Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.

In this article, we dive into the world of cryptocurrencies, a sector that has now firmly established itself as one of the most intriguing asset classes for both investment and trading diversification.

Bitcoin, of course, remains the undisputed leader among them, even though the CME has recently launched futures on some of the most well-known altcoins, such as Ethereum, XRP, and Solana. These are still relatively new products with modest volumes, which means they’ll need more time to mature before they can be considered viable for system development. Still, we’ll definitely revisit them in the coming months.

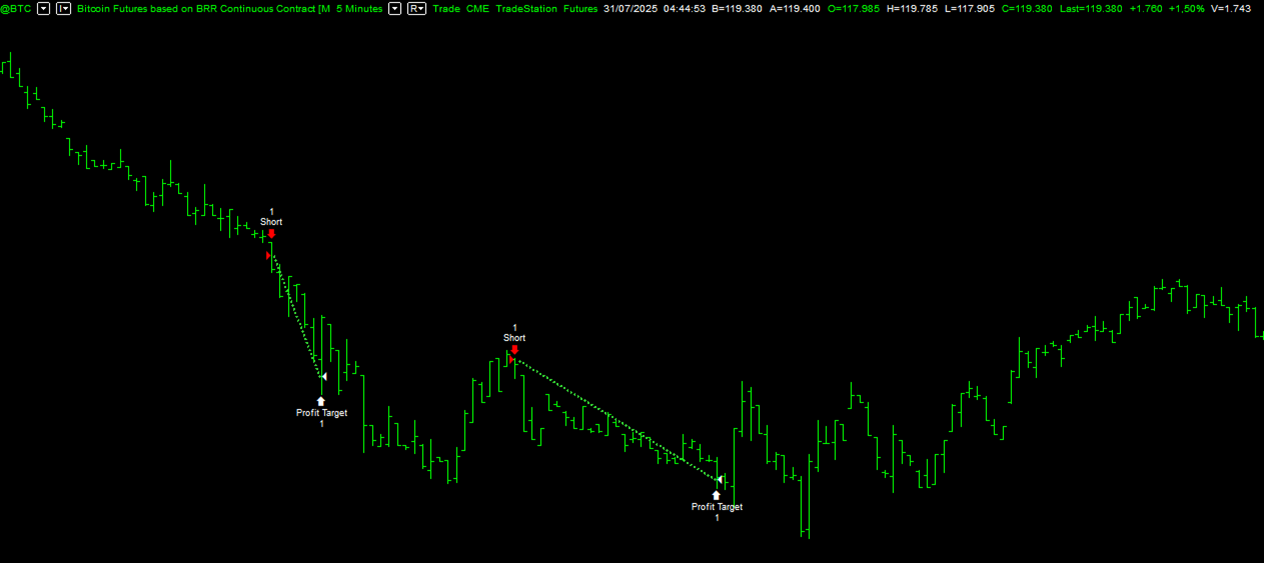

The strategies we’re discussing today both operate on Bitcoin futures, ticker symbol @BTC, using breakout logic, which comes as no surprise given the instrument’s inherently volatile nature.

It will be particularly interesting in this analysis to see how these systems have performed, especially considering that Bitcoin has recently hit all-time highs.

Strategy 1 – Volatility Breakout Intraday on Bitcoin Futures

The first strategy we’re presenting operates on a 5-minute time frame as data1 and a 1440-minute (daily) time frame as data2. It uses the standard 23-hour trading session, which mirrors that of equity futures, from 5:00 PM to 4:00 PM Chicago time.

The “engine” of the strategy is based on the breakout of a volatility channel built using the Average True Range (ATR) indicator. Additional filters, also based on volatility, have been applied to isolate only the best entry setups.

Since this is an intraday strategy, all positions are closed by the end of the session, unless the profit target or stop loss is hit earlier.

Performance of the First Bitcoin Trading Strategy

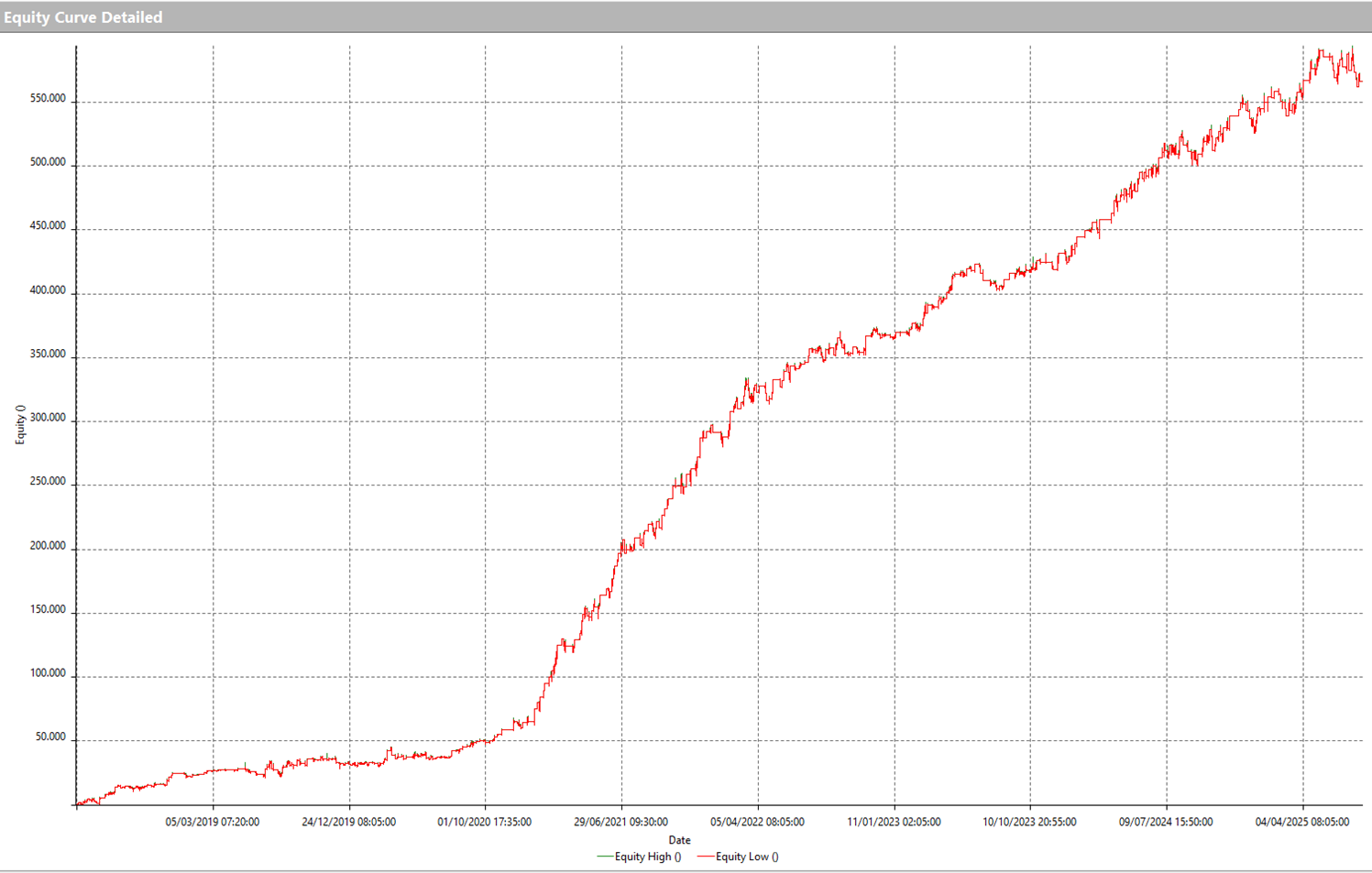

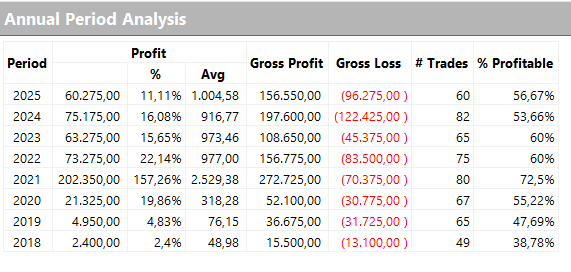

Looking at the profit curve of this strategy, it’s clear that, aside from the early years (2018 and 2019), when the Bitcoin market was still relatively immature, there was a decisive turning point starting in 2020. This shift was driven in part by the influx of liquidity into a sector that had previously received limited attention.

This trend is also confirmed by the strong growth in profits, particularly during bull-market years. Even in the current year, the system is performing very well, having reached new equity highs in July.

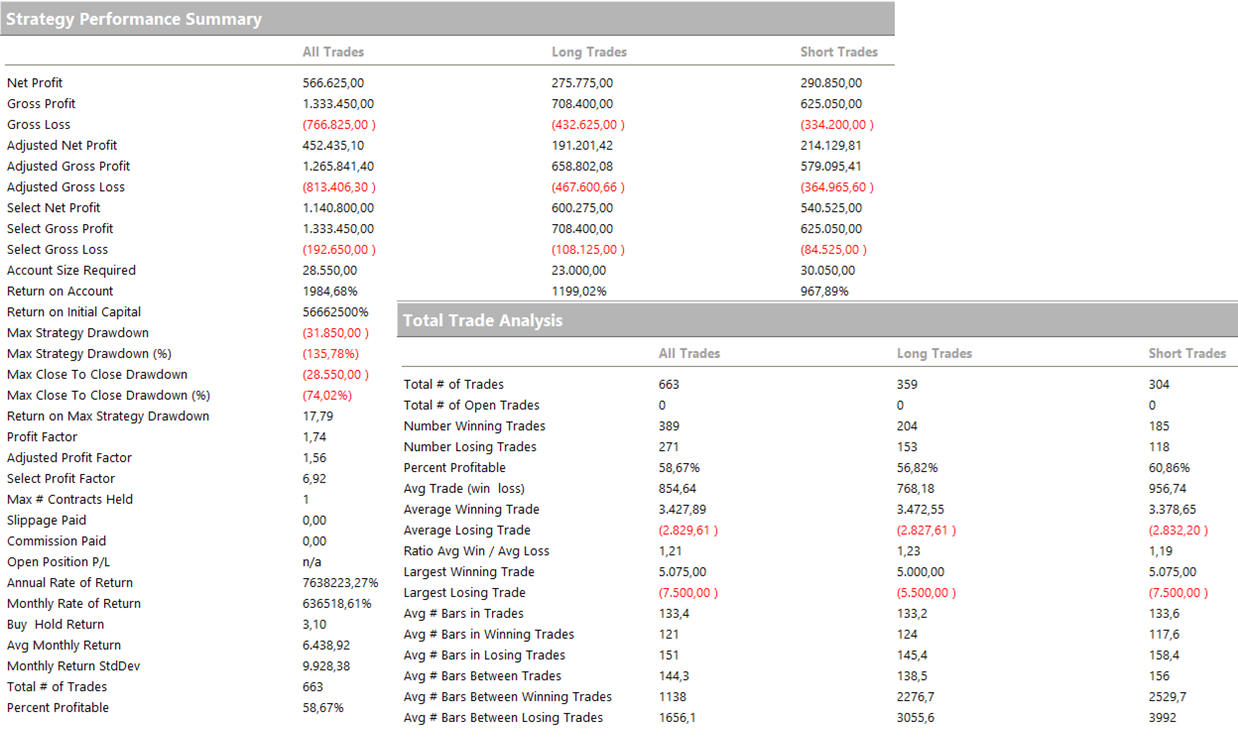

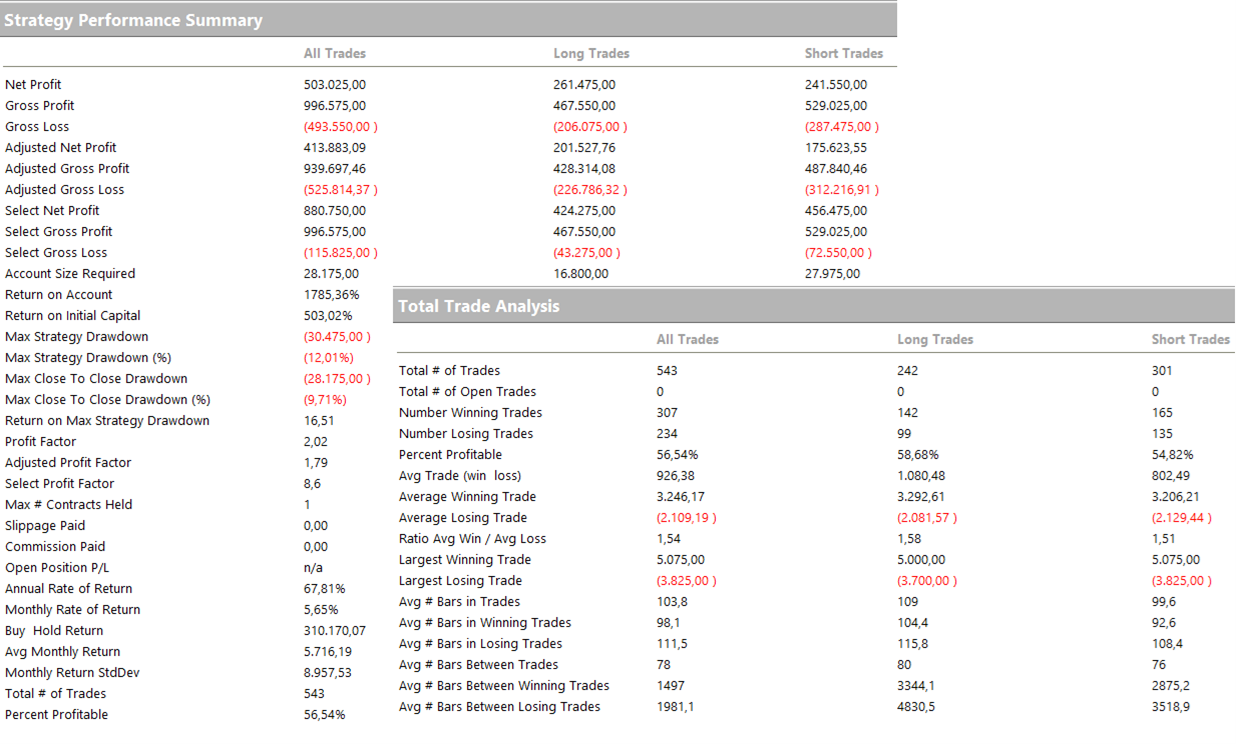

Below are the main performance metrics of the strategy, which show not only a high Net Profit (almost $600,000 from 2018 to present), but also an excellent average trade (over $850).

A major advantage of trading futures is the ability to go long or short with equal ease. Interestingly, even on an instrument that seems to trend mainly upward, like Bitcoin futures, the strategy has produced excellent short-side results, even outperforming the long side.

It’s worth noting that there’s also a micro version of this futures contract (@MBT), which is much more accessible to retail traders. The standard @BTC contract is quite large, representing five Bitcoins, while the micro contract is just 1/10 of a Bitcoin. Over the past year, this micro contract has become extremely liquid, making it highly suitable for trading.

Strategy 2 – Intraday Volatility Breakout with Different Conditions

Let’s move on to the second Bitcoin trading strategy, which also operates on a 5-minute time frame as data1 and a 1440-minute (daily) time frame as data2. The core logic is similar to the previous strategy, but it differs in terms of the time window used and specific filters, including patterns from our proprietary libraries.

Performance of the Second Bitcoin Trading Strategy

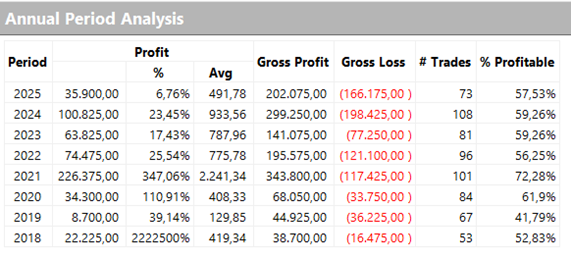

Just like with the first strategy, we’ll now take a look at the performance, starting with the equity curve, which is consistent and upward-sloping, just like the previous one.

This system executes slightly fewer trades compared to the first, but it yields a slightly higher average trade (around $930). In both cases, the maximum drawdown remains remarkably low, which is impressive given the nature of the instrument and the size of the futures contract involved.

For this strategy as well, 2025 is shaping up to be a highly profitable year, with approximately $60,000 in gains so far, perfectly in line with previous years and with considerable room for further growth given the remaining months ahead.

Conclusion: Systematic Bitcoin Trading in 2025

We hope this article has sparked your interest and provided useful insights or inspiration for developing your own systems in a market with such strong growth potential like Bitcoin.

If your goal is to build robust and efficient trading strategies, we invite you to dive deeper into our method and book a free call with one of our experts.

Until next time!

Transcription

Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.