Introduction

Hi everyone and welcome to this brand new video.

Today we’re going to be looking together at the results of our April Strategy of the Month contest.

So, we’ll see which strategy won as well as a selection of the most promising among all the strategies received.

We’ll also try to provide operational insights, by analyzing what logic underlies these strategies, in which markets they work, and how they perform.

What is the Strategy of the Month

We would like to remind you that the Strategy of the Month contest is reserved for Unger Academy students. Each month, you can participate by submitting your own strategy and compete for a chance to win a €1,000 Amazon voucher.

So hi, one of the coaches at Unger Academy here.

Strategy 1 – Mean Reverting on Mini S&P 500 – Rules and Performance

Let’s start right away with some very good strategies that didn’t win, but still impressed us. Then, at the end of the video, I’ll show you the winning strategy, which I already anticipate is really very interesting.

So let us start with the first strategy. It’s a strategy on the Mini SP 500 future.

It’s a mean-reverting strategy based on the high and the low of the previous day.

Let’s look at an example. We’ll go short around the highs of the previous day and long around the lows of the previous day.

Let’s look at a long entry to get an idea. Here’s how it works.

From the moment there is a trend reversal, that is when around the low of the day before, I’ll go long.

This is a very simple strategy using the Unger Academy templates. So you need absolutely no programming skills to create this strategy.

In addition to the stoploss and take profit, a time exit after N bars has also been included.

Let’s look in detail at the results we get with one contract. We can see that this is a really robust equity that is growing really well, especially on the long side.

One of the things that’s unique about this equity is that it did not suffer much from the last year’s downturns, where we know the U.S. stock market was pretty bearish.

The short side, on the other hand, has not done much in the years the market has been going up.

That’s a very good thing, because it means that the short side still works, but does not do any damage when the market goes up. However, it is needed, you can see here, when the market starts to go down. And that’s when the short component starts to take a lot of the profits.

If we look at the metrics, we have a really very large average trade of over $400.

Finally, I’d like to show you the annual overview, where we had only one negative year in 2018.

And I tell you right now, that 2018 was a very complicated year in terms of trading the U.S. equity indexes, and we would by no means force ourselves to try to make that strategy palatable this year as well.

So, I would say that part of the nature of this system is not to have done well in 2018.

But look, especially in the last period, the returns of this strategy are really spectacular. I mean, in 2023, it’s already making about a $18,000 profit.

Strategy 2 – Trend Following on Nasdaq – Rules and Performance

Let’s move on to the next strategy, again on a stock index. This time, however, on the Nasdaq.

Unlike the previous strategy, this is a breakout strategy, so let’s say the opposite.

We’ll buy at the highs and sell at the lows.

The reference this time is not the previous session, but the current session. So, we’ll buy on the break of the highs reached in the current session and sell on the lows reached in the current session.

In addition to the prices, another level is added based on the daily Average True Range, so we have a second time frame here below, precisely of a daily nature.

Let’s look at the performance of this strategy, which is really good for a single contract.

The average trade is over $450, which is unevenly distributed between long and short positions. In fact, the number of long positions outweighs the number of short positions.

This characteristic is typical of this underlying. In fact, we’ll notice that the long side does most of the work, while the short side has a trend that is more or less the same as the previous strategy.

Finally, let’s also look at the periodic returns year by year.

Unlike the previous strategy, this strategy performed well in 2018.

It did not do very well around 2010, but still showed very consistent returns.

This strategy is also positive as of early 2023 and has reached almost $16,000.

Commission costs and slippage are not included, but the average trade is so abundant that there is really very little impact on performance.

Winning Strategy – Trend Following on Gold – Rules and Performance

Finally let’s take a look at the winning strategy of the month of April, namely Luca’s strategy that earned him a €1,000 Amazon voucher.

This is a strategy designed on the Gold future, the gold commodity future.

This is also a breakout strategy based on the breakout levels of data2. This is the same underlying, but built on 480-minute bars.

This idea comes from a video we had published some time ago about developing trading systems on gold.

I’ll leave the link in the top right and below in the description.

And it was this operational cue video that generated this excellent strategy that took first place in the rankings for the month of April.

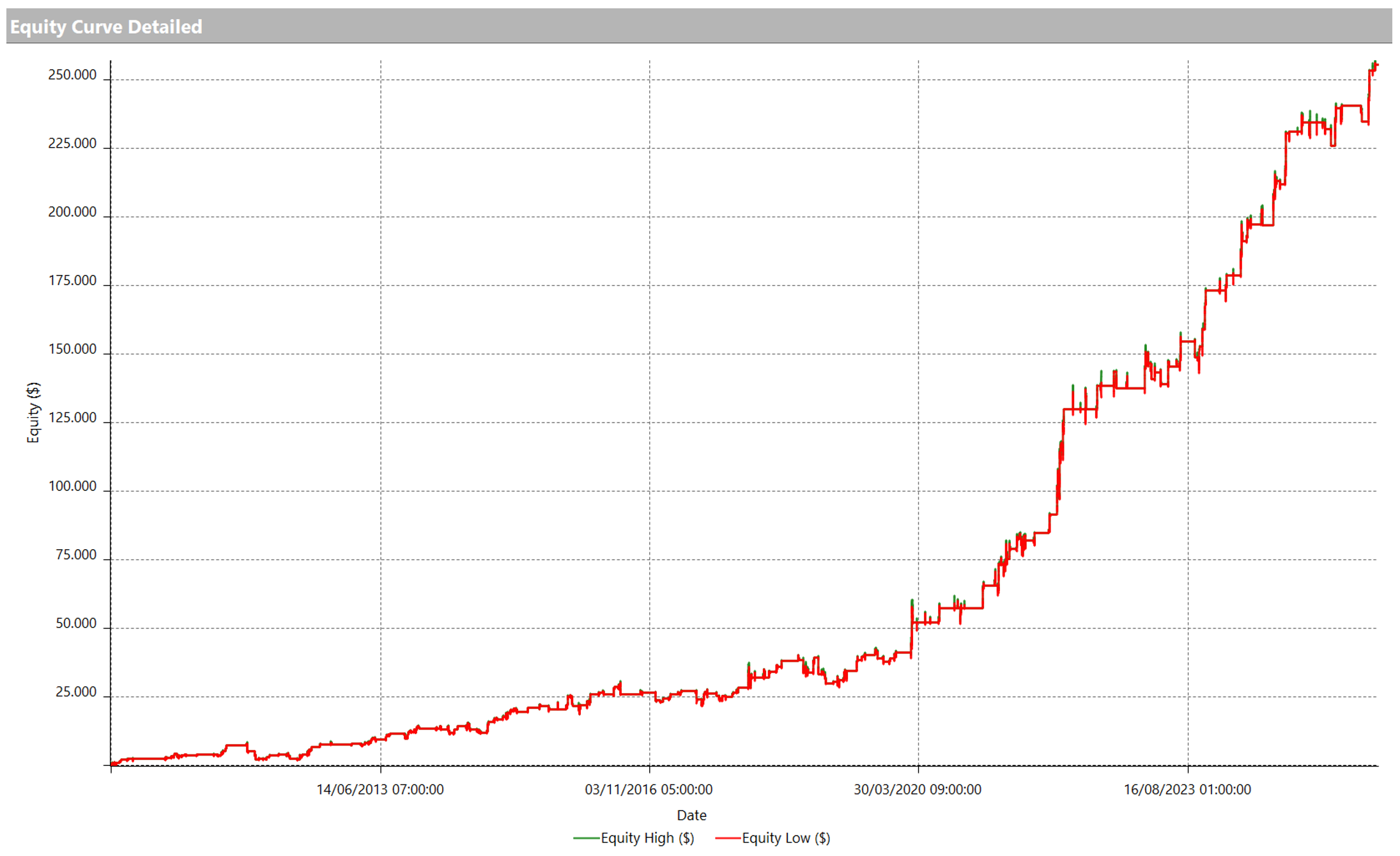

Let’s take a look at the performances, which are really very interesting.

We have a lot of trades, 1800 trades, and an average trade of over $200.

The performance is quite balanced. We have gains on both the long and short sides with some continuity.

The periodic returns are really good. There is no bad year, and as I told you, it is a strategy that works really very well.

In fact, the profit since the beginning of 2010, excluding costs and commissions, is almost $400,000.

This is indeed a very interesting strategy.

I’m glad to see that one of our operational insights has been followed, and I hope that these pointers will be helpful to you as well.

Well, if your goal is to learn how to independently create trading strategies like the ones we have just seen, then you’ve come to the right place.

In fact, while you’re learning, you can also participate in this contest dedicated exclusively to Unger Academy students for a chance to win a €1,000 of Amazon vouchers every month.

If you want to learn more, I invite you to click on the link below in the description.

The link will take you to a page where you will find the contest rules. From there, if you wish, you can book a free consultation with one of our tutors, who will give you all the information you need.

Finally, I’d like to remind you, if you have not already done so, to subscribe to our channel, click the notification bell to stay updated, and if you found the video useful, leave us a Like.

We’ll see you soon with more videos on new operational insights and tips on systematic trading. Goodbye for now and I’ll see you soon!