Who are you, what do you do for a living and how long have you been trading?

Well, my name is Sebastian Baumgaertel, I’m an orthodontist by trade, so I’m a dentist that specializes in doing braces, so that’s my day job and then my part-time I guess gig, is trading.

I’ve been trading roughly since 2008, and I mean Futures Trading.

I’ve been investing in stocks and things like that a lot longer, but Futures Trading roughly since 2008.

I know you are a discretionary trader, yet you came to the Trading Masterclass in New York too, what benefits did you get from this training material for your trading?

Yeah, I am a discretionary trader, I was sort of raised by Larry Williams and as you probably know, he’s a discretionary trader mostly and so I do have that bias.

But, you know, you never really know what you don’t know and so, when a good friend of mine suggested I should attend the trading master class with Andrea and Michael Cook and Kevin Davey and Tim Rea, I figured, you know, why not?

Let’s give it a try and see, see what I learned about systems’ development, because I’m certainly open, at the end of the day I don’t care how I make my money and I did learn, I did learn quite a bit.

You know, aside from meeting some really interesting people and having a great steak dinner at Wolfgang’s which, by the way, is one of my favorite restaurants, so that alone was a reason to go to the meeting.

So yeah, I learned a lot.

You know, you learn about system development, you learn or I’d learned how to make systems more robust, I also learn how to assess if the system is stood of working and in a drawdown or if a system might have stopped working, which that’s my biggest problem with the idea of systematic trading that, you know, the system might stop working and you continue to trade it because you’re not aware of that, and so that gave me a little bit more confidence.

I also really loved to learn a little bit… I had a little bit of statistics background and I’d love to learn a little bit about Kevin Davies Monte Carlo’s analysis and how he applies that to his trading systems.

So, you know, it was educational, I’m still a discretionary trader at the end of the day.

Most of the things I learned there, I apply to test out discretionary trading ideas, so I don’t just go into my trading with a gut feeling of what to do.

There’s some testing that goes on behind the scenes to make sure if there’s validity, that there’s validity to some of the approaches but I also have a couple of systems that I’ve been trading since then.

I developed those earlier, I didn’t have the confidence to put them live and I did tweak them a little bit after the weekend in New York.

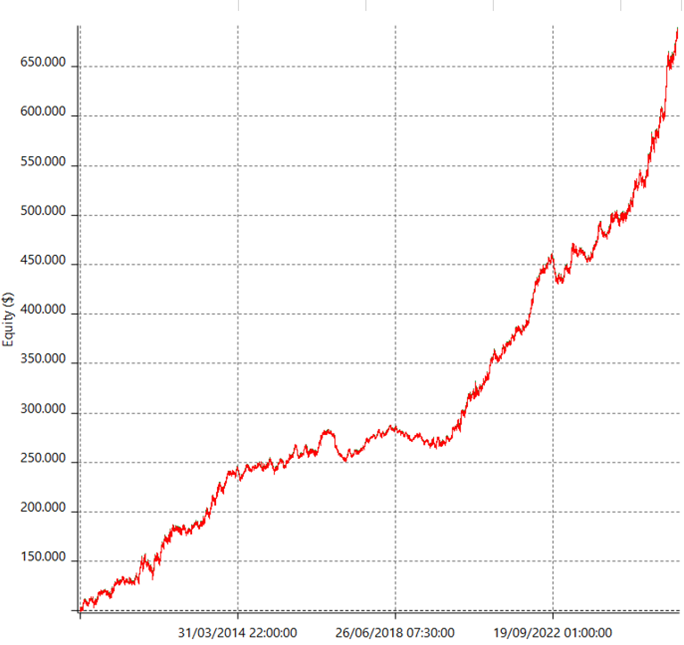

Then I’ve been trading them since 2017 in the summer, and yeah, it’s been really good for me, they’ve been profitable since, with minor drawdowns only.

So I did learn a little bit so I am 95% discretionary, but 5% systematic.

Which markets do you trade and why?

I trade pretty much anything that moves, so you know there’s got to be enough volume, so you get decent fills and I do not trade IC futures because a couple of years ago the IC introduced some new data fees and I’m just a little stubborn like that, I don’t think I need to trade cocoa and sugar and things like that, even though I used to like to trade those, but there are enough other things to trade, so I’ll trade anything that has enough volume.

How are you structured? Which platform, broker, and data feed do you use?

Yeah… so, for my trading I’m a really simple guy.

I just manually enter my orders with Charles Schwab that’s my broker for my private trading and for the World Cup, where Robbins is obviously the introducing broker I go through ADM Investor Services and CQG on the backend and I have… I use Genesis trade navigator as a platform that has served me really well over the years.

You might wonder why I do something different for the World Cup and why I do something different for my private account and that’s just me being a creature of habit.

I’d opened up an account with Schwab years ago and I just like the idea of generating signals in my trade navigator and then entering them manually in the Schwab platform.

That gives me a little bit more time to reflect on what I’m doing and if I really want to place that trade.

Trading through the platform for the World Cup is super simple, you know you can be very visual, you just click on the chart and placing that trade is so simple that I found that sometimes it’s too simple and I don’t have that extra pause that might keep me from trading and when I over trade, things usually don’t work out so well.

So in the World Cup, I have to do it that way in my private account, for now, that’s what I do.

And now tell us about the World Cup Trading Championship: what results did you get in the league?

Well, this was, I think my third or fourth time participating and I had a spot on the leaderboard almost every time I participated, but then I just lost that because I made bad decisions.

In 2019, so last year, I made fifth place, which I’m quite happy about.

Obviously, I play to win, first place would have been nicer, but I’m happy with fifth place.

I made a 97.1% return over those 12 months from January 1st to December 31st.

The really interesting thing is that I had a terrible first quarter that year and started with a pretty big drawdown.

Then I just stopped because I almost had given up, but I still had money in my account and so then later in the year I started trading the World Cup again.

So I basically created all that return in the last six months which was pretty good, definitely better than I had anticipated.

If you like to share, can you tell us what has been the one thing most responsible for achieving these results?

Yeah, it’s what a lot of other people say too, I think it’s discipline.

I can trade and many of your listeners can trade and if they learn from you guys they certainly can trade.

I can trade, the problem is I have a lot of good trades and I have a lot of bad trades, and I technically know what approach works and the other things I try out, I do this, I do that and I wasn’t very disciplined.

Especially the better I was doing, the more I lost discipline and so, you know, I just looked at myself in the mirror and I said: “Hey listen, stop messing around and just trade what you know, just trade what you’re good at!”.

Once I started sticking to that, it just was working out great, it just started taking off.

So discipline, that’s… I think that’s the top-secret here.

How much capital did you start with, how many strategies and what kind?

In the World Cup, I trade that purely discretionary.

I started with the minimal funding amount, which is $10,000.

I might do that differently next year, simply because I noticed that a lot of good trades I can’t take, so the bigger contracts like crude oil or the e-mini right now I can’t trade currently in the World Cup, because they have such high margin requirements, or I would just have too much risk on if I traded those contracts.

So right now, with the elevated margin requirements and the volatility that’s in the market, I’m a little limited as to what I can trade, because this year too, I just started out with $10,000, and I’m happy, I’m up roughly 50%, but in my private account, where I can trade everything because I have more money in it, is actually doing a little better.

So the next year I might use a little bit more.

I started 2019 with $10,000, I think my drawdown was down to… I was down to $6,000 or whatever at some point, and then I came back and finished with a little over $19,000 at the end of the year.

So what strategies and how many strategies… like I said I only have two systems which I learned in New York at the trading masterclass.

If you trade systematically you want to typically trade more systems, but I only have two systems and the rest is discretionary and in the World Cup it’s all discretionary in there.

I don’t just have one approach, really, I mean, I have a number of different indicators and, to me, it’s kind of like painting a picture, you know.

If you’re a painter you have different brushes and you pick the one that you need at that moment and so I’ll look at my indicators and they give me a rough idea of what’s going on and by now, I have enough experience to know how to weigh the information I get, because sometimes these indicators could be conflicting, right?

So I will then heed the information from some indicators more than I might from others, or I might throw out some indicators completely and in the end, I get a picture if that market is worth betting some money on, and that’s kind of how I trade.

So really it’s a single approach, but it’s a multi-pronged approach with a lot of different indicators.

Have you changed the approach to your trading during this competition year or has it remained unchanged?

In terms of the indicators, one of the things I’ve gotten a little better at using is the MACD and so I started using that over the course of last year and at the same time, I started using moving averages a little bit stronger to just help me find trends.

That’s not an approach that I’ve been typically trading but, yeah, so it’s been mainly moving averages and MACD that I started incorporating into my trading and then currently I’m working on the Fibonacci numbers a little bit to see how I might be able to benefit from that.

It’s something that, to me, is a little bit like black magic but I’ve started seeing some value in it.

So I’m not trading for the notches yet, but I’m working on building them into my trading and I think there’s some additional value that I could gain from those.

What can you tell us about the psychological aspect?

Yeah, so, in general with trading in my mind, the psychological aspect is key.

You know, I’m a pretty smart guy, and yet for so many years, you know, I learned to trade from the world’s best trader, Larry Williams right?

For so many years I couldn’t make any money, I didn’t lose a whole lot of money, but I also didn’t make a lot of money and it was absolutely not worth, it was fun but it was not worth it financially.

I certainly had the intellectual capacity to trade, so the question is, you know: why wasn’t I making any money?

It’s all psychological, right?

So the aspect of discipline is purely psychological, but I’ve also noticed that trading just tends to bring out the worst in people.

All the bad characteristics that you may have, trading brings out.

If you’re greedy, it’ll come out when you trade, if you’re impatient, it’ll come out when you trade, if you’re a wild gun, it’ll come out when you trade.

So I happened to have all these characteristics and more and so over the years I had to learn to curb these and then, once I’ve been working on that, things started getting a little better, and then I entered the World Cup and it’s completely different again because your leverage is so much higher and you don’t have a lot of capital to work with and one larger mistake can wipe you out and so the pressure is on.

That is one of the reasons I’d actually started trading the World Cup, not because I wanted to become the world champion, but because a friend of mine had been trading the World Cup for a few years and he got on the leader board a couple of times and he told me it’s a really valuable experience because it helps you learn about yourself.

It obviously teaches you more about margin requirements and all those things, but, you know, it puts a magnifying glass on you and so, the World Cup has been a real growing experience and so over the years, I’ve gotten better I think because I competed.

So yeah, the World Cup just magnifies all these psychological problems that you may have.

One more thing that I think a lot of traders have is that they’re perfectionists, right?

I certainly am, and that’s the other thing.

I started to learn that I had to let go a little bit, okay?

Because if you expect perfection from this game of trading because you have it all figured out, you have it backtested and this is gonna work, the market will teach you that it will work, but not as good as you think it will and if you think you’re a good trader, the market will teach you you’re not as good as you think you are.

So if you’re a perfectionist, get rid of that and the World Cup especially when you’re seeing how all these other traders are producing unbelievable gains if you saw this year, I mean with what was going on in the markets, there were some guys that are killing it in the World Cup, and still are, you know, thousands of percent performance so far.

That puts a little pressure on you too, because you try to keep up, and you try to compete, and then you might be tempted into taking trades or over-leveraging your trades.

So you just got to stay cool and do your thing and not worry what’s going on around you, in the World Cup and in general and then you will succeed.

What are the main differences between trading on your main trading account and trading on a league account?

I think I touched on that a little bit already, it’s mainly the amount of money I have in there.

I’m a little limited in the World Cup than my private account where I have more money in it.

So I’m not limited, I can trade whatever I want, and then the other aspect is that in my private account I only compete against myself and so there’s no pressure.

In the World Cup, I don’t want to trade, I want to win, so obviously I might have a little bit more risk on it than I would in my private account… not might, most definitely I have more risk in the World Cup account than in my private account.

That is a major difference, otherwise, I trade pretty much the same in both accounts.

After almost a year of the championship, is there anything going back in time you would not do again or would you do differently?

No, I wish I would have just been more honest with myself earlier on.

This year I’m having a great World Cup year even though I’m not on the leaderboard because, you know, I made that… I had that epiphany last year why I just, I just realized that I burn up a lot of my good trades with bad trades and I can kind of tell at the beginning which trades are good and which are not going to be good.

I just get rid of losers quicker or don’t even attempt to trade trades that I’m not too sure about, so I wish I would have just done that a little sooner, but, you know, at the end of the day, every day is a learning experience, and I’m happy to be doing this.

Why the Championship? Did you think about it for some time or was there anything that triggered the decisive spring?

Well, listen… I never thought I could do it, honestly, I didn’t think I was… you know to me people like Larry Williams trade the World Cup or Andrea or Michael Cook, you know, not me.

Then, my good friend Mike, who I met through trading actually at one of Larry’s courses, he joined one year and made it on the leaderboard and he encouraged me, just like he encouraged me to come to New York and he said: “Sebastian I think you would learn a lot from that!”.

When Mike says something, I typically listen because he’s a very smart guy and so I thought: “Okay, what the hell, let me try the World Cup!”.

I got on the leader board within about three months and I was first place for a couple of weeks actually, which I didn’t know what to make out of that my first go-around, and then I stumbled in big mistakes and obviously, I burnt up.

But I was kind of hooked because you know, Mike was right, it does teach you a lot about yourself, and I’ve played along in the World Cup ever since.

I think this is my fourth year, maybe my fifth year, I lose track and I just do it because I learn about myself, I learn about trading and last year I made the fifth place, so that was nice too.

What advice do you want to give to people still looking for their own way in trading?

Well, you know, the biggest advice I have is: “Be patient with yourself and try to preserve your capital!”.

I don’t mean paper trading, I find that paper trading is great but that really doesn’t help me much at all.

It’s very different when you put your own money on the line and that’s again psychological, right?

But, I mean, just be careful with your capital so you can survive, it helps to have a day job that creates some income for you, so it can keep you alive while you figure this out, but be patient.

I’m not a genius, I’m not an Andrea who was a member of Mensa, you know, I’m just a regular guy with a decent head on his shoulders and that I want to trade and it takes commitment but if you give yourself enough time and you choose a good mentor then, you know, eventually you should get there, because if I was able to do it then so can almost anybody else.

Is there anything else you want to add?

Yeah, you know, I don’t think so I think that was very comprehensive except for, you know, I’m really glad that I got this opportunity.

Again it’s a huge honor that when you guys contacted me to do this and you know, I hope you’re well down in Italy this was a terrible time we all went through.

I couldn’t work for eight weeks and I thought: “Great, I’m a trader, that’s fantastic!”.

In these eight weeks of not working as an orthodontist were also my worst weeks trading because I don’t know, it messed with my head whatever it did.

So again, psychology.

I’m glad to be back at work, I’m glad that life is a little bit more normal now, and my trading is back to normal too, I worked my way out of my drawdown and so being a part-time trader is not the worst in the world I think.

You don’t need to look for becoming a professional right away, just take some time and get good at this slowly, but steadily.

Yeah, thanks for the opportunity Andrea, and thanks for the great interview, very comprehensive.