Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.

In this article, we’ll take a look together at the results of our “Strategy of the Month” contest for March 2025. We’ll reveal the winning strategy, along with other excellent strategies selected from those you sent us.

We’ll aim to provide some operational insights by analyzing the basic logic behind these strategies, the markets they trade on, and of course, we’ll review their performance together.

We’d like to remind you that the “Strategy of the Month” contest is exclusively for Unger Academy® students and rewards the best strategy developed using the Unger Method™. By submitting their own strategy, each student can participate every month for a chance to win a €1,000 Amazon gift card!

Additionally, if you want access to the codes of the winning strategies, you can join the Unger Strategy Club, one of our Academy’s exclusive services. This club gives you access to the open code of the winning strategy of the month, along with all the strategies that have won in the past. Moreover, it also offers a monthly live Masterclass on advanced training and a monthly video full of operational insights, in which we explain the main rules of the strategies in our portfolio.

But that’s not all—by joining the Unger Strategy Club VIP, in addition to all of the above, you’ll also gain exclusive access to the open-source codes of all the strategies that participated in the contest and were approved by the Unger Academy coaches.

So, let’s begin by reviewing the best strategies you sent us during the month of March.

Multiday Breakout Strategy on DAX Futures (@FDAX)

Among the strategies we received last month that didn’t win the prize, we selected Roberto’s strategy, which still deserves our compliments.

This is a strategy on the DAX with a somewhat unusual 10-minute time frame. It uses a classic setup based on the breakout, either up or down, of a volatility channel built on the Average True Range indicator over N periods.

The strategy uses a trading window to limit trades to specific hours of the session and includes some patterns from our proprietary libraries.

Roberto also set a maximum holding period for trades, defined in a few days.

Figure 1 – Example trades executed by the multiday breakout strategy on DAX Futures (FDAX).

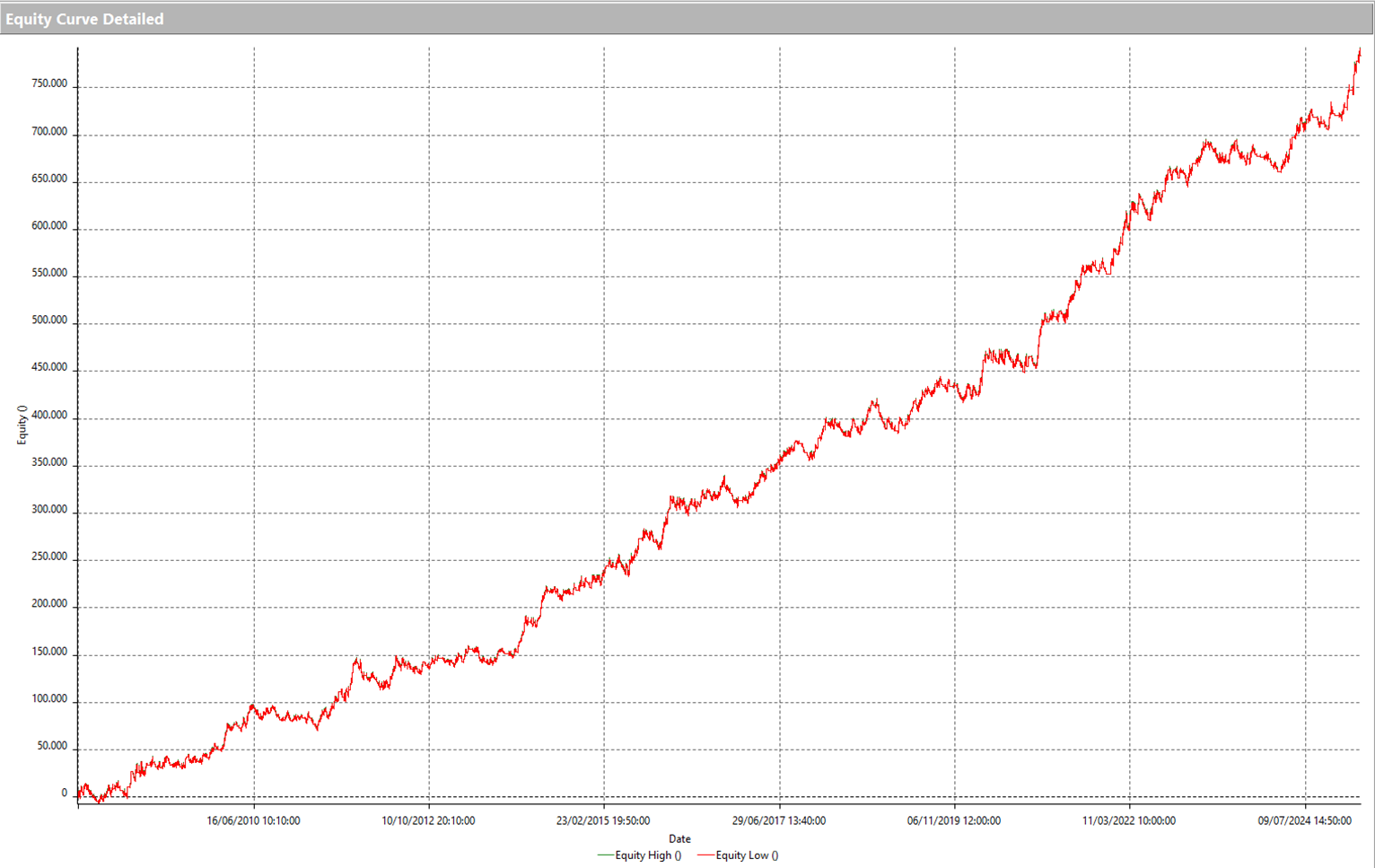

This is a very simple but effective strategy. Below are the key metrics shown based on historical data from 01/01/2010 to 03/31/2025.

The strategy’s performance is notable for its very consistent behavior, especially in the first three months of 2025, which delivered excellent results—thanks in part to strong gains in the underlying index.

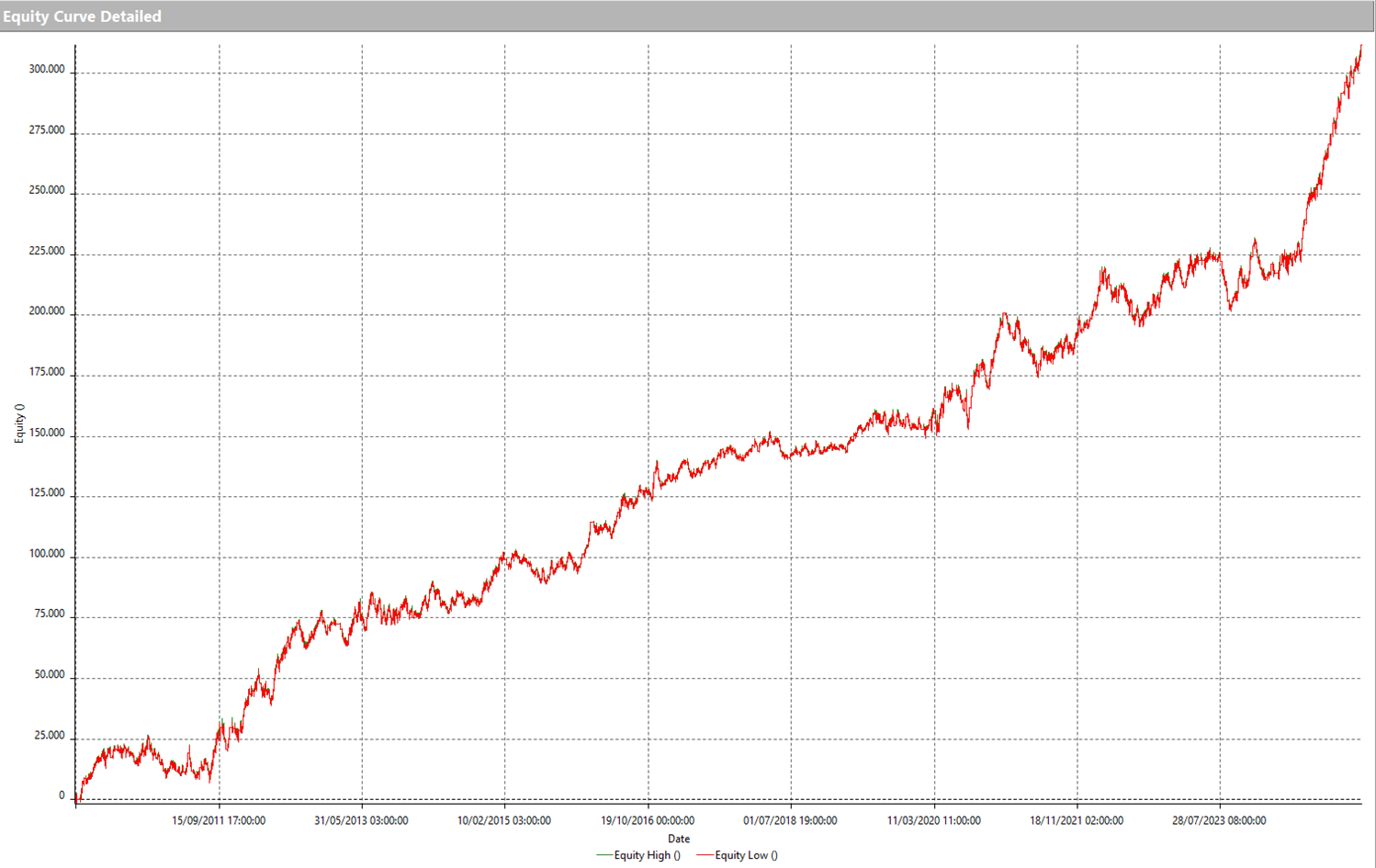

Figure 2 – Equity line of the multiday breakout strategy on DAX Futures (FDAX).

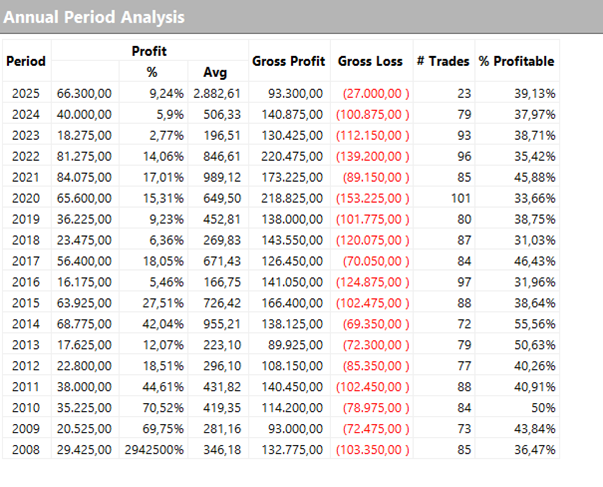

Figure 3 – Annual results of the multiday breakout strategy on DAX Futures (FDAX).

Multiday Trend-Following on S&P 500 Futures (ES)

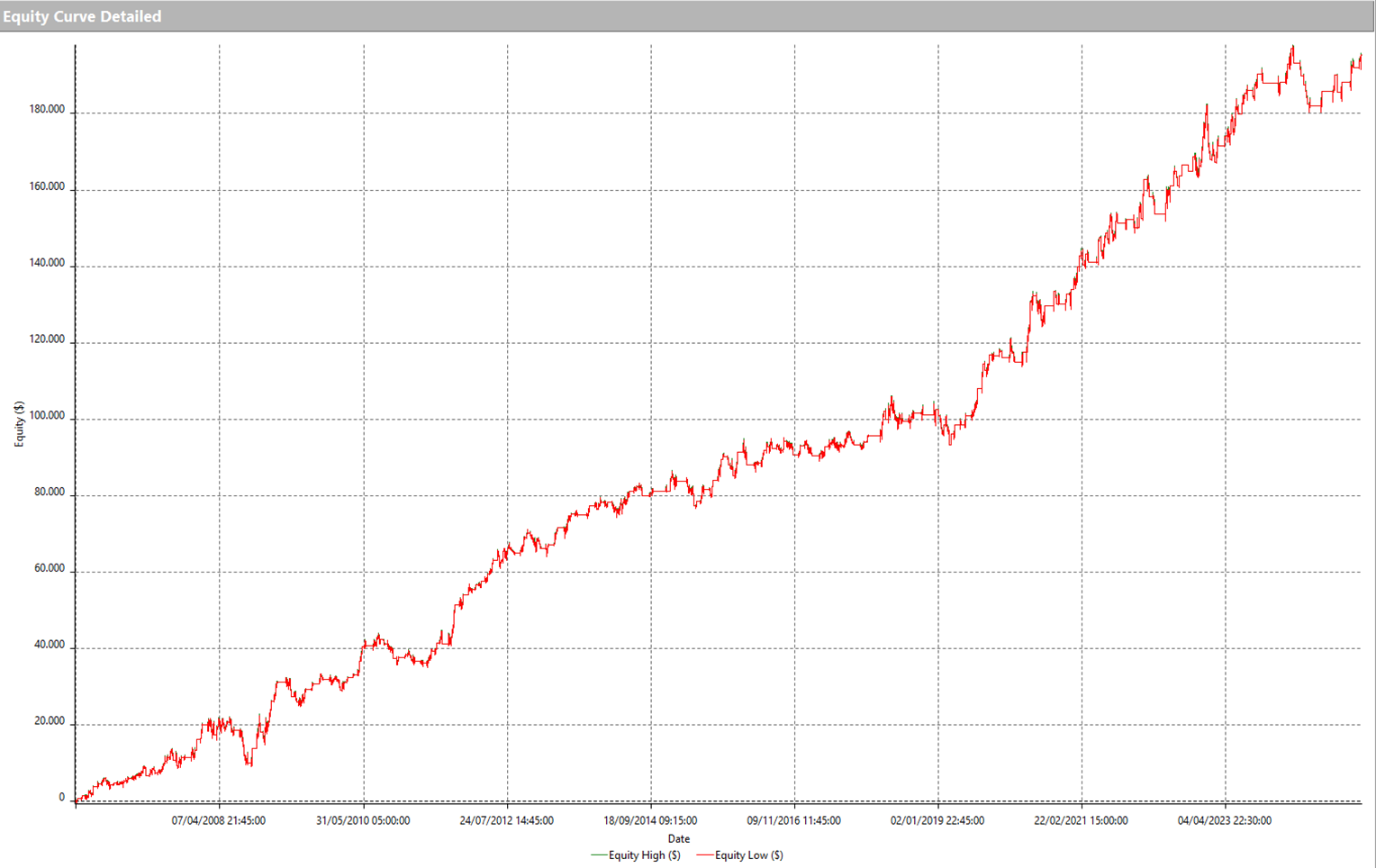

Another interesting strategy was submitted by Mirco. This is a trend-following approach on the S&P 500 (ES), using a 15-minute time frame. It’s based on the breakout of levels calculated from the high and low of the previous session.

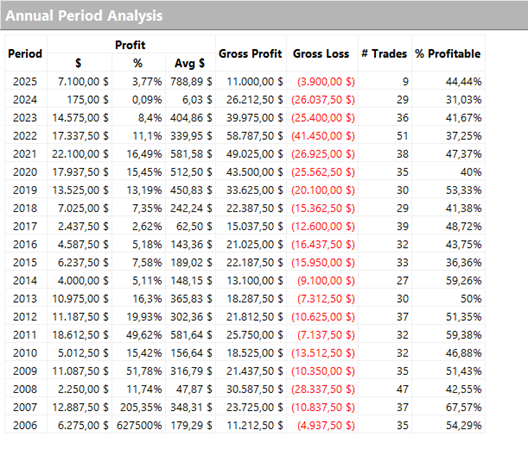

The system had a less impressive 2024 compared to previous years, but in the first three months of 2025, it began generating solid profits again.

Figure 4 – Equity line of the multiday Trend-Following strategy on S&P 500 Futures (ES).

Figure 5 – Annual results of the multiday Trend-Following strategy on S&P 500 Futures (ES).

Strategy of the Month for March 2025: Trend-Following on Gold Futures (GC)

And finally, let’s move on to the winning strategy, developed by Giuseppe, whom we congratulate for winning the contest prize: a €1,000 Amazon gift card.

This is an interesting Trend-Following strategy on Gold futures that operates on a 60-minute time frame.

Giuseppe’s strategy is based on the concept of Linear Regression, commonly used in statistics, and in this case adapted to financial markets to effectively calculate entry levels.

An interesting fact: Giuseppe developed his strategy starting from a trading idea presented by Andrea Unger in an article for the blog “Technical Analysis and Trading Systems,” which he manages on the website of a renowned Italian magazine called Il Giornale. The article is titled “How to Create a Gold Trading Strategy Using Linear Regression.” It’s in Italian, but if you’d like to read it with the help of Google Translate, you can find it by clicking here.

This shows how even a single idea shared in our free content can become the seed of a winning trading strategy—when combined with solid backtesting and optimization.

As with all Trend-Following strategies, this one also follows the newly formed trend, with a predefined maximum duration of a few sessions.

The system also includes standard monetary stop-loss and take-profit rules for trade management.

It’s an effective yet simple strategy—which, as we well know, is a key requirement for building a robust system.

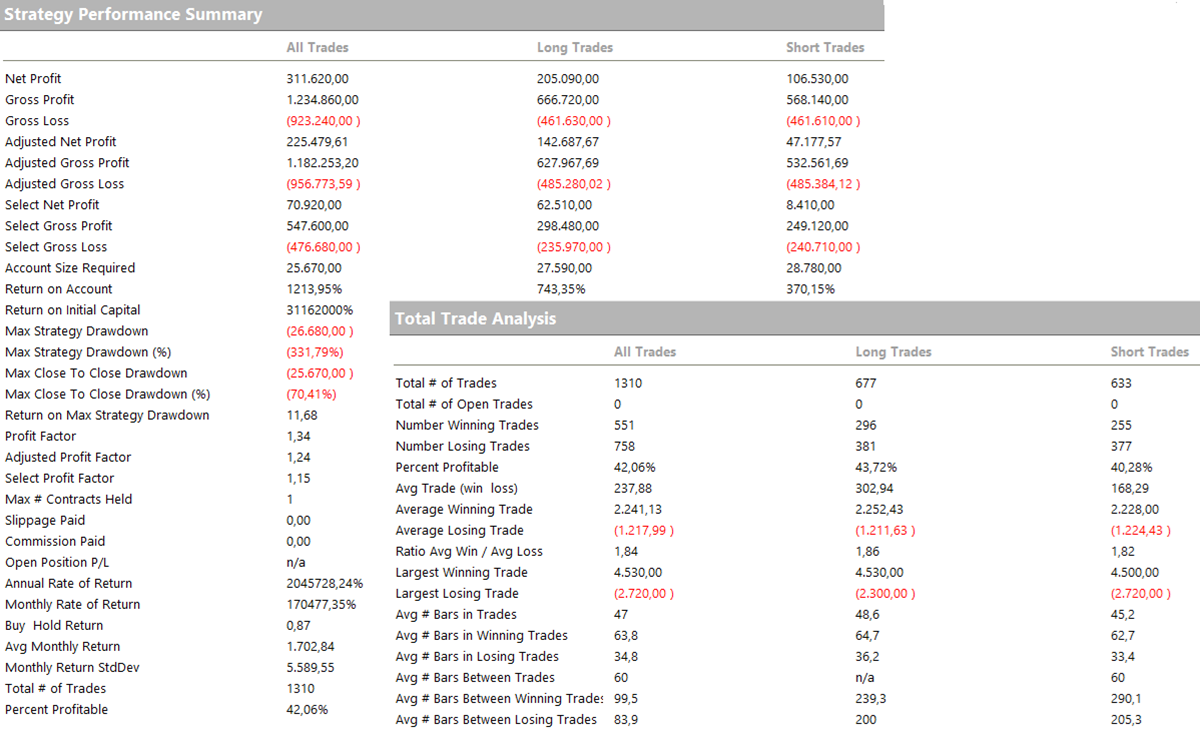

In the following figures, we show an example of executed trades, key metrics, and the full equity line. We specifically highlight the excellent average trade and the impressive equity curve over the last two years.

Figure 6 – Example trades executed by Giuseppe’s winning Trend-Following strategy on Gold Futures.

Figure 7 – Equity line of Giuseppe’s Trend-Following strategy on Gold Futures.

Figure 8 – Performance report of Giuseppe’s Trend-Following strategy on Gold Futures.

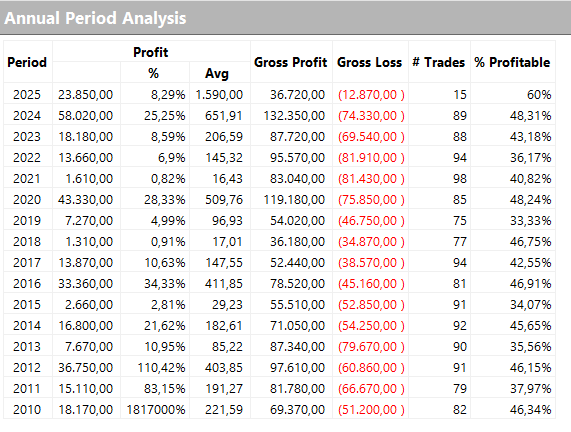

Figure 9 – Annual results of Giuseppe’s Trend-Following strategy on Gold Futures.

Conclusions

Once again, congratulations to Giuseppe, who this month takes home the €1,000 Amazon gift card, confirming the quality of his work.

We hope this article has been helpful and inspiring for you!

If your goal is to create trading strategies like the ones we’ve just discussed, you’re in the right place. As you progress in your learning, you’ll also have the opportunity to participate in our monthly contest exclusively for Unger Academy students and compete for a €1,000 Amazon gift card.

Remember, if you want access to the code for the winning strategy and the top submissions in the contest, you can join the Unger Strategy Club. Check out all the features of this service at www.ungerclub.com.

That’s all for now—see you in the next installment of “Strategy of the Month” for more actionable insights!

If you’d like to learn more about the “Strategy of the Month” contest, our monthly challenge for Unger Academy students awarding a €1,000 Amazon gift card to the best strategy developed using the Unger Method™, click here.

Or, if you’re curious about the past winners, click here.

Transcription

Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.