Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.

This past month has been nothing short of extraordinary, with many several of our traders showcasing remarkable skill and achieving impressive results.

While Giuliano rightfully claims the spotlight as the "Trader of the Month", we cannot overlook the great performances of Federico and Vincenzo, who both delivered results worthy of high praise.

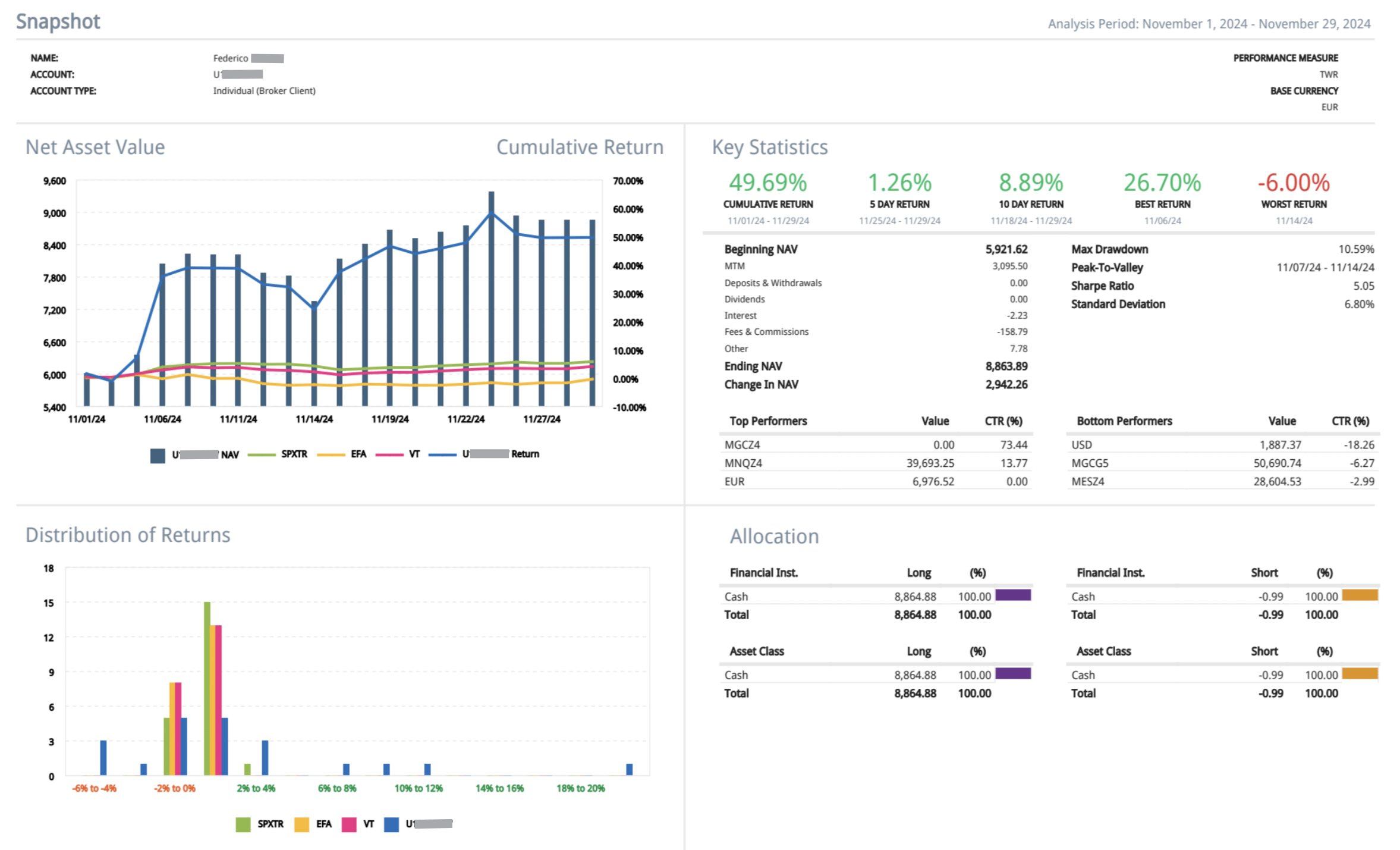

Federico achieved an outstanding 49.69% return with a 10.59% drawdown, resulting in a net profit of €2,942. His equity line displayed significant growth, although with some volatility and choppy movements along the way:

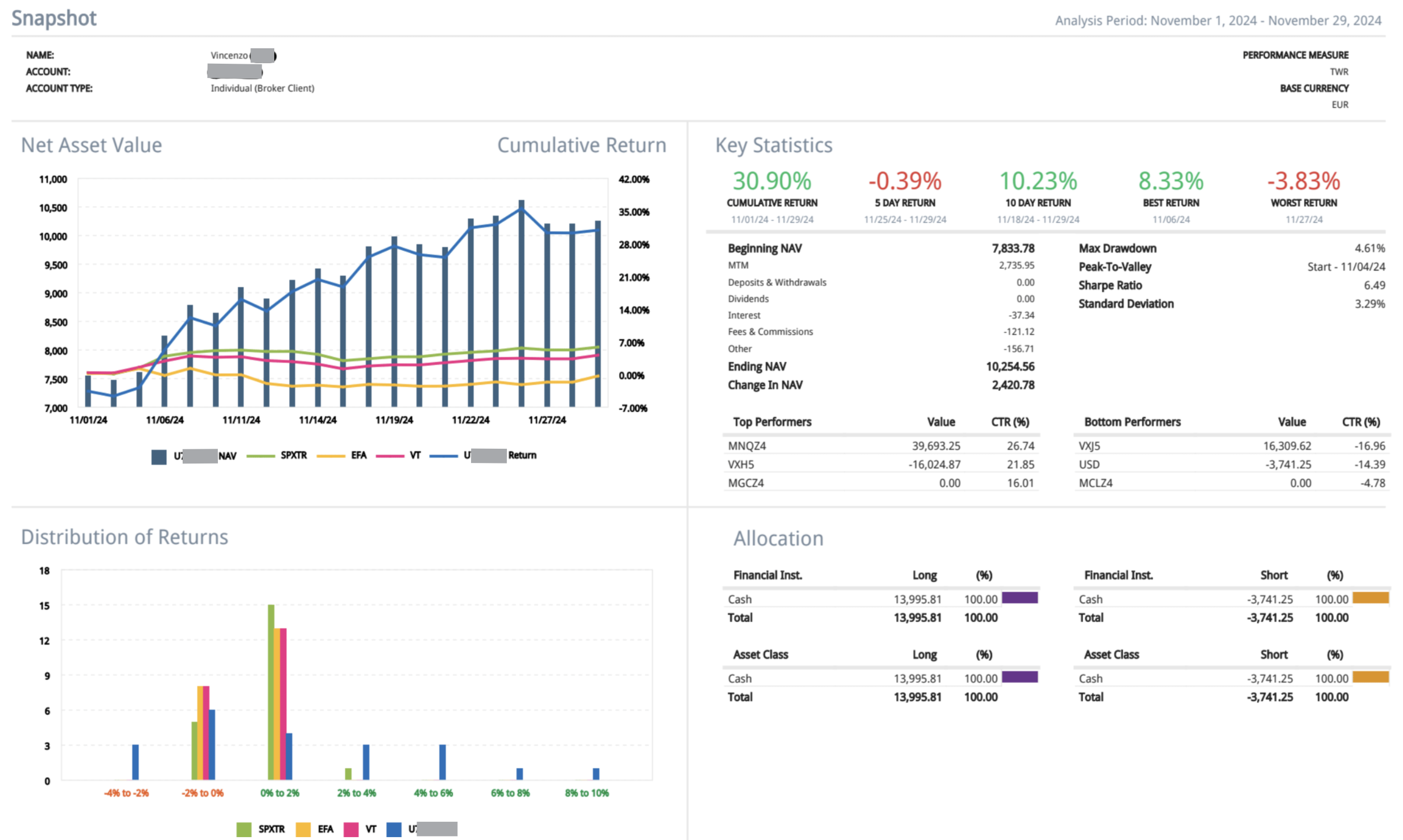

Vincenzo, on the other hand, delivered a 30.9% return with a 4.61% drawdown, achieving the best net profit-to-drawdown ratio of the month. His equity line was a model of consistency, exemplifying stability and disciplined risk management:

These exceptional results underscore the outstanding caliber of the Unger Academy® students, who continue to demonstrate the effectiveness of the Unger Method™ through their dedication, focus, and discipline.

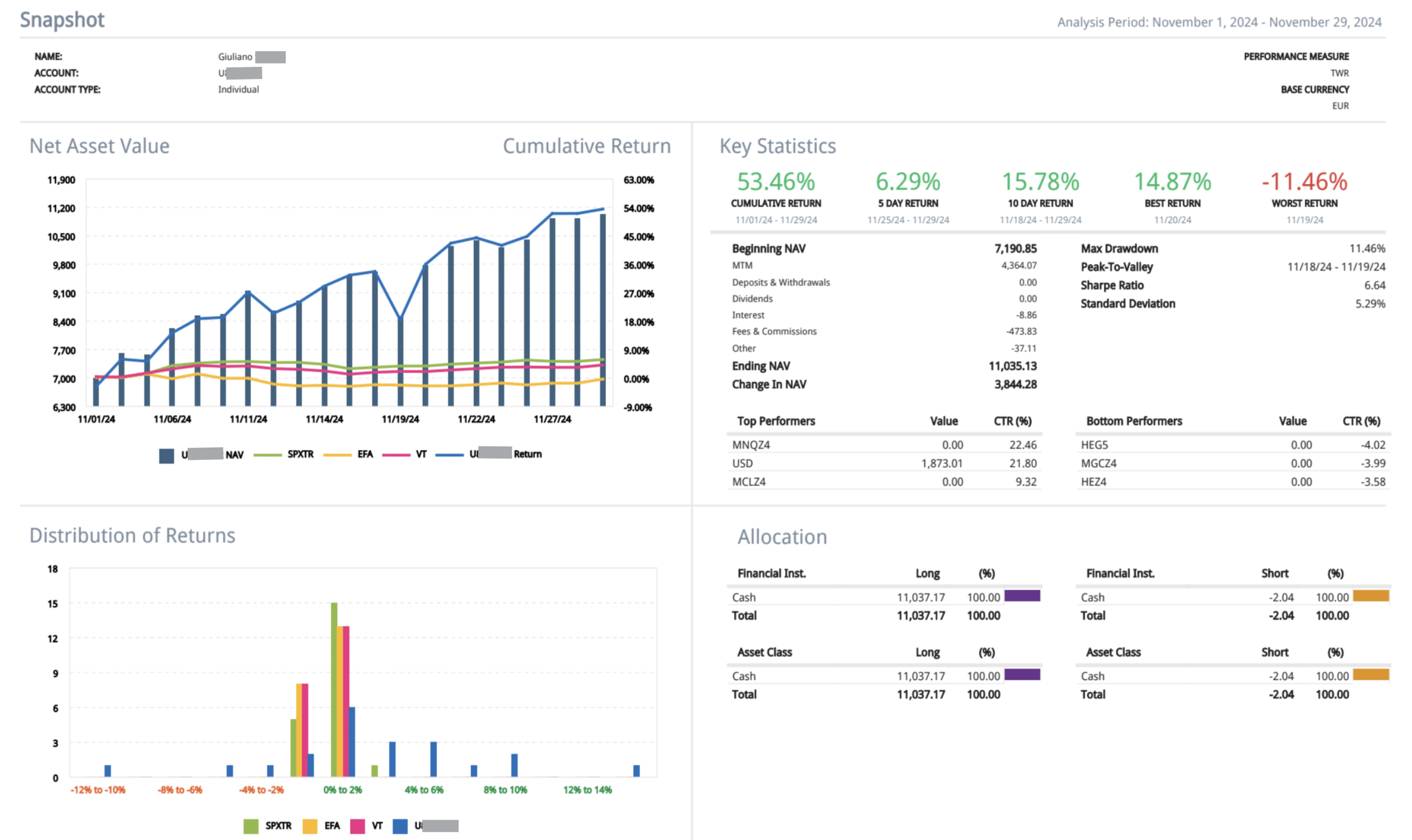

Now, let’s turn our attention to Giuliano, our Trader of the Month for November, whose extraordinary performance earned him the top position. Stay tuned as we explore his journey, strategies, and the key factors behind his success!

Giuliano’s Journey: From Novice to Trading Success Story

Giuliano, a chemist with a robust scientific background, began his journey with Unger Academy® with absolutely no experience in trading. Yet, his analytical mindset and innate curiosity became his greatest assets, enabling him to quickly grasp the Unger Method™ and build a solid, methodical trading approach.

Enrolling in the Academy three years ago, Giuliano transitioned to live trading with systematic strategies just a year later.

From the outset, his potential was evident. Through dedication and precision, he developed his own proprietary trading systems from scratch—systems that today serve as the cornerstone of his successful trading operations.

Giuliano’s Systematic Trading: Strategies and Tools

Giuliano primarily relies on trend-following systems that he has developed over the past three years. While Unger Academy® offers a wide range of ready-to-use strategies, Giuliano prefers to rely exclusively on his own proprietary systems, explaining that he finds it challenging to fully trust strategies developed by others.

Currently, Giuliano is live trading eight trading systems, carefully constructing his portfolio independently. His approach is guided by a blend of common sense and a detailed analysis of each system’s recent performance.

The markets Giuliano prefers include:

•Gold

•Lean Hogs

•Crude Oil (one of the markets that has contributed the most to his profits)

•E-mini S&P 500

•Nasdaq

•Euro

•British Pound

Whenever possible, he opts for micro futures due to the greater flexibility they offer.

With an aggressive risk profile, Giuliano successfully balances his operations through careful portfolio management and continuous performance monitoring.

The Growth and Mindset of a Trader

A defining trait of Giuliano’s journey is his insatiable thirst for knowledge.

Currently, he is delving into macroeconomics to better understand how global economic trends and market dynamics can shape portfolio strategies.

Despite achieving an advanced level of trading expertise and strong results, Giuliano still views Unger Academy® as a trusted family and support system—one that has guided him through every phase of his development and equipped him with the essential tools to thrive as a systematic trader.

Giuliano’s Top Tips for Aspiring Traders

For those stepping into the world of live trading, Giuliano offers three key pieces of advice:

•Take your time. Mastering trading concepts requires patience and dedication, so don’t rush the process.

•Follow the Unger Method™ with precision. Building robust trading systems through thorough development and testing is non-negotiable for success.

•Adopt a patient and disciplined mindset. Sustainable results come from a methodical approach and the ability to stay focused over time.

An Inspiring Success Story: Giuliano’s Remarkable Achievement

Giuliano’s journey stands as proof that dedication, passion, and a structured learning path can transform anyone into a highly successful trader.

His exceptional 53.46% return in a single month, paired with effective drawdown management, tells a story far beyond the numbers. It highlights how systematic trading, when guided by the Unger Method™, can drive consistent and sustainable results.

Stories like Giuliano’s—and those of Federico and Vincenzo—aren’t just success stories; they’re blueprints for success, offering invaluable inspiration to both current students and aspiring traders looking to carve their path in the world of systematic trading.

Hats off to Giuliano for achieving such an impressive milestone!

Curious about our “Trader of the Month” contest? This exciting monthly competition is open exclusively to Unger Academy students and rewards the top performer with a €1,000 Amazon gift card for achieving the best live trading results using the Unger Method. Interested? Click here to learn more!

Want to see the champions from previous months? Click here to check them out!

Transcription

Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.