Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.

Welcome back to a new in-depth look at some of the systematic trading strategies currently featured in our portfolio. In this article, we focus on the most famous stock market index in the world, the Standard & Poor’s 500 (S&P 500), through an analysis of two strategies that have been performing exceptionally well in 2025 when applied to its corresponding future: the @ES.

Our goal? To provide you with actionable, high-performing ideas for building robust trading systems on one of the most attractive and liquid markets in the global landscape.

We’ll break down the general rules behind each strategy, with a special emphasis on entry logic and current performance metrics, particularly relevant given the current state of the equity market.

High-Performance Strategies on the S&P 500: What’s Working in 2025?

Over the past few years, increased market volatility has challenged many traditional strategies. However, some trading systems have demonstrated an impressive ability to adapt to the new environment.

So what’s actually working in 2025 on the S&P 500 future (@ES)?

We’ll explore two fully automated trading strategies that, since the beginning of the year, have generated over $38,000 in combined profit. These are tested and validated systems designed to exploit short- and medium-term market inefficiencies.

Strategy 1 – Intraday Bias on the S&P 500 Future (@ES)

The first strategy we’ll examine is an Intraday Bias strategy that operates both long and short. It uses a 5-minute time frame as Data1 and a 1440-minute (i.e., daily) time frame as Data2.

Like all intraday bias strategies, this one seeks to capitalize on recurring market behaviors that typically appear during specific time windows of the trading day.

If the stop loss hasn’t been triggered earlier, the position is closed at the end of the trading session.

Performance of the Intraday Bias Strategy on the S&P 500

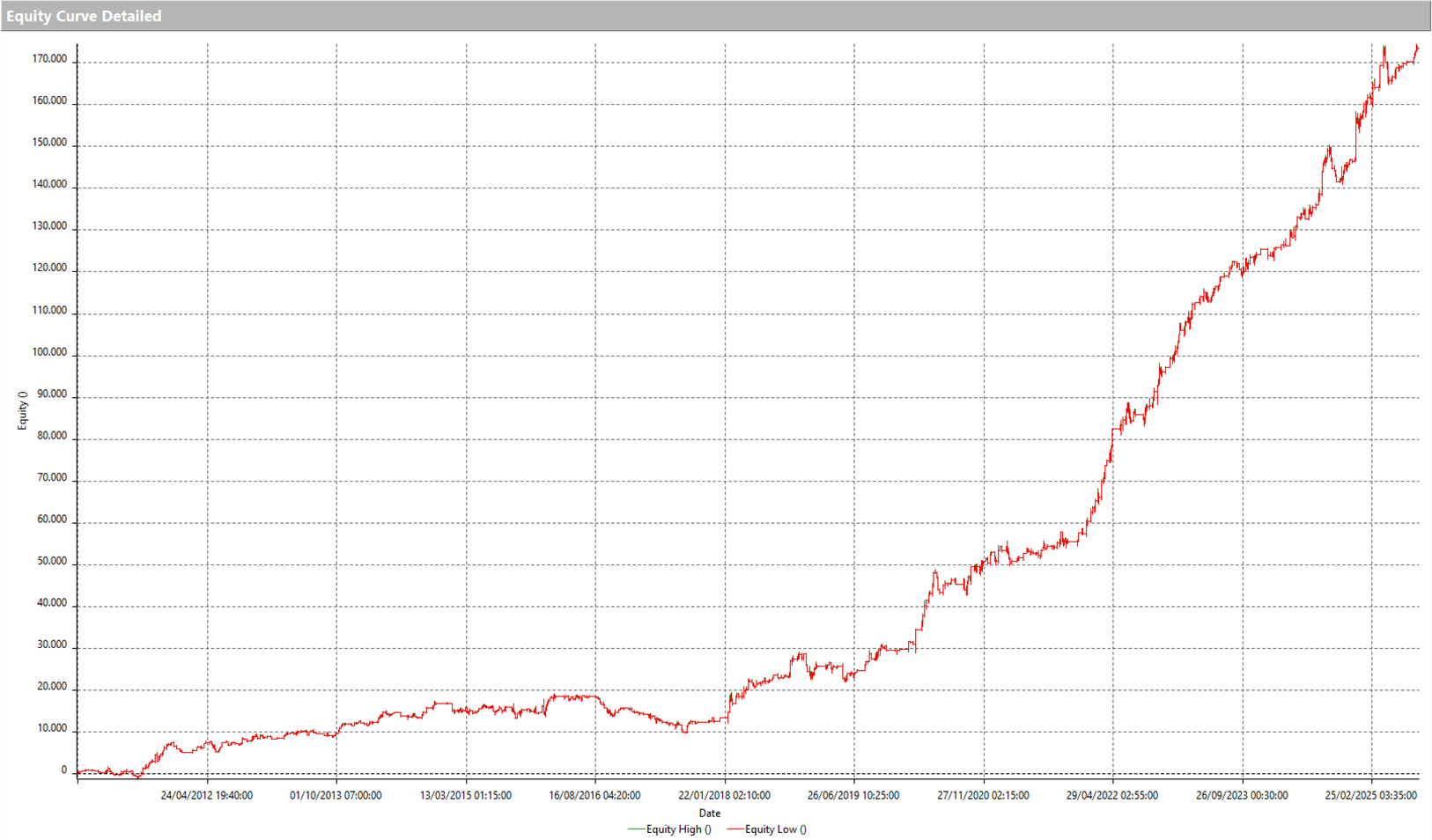

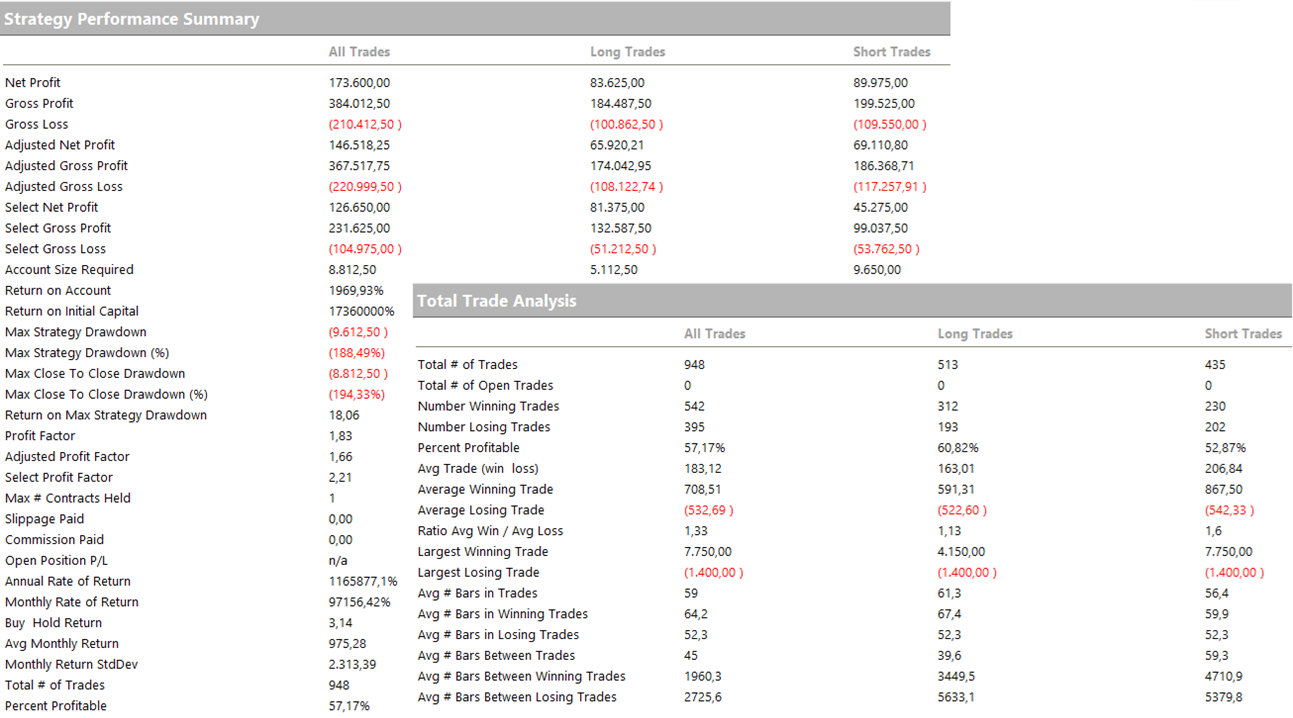

The system’s equity curve from 2010 to the present shows a significant growth in profits, particularly from 2020 onward.

The reason is clear: starting from the pandemic year, indices began rising rapidly alongside volatility, which boosted the performance of many trading systems.

When we look at this system’s metrics, we see a net profit of around $170,000 and a maximum drawdown of under $10,000, a very low figure. Most notably, it has a strong average trade of $183, which is excellent for a strategy that only stays in the market for a few hours at a time.

The annual performance breakdown shows that, with the exception of 2015 and 2017, all years have been profitable. Both net profits and average trade values have steadily increased over time. In the last five years alone, the average trade has frequently exceeded $400, a truly exceptional result.

As of 2025, the strategy is still in top form, currently sitting at the all-time highs of its equity curve.

Strategy 2 – Multiday Reversal Strategy on the S&P 500 (@ES)

Let’s move on to the second strategy, which operates on a 15-minute time frame and is based on a reversal logic. We’ve already analyzed this system in previous months and confirmed that its core engine, the Bollinger Bands, has been doing an excellent job.

As a multiday trading system, it can hold positions across multiple sessions, closing trades either through traditional stop loss or profit target levels, or through more complex trade management methods like breakeven and trailing profit mechanisms.

Performance of the Multiday Reversal Strategy on the S&P 500

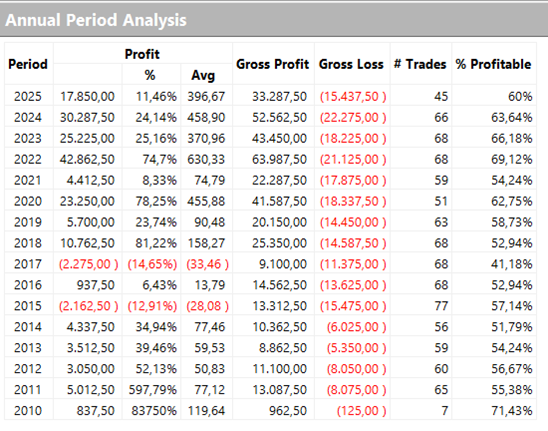

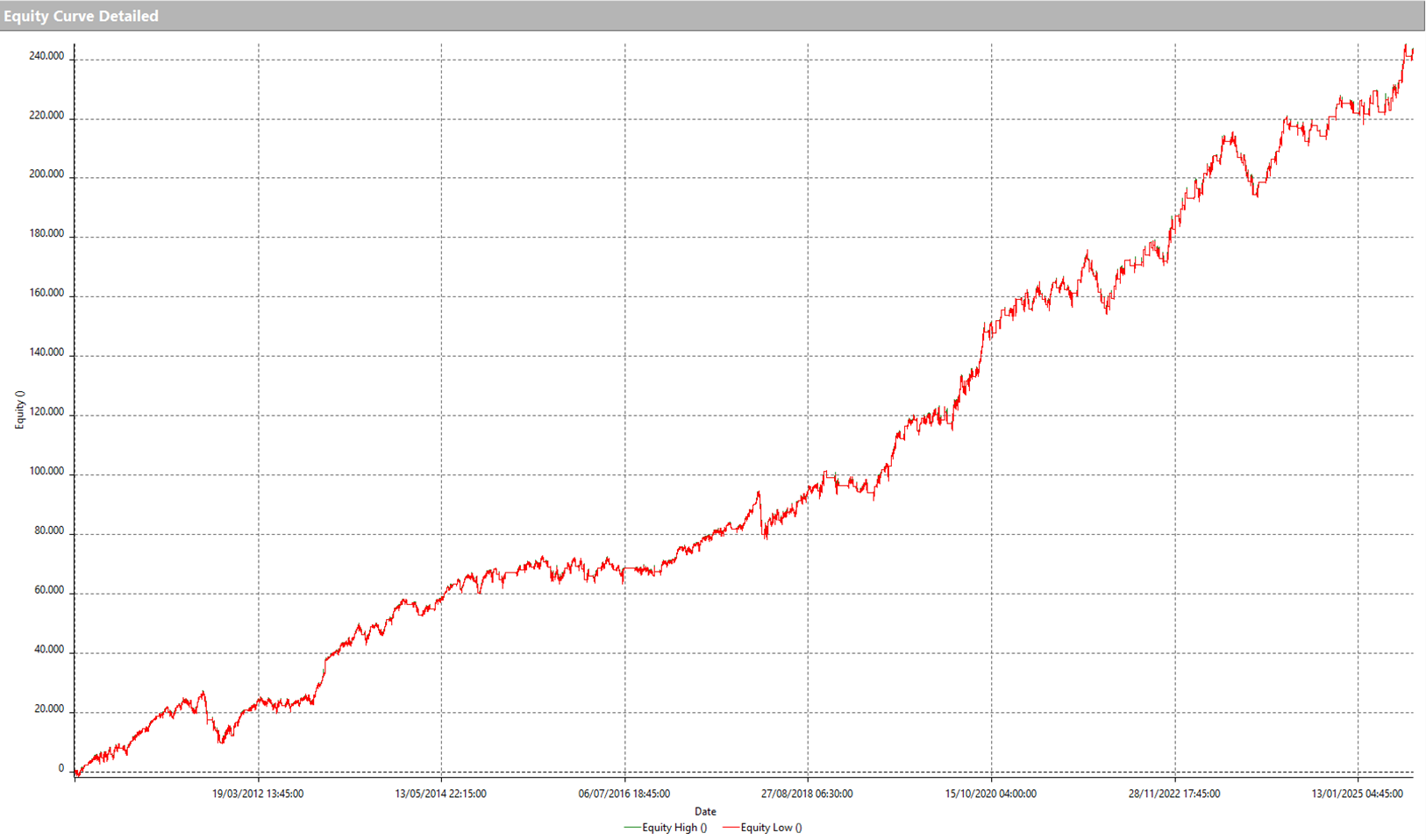

By looking at the equity curve, we can see a steadily rising line that shows consistent positive performance with no prolonged drawdown periods, and especially a strong acceleration in profits in the most recent period.

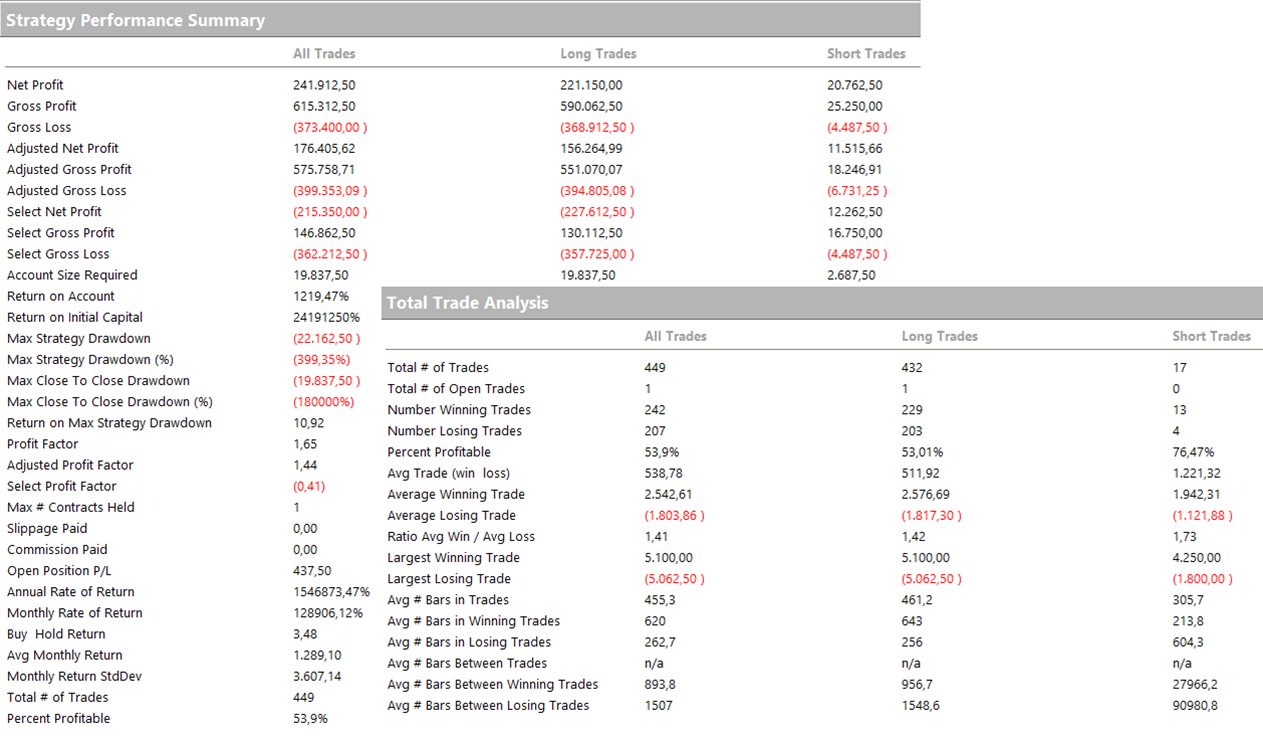

Let’s now take a closer look at the Strategy Performance Summary and Total Trade Analysis. The total net profit has exceeded $240,000.

In this case, the maximum drawdown is higher than that of the previous strategy, which is expected given the multiday nature of the system.

What really stands out here is the exceptionally high average trade, which comes in at over $530 per trade, a very strong result.

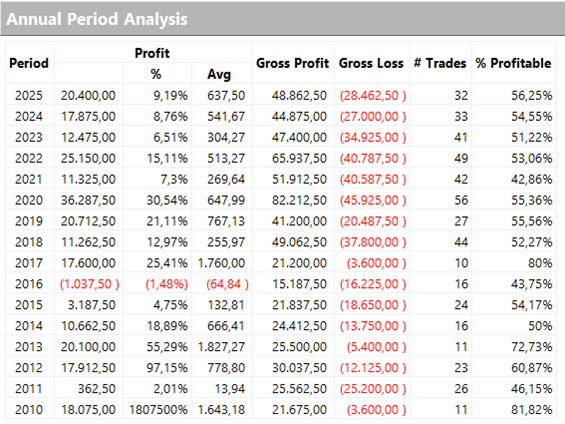

As mentioned earlier, the annual profit breakdown confirms the strategy’s consistency, showing a growth of over $20,000 in 2025 alone, a very solid performance, especially when considering the heightened volatility during the first quarter of the year.

Trading the S&P 500 with Effective Automated Strategies

In this article, we’ve explored two highly effective automated trading strategies applied to the S&P 500 future, one of the most liquid and widely traded instruments in the world.

These systems operate in a fully automated manner, offering significant advantages over discretionary trading:

– No stress

– No constant monitoring

– No manual order placement

With automation, you can:

- Exploit market inefficiencies even when you’re not watching the charts

- Free up valuable time for other pursuits

- Maintain discipline and reduce the emotional impact on your decisions

If your goal is to build trading systems like the ones we’ve just covered, you’re in the right place.

Feel free to explore more articles, videos, and resources available here on our blog. Or, if you’d prefer a more personal touch, you can book a free one-on-one call with one of our expert tutors using the button below.

See you in the next deep dive!

Transcription

Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.