Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.

Welcome to another installment of our portfolio strategy analysis. Today, we return to one of Europe’s largest stock markets, the Frankfurt DAX.

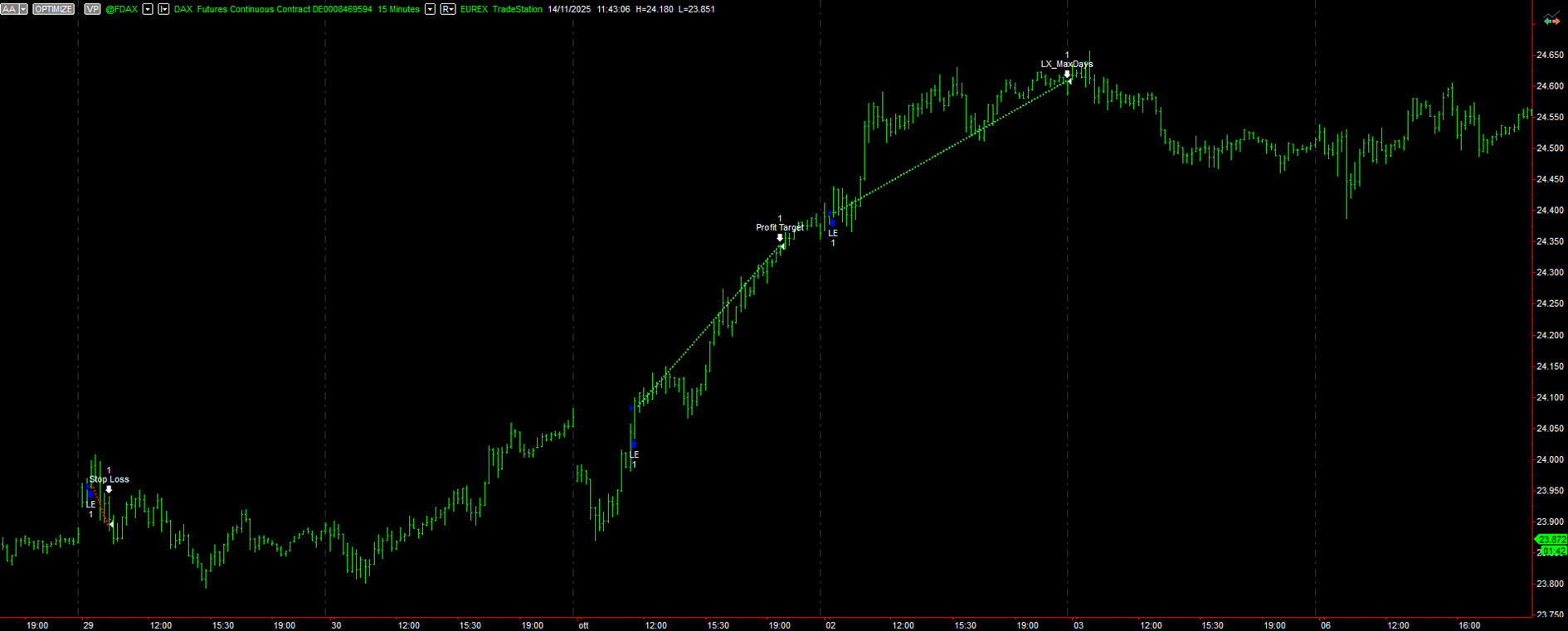

Both strategies discussed in this article trade the DAX futures contract (@FDAX) and belong to the Trend Following family, specifically the Breakout subcategory. It’s worth noting that they have been out of sample for many years now, which demonstrates their robustness even after their development.

Strategy 1: Intraday Breakout on the DAX Using the Previous Session’s Levels

The first strategy operates on a 15-minute time frame, with the historical session running from 8 AM to 10 PM. The system is driven by the classic breakout of the previous session’s high for long entries and its low for short entries.

We also use some proprietary pattern filters from our internal libraries to identify the best setups. Unless the stop loss or profit target is hit earlier, each trade is closed at the end of the session.

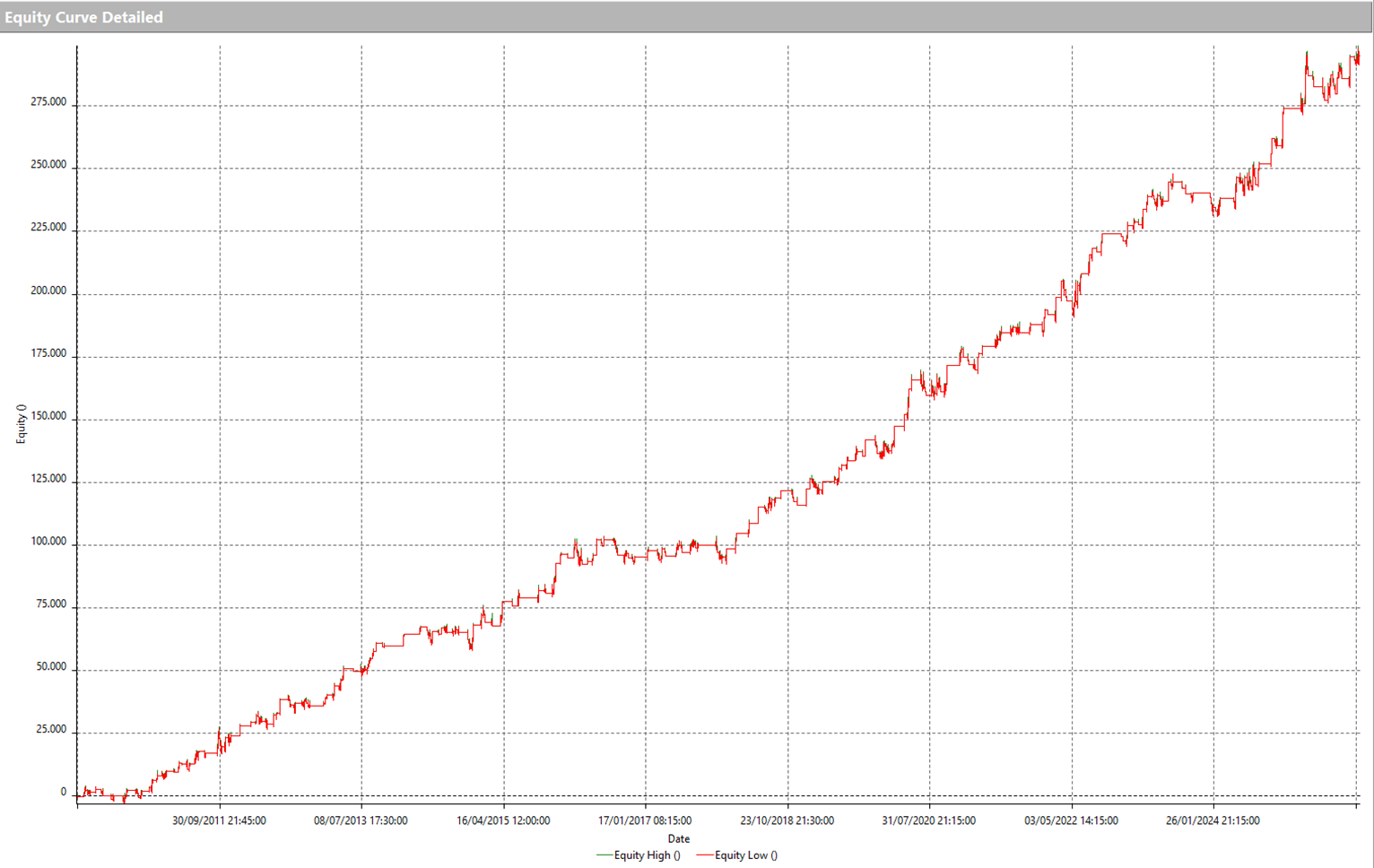

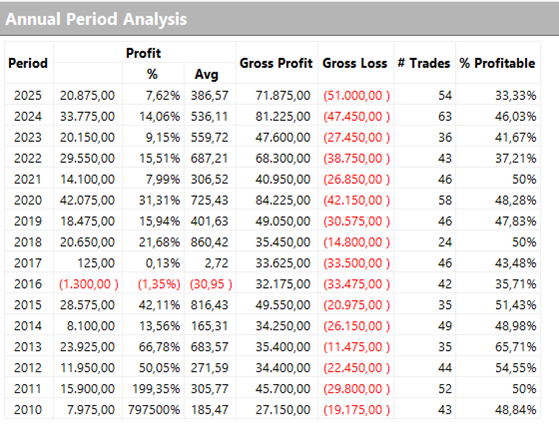

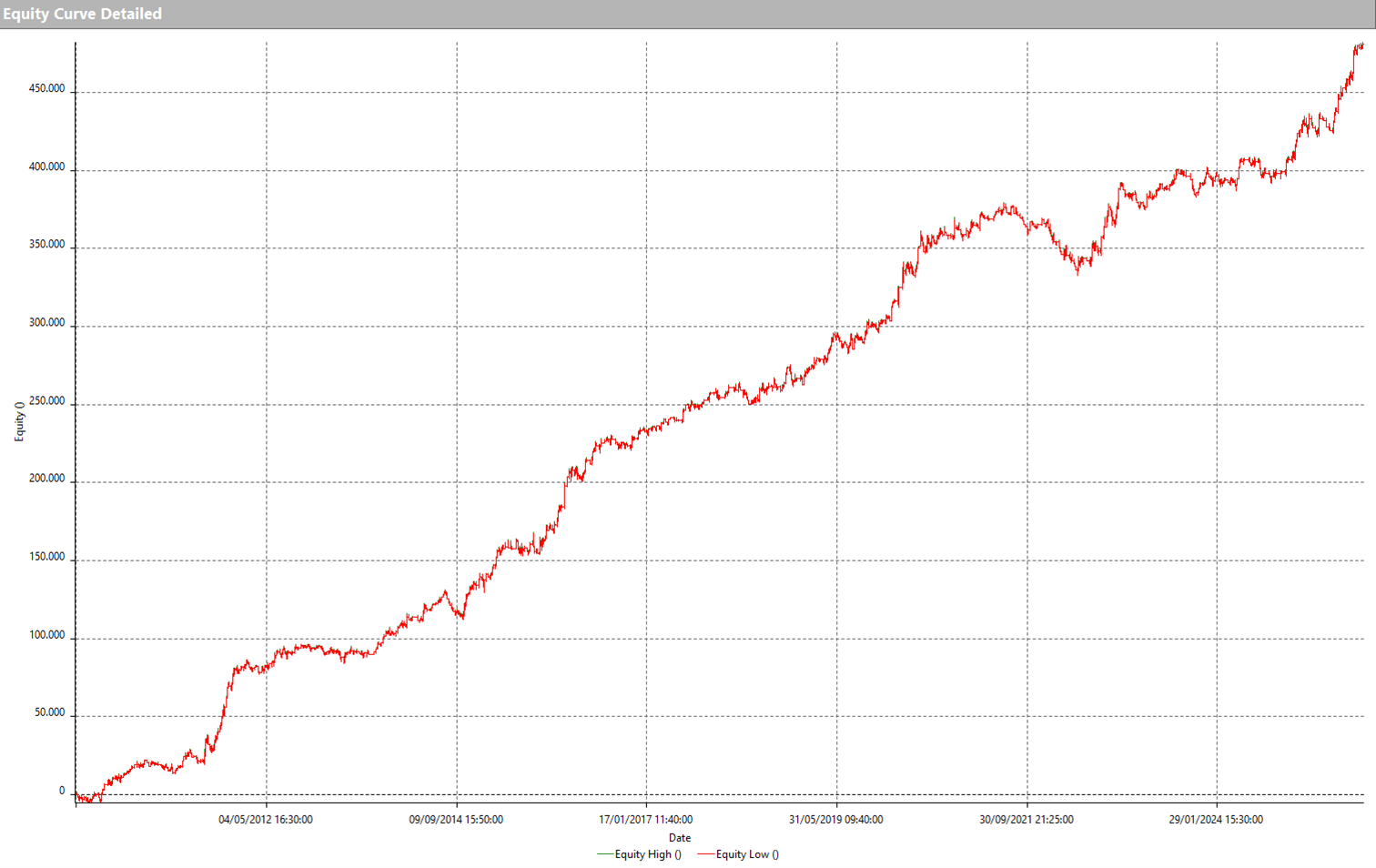

Looking at the equity curve from 2010 to today, its consistent performance across different market phases clearly shows how this type of strategy has remained effective over time.

Even this year, the strategy has generated over €20,000 in profits, with no significant drawdowns.

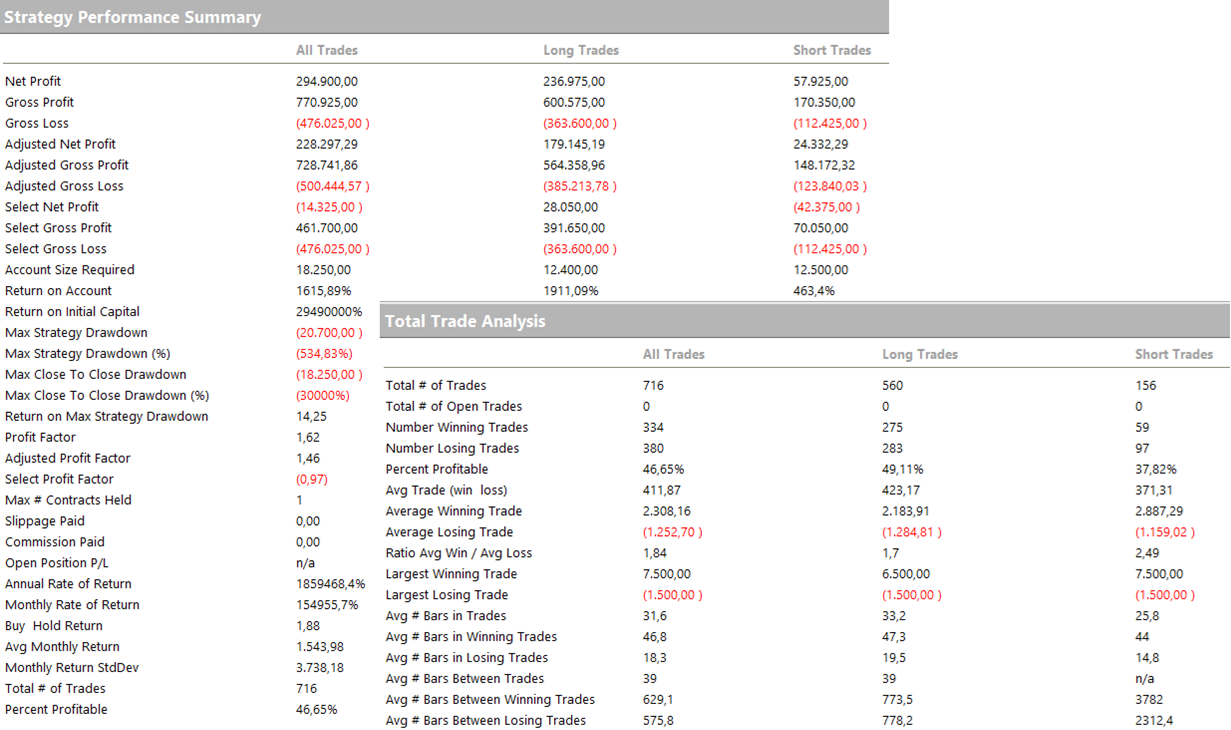

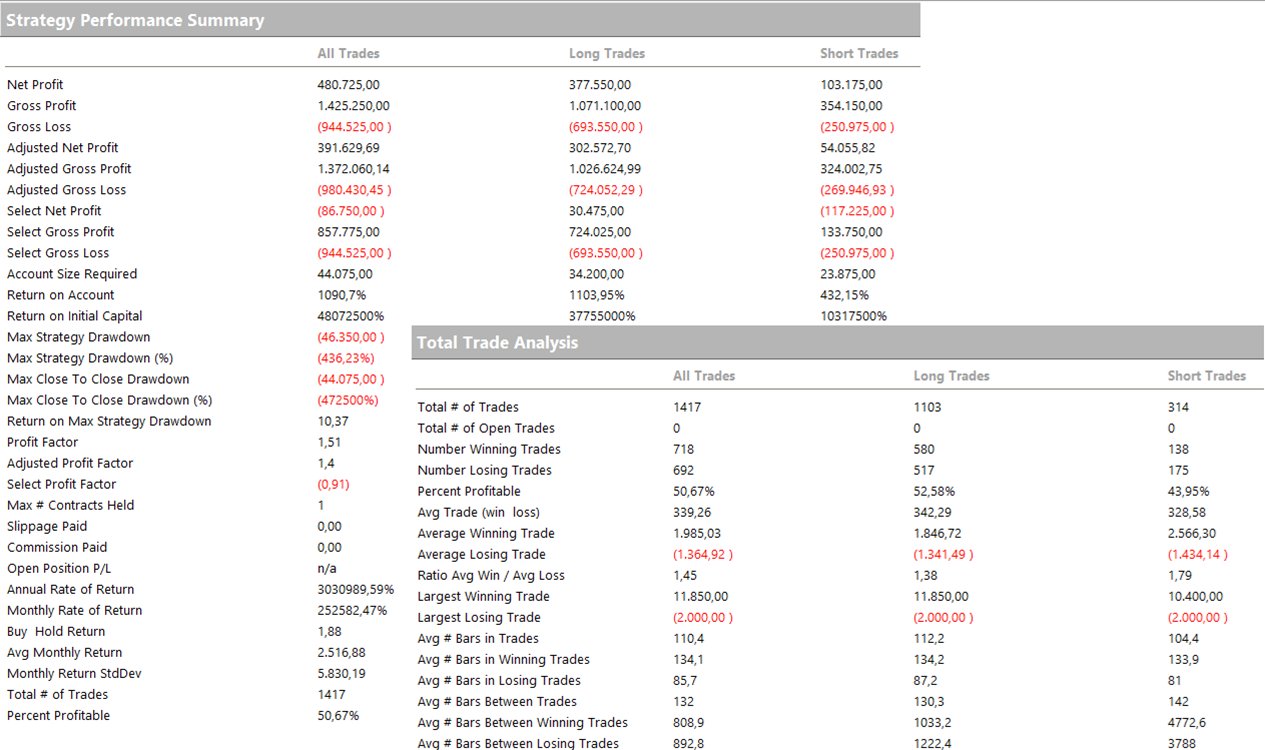

Here are the key metrics of the strategy, which feature a strong average trade (over €400) and an exceptionally low drawdown, just above €20,000, a very limited value considering the size of this futures contract.

Let’s also remember that this contract comes in “smaller” versions, such as the mini-DAX (1/5 of the full contract) and, more recently, the micro-DAX (1/25 of the full contract). All three contracts offer excellent liquidity, allowing traders to choose the size that best suits their portfolio capitalization.

Strategy 2: Breakout System on the DAX Futures Using Current Session Levels

Now let’s look at the second strategy, another intraday breakout system that operates on a 5-minute time frame. The logic is similar to the previous one, but in this case, entry levels are defined by the current session’s high and low breakouts.

As always, several operational filters have been added to improve the average trade.

Let’s dive into the metrics, starting with the equity curve. The curve shows a strong upward trend, though slightly less smooth than the first one, yet with exceptional performance this year, almost €75,000 in net profit.

Looking at the Total Trade Analysis, we see that this strategy executes about twice as many trades as the first (1,417 vs. 716), with a solid average trade of around €340. The results are well-balanced between long and short sides and more than sufficient to cover live trading costs (slippage and commissions).

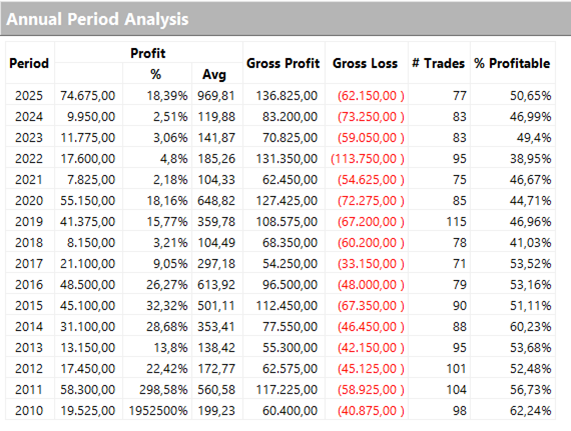

It’s worth noting the positive performance in every year of the backtest, which once again confirms the incredible flexibility of this market, not just for Trend Following or Breakout strategies, but also for Reversal ones. This is a tool that no serious systematic trader should ignore.

Final Thoughts on the Breakout Logic Applied to the DAX Futures

We hope this article gave you some ideas to create your own strategies.

The two breakout strategies analyzed here highlight how the DAX futures remain a reliable and opportunity-rich instrument for mechanical traders. Their consistent performance over time, adaptability to different market phases, and strong 2025 results demonstrate the value of a structured and rule-based approach.

Would you like to learn how to build effective breakout strategies like these for the DAX or other instruments? Book a free strategy session with one of our coaches and start your journey toward more solid and profitable systematic trading.

Click the button below to get started.

Until next time, happy trading!

Transcription

Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.