Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.

In this article, we will explore two trend following trading strategies that achieved excellent results on the Feeder Cattle (FC) market, one of the longest-standing and most interesting commodities on the CME for systematic trading. These automated strategies made the most of the high volatility and strong directional moves recorded in the Feeder Cattle market in 2025, a year marked by sharp rallies, rapid corrections, and subsequent recoveries.

Both strategies are based on a multiday trend following logic, but they use different operational approaches to determine market entries. Let us take a closer look at how they work, which filters they use, and how they managed, together, to generate nearly 8,000 dollars in profit in December 2025 alone.

#1 – Multiday Trend Following Strategy on Feeder Cattle: Trading with an ADX Filter

The first strategy trades both long and short on a 5-minute time frame with a multiday horizon, staying in the market for a maximum of 2 days. It uses the previous session high and low levels as entry points.

Entries are filtered by a neutral indecision pattern and by the ADX trend strength indicator, which must be below a certain threshold. This condition is considered ideal for a trend expansion once the entry levels are broken. In addition, the strategy does not trade on Thursdays and closes positions either at the end of the second day in the trade or when the stop loss is reached.

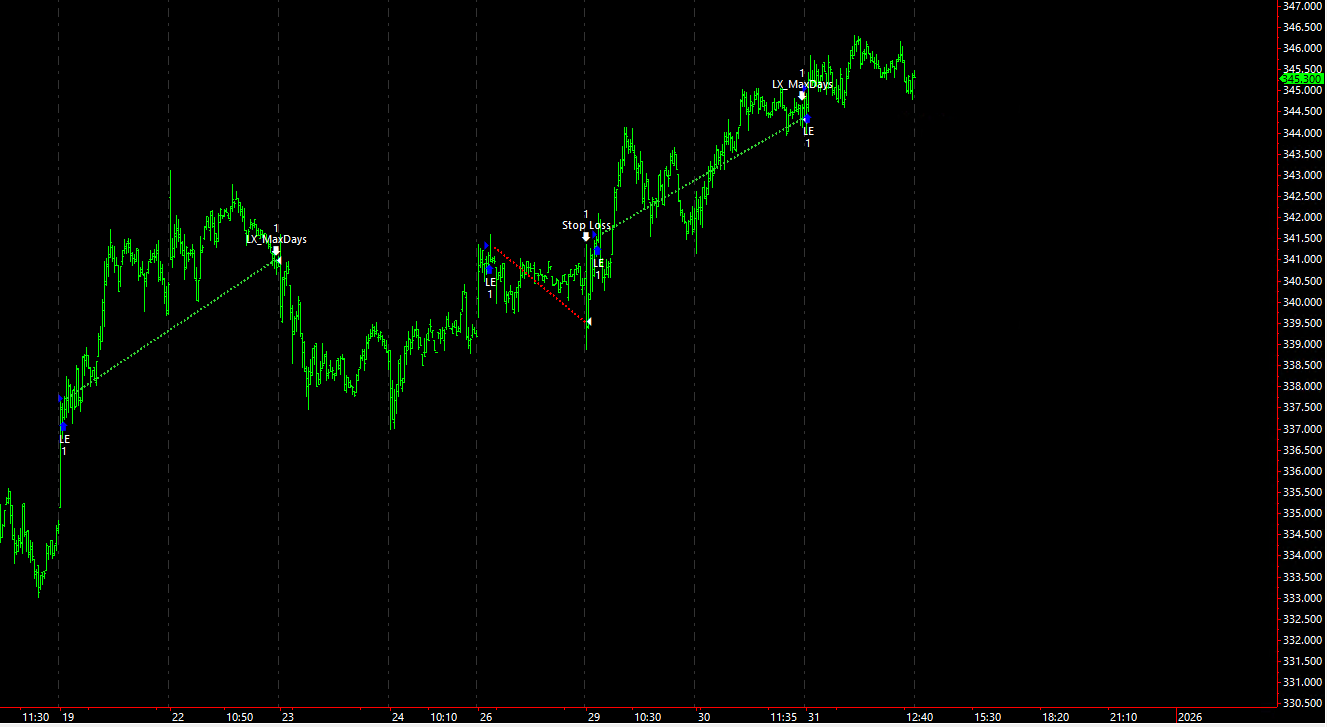

In Figure 1, the trades taken in December 2025 can be seen, with two profitable trades closed at the end of the two-day holding period and only one stop loss, for a total profit of approximately 2,200 dollars.

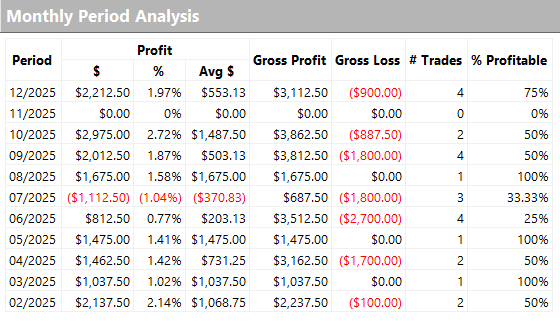

As shown in Figure 2, the previous months of 2025 were also quite positive, especially considering that this is a low-frequency strategy. This is partly due to the limited trading session of Feeder Cattle, unlike futures markets more commonly used by systematic traders.

#2 – Trend Following Strategy on Feeder Cattle with High and Low Breakouts

The second strategy operates on 30-minute bars and focuses on an operational window of just 2 hours within the roughly 5-hour trading session. It waits for the daily high and low to be defined.

After that, it starts placing stop orders to go long on a breakout of the high and short on a breakout of the low. Entries are filtered using two directional patterns and two neutral patterns.

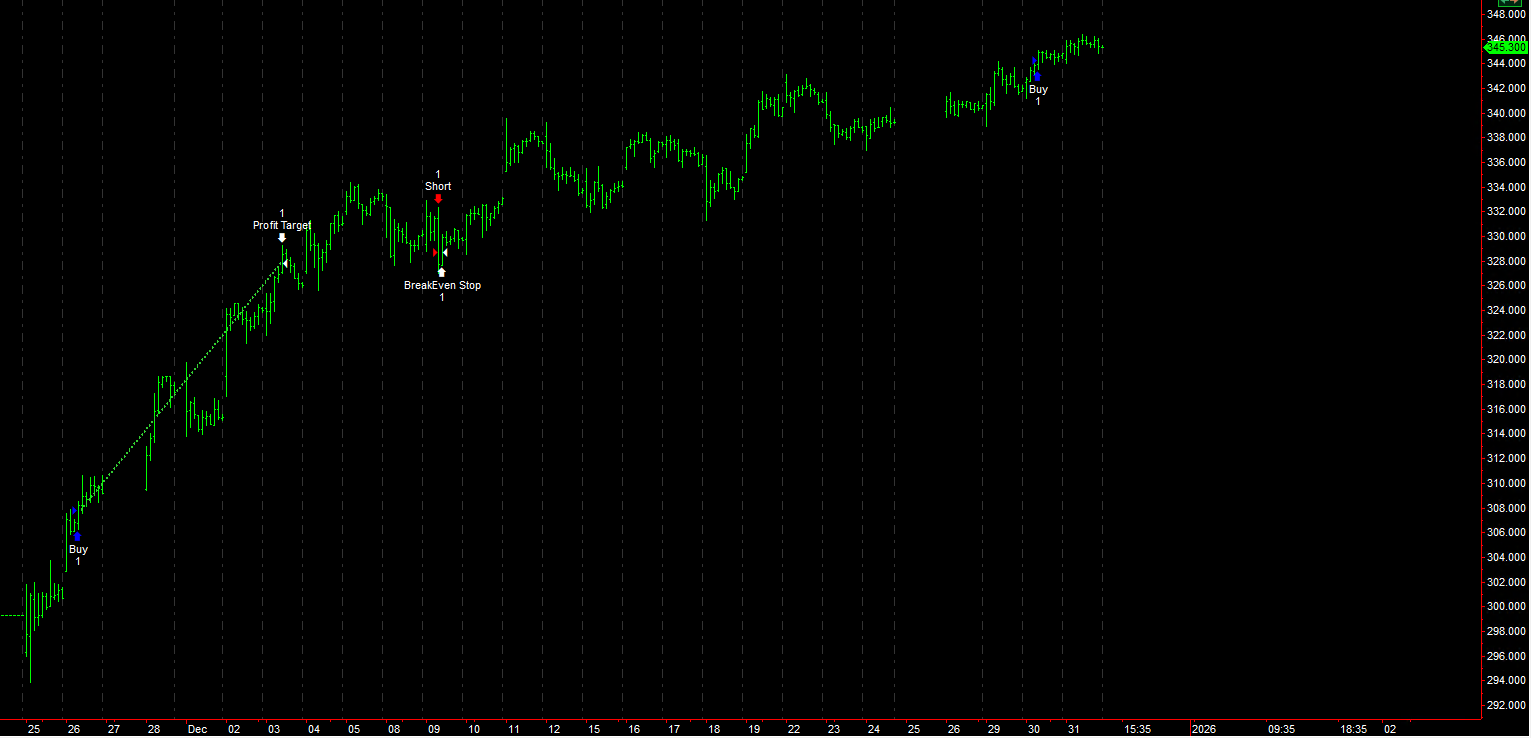

Positions are then closed after a maximum of 7 sessions, or when the stop loss or take profit is reached. A breakeven exit is also included, to prevent trades with good unrealized gains from turning into stop losses in the event of a pullback.

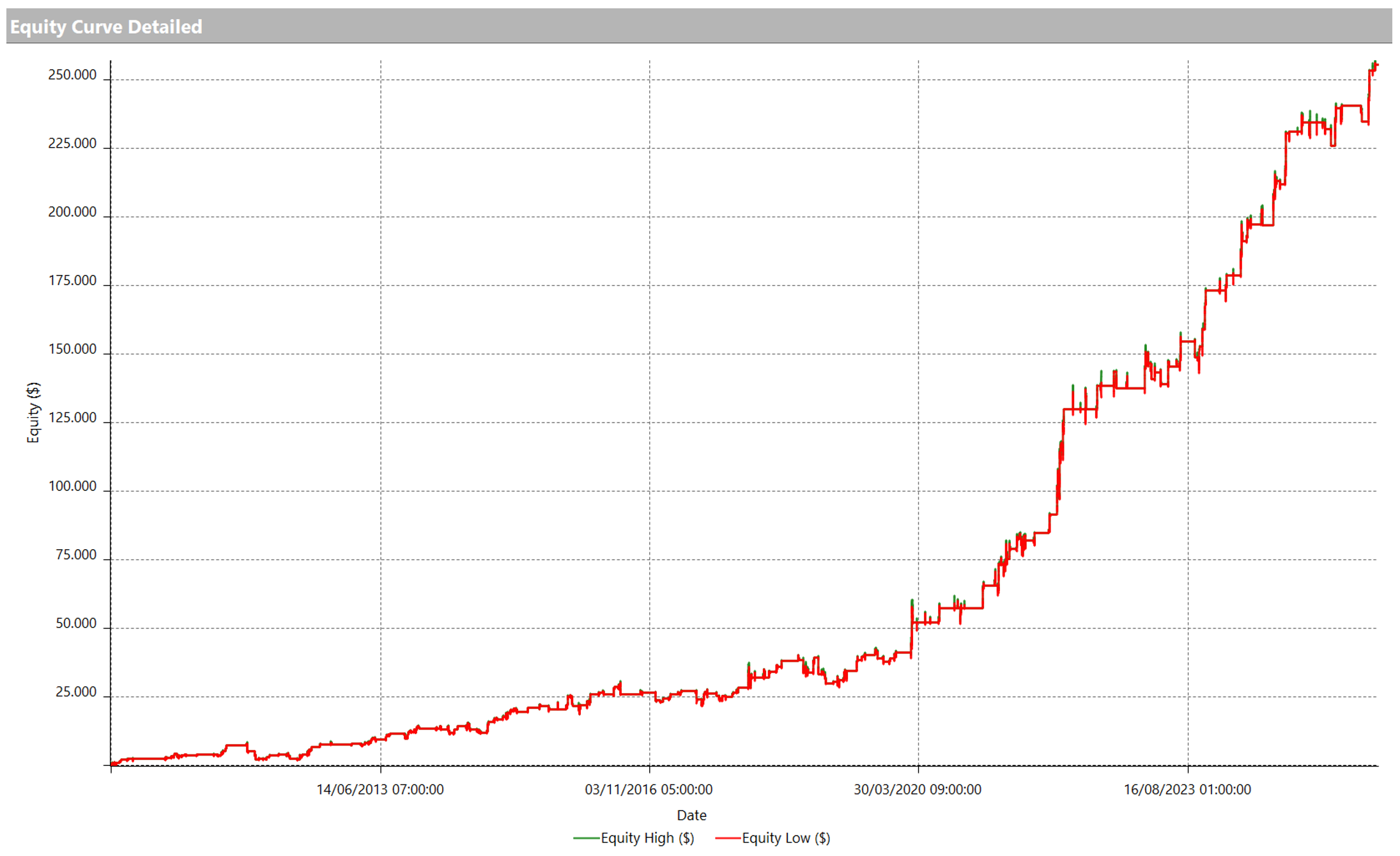

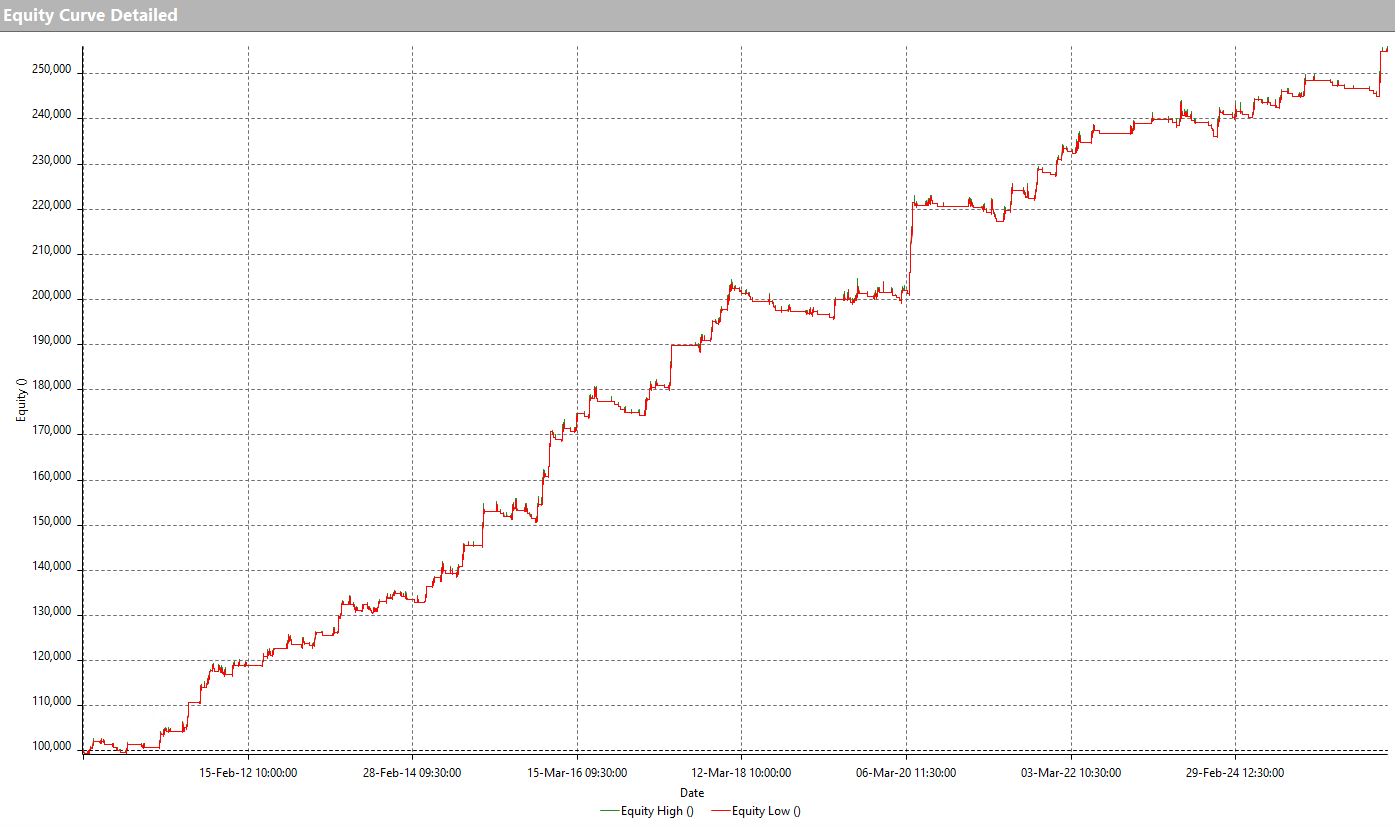

As can be seen in Figure 4, the equity curve of this strategy is fairly smooth, but like the previous one, it does not trade very frequently. This is due to the characteristics of this market, which make it attractive for strong trend following behavior but also somewhat challenging because of its limited trading sessions.

Despite this, thanks to the strong price movements of the most recent period, the strategy managed to generate as much as 5,762 dollars in December alone.

Conclusions on Trend Following Applied to the Feeder Cattle Market

In December, these two automated strategies were able to take advantage of the bullish momentum in Feeder Cattle thanks to their trend following logic, which fits perfectly with the characteristics of this market. Together, these two trading systems managed to bring home nearly 8,000 dollars in profit in December alone.

If you would like to learn more about our method for trading the markets using solid, well-tested strategies, click the link below and book a free strategic session.

See you next time, and happy trading.

Transcription

Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.