Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.

Welcome back to a new edition of our regular update on the systems in our portfolio.

Today, we’re turning our attention once again to gold — the ultimate safe haven asset — which in this 2025 has experienced an almost unstoppable rise, bringing plenty of satisfaction to us systematic traders.

In particular, we’ll focus on two trend-following strategies that have performed exceptionally well on the Gold Futures market (GC) in recent weeks. Just in the month of August alone, these two strategies generated over $25,000 in profits using a single full contract.

Both have demonstrated a strong ability to ride the bullish momentum that has driven gold prices higher.

While they are based on the same trend-following logic, they differ in their entry triggers and whilie one operates on a multiday timeframe, the other uses an intraday approach.

Let’s take a closer look!

Multiday Trend Following on Gold Futures with Bollinger Bands

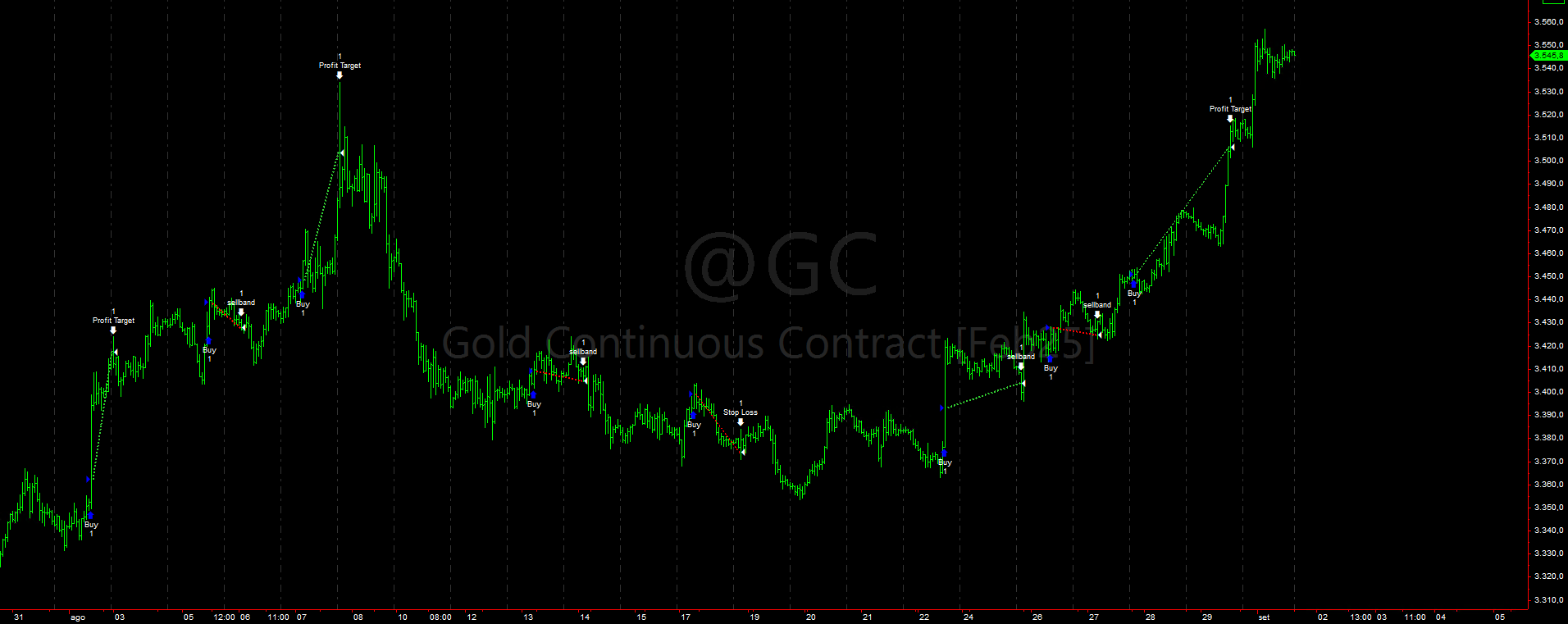

The first strategy operates only on the long side using a 60-minute timeframe and a multiday trading horizon. It executes a maximum of one trade per session, using the upper Bollinger Band as the entry level. Entries are filtered by the occurrence of a specific neutral indecision pattern. Positions are exited either when the lower Bollinger Band is hit or when the stop loss or take profit levels are reached.

In Figure 1, you can see the trades executed during August 2025: three trades hit their profit targets, while one additional trade closed in profit at the lower Bollinger Band. Of the four trades that were stopped out, only one hit the stop loss (the maximum theoretical loss), while the other three were closed at the lower Bollinger Band, with losses significantly smaller than the fixed monetary stop.

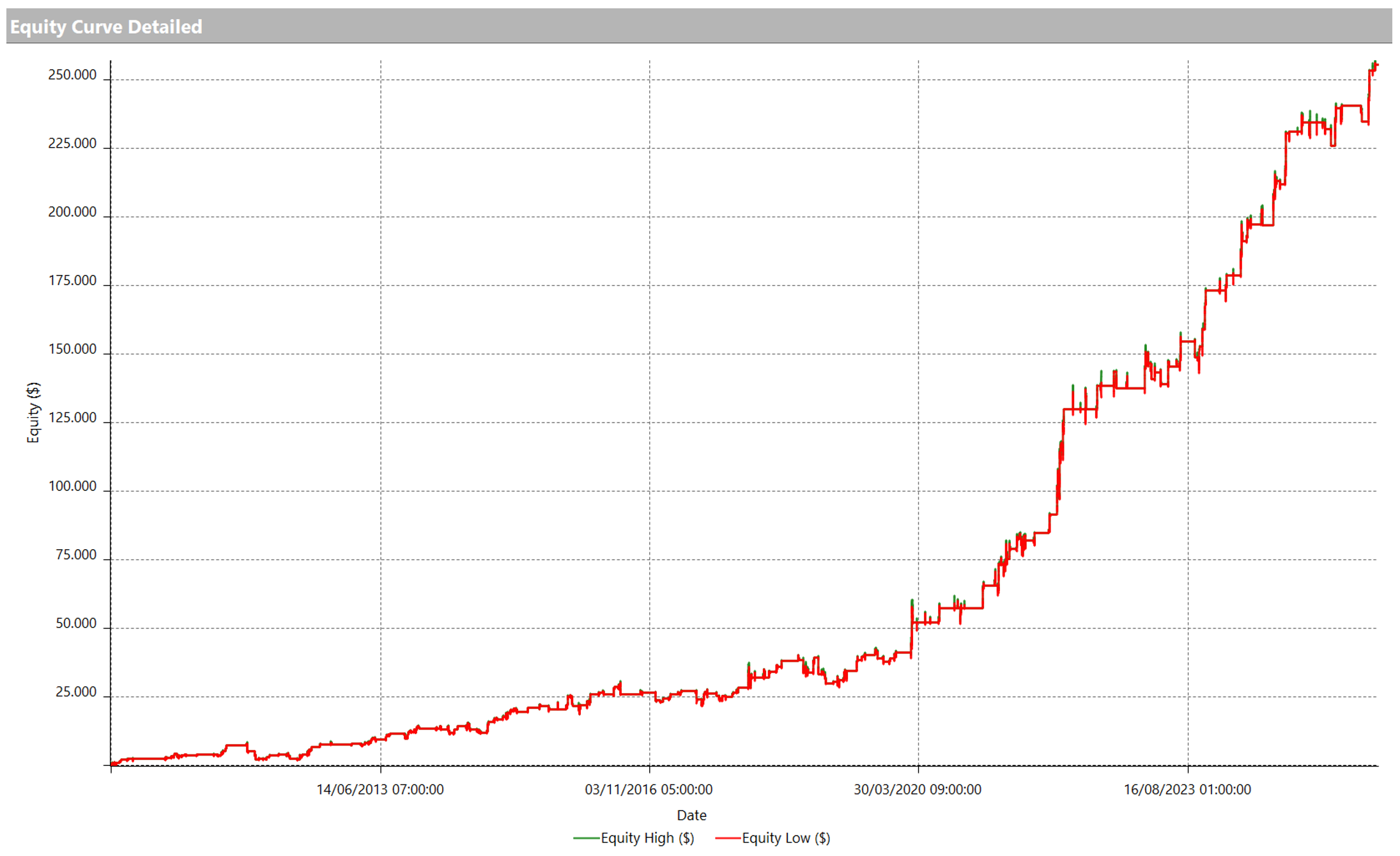

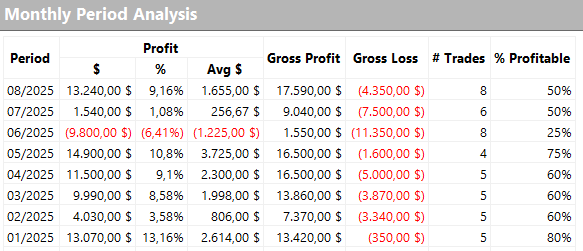

Overall, August was a very profitable month for this strategy, which generated $13,240 in profits. As shown in Figure 2, previous months in 2025 were also quite positive.

Intraday Trend Following Breakout on Gold Futures

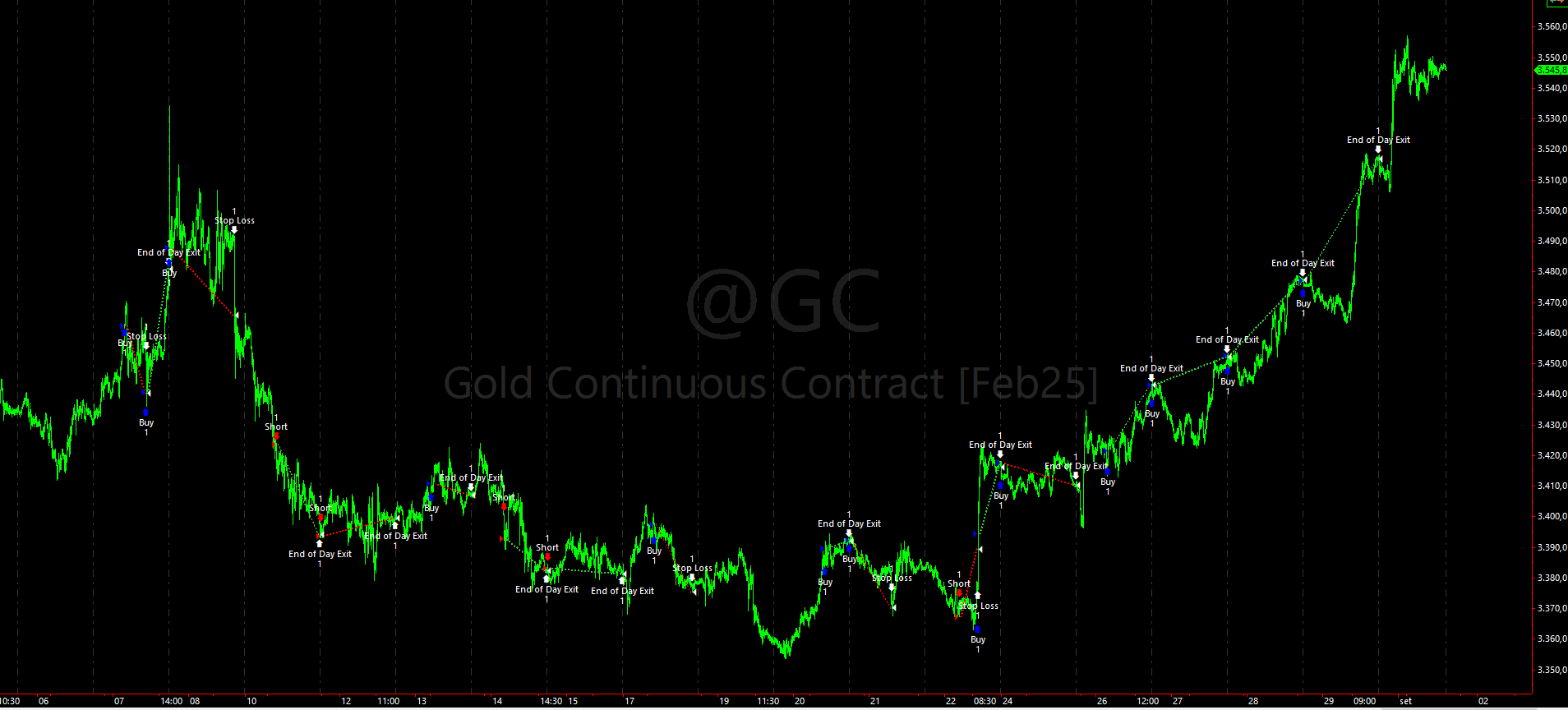

The second strategy uses 15-minute bars and operates within a shorter trading window, waiting a few hours after the session opens before placing any orders. It goes long using stop orders above the high of the previous session and short below the low. Entry signals are filtered with two directional patterns per side. Positions are closed at the end of the trading day or upon hitting the stop loss level.

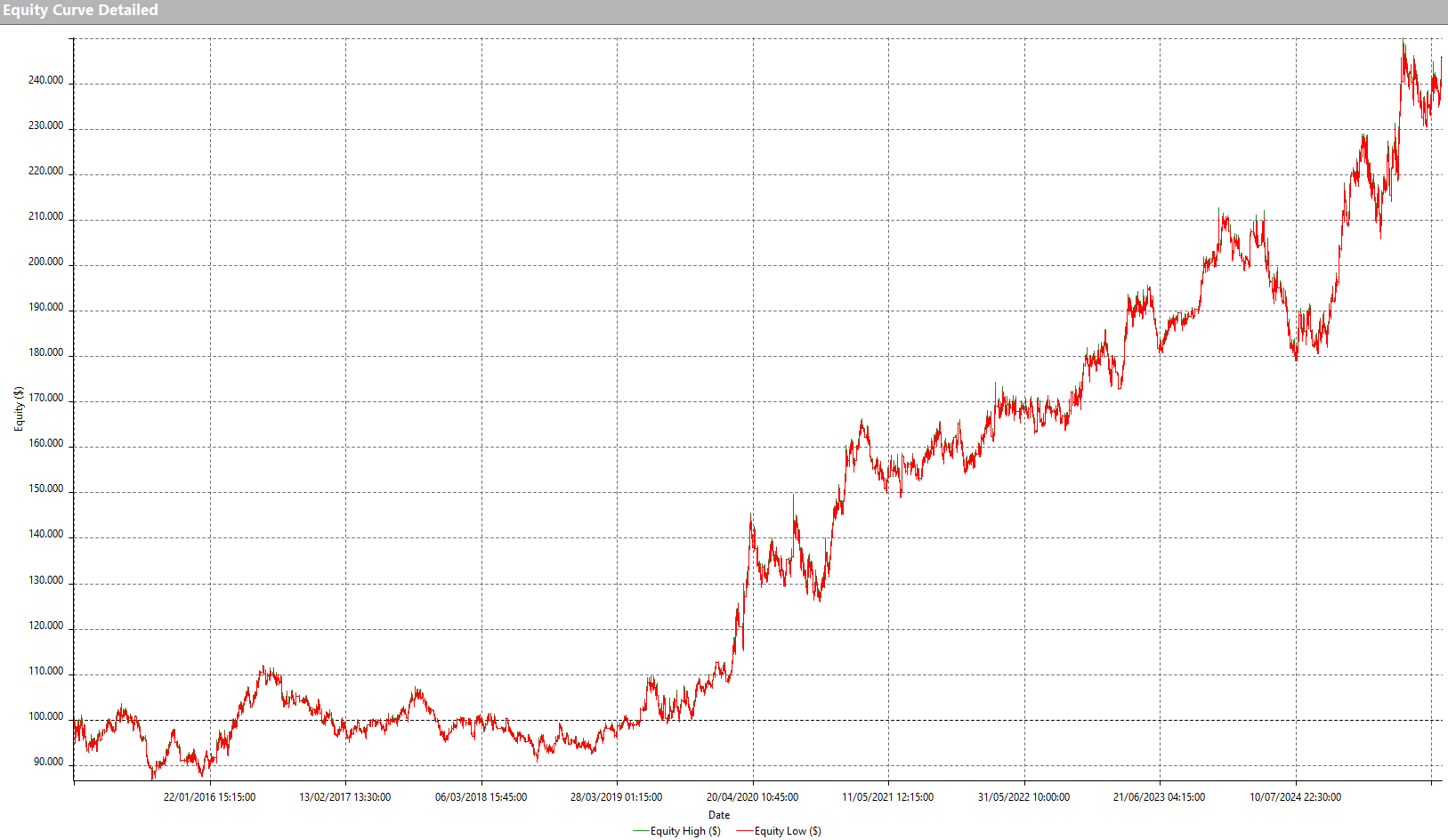

As seen in Figure 4, the equity curve of this strategy isn’t particularly smooth, which is to be expected from an intraday system with high trade frequency, but the recent strong moves in gold have helped it generate an impressive $11,320 in profits in August alone.

Conclusion

In August, these two systematic strategies on Gold Futures managed to fully capitalize on the market’s ongoing bullish momentum, a trend that has been in place for several months now and shows no signs of slowing.

Together, these trading systems brought in nearly $25,000 on the full Gold Futures contract just in August. That equates to approximately $2,500 on the Micro Gold contract, a more accessible instrument for those trading with smaller capital.

Do you want to learn how to develop profitable systematic strategies for gold and other major markets?

Click the link below and schedule a free call with our experts. You’ll discover how our trading method works, what you need to get started, and the next steps to begin your journey.

Happy trading, and see you next time!

Transcription

Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.