Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.

In this article, we’ll dive into the performance of two exciting strategies recently added to our database. Both are designed to operate on one of the world’s most prominent stock markets—arguably the best representation of recent trends—the Nasdaq, the quintessential tech stock index.

We’ll explore the general rules of these systems, focusing on their entry logic and current performance. Our goal is to provide you with valuable insights and inspiration for developing new trading systems tailored to this market.

One interesting aspect of these strategies is that neither relies on a reversal approach, which for years was considered the go-to logic for U.S. stock markets. Instead, both capitalize on the trend-following methodology, traditionally more associated with commodities. This approach has found fertile ground on the Nasdaq, thanks to the strong upward trend of the technology sector over the past decade.

Strategy #1: Intraday Bias on Nasdaq Futures (@NQ)

The first strategy we’ll discuss operates exclusively on the long side, using a 5-minute time frame for Data1 and a 1440-minute (daily) time frame for Data2. It follows the standard 23-hour session schedule (from 5:00 PM to 4:00 PM Exchange time).

This strategy identifies entries based on a recurring setup for this instrument. The setup involves a positive bar close relative to the session open, followed by new highs over a set number of periods, and then a pullback used as the entry point.

All trades are filtered through proprietary patterns from our internal libraries. As previously noted, if the predefined monetary stop loss is not hit, the strategy closes all positions by the end of the session.

Figure 1 – Example of a trade executed by the intraday bias strategy on Nasdaq Futures.

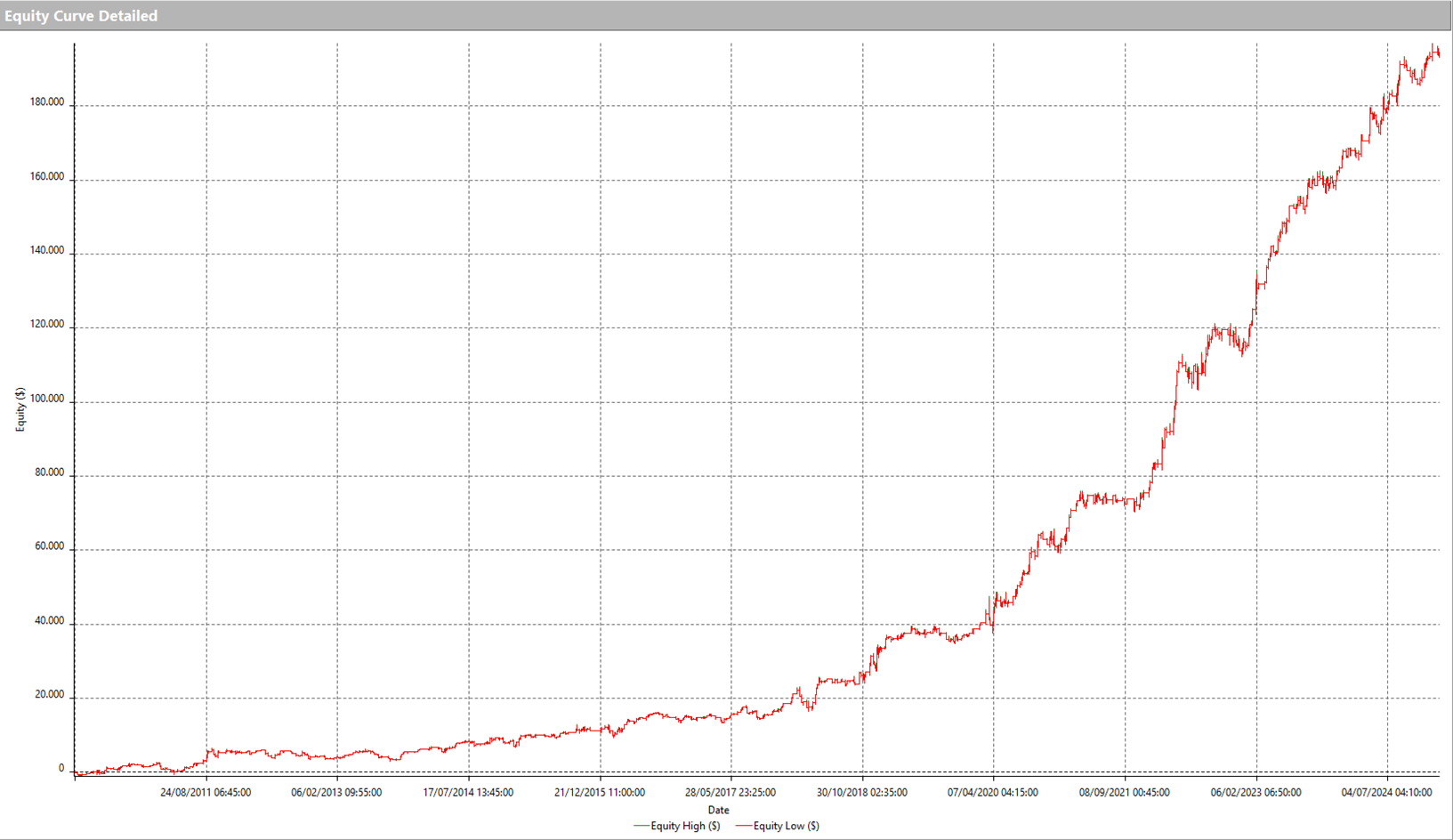

Below, you can see the equity curve spanning the entire history of the system from 2010 to the present. The results are undoubtedly impressive, and the remarkable growth of the underlying index in recent years has amplified this strategy’s already strong performance.

Figure 2 – Profit curve of the intraday bias strategy on Nasdaq Futures.

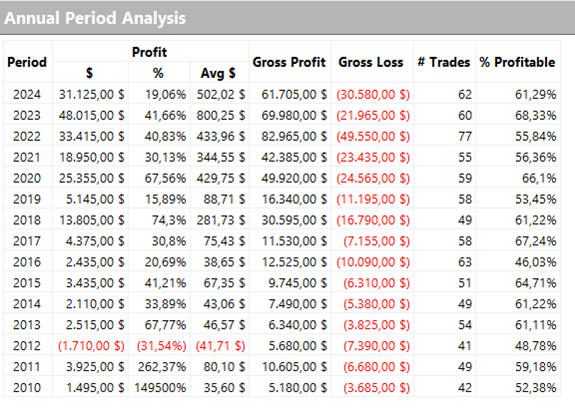

When we look at the Net Profit on an annual basis, we can clearly see that this trading system has performed significantly better in the post-COVID years compared to the past. For example, in 2024, the total net profit exceeded $30,000, while the year before it nearly reached $50,000.

Figure 3 – Annual performance of the intraday bias strategy on the Nasdaq Futures.

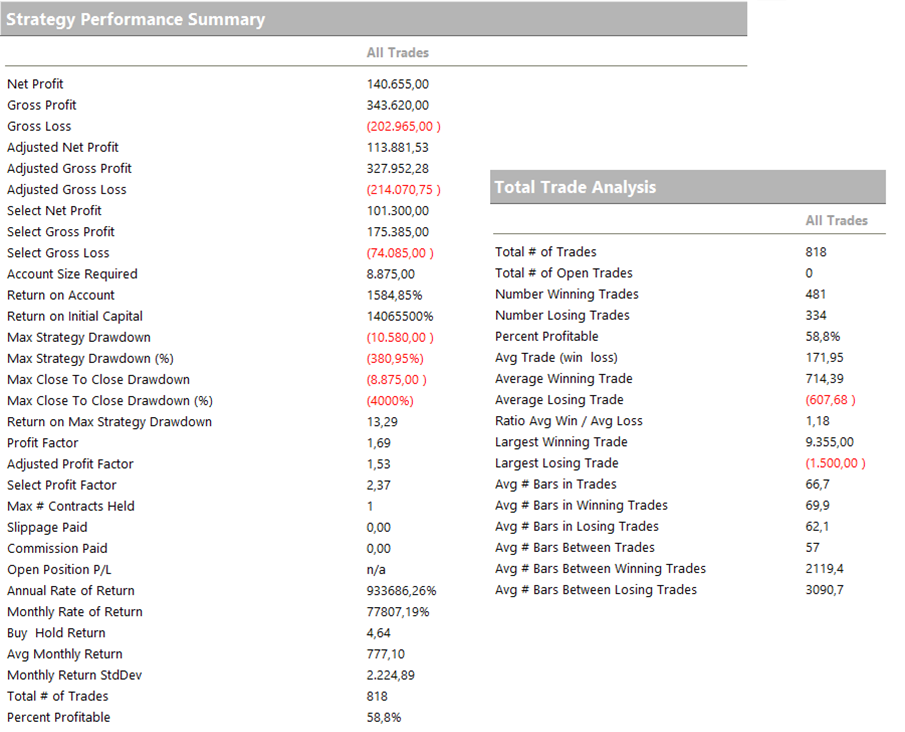

In Figure 4, we see the overall metrics. What stands out is the excellent net profit, combined with a remarkably low drawdown of just $10,000 and an equally impressive average trade, comfortably exceeding $200.

Figure 4 – Metrics for the intraday bias strategy on the Nasdaq Futures.

It’s worth noting that this futures instrument is highly versatile. It works well with trend-following strategies, mean-reverting approaches, and even bias strategies. Another major advantage is its accessibility for a wide range of portfolios, thanks to the micro version of the futures contract (@MNQ). This version is highly liquid and widely appreciated by retail traders across the globe.

Strategy #2: Intraday Trend-Following on Nasdaq Futures (@NQ)

Let’s dive into the second strategy we’re analyzing today. Like the first one, this strategy operates exclusively on the long side with a 5-minute time frame. However, this time it’s a breakout-based, intraday trend-following system. The logic is straightforward: it waits for the session’s highs to break and then uses those levels as triggers for entering positions. Of course, the strategy allows time for the market to settle after opening before identifying significant levels for entry.

Figure 5 – Example trade using the breakout intraday strategy on Nasdaq Futures.

Similar to the first strategy, this system incorporates multiple operational filters designed to improve the average trade value. These filters focus on identifying periods when prices are compressed or range-bound, as this setup increases the likelihood of a strong breakout.

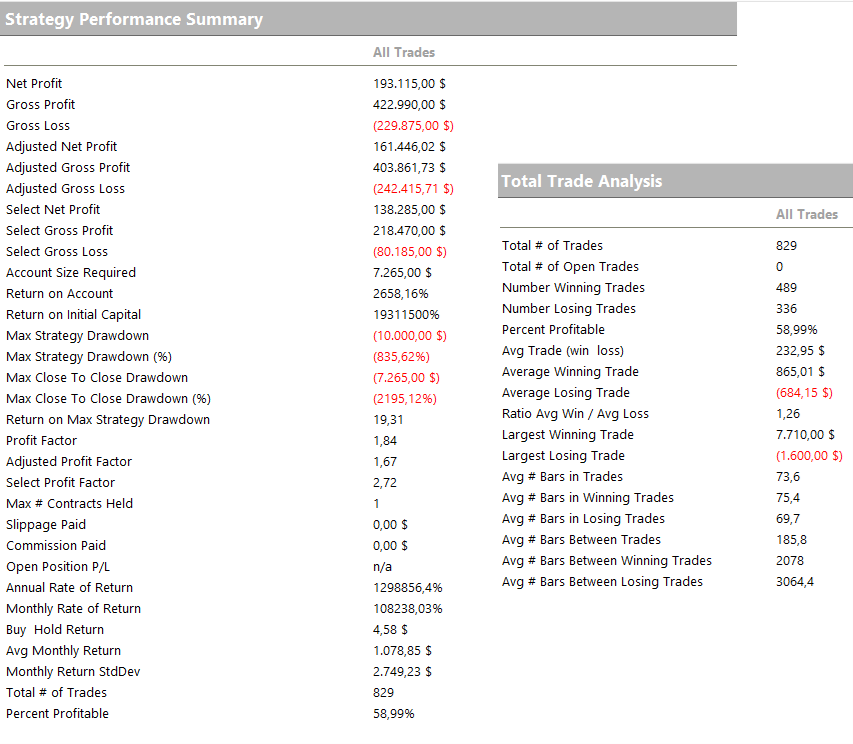

The equity curve for this strategy is strongly upward-trending, similar to the previous one. It did experience some slower performance during the pre-COVID years, when market volatility was much lower, leading to reduced profitability. However, the post-COVID era proved to be significantly more rewarding, mirroring the profitability of the first system.

Figure 6 – Profit curve of the breakout intraday strategy on Nasdaq Futures.

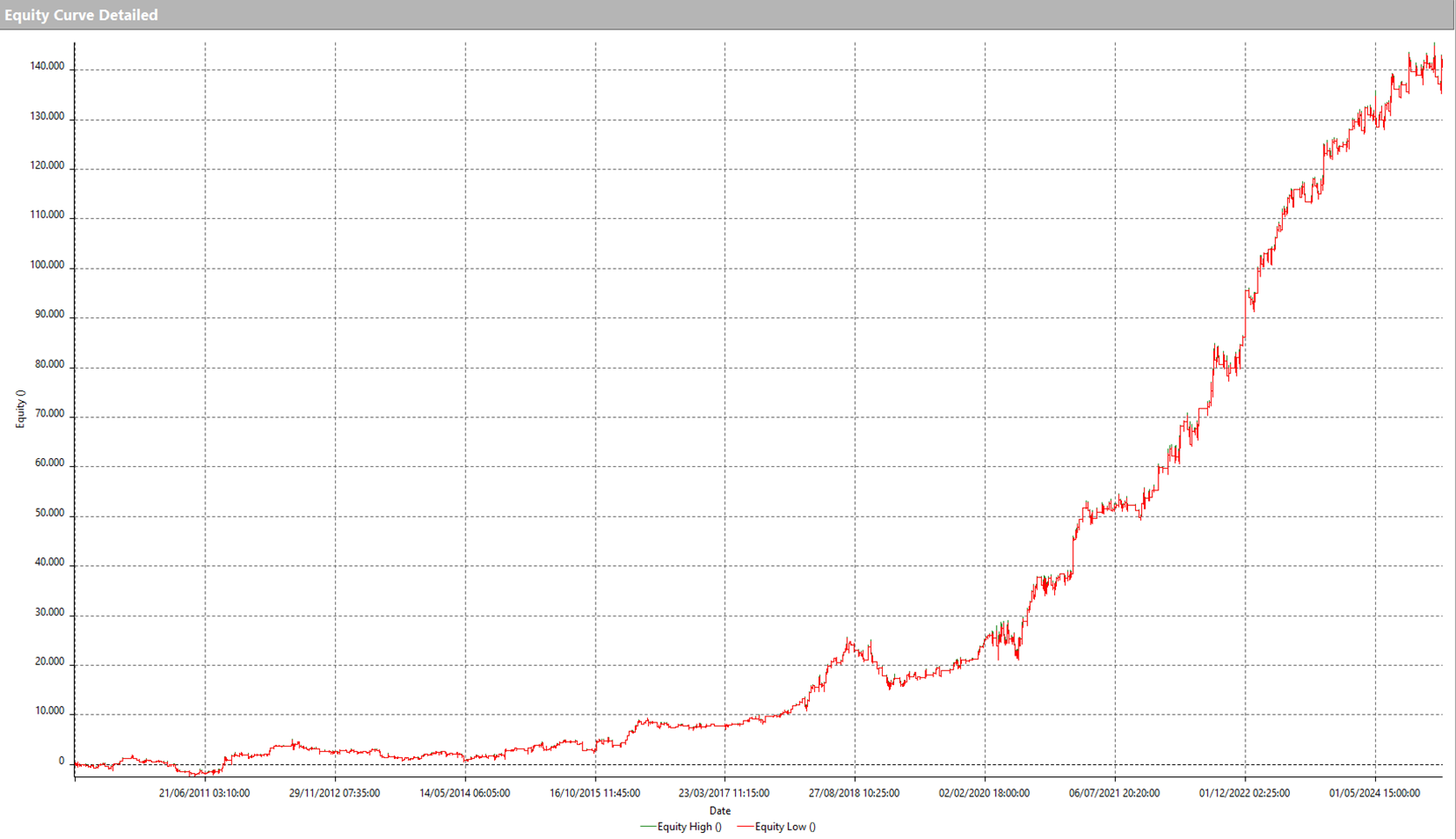

When analyzing the Total Trade Analysis, we see that this strategy executes a comparable number of trades to the first one—around 800 in total. Its average trade value is also solid at approximately $170, which comfortably covers the operational costs of live trading (commissions + slippage).

Figure 7 – Metrics of the breakout intraday strategy on Nasdaq Futures.

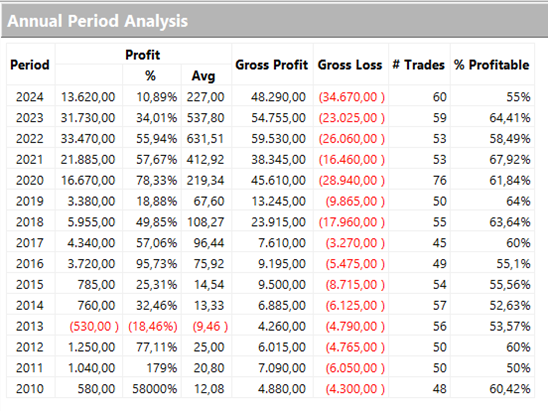

Looking at annual returns, this system has demonstrated remarkable consistency, with profitability steadily increasing in recent years. For instance, the net profit reached nearly $14,000 in 2024, while in the highly volatile years of 2022 and 2023, profits surpassed $30,000 each year.

Figure 8 – Annual performance of the breakout intraday strategy on Nasdaq Futures.

Conclusions on the Two Intraday Strategies for Nasdaq Futures

We’ve reached the end of this article, and we hope it has served as a valuable resource to inspire new ideas for your trading systems.

We’ve explored two innovative strategies for the Nasdaq, one of the most dynamic and opportunity-rich markets in recent years. By providing a detailed analysis of the rules, key metrics, and annual performance, our goal was to give you a practical and thought-provoking perspective.

These strategies highlight not only the importance of adopting systematic approaches but also how diversification and continuous optimization are essential in the trading world.

Keep exploring, testing, and refining—every step forward brings you closer to achieving your trading goals!

Transcription

Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.