Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.

Welcome back to another breakdown of the strategies in our portfolio. Today, we’re diving into gold, one of the most discussed assets in the world of systematic trading, and beyond. This commodity, now widely considered a symbol of value, a safe haven, and a store of stability, is also an extremely liquid and reactive instrument, offering plenty of trading opportunities.

In 2025, gold has experienced a particularly favorable phase, with a strong bullish trend that has rewarded trend-following approaches.

Additionally, thanks to its high liquidity and the availability of the Micro Gold Future (MGC), gold remains one of the best assets for systematic trading and for scaling into positions even with limited capital.

In this article, we’ll take a closer look at two specific strategies to understand whether, and how, they managed to take advantage of the current market conditions.

Ready? Let’s dive in.

Strategy 1: Trend Following with Entries After a Compression Day

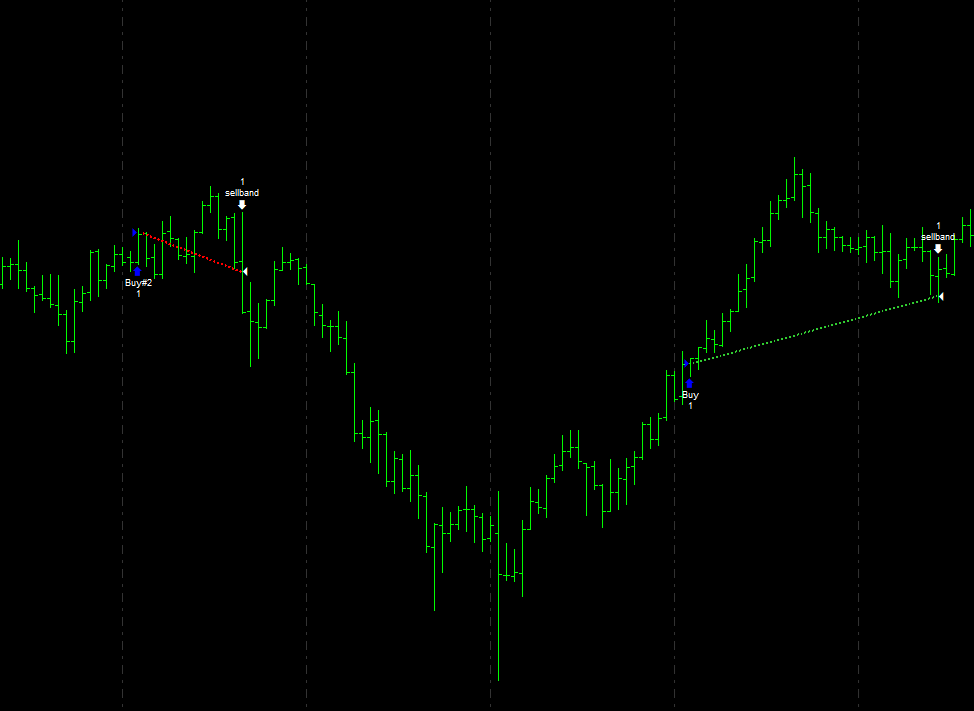

The first strategy we’ll look at is a trend-following system designed to capture directional moves in the gold futures market.

Specifically, this strategy waits for a compression day (a session marked by low volatility and uncertainty) based on the idea that such days are often followed by more directional moves. The system is designed to exploit those breakouts.

Buy orders are placed at the highest high of the last 80 bars (on a 15-minute chart). For short entries, sell orders are placed at the lowest low of the last 80 bars, effectively using the opposite side of the channel.

The strategy then closes trades at specific times of day, with different exit rules for long and short positions. Long trades are closed at midnight (Exchange time, New York) on the day following the entry, while short trades are closed at 10:00 AM (Exchange time) on the same day.

Performance of the First Gold Trading Strategy

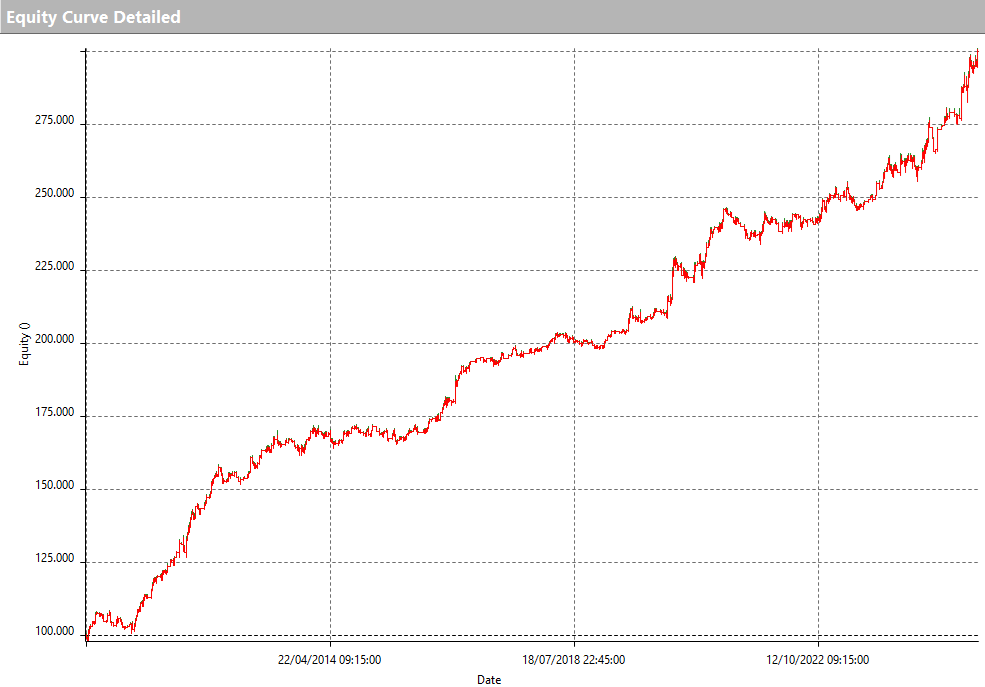

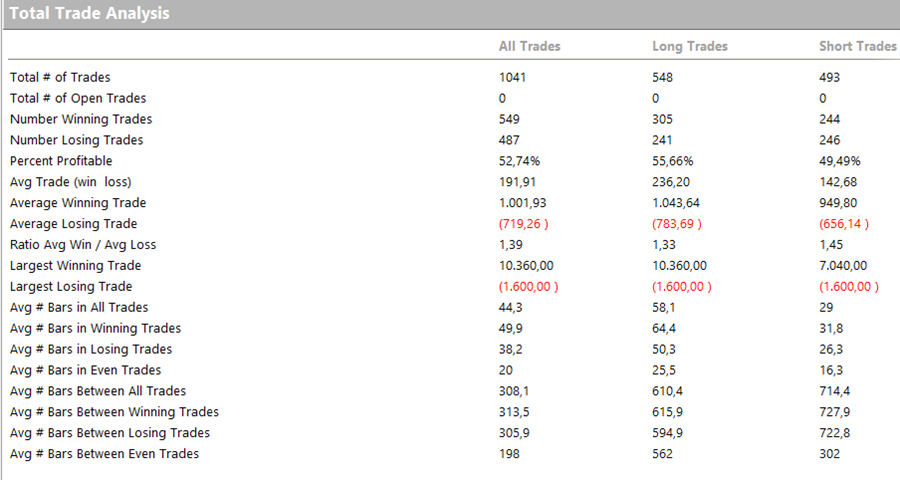

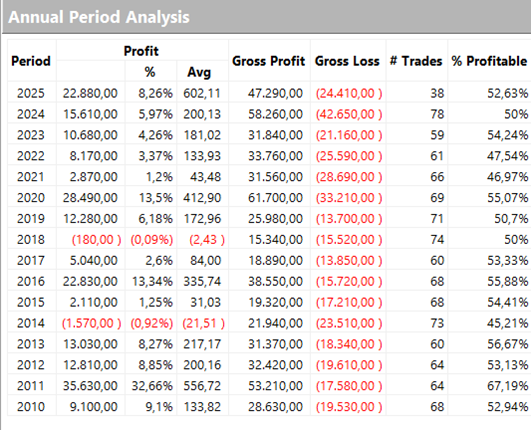

The following charts show that this strategy has been performing very well, especially over the past year. As of mid-2025, it has already generated more than $22,000 in profits.

The equity curve from 2010 is consistently upward, with total profits of around $200,000 and a maximum drawdown of $12,500, which is an excellent result.

The average trade is also solid, with an average profit of about $190, equal to 19 ticks on this market. This ensures a strong buffer against slippage and commission costs.

Strategy 2: Trend Following on Gold with Bollinger Bands

The second strategy also belongs to the trend-following family, but it uses different entry conditions. This system enters in the direction of the trend, but it uses Bollinger Bands (one of the most well-known indicators in technical trading) as its entry trigger.

This strategy only takes long trades, while the short side is completely disabled. A trade is opened when the price breaks above the upper Bollinger Band (2 standard deviations) using a 40-period setting on hourly bars (twice the typical value).

Positions are held for more than one day, and they are closed either at stop loss or take profit, set respectively at $2,500 and $5,500. Additionally, if the price crosses below the lower Bollinger Band, the position is closed early.

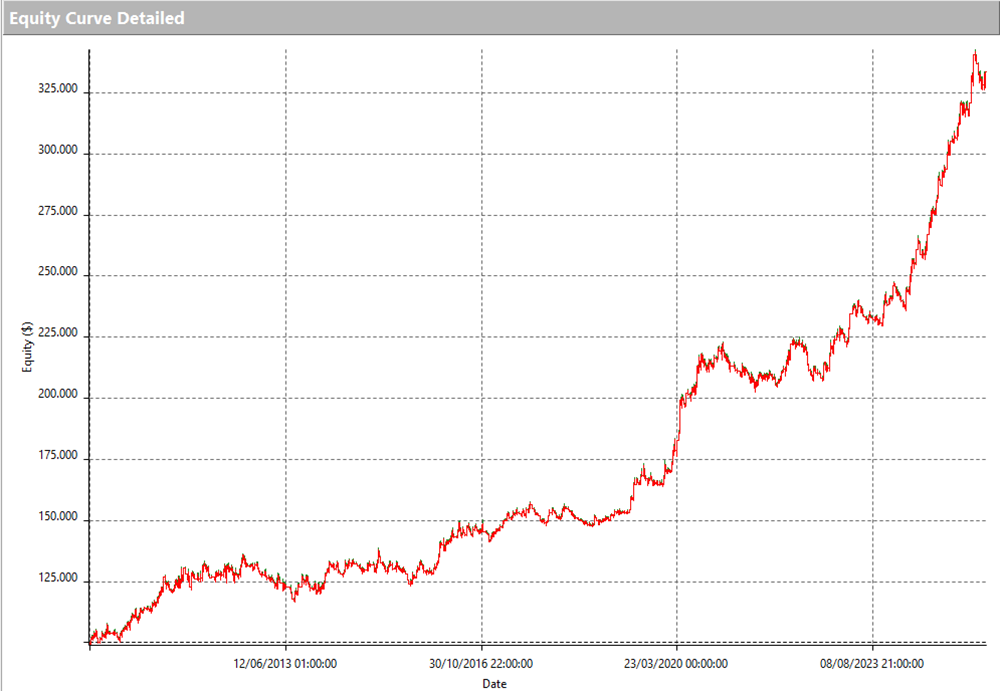

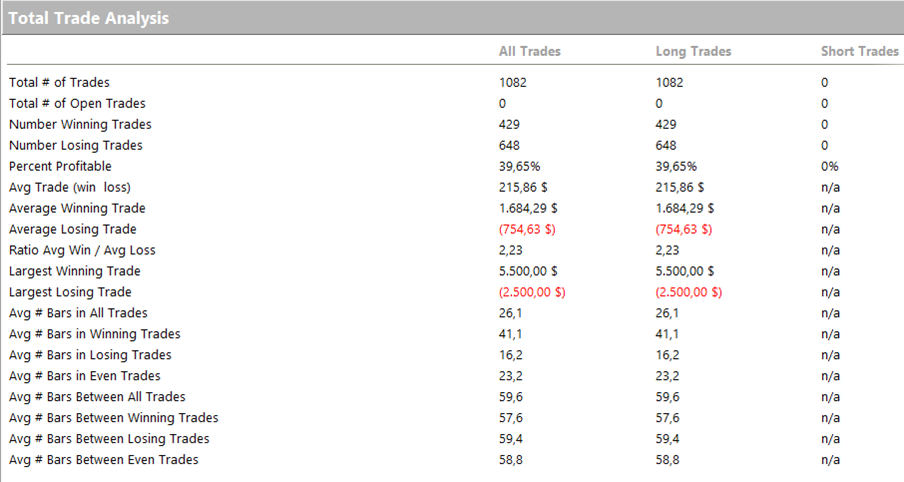

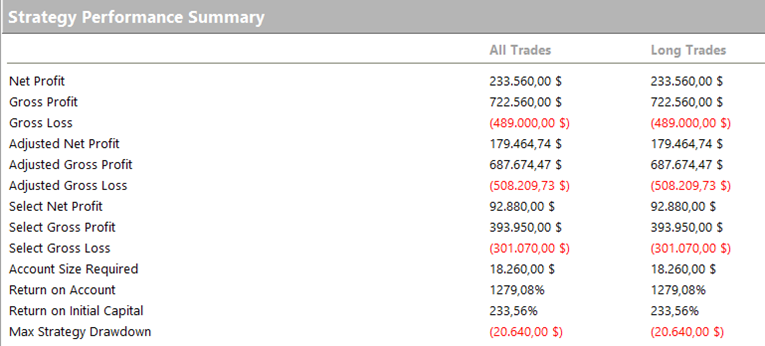

Performance of the Second Bollinger Band Strategy on Gold

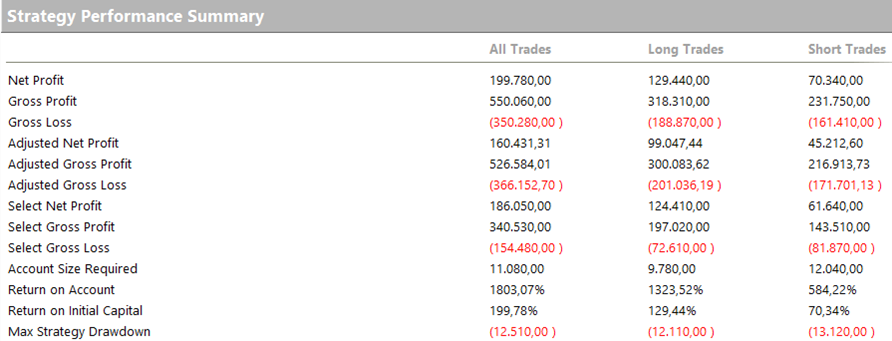

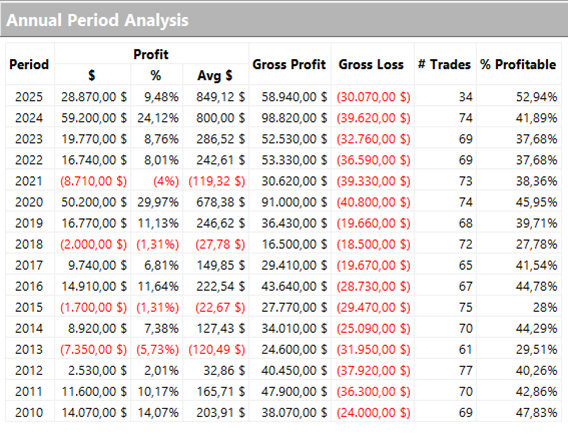

The following figures show that this second strategy has also performed strongly over the years, with a notable surge in the last two years. During this period, it has generated approximately $90,000 in profits, fully capitalizing on the strong bullish trend in the gold market.

Because trades are held for longer, this strategy achieves an even higher average trade than the first one, $215, which is more than sufficient to cover both commission costs and slippage.

Conclusions: Gold Trading in 2025

The gold market is proving to be one of the most profitable of 2025. Trend-following systems in particular are showing strong performance by taking advantage of the volatility and momentum currently present in this asset.

The strong upward movement of the past two years continues to fuel our systems, and we can only hope this positive phase lasts at least through the end of the year.

If your goal is to build robust and efficient trading strategies, we invite you to explore our methodology and book a free call with one of our experts.

See you in the next analysis!

Transcription

Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.