Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.

Welcome back to a new installment of our portfolio strategy analysis. We are kicking off the new year by introducing a very interesting addition: in-depth insights dedicated specifically to our options strategies.

We will begin by highlighting the many advantages that can be achieved using these exceptional instruments for short- and medium-term trading. Options are perfectly suited both for those looking to diversify their portfolio and for those who want to start trading but have limited time to dedicate to this activity.

Both strategies discussed in this article are applied to options on the S&P 500 index (SPX), listed on the Chicago Board Options Exchange (CBOE), the largest and most liquid market in the world for trading these instruments. It is important to note that both strategies have been out of sample for several years and have proven to be exceptionally robust even after their development phase.

S&P 500 Options Trading Strategies: OPT Formula Easy

The first strategy we will discuss is based on one of the most well-known operational engines among options traders: the Naked Put. This strategy essentially involves selling Put options with a specific expiration date while collecting the option premium.

The apparent simplicity of this approach, combined with straightforward execution, low transaction costs, and high profitability, has always made it particularly attractive even for those approaching options trading for the first time.

And this is precisely where the issue lies. This high win rate, which often results in long streaks of profitable trades, is occasionally interrupted by losing trades that are significantly larger than the collected premiums, typically during market crashes.

These losses, especially when positions are oversized, can cause very serious damage to a trading account.

For this reason, our main objective in developing this strategy was clear: preserve the advantages of the underlying edge while making the maximum risk per trade predefined and strictly controlled.

Historical Performance of the OPT Formula Easy Strategy Compared to the SPX Index

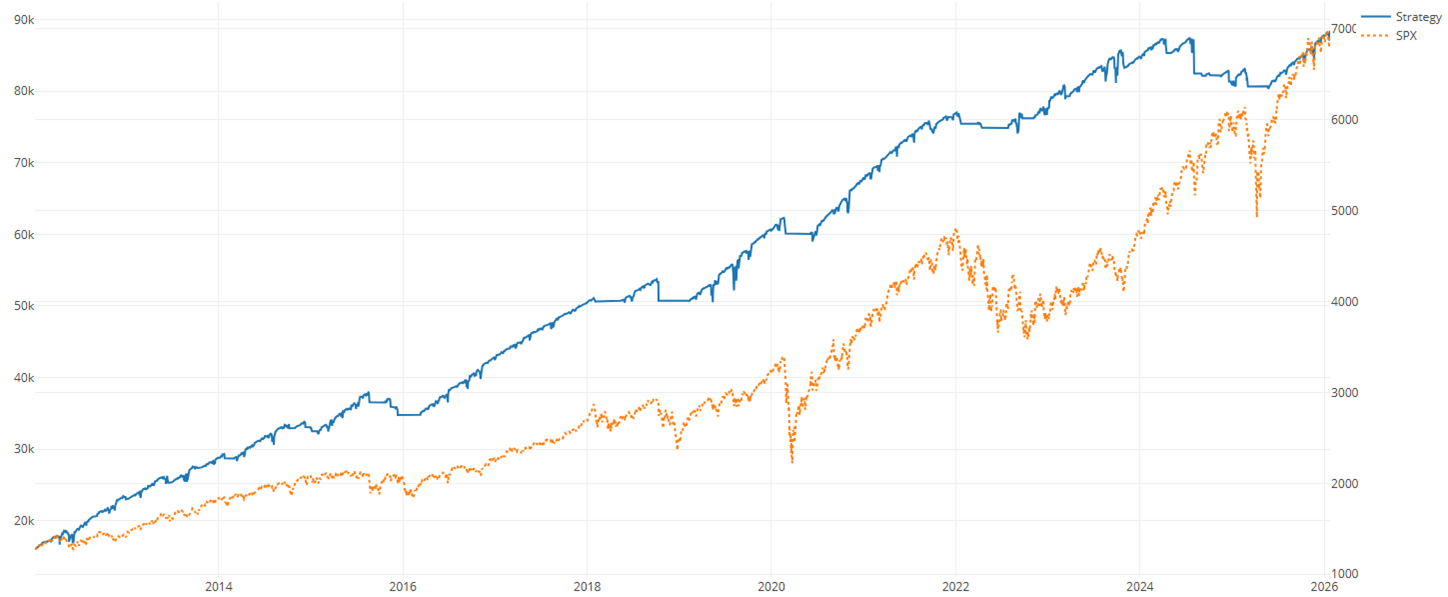

The strategy’s equity line is shown in Figure 1, displayed in blue, and compared with the underlying asset, the S&P 500 index (SPX), shown in orange.

By observing the profit curve from 2012 to today, the remarkable consistency throughout the entire historical period is immediately evident. This confirms that this type of trading approach has remained effective and aligned with the different market phases over time.

Table 1 summarizes the main performance metrics in percentage terms. Worth highlighting is the total return of 452.9%, equivalent to approximately 30% per year (without reinvesting profits). More importantly, these results were achieved with significantly lower risk compared to simply holding the underlying asset, such as buying an ETF that tracks the index.

The drawdown, calculated as a percentage from the equity curve peak, is more than three times lower at minus 9.56% compared to buy-and-hold, which experienced a drawdown of minus 34.44%.

Proprietary Indicator and Risk-Off Phases in Equity Markets

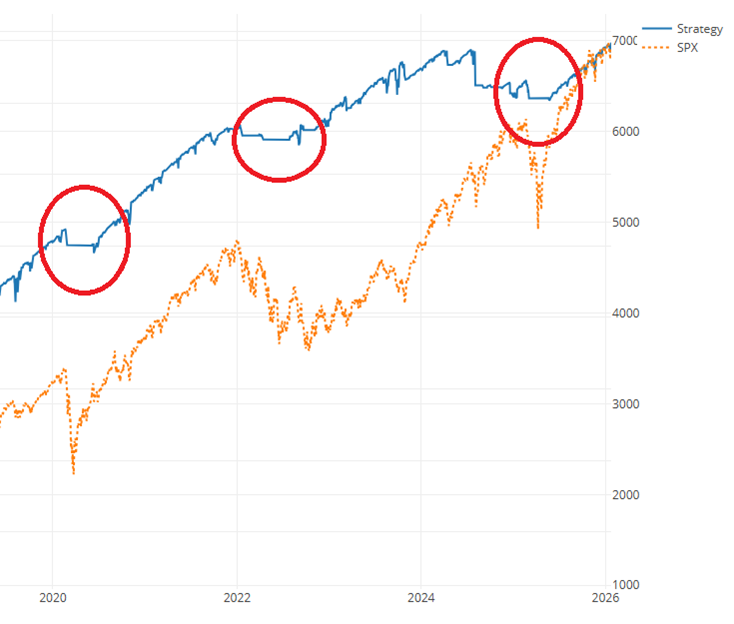

As mentioned earlier, this strategy relies on predefined risk per trade and the use of a proprietary indicator that effectively keeps us out of the market during the most turbulent phases.

This aspect is clearly illustrated in Figure 2, where we highlight three emblematic moments in recent years (Covid crash in 2020, the Ukraine invasion in 2022, and Liberation Day 2025) during which equity markets experienced sharp declines while our strategy remained flat, therefore avoiding any exposure to risk.

S&P 500 Options Trading Strategies: OPT Formula Master

Let us now move on to the second strategy, also built on SPX options. In this case, we enter the world of delta-neutral strategies, meaning they are not dependent on the directional movement of the underlying asset.

These strategies are extremely effective because they take advantage of a common market characteristic: most of the time, markets tend to move sideways or moderately upward, without strong directional moves either up or down. In this context, profits are generated primarily through the passage of time.

As you may have already inferred, this strategy pairs very well with futures trading systems, which, as we know, perform best when markets exhibit strong directional trends.

Equity Line and Outperformance Versus the S&P 500 Index

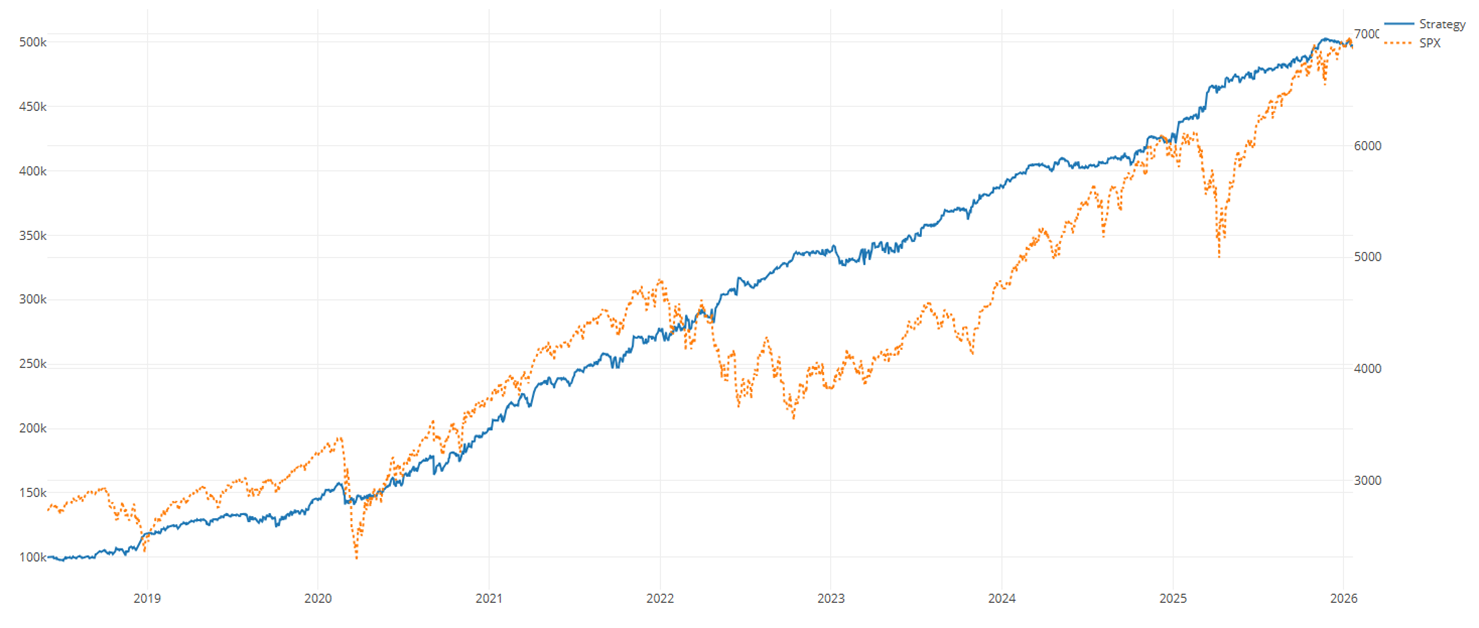

Let us now analyze the metrics, starting with the equity line. Once again, we observe exceptional consistency in returns, even greater than in the previous strategy, along with significant outperformance relative to the SPX index.

The total return from 2018 to 2025 was approximately 400%, more than 2.5 times higher than the underlying index.

The initial capital assumption was 100,000 dollars, with one position opened each week. However, it is important to note that this strategy offers a high degree of scalability and can therefore be adapted to much smaller account sizes.

Risk parameters are also excellent for this strategy, with a maximum drawdown of around 10% and a Sharpe Ratio of 1.77. The Sharpe Ratio is a well-known metric that measures risk-adjusted return, and this value is considered very strong.

Conclusions: Why Choose S&P 500 Options Trading Strategies

The two strategies presented in this article clearly demonstrate how options, when used with a structured approach and strict risk control, can represent an effective tool for both diversification and portfolio growth.

OPT Easy and OPT Master, while based on different operational logics, share several key elements: highly consistent returns, limited drawdowns, and robustness proven over time, even in particularly complex and volatile market environments.

The direct comparison with the underlying index also highlights how it is possible to achieve competitive, and in some cases significantly superior, performance while assuming a substantially lower level of risk.

Another important aspect is the complementarity of these strategies with other forms of trading, such as directional futures trading systems. Integrating different approaches allows for the construction of more balanced portfolios, capable of adapting to various market phases and reducing dependence on any single market condition.

In a context where risk management is becoming increasingly central, options strategies therefore represent a concrete and structured solution for those seeking a professional approach to the markets, even with limited operational effort and greater long-term stability.

Transcription

Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.