Who is David?

Chelsi

Hello, everybody. Welcome to a new Unger Academy success story. Today, we’re speaking with David, one of our students who’s achieved some truly remarkable results, doubling his account in just 400 days of trading.

David’s been with us for over a year now. Applying what he learned consistently in his progress is nothing short of inspiring. So let’s hear his story.

So, David, to start off, could you tell us a bit about yourself, about your background, and what you do?

David

Yeah, I’m originally from Flint, Michigan. I moved to Canada when I was a kid. I’m in Ottawa, Ontario right now. I spent the last 35 years in the restaurant in in the food service industry as an executive chef.

And for the last, I’d say 10 or 15 of that, I’ve wrote a lot of system software for larger institutions in the food service sector. When I got into investing and trading, the algorithmic area was very attractive to me because I had some coding skills already.

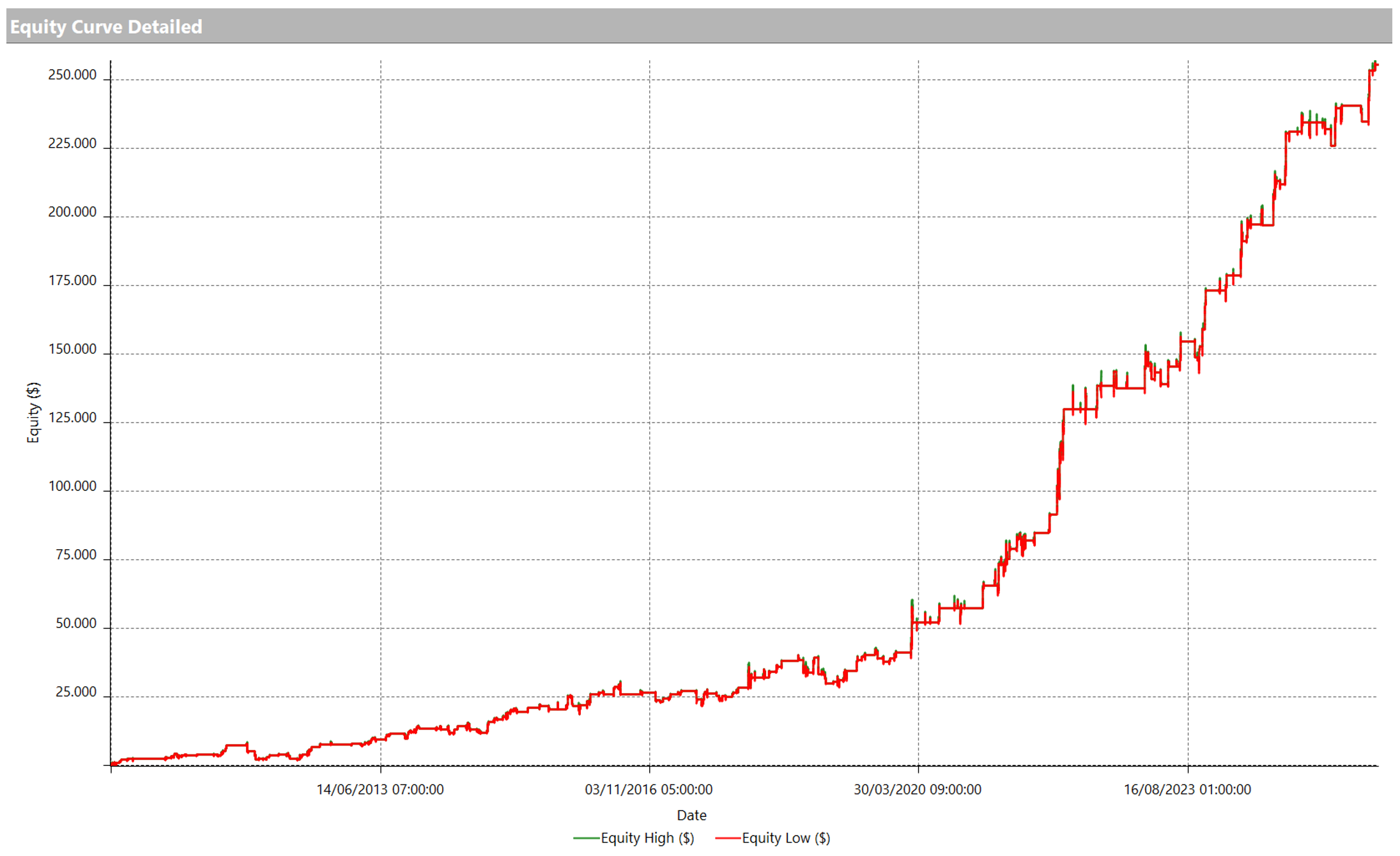

Little did I know there was a lot more to it than just putting together a couple of algorithms and letting them go loose. Right now, like you mentioned, I’m about plus a couple of weeks in. We’re well over 100% just chugging along with a nice equity curve. Things are going well.

Chelsi

That’s great. That’s amazing. Before you joined Unger Academy, what challenges or struggles were you facing in your trading?

His Biggest Trading Challenge

David

I think the biggest challenge that I had was psychology. I mean, you hear this a lot, and there are a lot of books out about trading psychology. But honestly, the one thing that really, really stood in my way was the idea of looking for some monetary target.

You hear that a lot, and it’s 100% true. I tried all those futures. They used to call them bucket shops. You can sign up and pay this amount of money per month. And if you can reach this target, you get a big account and you can trade.

But it’s counter indicated to success, those systems, because when you learn trying to reach a $9,000 or $12,000 target, your mind is fixed on a target instead of the process, and you trade very, very badly.

The Discretionary Trading Approach

So I tried that discretionary stuff, and I said, this is enough. And I got a platform that I thought was something I could use for algorithmic trading, and I picked up Ninja Trader, and I really enjoyed the three years I spent in there, just writing and learning and messing around.

But the problem was that I didn’t get anywhere. There were components in my algorithms that were good, but there were a lot of missing steps.

And I think in the Unger Academy courses, you learn a good catalog of steps that you need to take. And there are certain things you just can’t leave out, and certain things that aren’t important at all.

Chelsi

Yeah. So there are many trading programs out there. Like you said, you mentioned Ninja before. What made you decide to choose our program over the others?

Courses on Trading Systems

David

Yeah, MultiCharts is what I’m using right now because that’s what the Unger Academy recommends. And the number one thing that sets it apart from NinjaTrader specifically, is the ability to run multiple strategies on the same instrument at the same time.

And they will aggregate the long and the short automatically for you. And that’s amazing because you can diversify even within the same symbol with different approaches.

Chelsi

What about trading, learning trading programs, trading educational programs?

David

Well, I was a member of Simpler Trading for a year or two while I was trying a discretionary trading, John Carter’s group, and that was a lot of fun. I learned a ton about options, but I didn’t learn a lot about how to trade consistently and how to set up a method.

You can follow trades with Simpler Trading, and some of them will work and some of them don’t. And there’s just a lot going on there, a lot of people to consider as mentors.

And the thing about options is you just don’t have the precision in your backtest, because when you decide you’re going to take 50% of the possible profit, it’s really hard to get a good backtest.

Anyway, I moved on from options. And then I joined Kevin Davey’s course. I think he and Andrea are old friends from the international trading competitions. And Kevin’s course was a lot of fun. I learned a lot more about setting up a process. He calls it his strategy factory.

And I learned a lot of the components that you really need to put in place and not leave out. But I still wanted more, and I wanted to go a lot deeper.

Discovering Unger Academy

And I felt like I needed something that I can use as a template for my ideas, but with just a lot more structure. I think Andrea Unger, of course, was my last stop. I said, this guy, he’s won so many competitions. I’ve got to see what this is about because he’s clearly the king of winning at trading. So it was a little more expensive, but it was well worth it. I paid for the course many times over already.

Chelsi

That’s great to hear. So once you were a member of Unger Academy, was there anything specific about the program that stood out to you or made the biggest difference in your learning? And if so, why do you think it worked so well for you?

The Benefits of Following Andrea Step by Step

David

I think the best thing for me was the ability to follow Andrea along while he performed tutorials on each type of strategy. That was unique to me. So if you get AlgoTrader Fast, I think that’s the course that I took, he walks you through his process and his thoughts and ideas as he’s moving along through the steps that he takes within each strategy. So I followed him along exactly.

And it wasn’t really about learning any insights into what he was doing. It was actually just about getting my reps in and getting some good habits going. Going from step one to 15 in the right order is huge. So following him along in those videos, I think, made a huge difference for me.

Chelsi

That’s great. That’s great. After putting the program into practice, now, what results have you seen so far?

One Year Results: +100% on Initial Capital

David

So far, everything’s great. I’m over 100% on my initial capital, and it’s been just over a year. So I started out… For me, I wanted to be able to run a bunch of strategies.

Right now, I have six going, and to do that, I needed to decide which instruments to trade, and I needed to be able to trade at least one contract on each one to start out without hitting margin restrictions.

So I found out that I had to start at a certain size of account. And I went with micros because we can grow the account faster than waiting for the thresholds to be hit with the regular minis.

I used the micro MES, MCL, and MGC. And I would recommend those three. It would definitely be the ones for everyone to start on. They have the liquidity and the volume. It’s definitely the way to go.

Chelsi

That’s great. I bet anybody watching this, any newbies to the world of trading, would take those words to heart. Absolutely. Thank you.

David

Yeah, they should.

Chelsi

So beyond the numbers, how is your life, your day to day trading experience changed?

How David’s Trading Experience Has Changed

David

I do want to say one thing that was helpful was I took some time off to learn about all this stuff, two or three years. And we did some family adventures. My son and I like to go on adventures, and we got a lot of fitness plans going. However, after about three or four years, he wanted to come to Ottawa to go to an art school.

And now that I was in a big city, we were up in a place called Wakefield in the country, just in Western Quebec, which was gorgeous. But we came here to Ottawa, and I immediately got headhunted by a cooking school, a really famous one.

Everyone will know its name. And I was hired to write some software to run their systems there. And it was right after I set up my server and set up my six strategies and press the button, the go button.

The Hardest Part of Systematic Trading

The hardest part is pressing that button and just letting go of that capital you’ve decided you can lose. You probably won’t, especially with this Unger Academy, I’d be shocked if you followed the instructions.

Automation Always Pays Off

So the great thing about getting that job was that it was only going to be about a year it was a contract to write some software. I pressed my “go” button. And about two weeks later, I started that job, and I was only able to check my server and check my positions twice a day, once when I woke up in the morning and once when I got home after work before we make dinner. And I think that I’m lucky that I was unable to just watch things like a hog all day.

Chelsi

You were forced into having the let it go mindset, let it go on its own and trust it.

David

Yeah, I had discipline thrust upon me by alternative employment. I wasn’t able to get scared. You know what I mean? When most of us start trading, it’s discretionary.

And we’re just clicking like crazy, racking up the costs and the losses. And I had to leave the thing alone for at least 10 hours a day and just walk away.

And to my pleasant surprise, all of the research and all the hard work just slowly started to grind out into returns. And it’s still going now. Everything’s going well. I have pretty aggressive position sizing going, so really good that I wasn’t able to check every day.

Chelsi

That’s cool. So the discipline thrust upon you. That’s true. Looking back, where do you think you’d be today if you hadn’t taken action and joined the program?

Where Would David Be Without Joining Unger Academy?

David

I think I probably would have… I probably would have ceased activity in this area.

Chelsi

Really?

David

It’s a lot of hard work. And honestly, you hear a lot of people on YouTube saying it’s going to take six months, it’s going to take eight months. This is nonsense.

It’s going to take years, and you have to be okay with that. Unless you join the Unger Academy, of course, if you’re just a genius that I wasn’t enjoying that right away, you’re going to spend a few months learning about everything, setting up a server, setting up MultiCharts, all that stuff.

You’re going to do a lot better than I did. I’d probably just be investing more passively. I had a pretty rough time trading in a discretionary manner. I didn’t lose a ton of mine, nothing that I couldn’t handle, but it wasn’t really going anywhere.

Chelsi

Probably stressful, too.

David

Yeah. I was in that boom-bust cycle that you hear about, so I wasn’t losing money anymore, but I wasn’t making any. I didn’t really see any new horizon.

There was no blue ocean opening up for me where I could see consistent results in good position sizing, turning into good profit. But like I said, the Unger Academy was my last stop.

I said, this guy has got to know what he’s doing. I know this is going to work. And I took all of my knowledge from before, and that probably helped me get through the course a little more quickly than younger students did.

But yeah, I’d probably still be writing software for institutional and educational food service and restaurant businesses. And being a little more passive. I love trading options, but I don’t know. It’s a little sluggish for me.

Chelsi

I’m glad that this has given you the opportunity to choose where you put your energy. For sure, that’s not taken for granted these days. Well, finally, last question: if someone is watching this interview and is still undecided about joining the Unger Academy, what advice would you give them?

Advice for New Traders

David

I would say that if you can start with a reasonably sized account, nothing too big, you don’t need much. But you do have to make sure that you can diversify a little bit so that you can trade at least a contract on at least, I’d say, three instruments in micros is the way to start.

I would say you’re going to be rewarded. I can’t imagine having come even as a rookie into Unger Academy not being successful. Honestly, it’s set up that well.

Chelsi

That’s quite a compliment David, thank you so much.

David

It’s well deserved.

Chelsi

Thank you. Thank you so much for sharing your journey with us. And your story is a great reminder of what’s possible with the right tools and mindset and commitment.

And for those of you watching, if David’s experience has inspired you and you’d like to learn more about how Unger Academy can help you succeed in trading, don’t hesitate to reach out.

And until next time, guys. Happy trading. Thank you so much, David.

Ciao, ciao.

David

Good luck.