Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.

Welcome back to another deep dive into the trading systems currently in our portfolio. After exploring the futures markets, today we’re shifting our focus to two of the most well-known stocks in the US market: Netflix (NFLX) and Microsoft (MSFT). The former operates in the paid multimedia content sector, while the latter is the world’s largest software producer.

The goal of this analysis is to evaluate whether these two stocks present interesting opportunities from a systematic trading perspective and to determine which methodology best suits the nature of each stock.

Multiday Trend-Following System on Netflix (NFLX) Stock

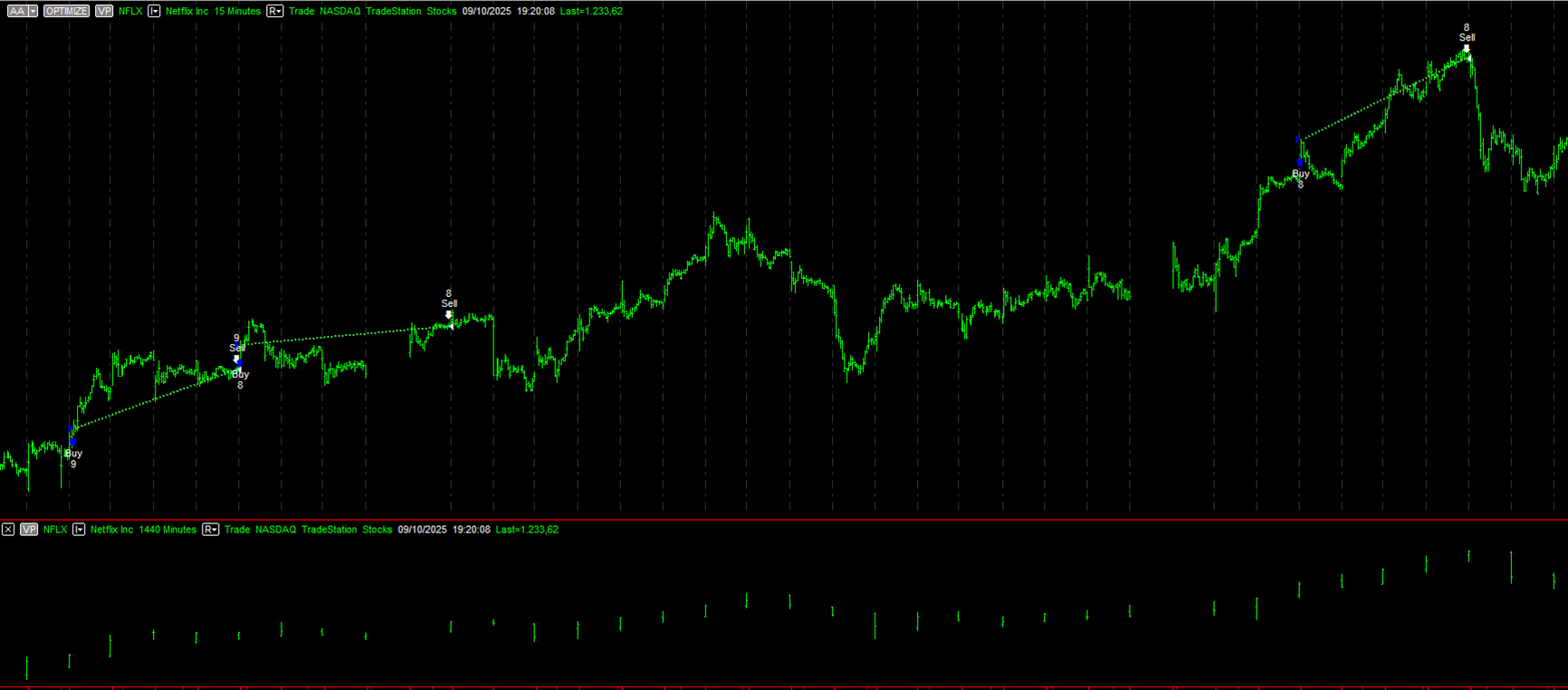

The first strategy we’ll analyze is a trend-following system. It operates only on the long side, using a 15-minute time frame as data1 and a 1440-minute time frame as data2.

The system logic involves entering a position upon breaking the high of the current week, starting from the second trading day, which is Tuesday.

Since this is a trend-following system, it performs at its best when combined with a volatility filter.

The position is closed after N sessions, unless the stop loss or profit target is hit first.

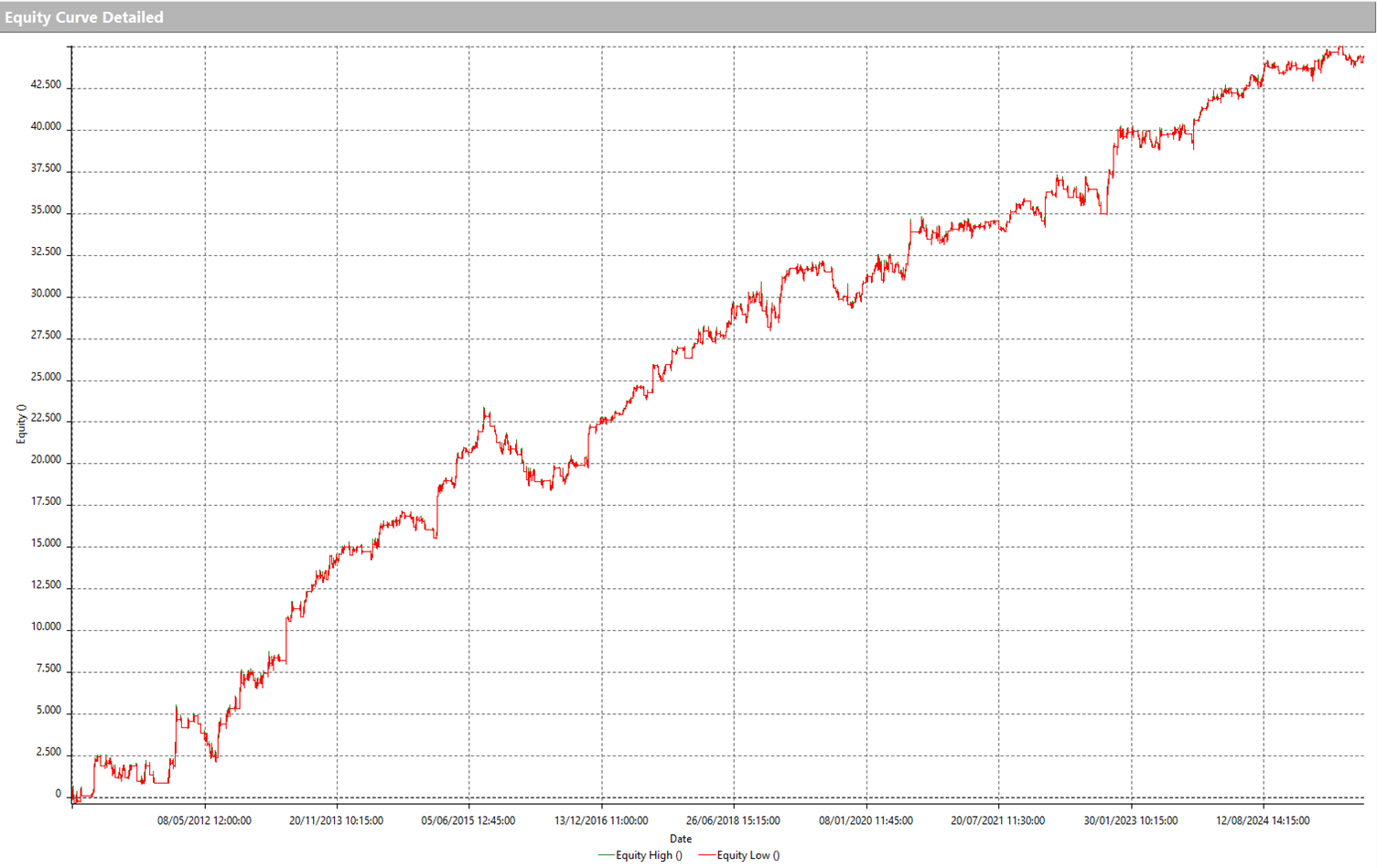

The equity line of the system from 2010 to the present, shown below, highlights an extremely consistent growth in profits, especially from 2016 onward, in line with the strong performance of the Nasdaq index and the broader technology sector.

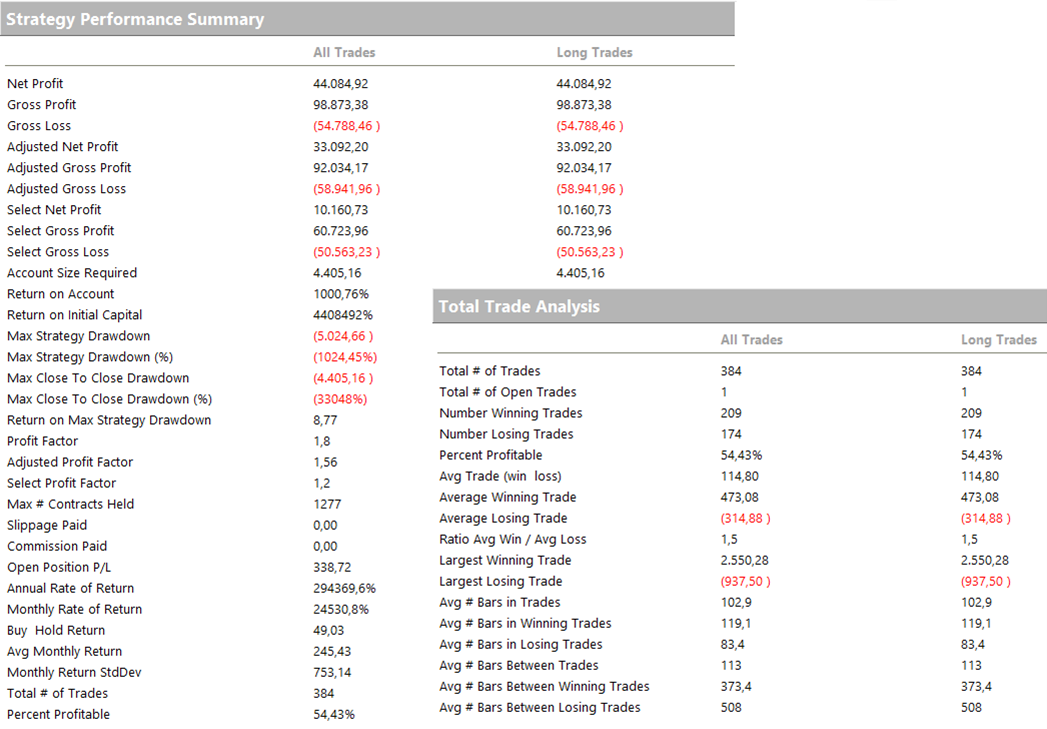

Analyzing the system’s performance, we observe a net profit of $44,000 and a very limited maximum drawdown of about $5,000. Most notably, the average trade value is an excellent $114.80. This is a strong result for a system operating on a single stock and corresponds to over 1% of the capital used per trade ($10,000).

Multiday Reversal System on Microsoft (MSFT) Stock

Let’s move on to the second strategy, which focuses on Microsoft stock. This system operates on a 1440-minute time frame and is based on a reversal logic.

In this case, the well-known oscillator developed by Larry Williams, the Percent-R, is used to determine entry levels by identifying oversold zones where long positions can be initiated.

Being a multiday system, it can remain in position for several sessions or exit earlier if the monetary stop loss is reached.

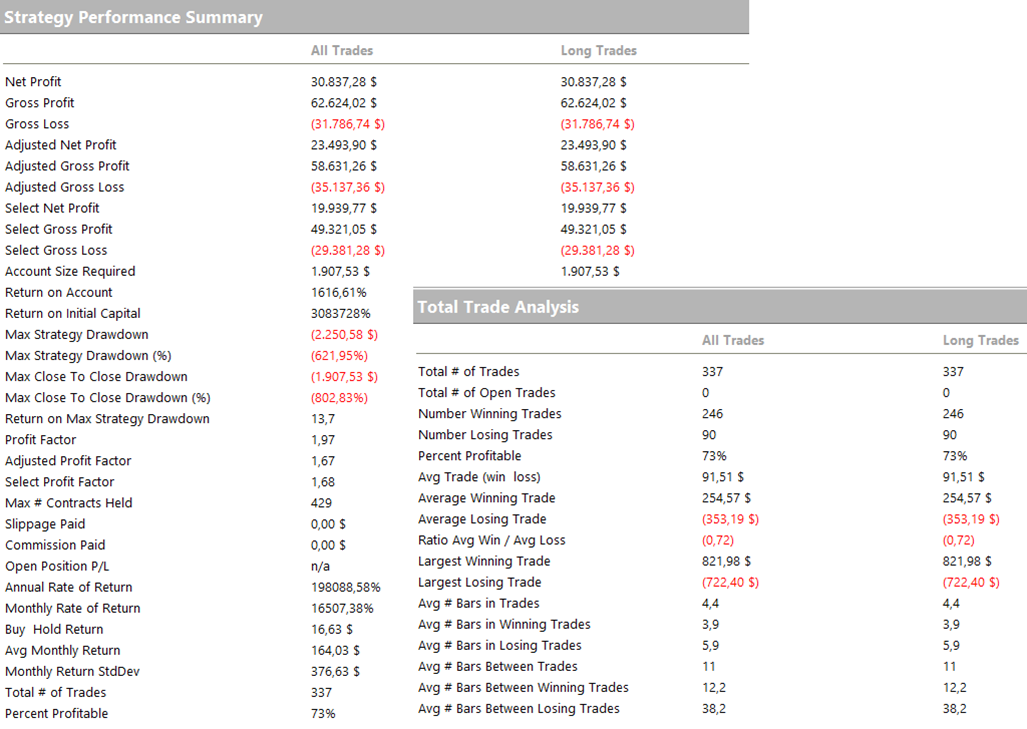

When we look at the equity curve, we see a line that has consistently delivered positive results, proof that this stock is well-suited to a mean-reverting approach.

Looking at the system’s metrics, we note a total net profit of nearly $31,000, a very low maximum drawdown ($2,250), and a strong average trade value, which in this case as well is close to 1% of the position size used.

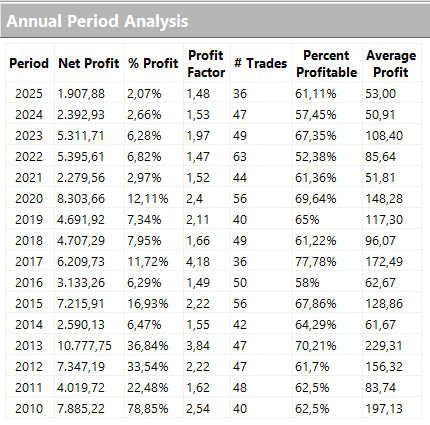

Finally, let’s take a look at the combined annual performance of both strategies. Beyond the absolute values of net profit, which naturally depend on the capital used, what stands out is the consistency of solid results across all years, including particularly challenging periods for equities like 2022 and even partially the current year.

It’s clear that the two different trading logics work in synergy, helping reduce the risk that would come from relying on just one type of system.

Conclusions

As we’ve seen, even in the world of equities, it’s possible to apply effective systematic trading strategies that adapt to various market environments.

We hope this article has helped you discover new ideas for your own systems and encouraged you to explore the opportunities that markets continuously offer.

Would you like to learn how to develop profitable systematic strategies on stocks like the ones showcased in this article?

Then click the link below to schedule a free call with one of our experts. You’ll discover how our trading method works, what the requirements are to apply it, and the next steps to begin your journey.

Happy trading and see you next time!

Transcription

Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.