Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.

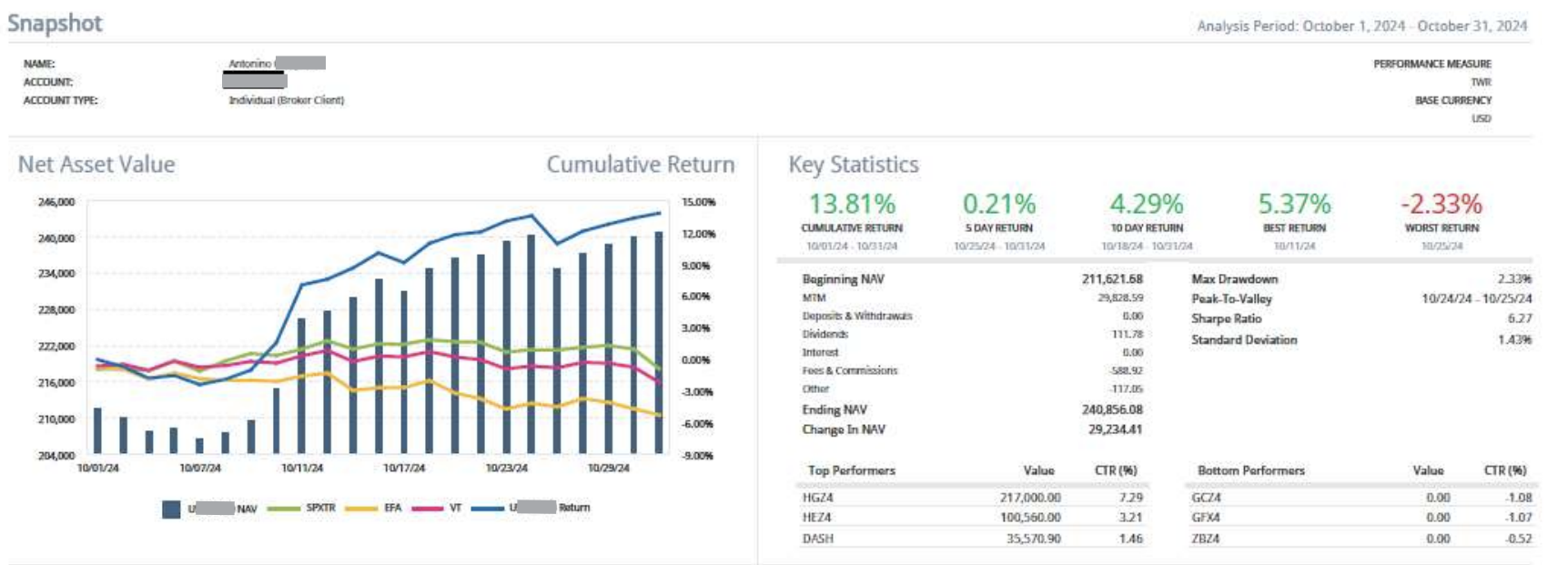

Antonino, one of our star students, has been crowned October’s "Trader of the Month" after delivering an extraordinary performance. He earned over $29,000, achieving a 13.81% return on his initial capital while maintaining an impressively low drawdown of just 2.33%.

In this article, we’ll dive into the journey that led Antonino to this achievement, showcasing how a methodical and disciplined approach can lead to exceptional trading results.

A Path to Success: Antonino’s Trading Story

Antonino, a computer engineer by profession, leveraged his background to gain an edge in understanding and applying the Unger Method.

He joined the Unger Academy in September 2020 and began trading live in March 2021.

Antonino’s live trading experience started strong, and his overall results since 2021 have remained positive. The only exception was 2022, a tough year marked by significant geopolitical and economic turmoil. Even so, he bounced back, delivering steady gains.

After a bumpy start to 2024, Antonino staged a remarkable recovery in the later months, finishing slightly ahead of where he began.

Crafting Success: Strategies and Tools

Antonino relies on a blend of trading systems he developed himself and strategies from the Million Dollar Database, a curated collection of ready-to-use trading systems available to Unger Academy students.

Over the years, he has developed approximately 450 strategies. This high number partly reflects his approach: inspired by one of our instructional videos, he chose to separate long and short strategies, which contributes to the larger count of systems.

Out of these 450 strategies, Antonino currently uses about 15 for live trading, rotating them based on guidance from Titan, our proprietary portfolio management software.

A Look at Antonino’s Portfolio

Antonino’s primary focus is on futures, particularly in stock indices, energy commodities, and metals. His portfolio also includes some cryptocurrency systems.

Recent standouts in his trading include the Nasdaq and Copper, which significantly contributed to his returns.

In addition to his main portfolio, Antonino manages a second, more conservative portfolio, trading Nasdaq stocks with momentum-based rotational strategies.

Words of Wisdom from Our Trader of the Month

Antonino encourages new traders to manage their expectations and avoid seeing trading as a shortcut to quick wealth.

He stresses the importance of staying calm, trading patiently, and steering clear of emotional decisions.

Like many, Antonino initially tried discretionary trading with stocks but found it challenging to achieve consistent results. His search for a structured, data-driven approach led him to the Unger Method, which he praises for its rationality and accessibility—even for beginners.

Before going live, Antonino honed his skills with a month of paper trading to gain confidence.

Inspiration for Every Trader

Antonino’s story is a testament to the power of systematic trading when paired with discipline and a structured education. His achievements underscore that success in trading isn’t about luck—it’s about effort, passion, and applying the right tools and techniques.

Antonino’s journey serves as inspiration for every Unger Academy student and anyone aiming to master the art of trading.

Curious about our “Trader of the Month” contest? This exciting monthly competition is open exclusively to Unger Academy students and rewards the top performer with a €1,000 Amazon gift card for achieving the best live trading results using the Unger Method. Interested? Click here to learn more!

Want to see the champions from previous months? Click here to check them out!

Transcription

Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.