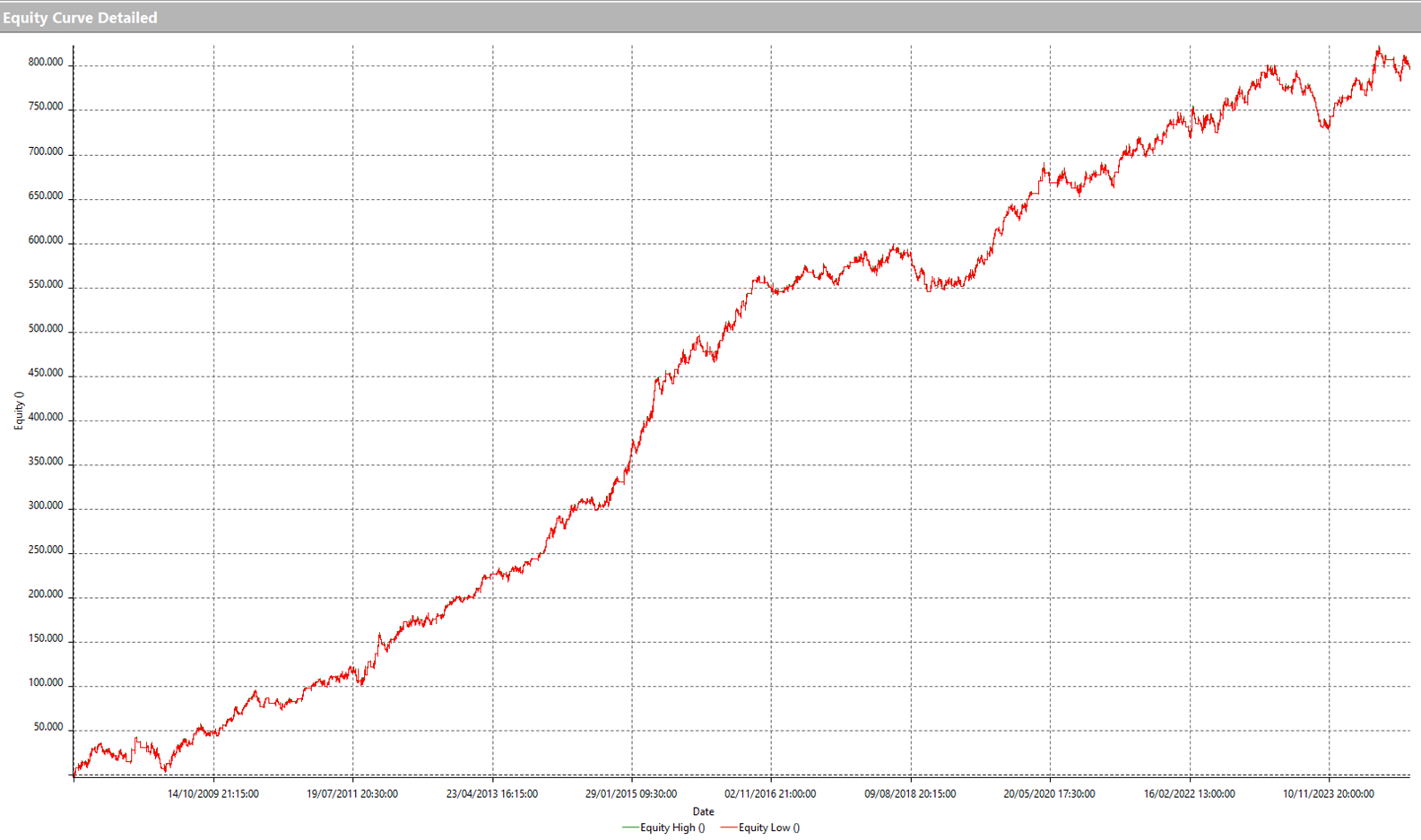

Let’s dive into the performance, starting with the equity curve.

The strategy demonstrates a robust and steadily upward trend. Its equity curve is even smoother than that of the first strategy. While 2023 was not a stellar year for performance, the strategy bounced back significantly in 2024, recovering its drawdown and hitting new equity highs.

Figure 5 – Equity Line for the Reversal Strategy on DAX Future No. 2

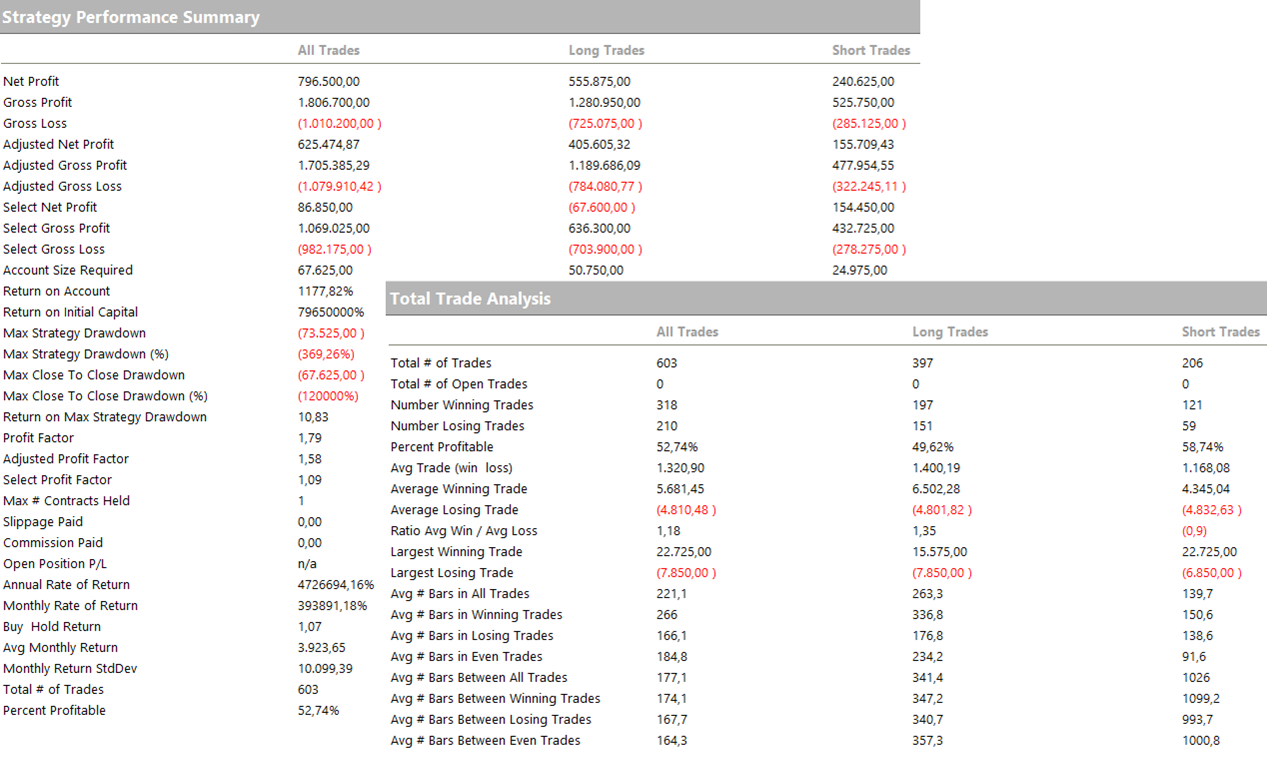

Now, let’s dive into the Total Trade Analysis. This strategy executes significantly more trades than the first one—about 600 in total—with an average trade exceeding €1,300. This figure is well-distributed between long and short trades and comfortably covers the operational costs of live trading, including slippage and commissions.

Figure 6 – Strategy Performance Summary and Total Trade Analysis for the Multiday Reversal Strategy on DAX Future No. 2

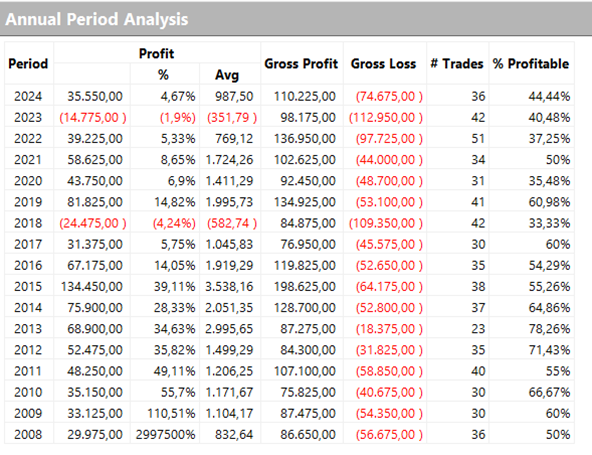

When we break down the system’s annual returns, a clear picture of consistency emerges. While the strategy faced challenges in 2023, it made a remarkable comeback in 2024, delivering over €35,000 in profits.

Figure 7 – Annual Profit Distribution for the Multiday Reversal Strategy on DAX Future No. 2

Final Thoughts on the Two Reversal Strategies for DAX Futures

The review of these two multiday reversal strategies on the DAX Index future (FDAX) underscores the power of a systematic and structured trading approach, even in challenging market environments. Both strategies excel in adapting to recent market trends by leveraging reversal techniques that capitalize on the DAX’s mean-reverting tendencies.

With tools like Bollinger Bands, customized operational filters, and clearly defined rules, these systems improve trading efficiency by delivering solid average trade values and effective risk management.

Additionally, the versatility of the DAX contract makes diversification accessible. The contract comes in different sizes, ensuring traders of all portfolio levels can find the right fit.

For anyone aiming to design new strategies or enhance existing ones, the insights shared here provide a valuable starting point. Success lies in the continuous refinement of systems to keep pace with changing market dynamics.

Transcription

Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.