Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.

In this article, we’ll review the results of the “Strategy of the Month” contest for December 2024. We’ll reveal the winning strategy along with another outstanding one chosen from the submissions. By analyzing the underlying logic, the markets they operate in, and their performances, we’ll provide some actionable insights.

The “Strategy of the Month” is a contest exclusively for Unger Academy students that awards the best strategy developed using the Unger Method™. Each month, students can compete for a chance to win a €1,000 Amazon gift card!

For those interested in obtaining the codes for the winning strategies, joining the Unger Strategy Club offers this and more. This exclusive membership provides access to the open-source code of the month’s winning strategy and all past winners, a monthly advanced live Masterclass, and an operational video explaining key rules from our portfolio strategies.

For even greater access, the Unger Strategy Club VIP membership includes all the above plus exclusive open-source codes for all approved contest entries, as vetted by Unger Academy coaches.

Now, let’s dive into the standout strategies submitted this month.

A Reversal Strategy for S&P 500 (ES)

Among this month’s entries, we commend David’s S&P 500 (ES) reversal strategy, which, while not the winner, deserves recognition.

This is a 15-minute reversal strategy for the S&P 500 (ES) that employs limit orders at price levels adjusted according to volatility. Volatility is assessed using the CBOE VIX index, incorporated as a secondary data series ("data2") with a time frame of 1440 minutes. The strategy compares the most recent VIX value to historical values over a defined period, using the fastpercentrank function. This function generates a percentile rank ranging between 0 and 1.

Based on the percentile rank output, the limit order is placed at the close of the 3:00 PM bar, adjusted upward or downward by a specific amount depending on whether the order is short or long, respectively. The adjustment amount is calculated as a fixed multiplier of the percentile rank value, with a minimum threshold set at 0.4. This ensures that the entry level is proportionally sensitive to recent volatility levels.

Figure 1 – Examples of trades executed by the S&P 500 (ES) reversal strategy.

Entries are further filtered by a time window and two proprietary patterns from the PatternFast list, one for long and one for short orders. Positions are managed with appropriately calibrated Stop Loss, Take Profit, and Break Even levels tailored to this instrument.

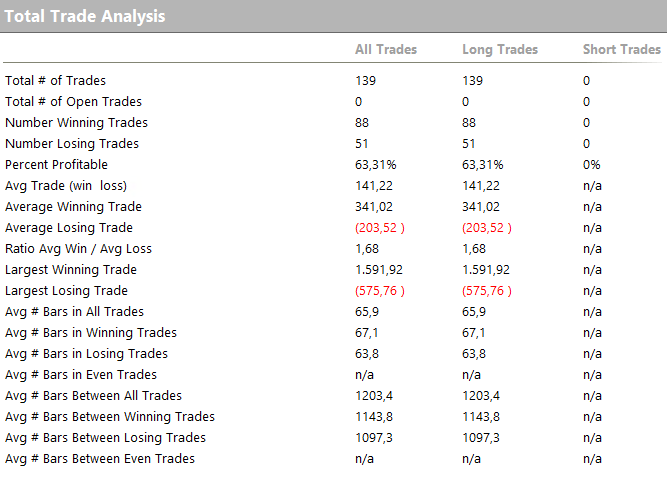

Below, we present the key metrics of the strategy based on data spanning from 01/01/2010 to 12/31/2024. The strategy stands out for its excellent net profit-to-drawdown ratio (exceeding 18), proving particularly effective over the past 5-6 years.

However, the primary drawback is that up to three entries per session are allowed, which can be quite risky for a reversal strategy. If the market moves in the wrong direction, this could result in up to three stop-loss hits in a single day.

Figure 2 – Equity line of the S&P 500 (ES) reversal strategy.

Figure 3 – Annual results of the S&P 500 (ES) reversal strategy.

Strategy of the Month for December 2024: Breakout on ETHUSDT

Now let’s dive into the winning strategy for the December edition, created by Alessandro, who earned a well-deserved €1,000 Amazon gift card. Congratulations, Alessandro!

This is a breakout (BO) strategy designed for long-only trades on ETH against USDT, operating on a 5-minute time frame. It’s versatile and can be applied to both the spot and futures markets.

The strategy initiates entries when the price breaks above the upper Bollinger Band, which is set at 3 standard deviations instead of the standard 2. While this adjustment can sometimes be seen as a bold move, in this case, it effectively reduces false signals that this type of strategy might generate on 15-minute charts.

It also incorporates a time window and two patterns to filter trades, with the position exiting at the end of the session or, on Fridays, by 12:00 PM—unless the stop loss level is reached earlier.

Figure 4 – Breakout strategy on ETHUSDT (Ethereum vs USDT).

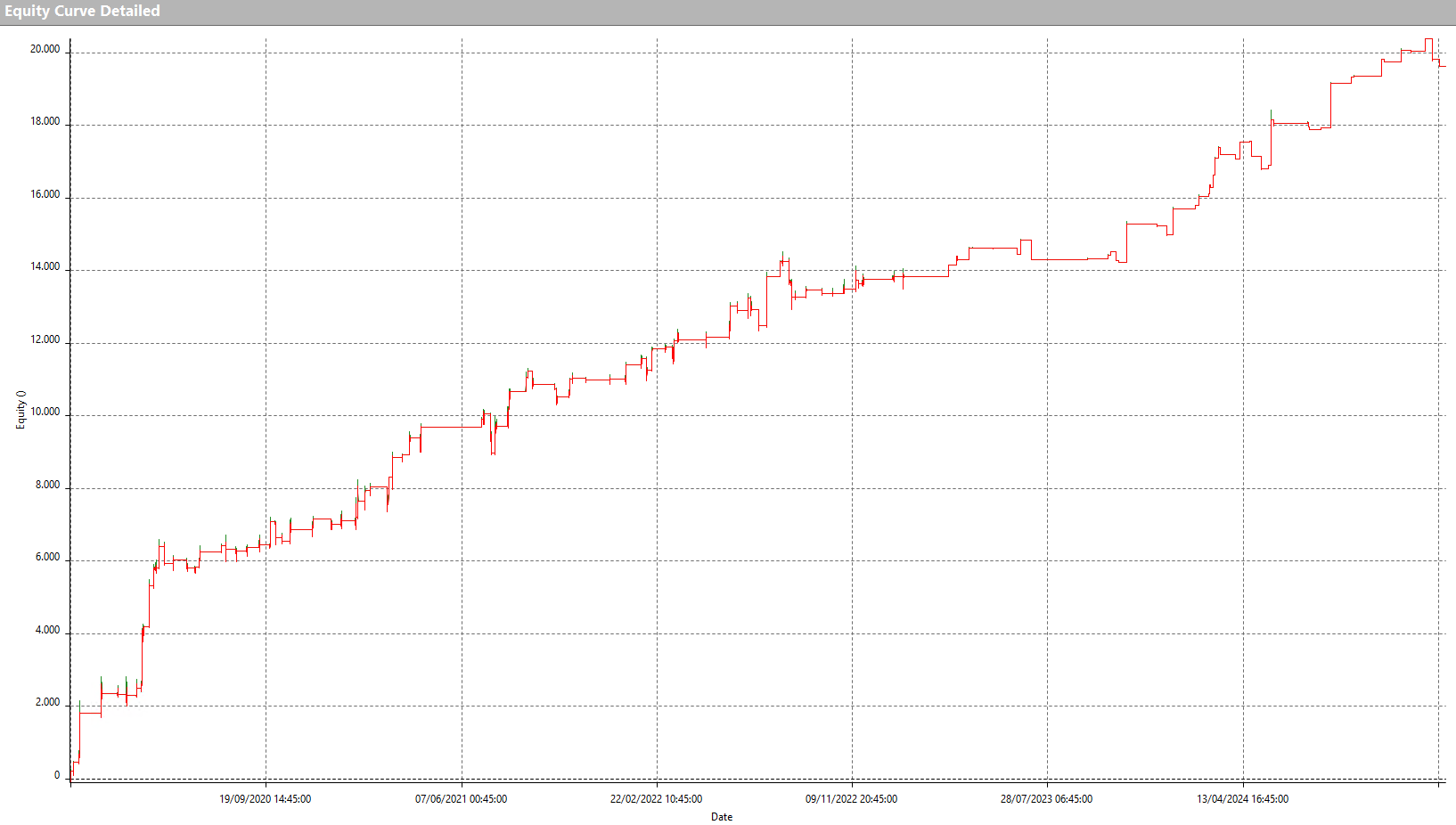

The core of this strategy is both simple and effective. Below are the key performance metrics of the strategy, based on data from 01/01/2020 to 12/31/2024, with a capital of $10,000 per single trade. The results demonstrate remarkable consistency. A comparison with the performance of ETHUSDT under a buy-and-hold approach highlights how the strategy delivered strong results, even during periods of significant price drawdowns for Ethereum.

Figure 5 – Performance report for the breakout strategy on ETHUSDT (Ethereum vs USDT).

Figure 6 – Price performance of ETHUSDT (Buy&Hold).

Figure 7 – Equity line for the breakout strategy on ETHUSDT (Ethereum vs USDT).

Congratulations again to Alessandro, who wins this month’s €1,000 Amazon gift card!

Takeaways

We hope this article has been helpful and inspiring!

If your goal is to create trading strategies like the ones we’ve just discussed, you’re in the right place. As you progress in your learning, you’ll also have the opportunity to participate in our monthly contest exclusively for Unger Academy students and compete for a €1,000 Amazon gift card.

Remember, if you want access to the code for the winning strategy and the top submissions in the contest, you can join the Unger Strategy Club. Check out all the features of this service at www.ungerclub.com.

That’s all for now—see you in the next “Strategy of the Month” installment for more actionable insights!

If you’d like to learn more about the “Strategy of the Month” contest, our monthly challenge for Unger Academy students awarding a €1,000 Amazon gift card to the best strategy developed using the Unger Method™, click here.

Or, if you’re curious about the past winners, click here to check them out.

Transcription

Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.