Hey everyone! One of the coaches of Unger Academy here, and welcome back to our usual chat about the strategies of our portfolio that have performed the best in the last period.

Okay, so this week we’re going to be talking about Gold, namely the Gold Future. It’s a very heavily traded contract. We’ve seen it rise dramatically over the last few weeks and even months. This is due to an increase in inflation, and also because we know that gold is a commodity that generally acts as a safe haven both in times of high inflation and in times of war, for example. So when the news from the various world fronts is not so good, this market should serve as a shield for our capital.

And indeed, we’ve seen it go up. This future is present in many types of asset allocation that involve mixing not only shares but also ETFs, bonds and even commodities such as gold.

The first strategy I want to show you is a mean-reverting strategy, which basically means that when the market goes up, as we see for example in this case, we’ll enter short. The entry trigger for the short side… Well, we’ll wait to see a close above…. Let’s zoom in… We’ll wait to see a close above the high of the previous day, which in this case is here.

And then when prices return below this level, we’ll go short. So, basically: when the market breaks through the highs of the previous session but then makes a sort of bluff and goes back, in that case we take the opposite position to what was the trend.

Vice versa on the short side. You see here that the market was down. Near the low, the low of the day before, there was this fake breakout. So, the market tried to break this level downwards. It didn’t make it. It bounced back up. The strategy entered long and then closed the trade in profit.

This strategy has a take profit that we could say is relatively small. Because it’s around $1,500. That’s not much for an intraday strategy on Gold but it is something that would work very well in a mean-reverting strategy.

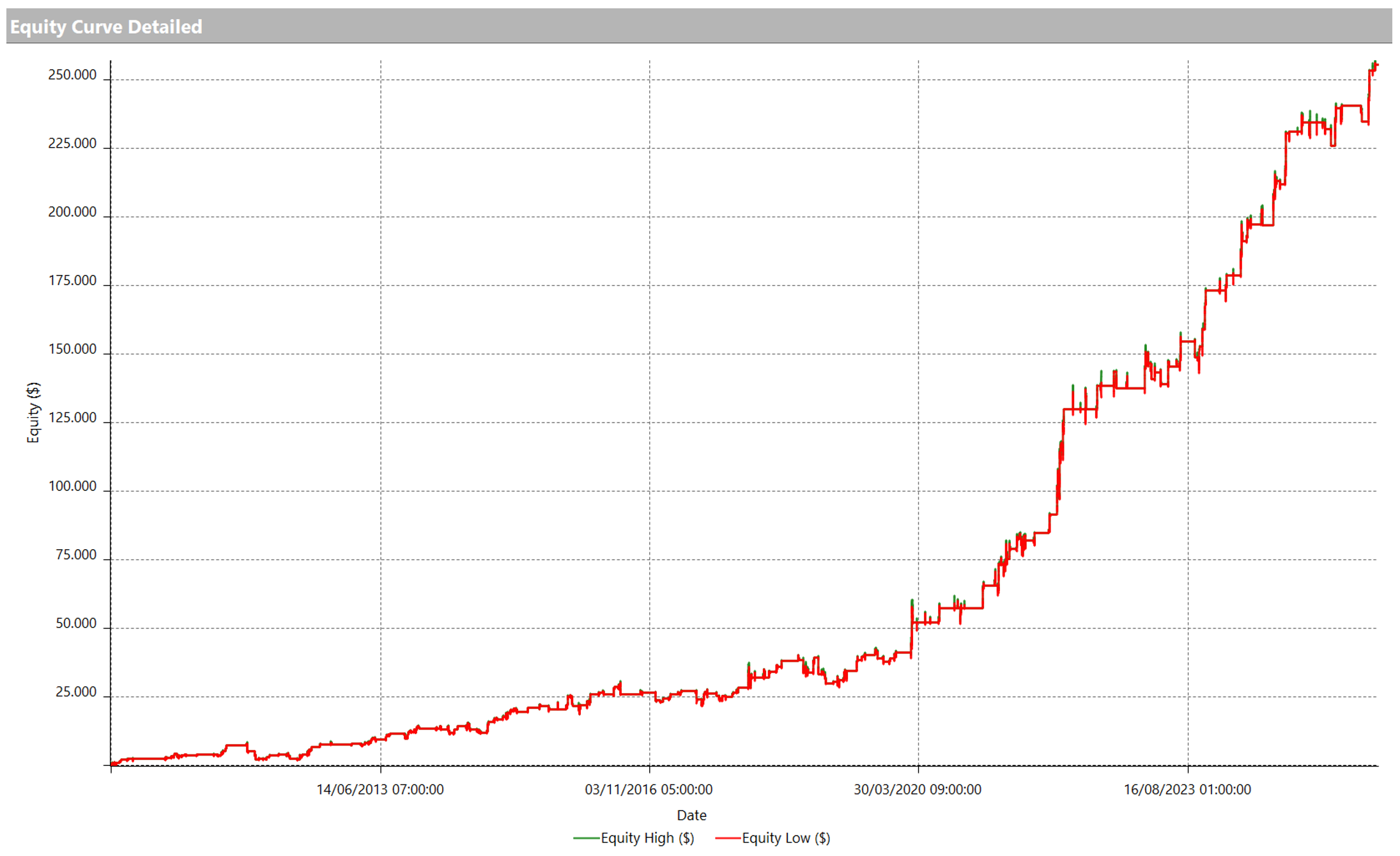

This is the equity line for the last 365 trading days, so roughly a year and a half. Here’s the short side. Surprisingly, in the face of these big upswings however the strategy managed to run into a great series of short trades.

Obviously, a strategy of this type will have more opportunities to enter mean reverting when the market rises. And vice versa, for the long: the more the market goes down, the more there will be opportunities to buy. This is obviously risky so please use extreme caution when using this type of strategy especially on commodities.

Here is also the long side, which as I said, instead, has performed a bit worse than the short side, even here incredibly. But, overall, we can definitely be satisfied with how this strategy has performed.

The next strategy I want to show you is a strategy known by those of you who have been following our channel for a long time. It is a bias strategy, but it also awaits trend-following confirmations in order not to enter only in proximity of a specific time of day, but also to have a sort of confirmation on the short-term trend.

The short will enter in the first part of the day, so it will be enabled between the first bars of the day, of the session. While instead the long as you see will enter in the second part of the session and then close in the first part again, before entering short.

This is the famous, very famous bias on gold. This strategy is continuing to perform very well.

So, guys, as always, I invite you to try it too.

If there is anyone among you interested in the world of systematic trading, please go and click on the link in the description below. You’ll have the opportunity to see a presentation by Andrea Unger, or get our best-selling book covering only the shipping costs, or book a free call with one of our team members.

Subscribe to our channel, click on the notification bell so you will stay updated on the release of all our new videos and if you liked this video, please leave us a “Like”.

Bye everyone, I will see you soon!