Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.

In this article, we’ll go over the results of our "Strategy of the Month" contest for October 2024. We’ll reveal the winning strategy as well as another impressive submission selected from the entries sent in by participants.

We’ll analyze the fundamental logic behind these strategies, the markets they operate in, and, of course, we’ll review their performance.

Just as a reminder, the "Strategy of the Month" contest is an exclusive competition for Unger Academy students, rewarding the best strategy developed using the Unger Method. By submitting their strategy, participants have the chance to win an Amazon gift card worth €1,000 every month!

If you’re interested in accessing the winning strategies, you can join the Unger Strategy Club, one of the Academy’s exclusive services. Members gain access to the open-source code of the winning strategy each month, as well as all past winning strategies. In addition, members enjoy a monthly live masterclass for advanced training, plus access to monthly videos with practical trading insights where we showcase the main rules of one of our portfolio strategies.

And it gets even better for those who join the VIP level of the Unger Strategy Club: VIP members get exclusive access to the open-source code of all contest strategies approved by the Academy’s coaches.

Now, let’s dive into the top strategies submitted for October.

Trend-Following Strategy on RBOB Gasoline (RB)

Among the entries we received this month, though not the winner, is Pietro’s trend-following strategy on RBOB Gasoline (RB) with a 120-minute timeframe. Our congratulations go out to Pietro for his work.

This strategy relies on a momentum indicator, set to a 25-period moving average, as its primary trigger. It initiates a long position when the indicator crosses above zero and enters a short position when it drops below zero, provided the filters permit it.

Figure 1 – Trend-Following Strategy on RBOB Gasoline

To avoid trading in indecisive market moments, Pietro included the ADX indicator as a filter, preventing trades when ADX falls below a certain level. Additionally, he incorporated a pattern from the PatternNeutralFast list and manages positions with appropriately tailored stop-loss, take-profit, and break-even levels for this instrument.

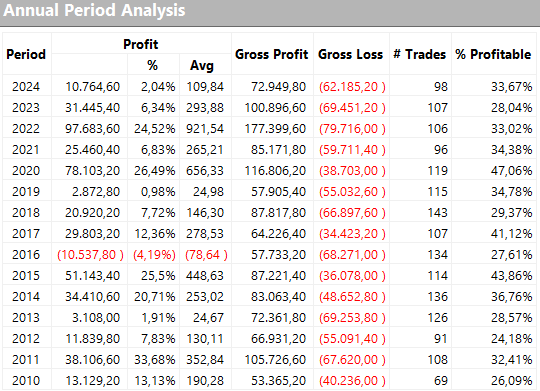

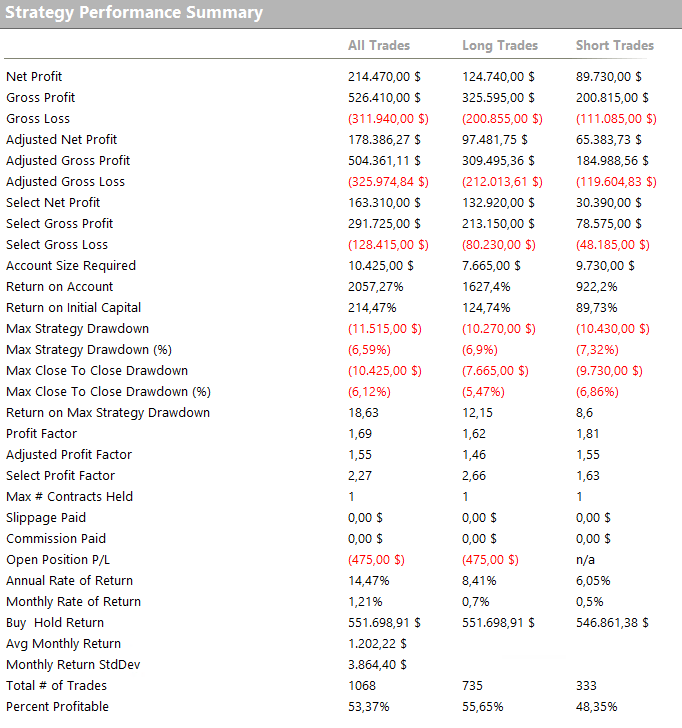

Below are the main performance metrics for this strategy, based on data from January 1, 2010, to October 31, 2024. The strategy demonstrates an impressive net profit-to-drawdown ratio (over 18) and consistent results, with only one negative year and two relatively flat years over this 15-year span.

Figure 2 – Equity Curve for the Trend-Following Strategy on RBOB Gasoline

Figure 3 – Annual Results for the Trend-Following Strategy on RBOB Gasoline

October 2024 Strategy of the Month: Trend-Following on the Nasdaq

Now for this month’s winning strategy, submitted by David, who earns the €1,000 Amazon gift card!

David’s trend-following strategy focuses on the Nasdaq (NQ) with a 5-minute timeframe, trading only in the final hour of the cash session (3:05–3:55 PM, Exchange Time) and entering on a breakout above or below a price level based on the 3:00 PM close. Unless the stop-loss is hit, positions are closed at 2:00 AM the following session.

David’s strategy uses two filters from the PatternFast list, and entry levels are set as a percentage of the 3:00 PM close, differing for long and short trades. The strategy also avoids long trades on Fridays and short trades on Mondays.

Figure 4 – Trend-Following Strategy on the Nasdaq

Despite its simple and effective structure, this strategy leverages the cash session close to capitalize on potential trend-following moves.

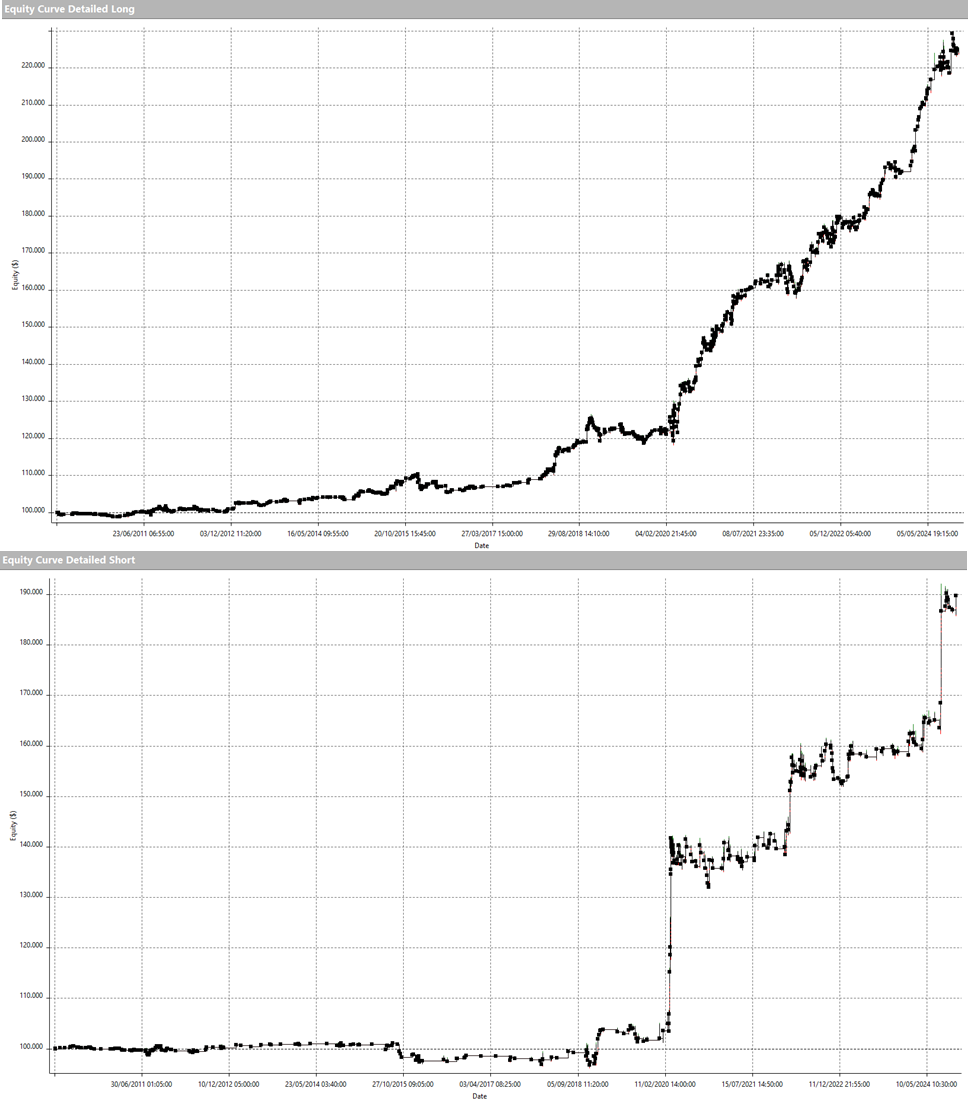

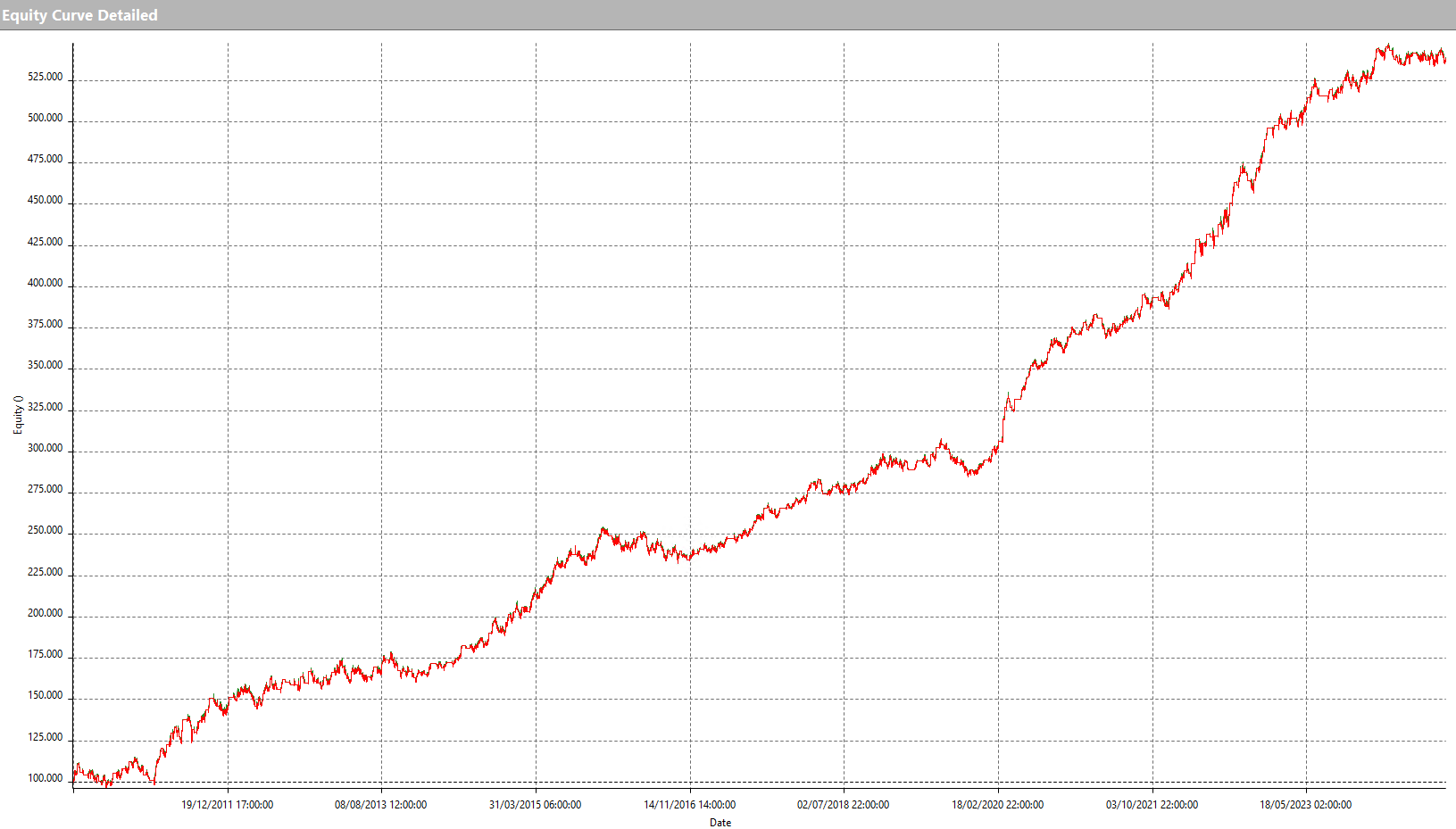

Here are the main performance metrics from January 1, 2010, to October 31, 2024. Notably, this strategy performs well on short trades, which can be challenging to capitalize on with the Nasdaq due to its bullish bias. It’s worth mentioning that the best results have come since 2018, reflecting the recent shift in Nasdaq behavior.

Figure 5 – Performance Report for the Trend-Following Strategy on the Nasdaq

Figure 6 – Equity Curve (LONG and SHORT) for the Trend-Following Strategy on the Nasdaq

Congratulations again to David for winning the €1,000 Amazon gift card this month! David also secured the "Trader of the Month" award in August 2024, reinforcing the strength of his approach.

Conclusion

We hope this article has provided you with useful insights and inspiration. If your goal is to develop trading strategies like those showcased here, you’re in the right place. As you progress in your studies, you too can enter our exclusive monthly contest and vie for the chance to win a €1,000 Amazon gift card.

Finally, if you want access to the open-source code of the winning strategy and other top entries, consider joining the Unger Strategy Club VIP. Explore the full range of benefits at ungerclub.com.

Thank you, and stay tuned for the next "Strategy of the Month" article for new trading ideas!

Transcription

Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.