Why Numbers Matter in Trading

Hi everyone, and welcome to this new video. Today, we’re talking about numbers—and how crucial it is to know how to handle them.

It feels like just yesterday when, on April 2nd, Trump revealed the tariffs he wanted to impose on more than half the world. From that moment on, the markets experienced a series of moves we’re definitely not used to seeing on a daily basis.

Can Market Movements Be Predicted?

Throughout this short video, I’ll be repeating one idea quite a few times: could anyone have predicted what happened in the markets during those days?

The answer is no. We couldn’t have predicted it—not us, the poor retail traders, and not even the big investment banks or large hedge funds. Maybe a very small number of people close to Trump had an idea of what was going to happen. But that’s not who we’re here to talk about today.

What we are focusing on is the management of numbers. Let’s start with a simple concept about the anomaly we witnessed.

It was the numbers that first told us the market was moving aggressively. Actually, using numbers, we could say that the average monetary range of stock indices around the world during those days far exceeded the average range of the previous year. And we can make that comparison because we have historical data.

Every Crisis Is Different: What the Data Teaches Us

Some people compared this crash to the Covid crash, and others even to the 2008 collapse. But we all know that every event brings something new to the table.

In 2008, it was the first time we saw a subprime mortgage crisis. In 2020, it was the first time we faced a global pandemic. And now, in this modern era, it’s the first time we’re facing such an extensive imposition of tariffs.

I often hear people say things like, “It’s so hard to invest right now—everything feels uncertain.” But that’s the kind of statement that’s been true now, just as it was 5, 10, 20, even 50 years ago. It is always true because uncertainty will always be part of the picture, and unprecedented events will always keep coming.

How to Navigate Without Letting Emotions Take Over

The only thing we can really do is analyze what has already happened, to try and find a kind of compass to guide us through these types of market phases.

I want to make something clear right away—we’re talking about a compass here, not a crystal ball. So yes, we can build a tool that points us in a possible direction to follow, but not one that tells us exactly what’s going to happen in the future.

The Indicator We Use at Unger Academy

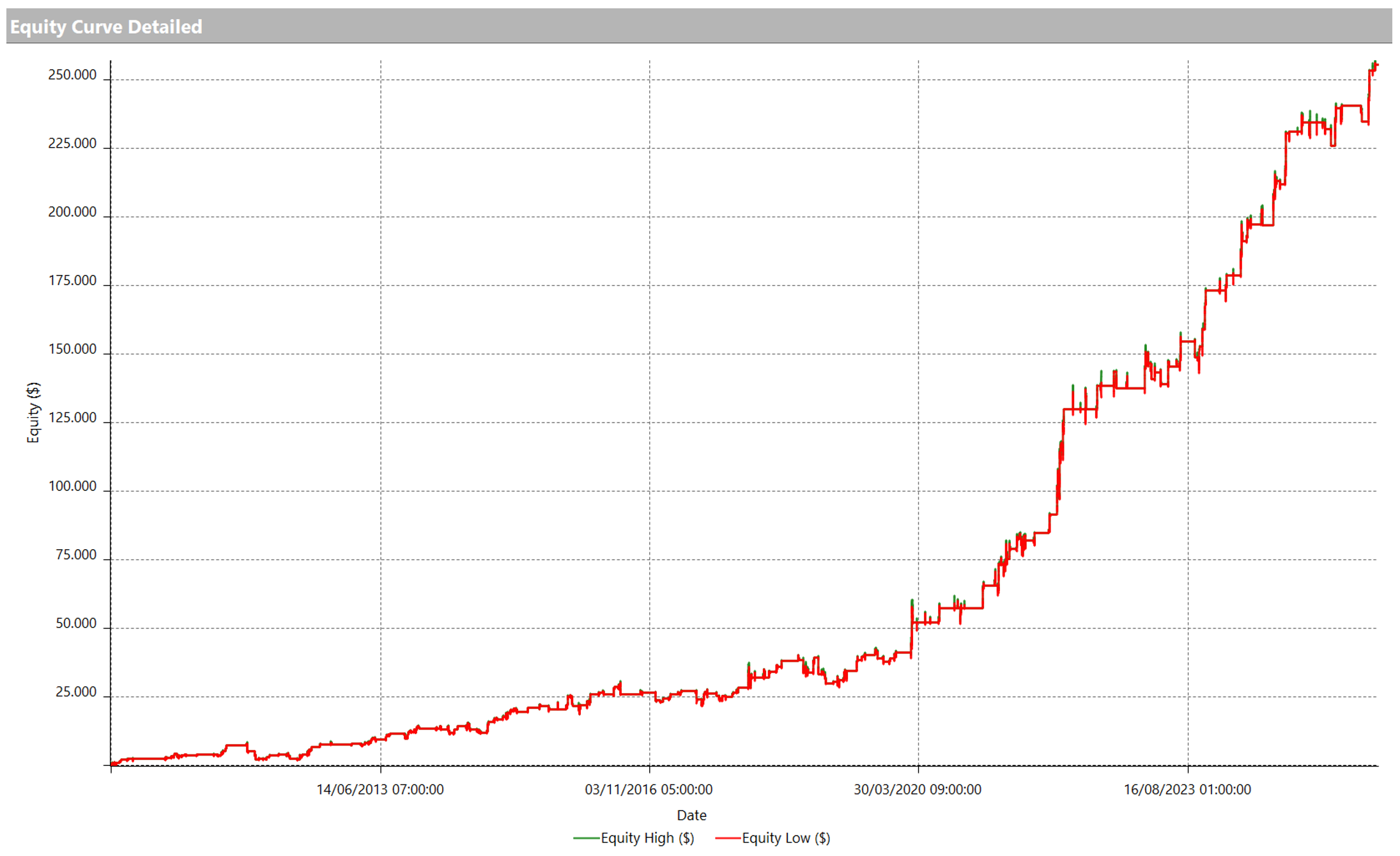

The example I want to share today is about a proprietary signal we use at Unger Academy to help us navigate these kinds of market phases.

Now, I already know what some of you are thinking: “Here comes the sales pitch—he’s going to tell us that his indicator kept him out of the market.” And you know what? It’s true. At that time, both myself and the students of the Unger Academy were out of the market. But that’s not because we can predict the future. It’s simply because the numbers were telling us it was better to stay out. And just to be transparent, that same indicator also told us to stay out after the -3% drop on December 18, 2024.

And what happened next? The market rebounded, so we not only locked in some losses but also missed the recovery that followed.

So no—I’m not talking about some magical tool that works 100% of the time. What I’m talking about is something we’ve tested on a massive amount of historical data, and it gives us a compass we can rely on when making our decisions.

The key to reading numbers and using them to guide you is being able to detach yourself emotionally from what’s going on. Because most of the time, emotions are what lead us to make the biggest mistakes.

Deciding to stay out of the market after December 18, 2024, and again after the start of March 2025 wasn’t some last-minute decision made in panic. It was based on strategies developed years ago.

And honestly, I find it hard to believe that a decision made calmly and carefully—after months of work, maybe during a period of low volatility—is less thoughtful than one made in a few days, or even a few hours, in the heat of the moment.

Final Thoughts: What You Need Is a Compass, Not a Forecast

That’s exactly what I want to encourage you to do. It might sound obvious—and I’m certainly not the first person to say this—but in this field, there’s nothing more important than having a plan, and a compass, that tells you what to do based on cold, hard numbers.

Because markets are always unpredictable. Always remember that.

So don’t let your emotions call the shots—let logic guide you. And as always, stay tuned to this channel for more insights. Take care and see you next time!