Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.

In this article, we’ll go over the results of the “Strategy of the Month” contest for September 2025. We’ll take a look at the winning strategy along with other excellent contenders selected from all the strategies you submitted.

We’ll also try to offer some practical insights by analyzing the basic logic behind the strategies, the markets they operate on, and of course, we’ll look at their performance together.

Let us remind you that the “Strategy of the Month” contest is open exclusively to students of Unger Academy® and rewards the best strategy developed using the Unger Method™. By submitting their strategy, each student can enter the contest every month and try to win a €1,000 Amazon gift card!

What’s more, if you’d like to access the codes of the winning trading systems from this contest, you can join the Unger Strategy Club, one of the exclusive services offered by our Academy, which gives you access to the open-source code of the current month’s winning strategy, as well as those of past winners. In addition, you’ll get access to a monthly live advanced training Masterclass and a monthly video with trading ideas where we explain the main rules behind the strategies in our portfolio.

But that’s not all: by joining the Unger Strategy Club VIP, in addition to all of the above, you’ll also get exclusive access to the open-source codes of all contest strategies that were approved by the Unger Academy coaches.

Let’s now go over the best strategies you submitted in September.

Reversal Strategy on the Nasdaq (NQ)

Among the strategies submitted this month, but which didn’t take the top prize, we’ve selected David’s entry, which still deserves recognition.

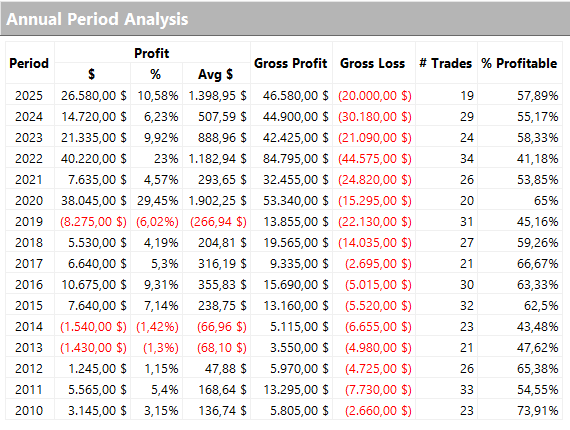

This is a Reversal strategy on the Nasdaq (NQ), operating on a 5-minute time frame. It uses one of the most classic countertrend triggers: the previous session’s high and low, respectively used for entering long or short trades.

The strategy uses a trading window to limit entry times and closes all positions by the end of the session, making it a clear intraday strategy.

It’s a simple yet effective approach. Below are its key metrics based on data from 01/01/2010 to the present. The strategy has shown consistent performance throughout its history, with an especially strong uptick in recent years, particularly during the post-COVID era, which seems to have steepened the profit curve.

Trend Following Strategy on the Nasdaq (NQ)

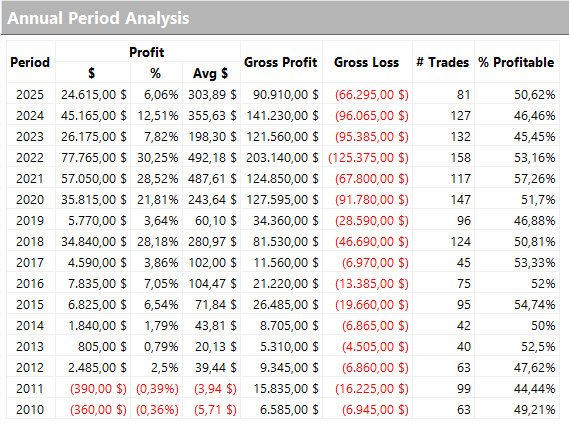

Another very interesting entry comes from Matteo. Like the winning strategy, this is a Trend Following strategy on the Nasdaq, using a 30-minute time frame. It employs stop orders placed at the highs and lows of the bar preceding the U.S. stock market open—an approach we might describe as “opening range breakout.”

The metrics are impressive, and it’s certainly not a strategy you see every day. While similar in some ways to this month’s winning strategy, which we’ll review shortly, this entry also performs very well in 2025, again reflecting the increased market volatility seen in the post-COVID era.

Reversal Strategy on the Mini S&P 500 (ES)

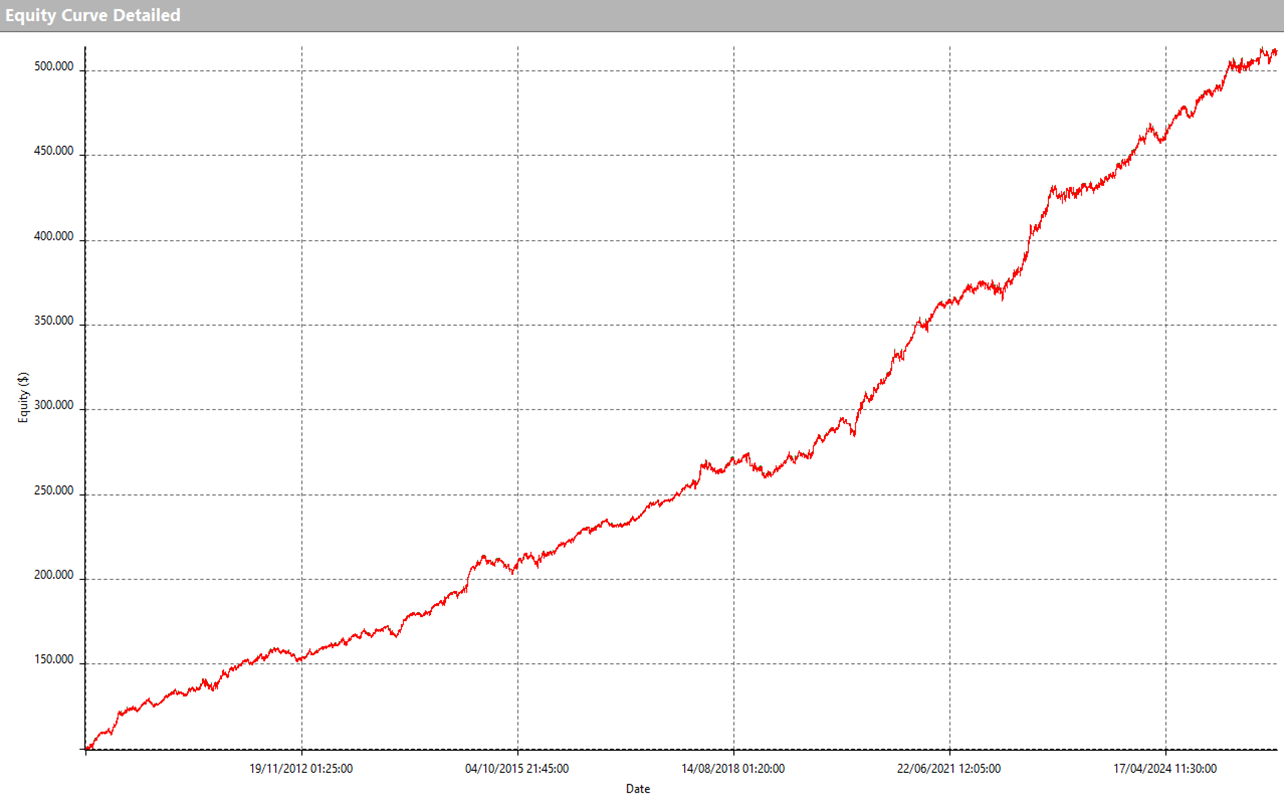

Another noteworthy strategy was submitted by Alessio. This Reversal strategy operates on the Mini S&P 500 with a 5-minute time frame. It uses limit orders placed at levels calculated as a fixed distance from the session open. If the market drops to a certain level from the open, the system goes long. The reverse applies for short trades, it waits for a rise of a specific size before entering short.

The strategy executes a high number of trades due to its limited filtering. The total profits since 2010 are truly impressive, although there’s a potential Achilles’ heel in the average trade value.

Due to the high volume of trades and relatively tight take profits, the average trade comes out to about $118. While this is usable in live trading, especially considering the liquidity of this market and the use of limit orders, it’s something to keep an eye on during live, out-of-sample trading.

Strategy of the Month – September 2025: Trend Following on the Nasdaq Future (NQ)

Now let’s look at the winning strategy submitted by Giovanni… congratulations on winning the €1,000 Amazon gift card!

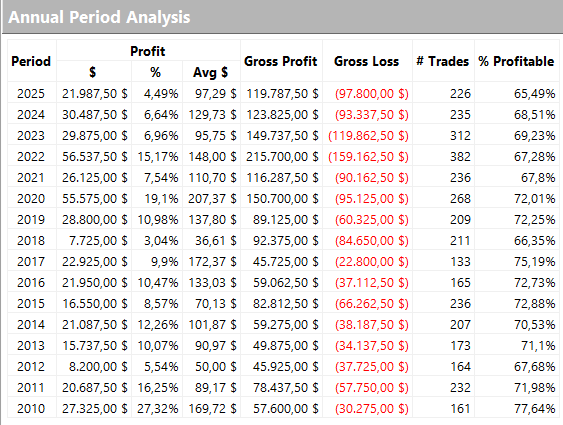

This is a Trend Following strategy on the Nasdaq (NQ) with a 60-minute time frame. This strategy uses the DVI indicator by David Varadi as a key filter for long or short trades.

Once a signal is confirmed, it places stop orders at the previous session’s high (for longs) or low (for shorts). Stop loss and take profit levels are set at fixed monetary values. There’s also a wide trading window concentrated in the second half of the session, plus two distinct patterns used to filter long and short entries.

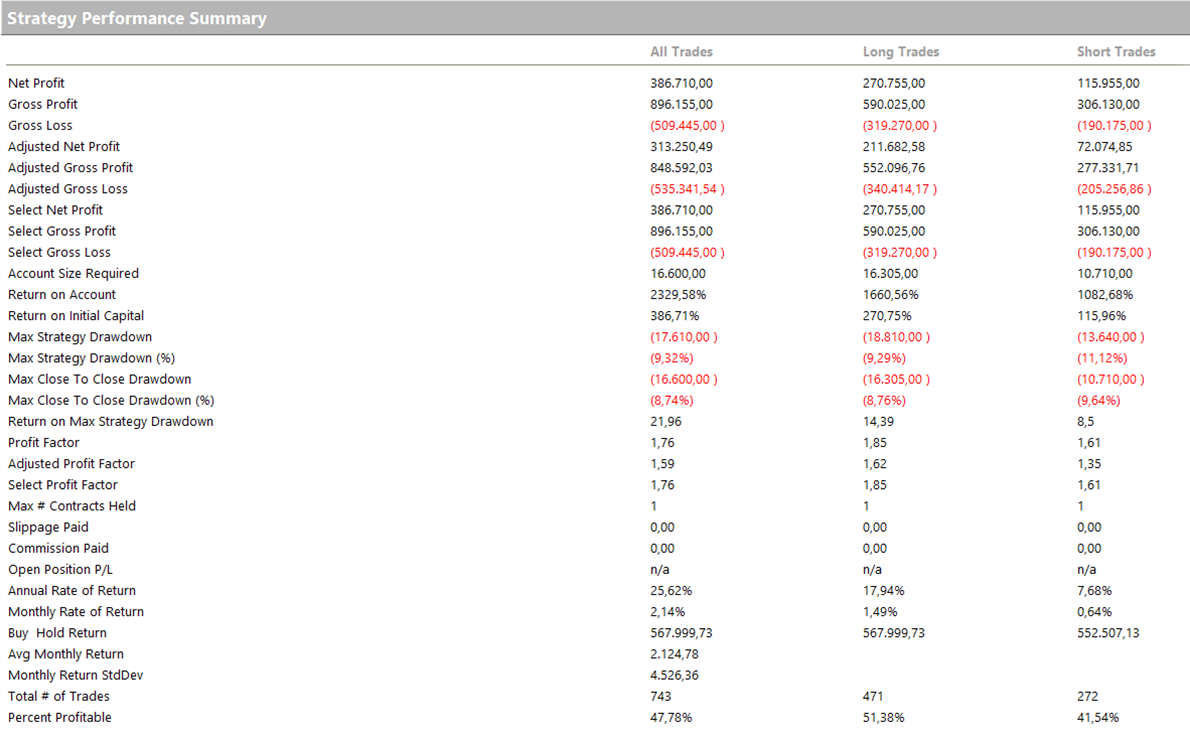

This is a well-structured yet highly effective strategy. The key metrics are shown below, including an outstanding net profit to drawdown ratio and a very healthy average trade value of $520, which is excellent considering the large statistical sample.

Conclusions and How to Access the Strategy Codes

Congratulations once again to Giovanni for taking home this month’s €1,000 Amazon gift card, confirming the robustness of his strategy.

We hope this article has been both helpful and inspiring!

If your goal is to craft winning trading strategies like these, you’re in the right place. Along the way, you can enter our exclusive monthly contest for Unger Academy students, competing for a €1,000 Amazon voucher.

Want to dig deeper? Join the Unger Strategy Club to access the winning strategies and other top entries. Check out all the benefits at www.ungerclub.com.

That concludes this month’s feature. Join us next month for more innovative trading strategies and inspiration!

Curious about our “Strategy of the Month” contest? This exciting monthly competition is open exclusively to Unger Academy students and rewards the best strategy developed using the Unger Method with a €1,000 Amazon gift card. Interested? Click here to learn more!

Want to see the champions from previous months? Click here to check them out!

Transcription

Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.