Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.

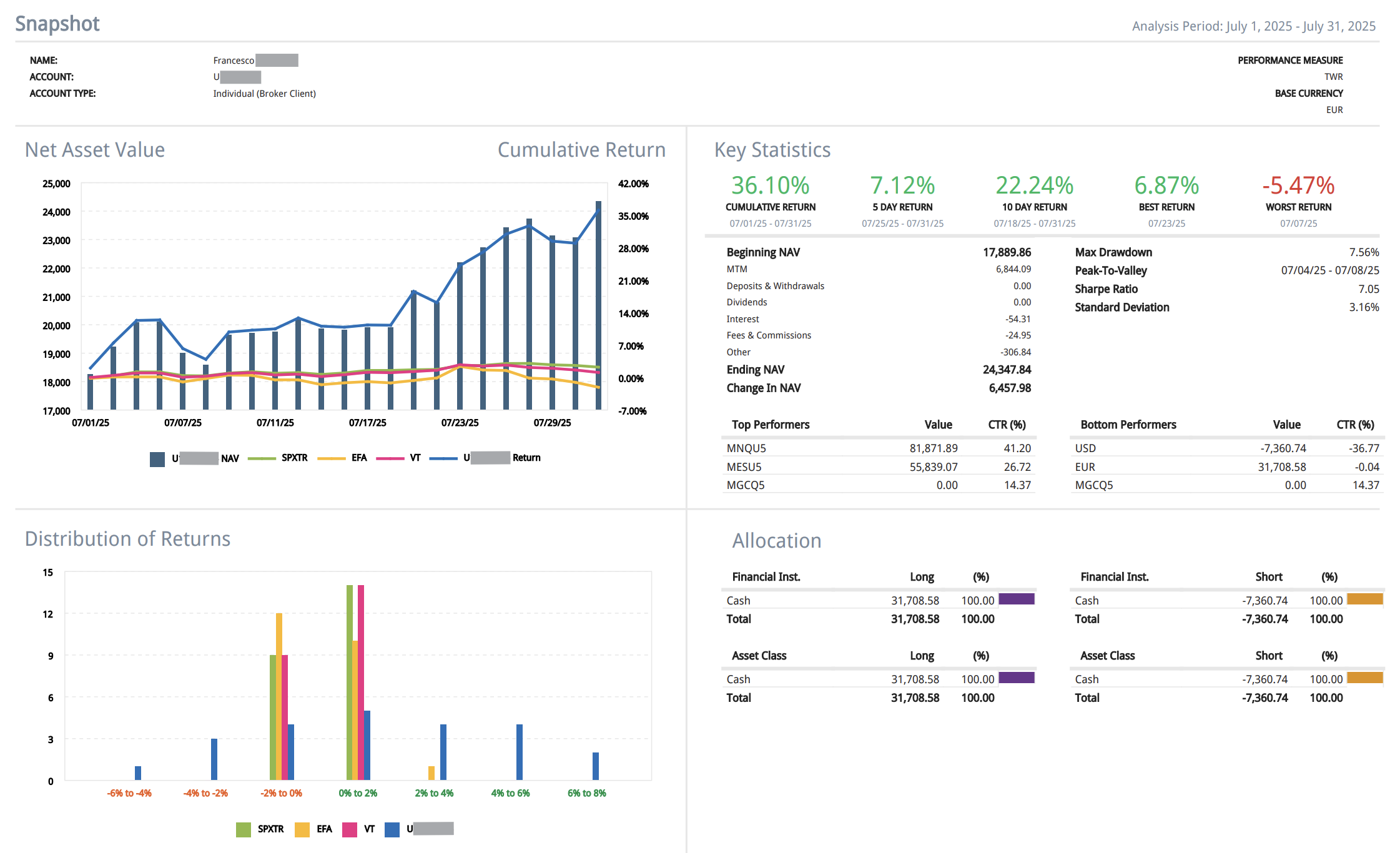

In a market environment full of challenges, Francesco achieved outstanding results thanks to a strategy built on solid foundations: quantitative logic, diversification, and risk control.

With a +36% return and a maximum drawdown limited to 7.6%, Francesco earns the title of Trader of the Month for July 2025. His €6,458 net profit is the result of refined portfolio management using proprietary Excel models and strategies developed from ideas taken from our Million Dollar Database, optimized to fit his personal criteria.

From a Hot Streak to a Smarter Strategy: A Method Evolves

This isn’t Francesco’s first win. He was also named Trader of the Month in May of last year during a particularly fortunate stretch in which he posted a remarkable +96% return in just a few months. But that performance, as exciting as it was, came with a crucial lesson.

“The performance was real, but it also came from an imbalanced risk appetite,” he told us.

After experiencing a significant drawdown, Francesco re-evaluated everything and adopted a more conservative, long-term oriented approach.

A Thoughtful, Strategic Portfolio

Francesco’s portfolio includes a broad set of strategies across major markets. At present, he operates around 15 active systems, selected with a strong focus on performance metrics. He has no particular preference for trend-following, countertrend, or bias-based strategies. His selection process is purely quantitative, but diversification remains a priority.

“If I had 3 or 4 of my best systems, but they were all trend-following on equity indexes, I’d drop at least two in favor of different approaches,” he explains, well aware that robustness comes from variety.

The bulk of his July gains came from a mix of Micro S&P, Micro Nasdaq, Micro Gold, and Micro Crude strategies.

A recurring theme in Francesco’s performance is the strength of his systems on the Micro Nasdaq, which consistently ranks at the top of his models—not due to preference, but because the data proves its edge.

More Than a Trader: A Multi-Asset Capital Manager

Francesco’s expertise goes beyond systematic trading. He also invests in ETFs, crypto, and real estate, moving capital from one asset class to another based on relative performance potential.

This flexible approach helped him reduce exposure to trading systems during drawdown phases, allowing him to protect capital when it mattered most.

Driven by Curiosity: Diving Into Options

What stands out most about Francesco is his endless curiosity. Recently, he enrolled in our new OPT Formula training program to deepen his understanding of options.

He’s extremely satisfied with his journey so far at the Unger Academy—not just because he’s in profit, but because the vast library of training resources continues to unlock new opportunities and keep him moving forward.

Want to Know More About the “Trader of the Month” Contest?

Curious about our “Trader of the Month” contest? This exciting monthly competition is open exclusively to Unger Academy students and rewards the top performer with a €1,000 Amazon gift card for achieving the best live trading results using the Unger Method. Interested? Click here to learn more!

Want to see the champions from previous months? Click here to check them out! to check them out!

Transcription

Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.