Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.

In this article, we review the results of the “Strategy of the Month” contest, analyzing two interesting trading strategies selected from those submitted by our students.

Specifically, we will focus on two different approaches, both in terms of market and trading logic: one strategy developed on the Crude Oil futures (CL) and one strategy trading the Nasdaq futures (NQ).

As usual, our goal is to provide practical insights by analyzing the core logic of each strategy, the markets they trade, and of course, their long term performance.

We would like to remind you that the “Strategy of the Month” competition is a contest reserved exclusively for Unger Academy® students and rewards the best strategy developed using the Unger Method™. By submitting their strategy, each student can participate every month and compete for a 1,000 euro Amazon gift card.

In addition, if you would like to obtain the source code of the winning strategies, you can join the Unger Strategy Club, one of the exclusive services offered by our Academy. This service allows you to access the open-source code of this month’s winning strategy, along with all previous winners. It also gives you access to a monthly live advanced training Masterclass and a monthly video with practical insights, where we explain the main rules of the strategies included in our portfolio.

But that is not all. By joining the Unger Strategy Club VIP, in addition to all the benefits mentioned above, you will also receive exclusive access to the open-source code of all contest strategies that have been approved by Unger Academy coaches.

Let us now begin reviewing the best strategies submitted during the month of December.

Intraday Bias Strategy on Crude Oil Futures (@CL)

The first strategy we analyze is an intraday bias approach, meaning a strategy designed to capture a recurring trend within the trading session. This type of logic is particularly well suited to the instruments we typically trade, especially commodities, which often exhibit well-defined seasonal and intraday behaviors.

In this specific case, the strategy opens a long position at 4:00 PM New York Exchange time and closes the position at 3:00 AM of the following session.

For short positions, the strategy opens trades at 10:00 AM and closes them at 3:00 PM, again based on exchange time.

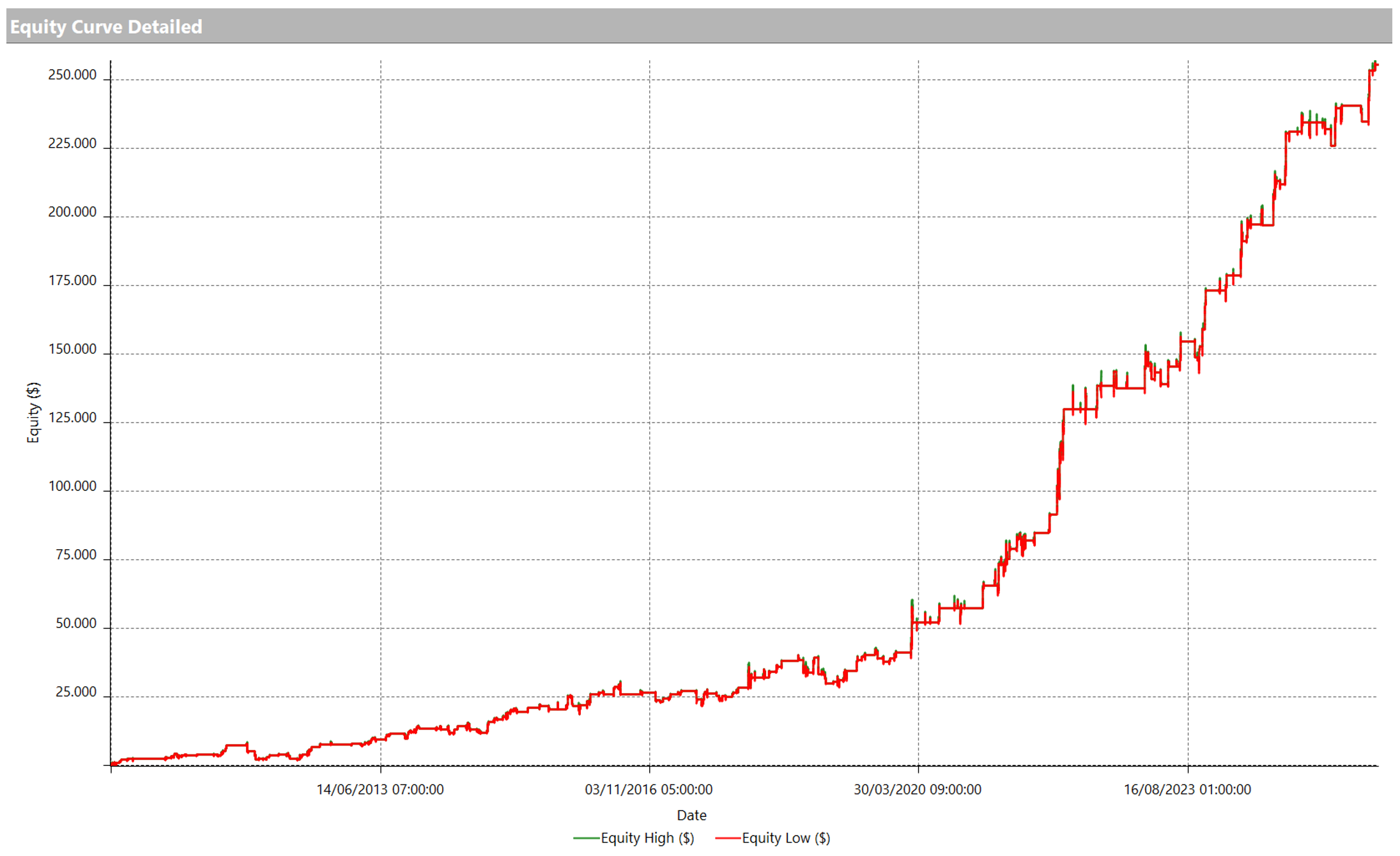

In Figure 1, we show the preliminary analysis carried out using proprietary software called Bias Finder. This tool evaluates the average price movement of the Crude Oil futures within specific time windows, dividing the data across different historical periods. This type of analysis is essential to verify whether the identified bias truly exists and whether it is persistent over time.

We can observe that, for the long bias, prices have increased on average over the years within the selected time window, confirming the presence of a recurring trend.

For the short bias, prices tend to decline on average within the window identified by the student. However, it is worth noting that during the 2010 to 2013 period (orange line), this behavior was not yet statistically favorable. This further confirms the importance of analyzing biases across different subperiods.

Finally, several operational filters were added to the base structure of the strategy in order to increase the average trade value and improve the overall robustness and tradability of the system over time.

Performance of the Intraday Bias Strategy on Crude Oil

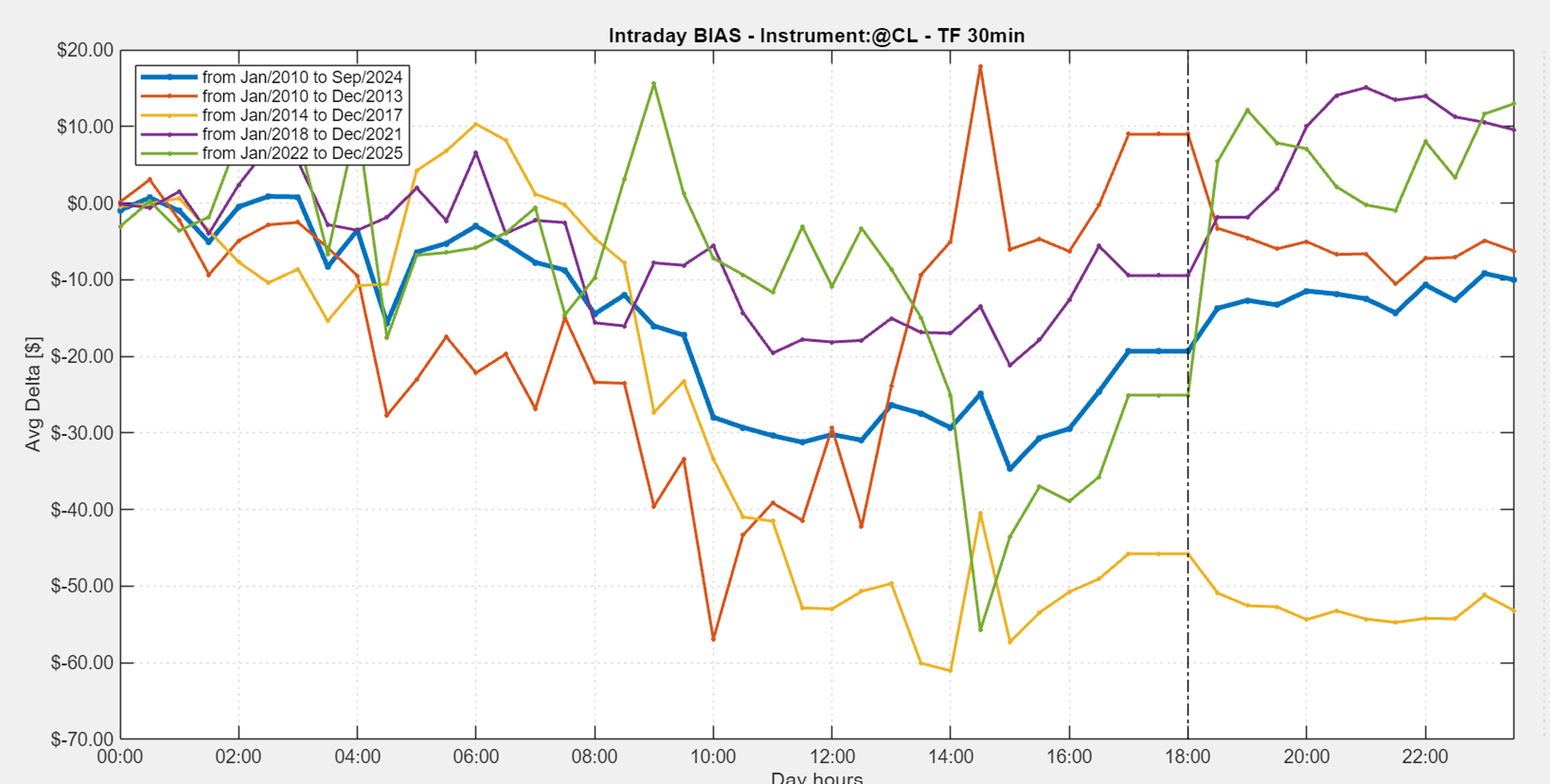

Moving on to performance analysis, Figure 2 shows the complete equity line of the strategy on Crude Oil futures. Overall, the performance is positive, although not particularly smooth.

It is interesting to note that the strategy struggled during the early phase of the backtest, especially between 2010 and 2014. This time period perfectly aligns with what we observed in the bias analysis, where intraday market behavior was not yet optimal for the selected trading window. This evidence confirms the importance of analyzing the historical context of a bias rather than relying solely on aggregated results.

In the following years, and even more clearly in recent periods, the strategy showed a significant improvement, with a more directional equity line and a growing ability to generate consistent profits. It is precisely this recent behavior that makes the system particularly interesting from an operational standpoint.

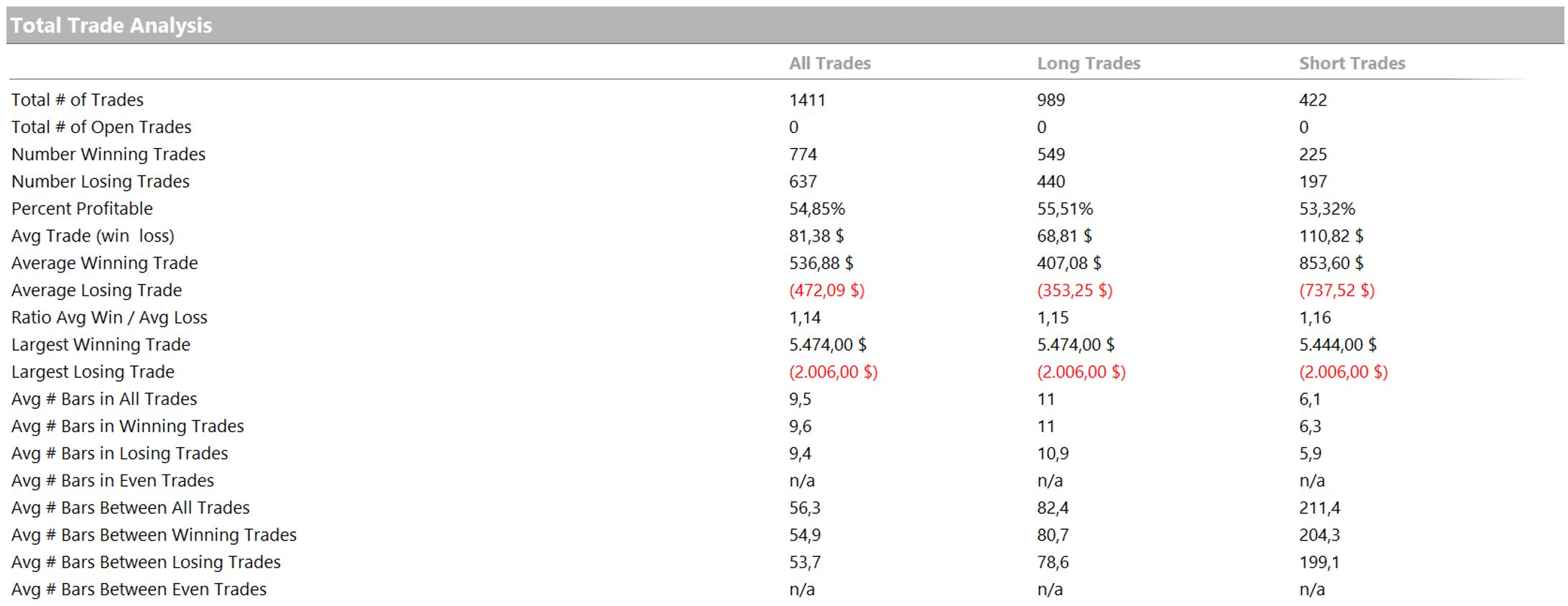

Figure 3 reports the main performance metrics. The average trade value can be considered borderline for real live trading. However, it is important to point out that this figure is partially penalized by the early phase of the backtest, which was characterized by a less efficient bias. When analyzing more recent performance, the average trade is significantly better and more aligned with tradability requirements.

For this reason, while maintaining a prudent approach, we considered the strategy worthy of promotion due to its recent performance, consistency with the bias analysis, and overall robustness of the development process.

The Winning Strategy: Multiday Trend Following on the Nasdaq

We now move on to the winning strategy submitted by Bogdan, a trend following system developed on Nasdaq futures. We extend our congratulations for standing out among all contest participants.

This strategy is built on a simple yet effective logic. It operates on a 60-minute time frame and aims to capture short-term directional price movements.

Specifically, the system enters long or short positions when key levels are broken. These levels are calculated based on the highest and lowest closes of the last n bars, allowing the system to identify potential price acceleration phases.

To support the entry logic, trend filters based on moving averages are used. Their purpose is to ensure trades are taken only in the presence of a coherent directional context and to avoid sideways market conditions.

Position management includes the use of stop losses and a breakeven logic, both of which are essential for risk control and for protecting accumulated profits during the trade. The strategy is therefore fully multiday in nature, with positions that can remain open for multiple sessions.

It is important to highlight that the system includes a forced exit of all positions at the end of the Friday session. This rule is designed to avoid the risks associated with holding positions over the weekend, when gaps or external events may occur and cannot be managed operationally.

Performance of the Trend Following Strategy on the Nasdaq

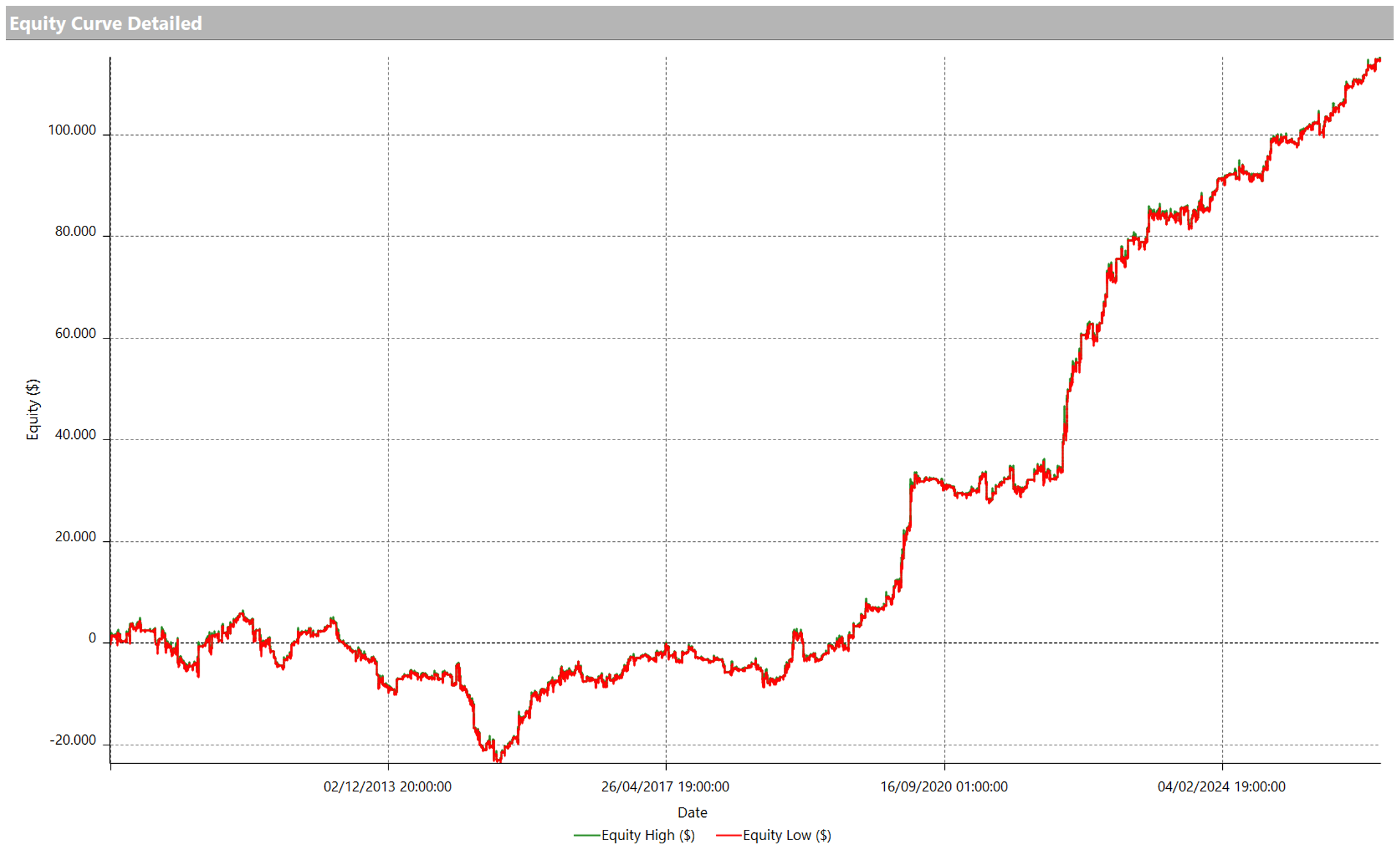

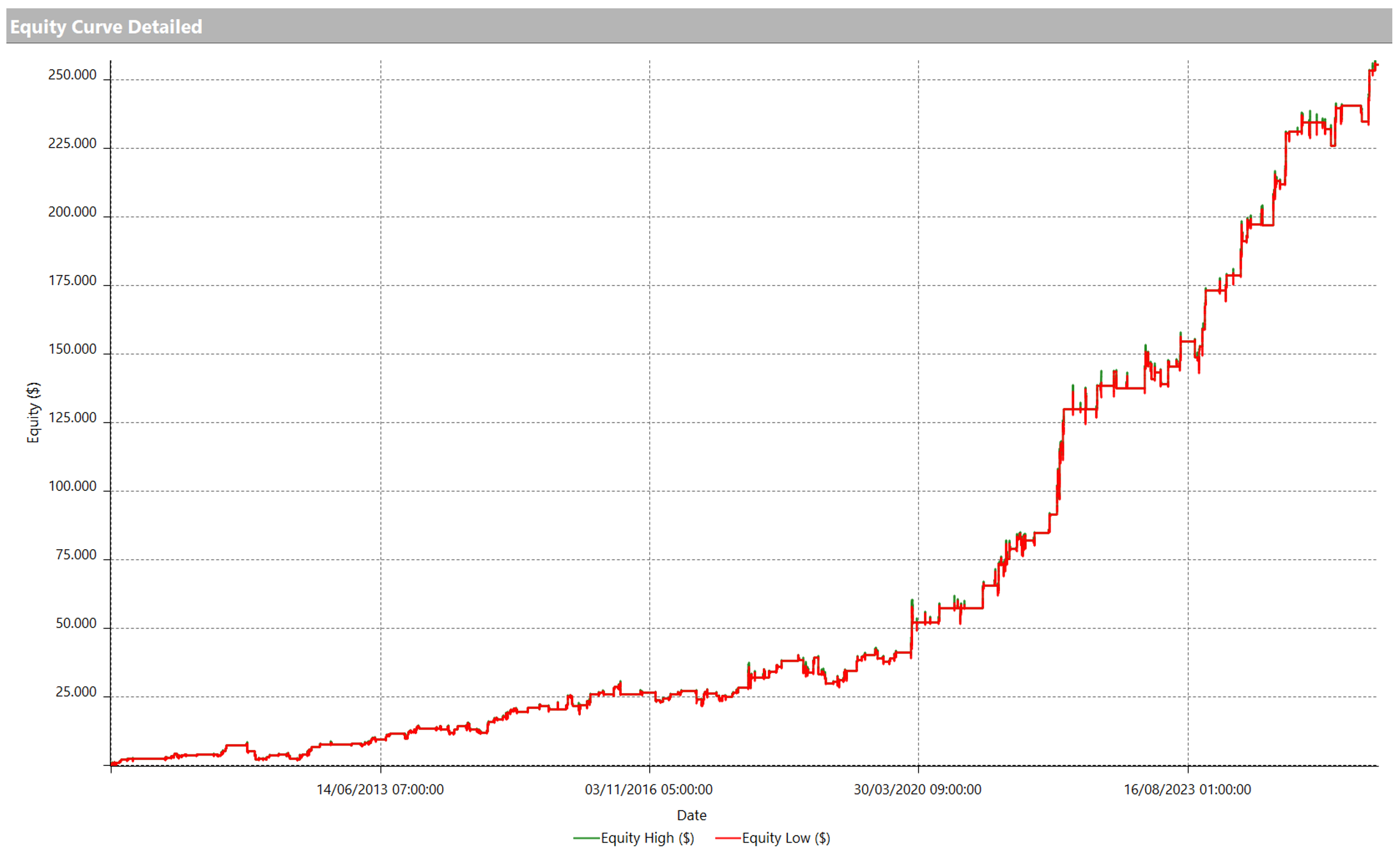

Turning now to the performance analysis of the winning strategy, Figure 4 shows the complete equity line of the system on Nasdaq futures. The performance appears particularly solid and directional, with steady growth over time and overall limited drawdowns.

One notable aspect is the strong acceleration of the equity curve in recent years, a period during which the Nasdaq experienced wide and persistent price movements. This confirms the strong alignment between the system logic and the structural characteristics of the underlying market.

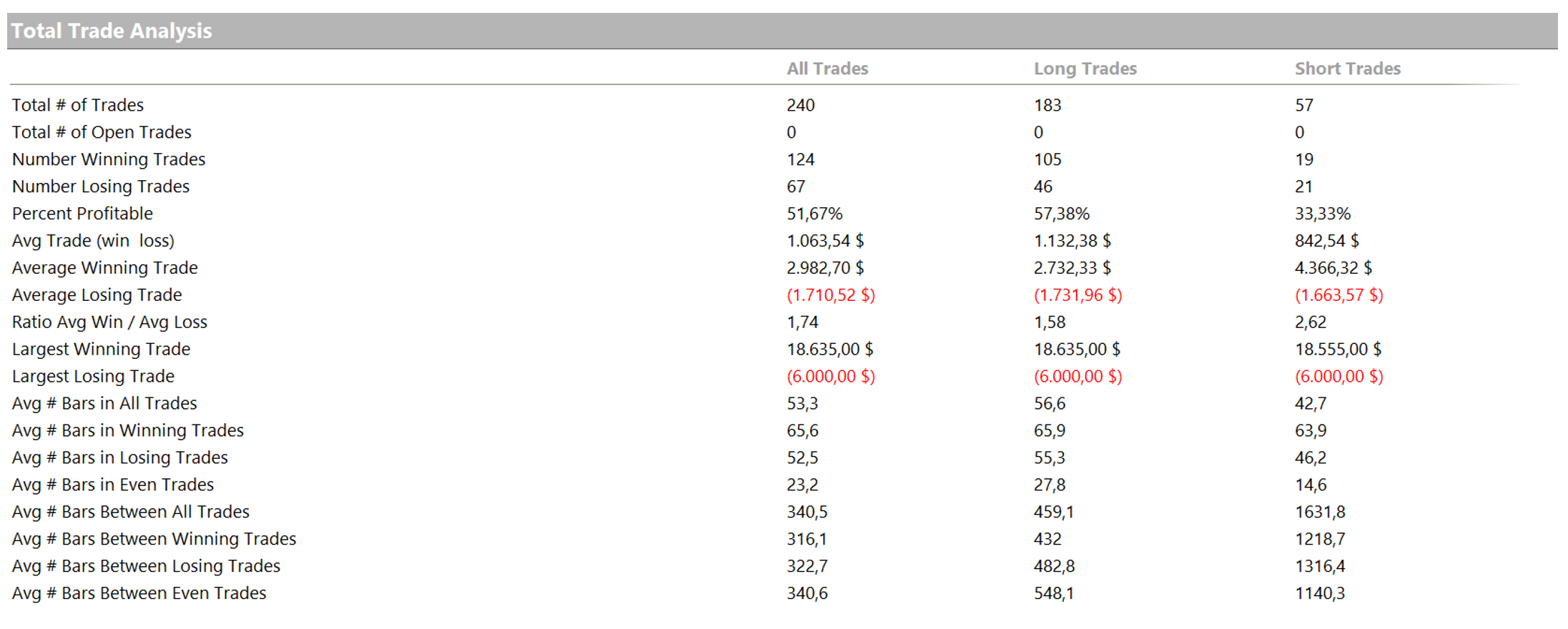

Figure 5 shows the main performance metrics. What immediately stands out is an exceptionally high average trade value, which is particularly impressive when compared to typical intraday or short-term strategies.

It should be noted that the statistical sample is not particularly large, which is entirely normal for this type of strategy, as it operates with lower frequency than faster trading approaches. Nevertheless, there is nothing preventing the development and integration of strategies with these characteristics, especially within a well diversified portfolio where systems with fewer trades but high average trade values can play an extremely effective role.

Conclusions

We therefore congratulate Bogdan on his Nasdaq trend following strategy, which earns the title of Strategy of the Month for December. The system stands out for the quality of its development, the coherence of its trading logic, and the solidity of its long-term performance.

We also extend our compliments to all other contest participants, whose work continues to raise the overall level of submitted strategies each month.

Through the analysis of the two strategies presented in this article, we have seen how systematic trading can be applied to very different markets and approaches, ranging from an intraday bias strategy on Crude Oil to a multiday trend following strategy on the Nasdaq. Once again, the true value does not lie in the single idea, but in the robustness of the development process, the analysis of market context, and proper risk management.

We hope this article has provided inspiration and support for your ongoing growth as a systematic trader.

Finally, we remind you that if you would like to obtain the source code of the winning strategy and the best participating systems, you can join the Unger Strategy Club and review the contents of this service directly at www.ungerclub.com.

That concludes this month’s feature. Join us next month for more innovative trading strategies and inspiration!

Curious about our “Strategy of the Month” contest? This exciting monthly competition is open exclusively to Unger Academy students and rewards the best strategy developed using the Unger Method with a €1,000 Amazon gift card. Interested? Click here to learn more!

Want to see the champions from previous months? Click here to check them out!

Transcription

Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.