Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.

We’ve reached our first analysis of 2025, where we’ll evaluate the performance of the trading systems in our portfolio. Today, we’ll focus on two strategies operating on the most famous stock index future in the world: the S&P 500.

We’ll summarize the general rules of these two strategies, with special attention to their entry logic and current performance, aiming to inspire and assist you in developing new trading systems on this underlying asset.

As is often the case, the logic behind these two systems differs significantly, demonstrating the remarkable flexibility of markets such as the S&P 500 futures.

Strategy No.1: Trend Following-Bias on the S&P 500 Future (@ES)

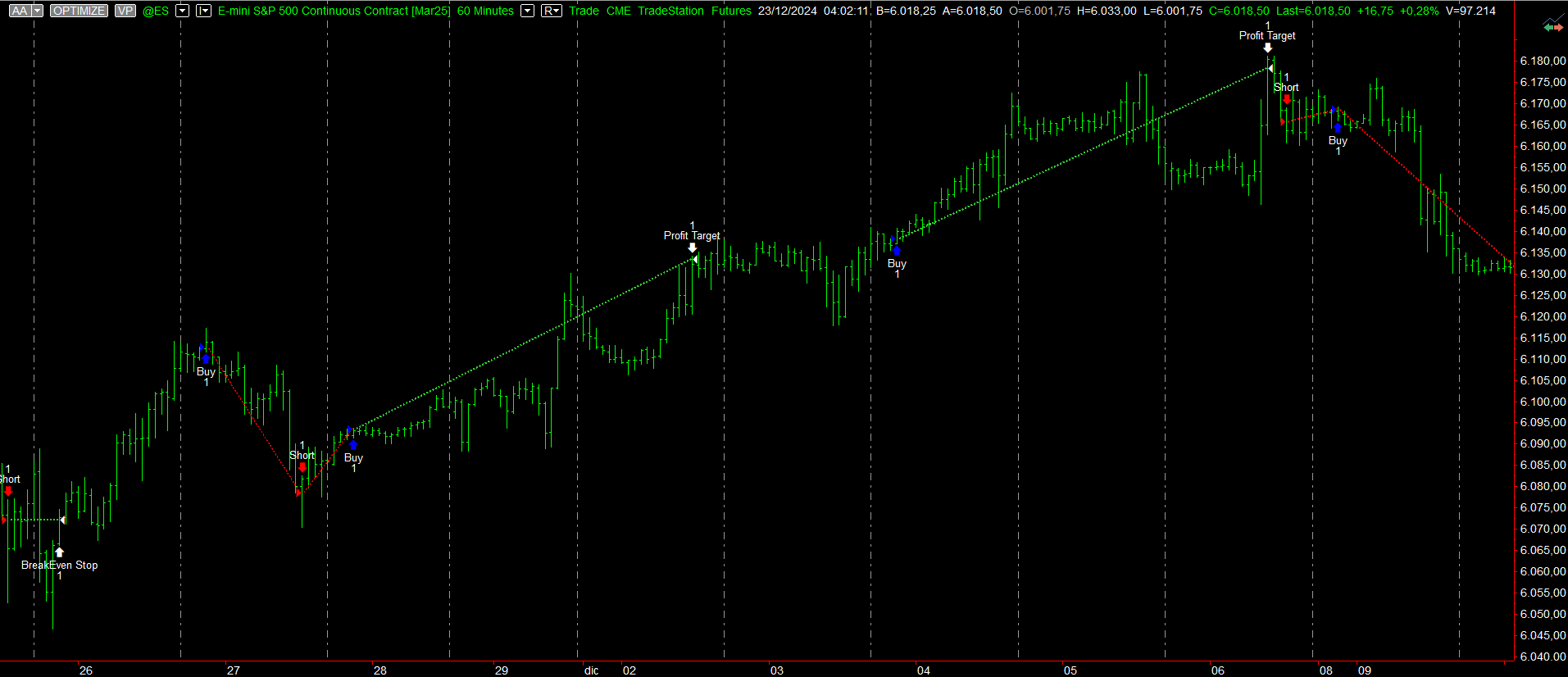

The first strategy operates on a 60-minute timeframe and blends elements of both Bias and Trend-Following systems. Specifically, it uses a Bias component based on entry timing, combined with triggers and patterns typical of Trend-Following strategies.

In essence, at a specific time in the evening (based on the Exchange time zone), if certain conditions tied to the applied patterns are met, the system enters long on a breakout above that bar’s high.

The same logic applies to short positions, but the entry timing and filters differ. In this case, the identified window is late morning, again based on the Exchange’s time zone.

Positions are closed after a set number of bars unless they hit predetermined Stop Loss, Profit Target, or Breakeven monetary levels beforehand.

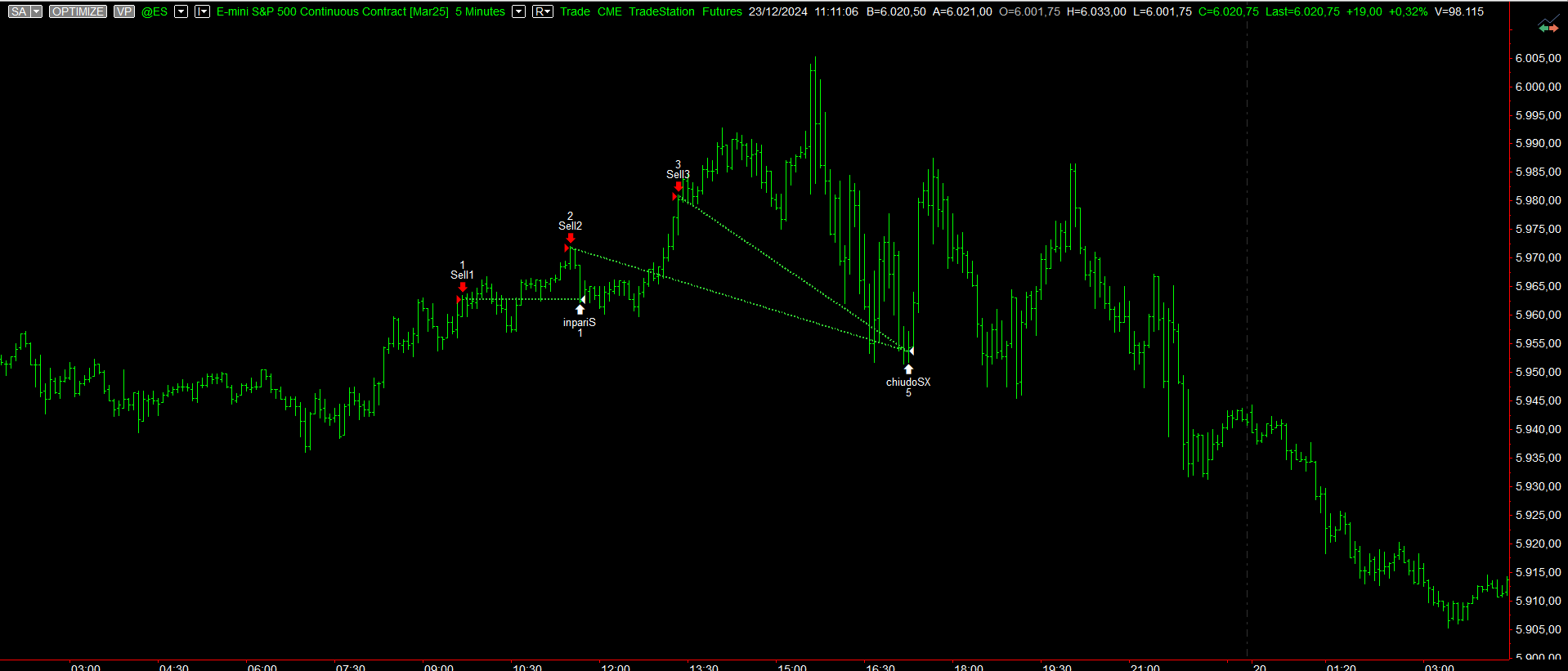

Figure 1 – Examples of trades executed by the Trend-Following Bias strategy on the S&P 500 future.

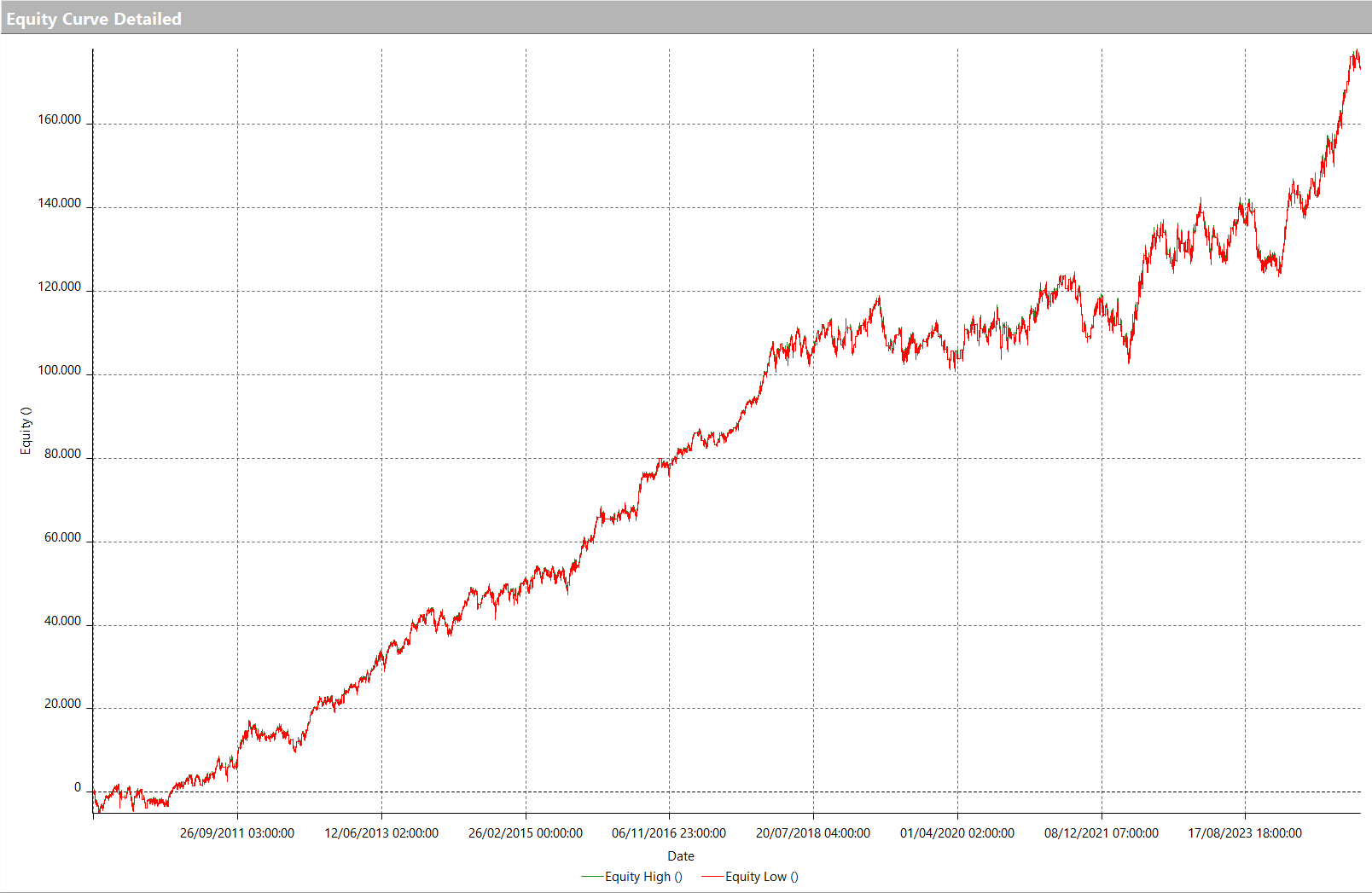

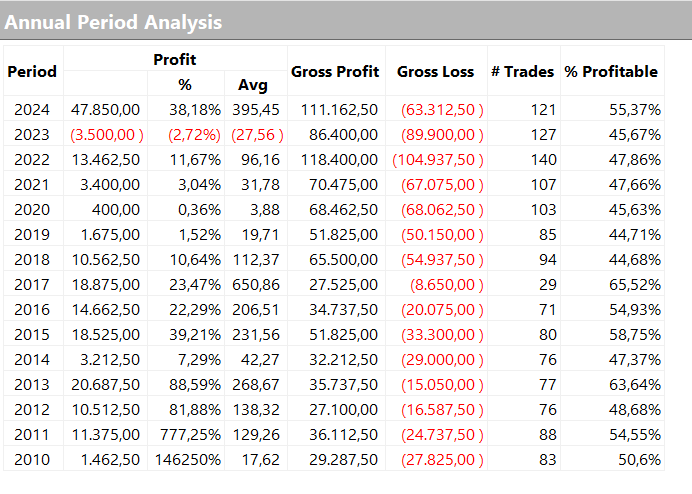

Below, we can observe the equity line for the system’s entire historical performance from 2010 to today. It’s clear that 2024 delivered astonishing results, with gains of approximately $48,000, following a relatively sluggish and sideways 2023. This is evident from the steep upward slope of the curve.

Figure 2 – Equity curve of the Trend-Following Bias strategy on the S&P 500 future.

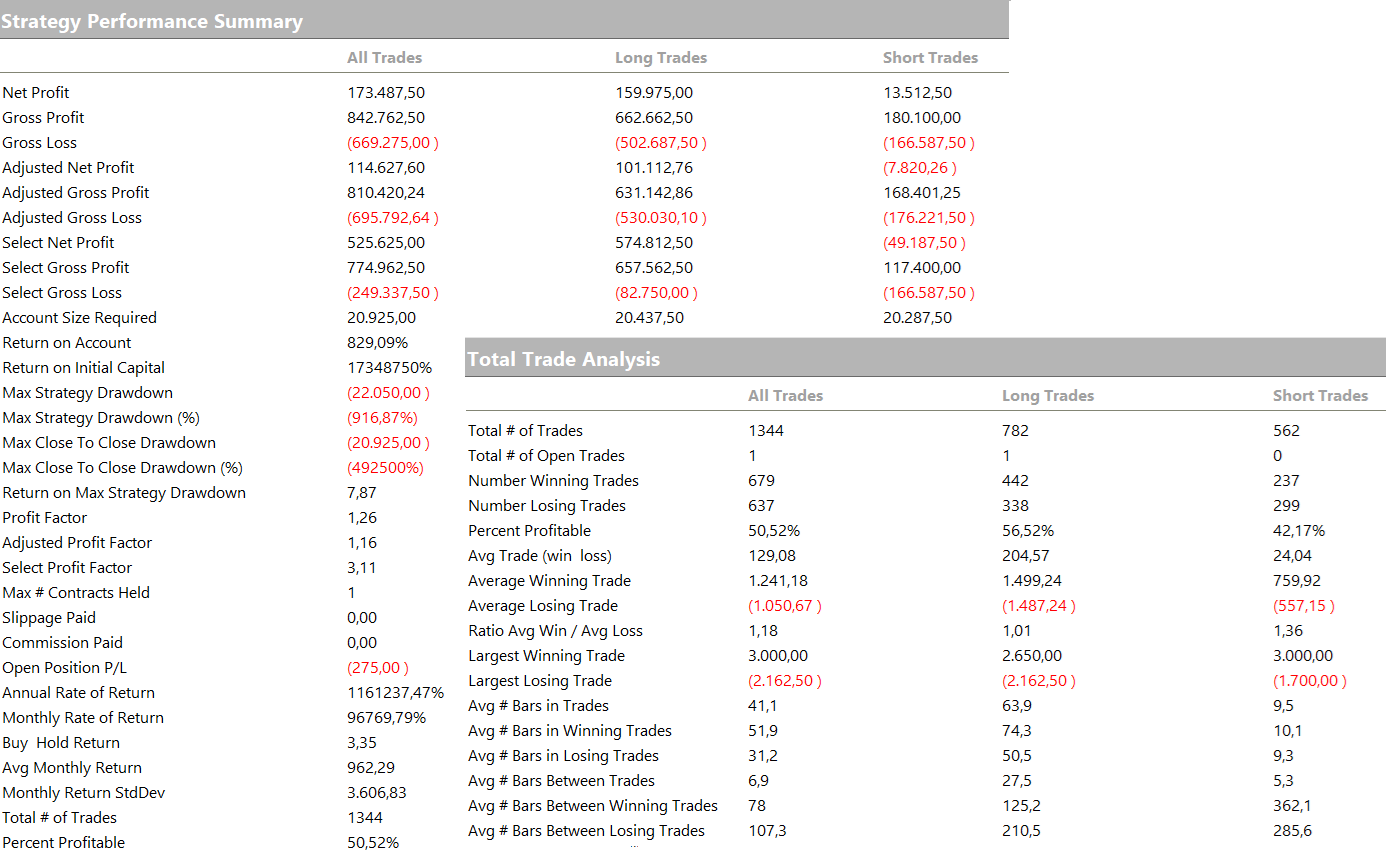

The strategy’s metrics reveal a total Net Profit of approximately $173,000, with a maximum drawdown of $22,000. The average trade stands near $130—a solid figure for this underlying asset.

You’ll notice that long-side performance significantly outshines short-side results, which is consistent with the challenge of managing short positions across equity futures.

Figure 3 – Metrics of the Trend-Following Bias strategy on the S&P 500 future.

Figure 4 – Annual performance of the Trend-Following Bias strategy on the S&P 500 future.

As a reminder, this future, like others listed on the CME—the world’s largest regulated exchange—is also available in a micro version, with a contract size equal to 1/10 of the standard version. This adaptability makes it accessible for a wide range of portfolio sizes.

Strategy No.2: Reversal on the S&P 500 Future (@ES)

Let’s move on to the second strategy, which operates on a 5-minute timeframe. As a Mean-Reverting system, it enters trades against the prevailing trend, executing Long entries on session lows and Short entries on session highs, both referencing the current trading session.

One particularly intriguing aspect of this strategy is its ability to execute multiple entries in the same direction—a technique commonly referred to as "pyramiding" a position. The maximum number of entries per side is three, distributed across different levels. When these levels are triggered, they initiate a sequence of buys or sells, as illustrated in Figure 5. Each trade is closed at the end of the session unless profit targets or Stop Loss levels are hit earlier.

Figure 5 – Examples of trades executed by the Reversal strategy on the S&P 500 future.

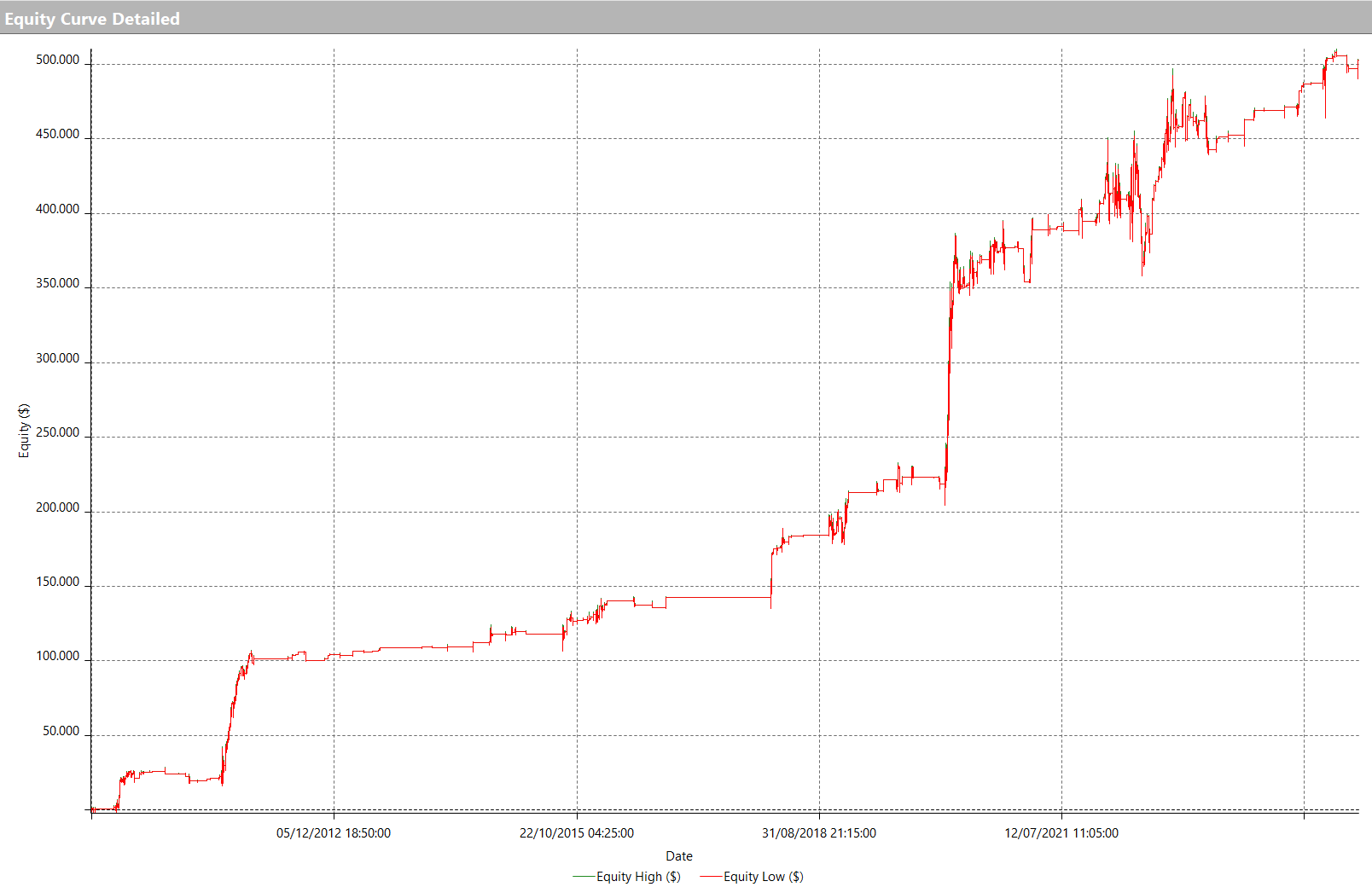

When analyzing the Equity Curve Detailed, we observe a steadily upward-trending curve, showcasing positive performance year after year. Particularly noteworthy are the years 2020, 2022, and 2024, which delivered outstanding results. It’s evident that the market pullbacks and corrections during these years provided the necessary "fuel" for such impressive performance.

Figure 6 – Equity curve of the Reversal strategy on the S&P 500 future.

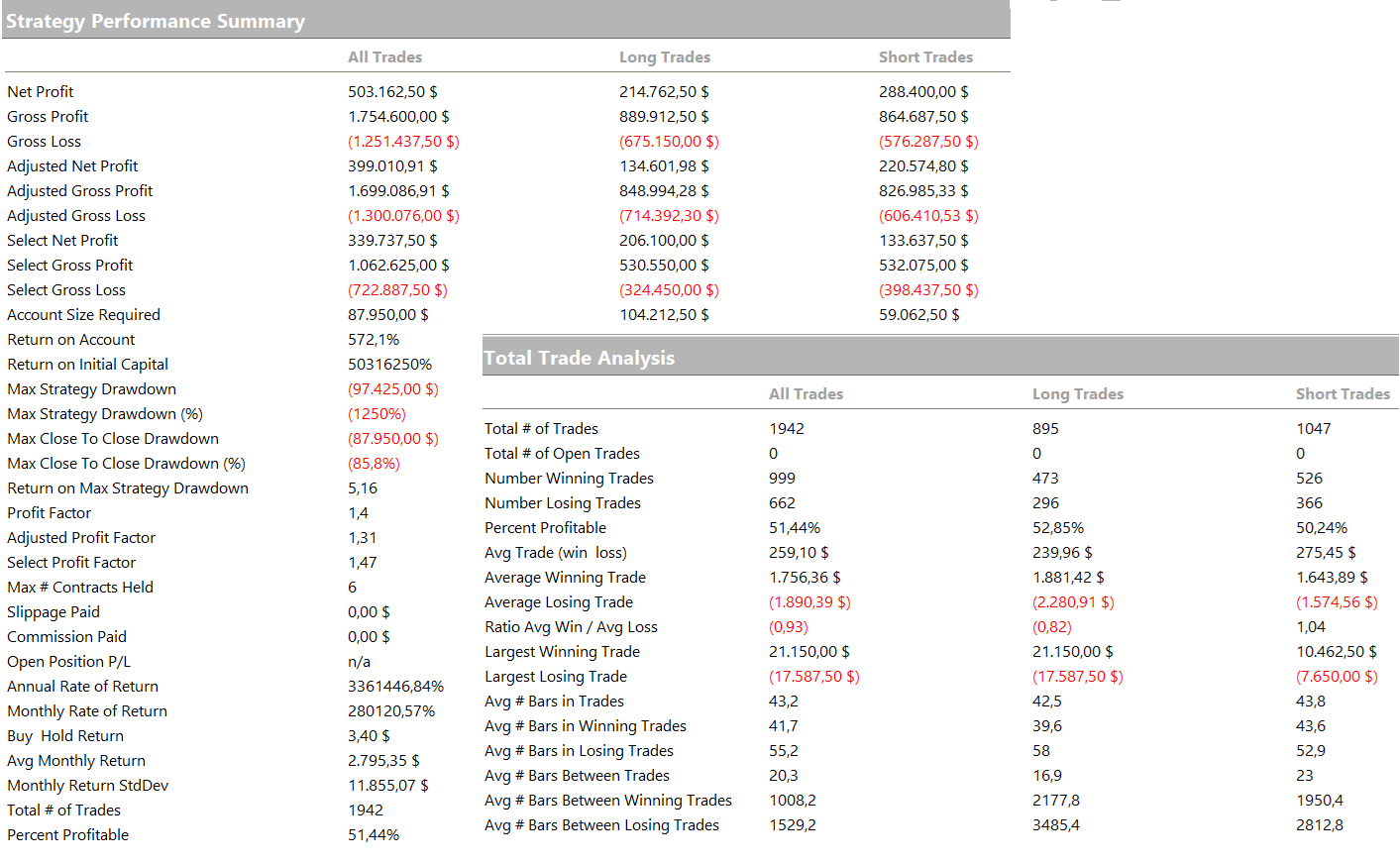

Now let’s examine the Strategy Performance Summary and Total Trade Analysis. The net profit is remarkably high, exceeding $500,000, with performance actually better on the short side. While the maximum drawdown is significant, it’s important to note the potential to drastically reduce risk by utilizing the micro contract version of the future.

Figure 7 – Metrics of the Reversal strategy on the S&P 500 future.

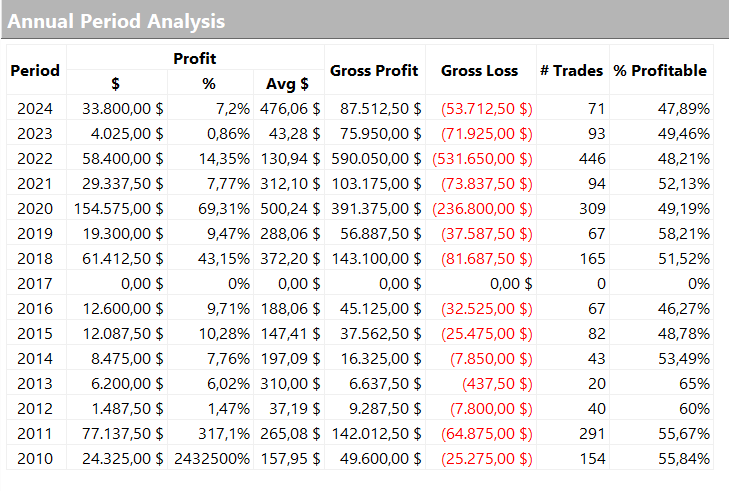

Figure 8 – Annual performance of the Reversal strategy on the S&P 500 future.

Key Takeaways and Final Thoughts

We hope this analysis has been helpful in identifying new edges for your trading systems, leveraging the inefficiencies that markets often present.

The strategies examined highlight how the S&P 500 remains a versatile market, offering profitable opportunities through both Trend-Following and Mean-Reverting approaches. As always, diversification represents the cornerstone of a successful portfolio, and these strategies contribute significantly to achieving that goal.

That’s all for today—see you in our next analysis!

Transcription

Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.