Hey everyone! One of the coaches at the Unger Academy here and welcome back to our usual chat about the strategies in our portfolio that have performed the best over the last period.

Alright, so this week we’re going to be talking about the Gold market and in particular two intraday strategies that will close their trades at most by the end of the day.

So let’s start with the first strategy, which is based on a trend-following approach and opens long positions when the close is above a 110-period moving average calculated using 60 minute bars. And vice versa, it opens the short positions when the market closes under this moving average.

This strategy is characterized by a very tight stop loss, and indeed it was built on 5-minute bars. Actually, I’d suggest that if you want to use very tight stop loss or take profit levels, as we are doing in this case, where we have a stop loss of $1,200 and a take profit of $650, so they are relatively short if compared to the width of the daily bars that we see on the Gold future, then I recommend using a very fast timeframe to have a clean backtest.

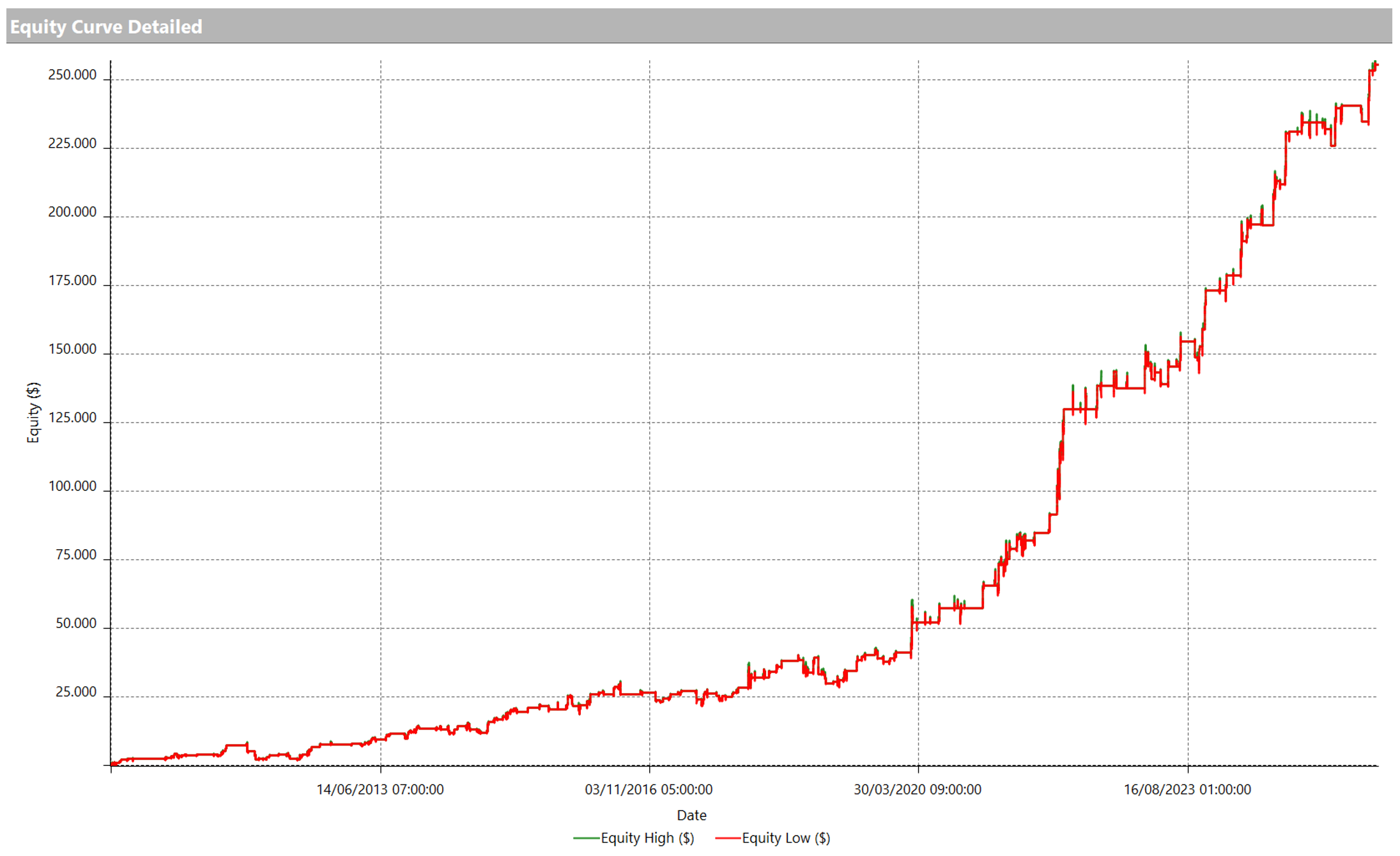

Here you can see the equity line of the strategy, and it’s really a good one. What you’ll notice in strategies of this type is that sometimes after, for example, several profitable trades in a row, the strategy can hit a series of stop losses that make the it retrace. However, on the whole, this strategy has performed very well in the last year and continues to do so.

Now let’s move on to the next strategy. This is a strategy that we’ve already seen in the past. It is based on a mean-reverting logic, so it opens the positions in a different way compared to the previous strategy, and in fact it enters when false breakouts occur. So in situations that are very similar to the one that’s happening right now. Here you can see that the market broke the previous day’s low and then also closed above the previous day’s low. And this is our entry trigger. However, in this case the strategy might not open any position because there are also other conditions that limit the number of trades.

This strategy is also performing well. The Gold market has been probably changing over time and intraday strategies seem to be more performing, in at least the last 2-3 years. Moreover, reversal strategies are also starting to pay off.

So, go and give it a try! The Gold future is a versatile and very liquid market and you can approach it using a lot of different strategies. I can’t say that it’s very scalable but today there are also micro contracts and I can tell you that the Micro Gold is a very scalable market. It’s worth 1/10th of the value of the “big” contract, so, fortunately, today there are alternatives even for capitals that are not too large.

If there is someone among you who’s interested in the world of systematic trading, I suggest that you go and click on the link in the description below. From there you can watch a video of Andrea Unger or get our best-selling book covering only the shipping costs, or even book a free call with a member of our team.

Please leave us a Like if you liked the video and please remember to subscribe to our channel and click on the notification bell so you can always stay updated on the release of all our new videos.

And with that this video is over! I will see you soon, bye-bye!