Hi guys, hi from Andrea Unger! Today, I’d like to talk about the Martingale/anti-Martingale approach and more in particular about a “regulated” version of the Martingale approach you can include in your portfolio for the sake of diversification.

As you probably know, I published a book on position sizing and money management. In that book, I strongly suggest that traders use an anti-Martingale approach. This means that you should increase your size when your account is larger and decrease the size of the next trade if losses reduce your account.

In the book, I demonstrated with numbers that this approach makes sense, so I suggest that traders use it.

But what about strategies that are built with a Martingale? Is this approach always wrong? Let me show you something.

Suppose you have a Martingale approach that consists in going on buying increasing the size of your position. In this case, the stop-loss of your strategy is, actually, the size of your account. If you think about it, this is dramatic, as it means that you may lose all your money.

Of course, they don’t tell it that way. They say it in a different way, so that it sounds more professional. However, at the end of the day the result is the same. There’s no money left in your account.

Now, suppose we create a “regulated” version of this Martingale approach, in which we set a limit to the maximum number of contracts we can add up. For example, if we have one contract and then we add two and then three, we can decide to stop at six. This means that, in a falling market, we’re ready to buy, at different levels, one, two and then three contracts, but we don’t want to have more than six contracts in our account at the end of the day.

So, once we have these six contracts, we calculate, more or less, their size and, from this level, a stop-loss level at which we will close our position, i.e. those six contracts, so that the loss we suffer is still in line with our risk profile.

In this case, it’s true that we have a Martingale approach, but it’s also true that we keep losses under control. We keep them smaller than the maximum level we can afford to lose in a single operation—where the operation is the small number of all the edges. There might be more, but this is just an example.

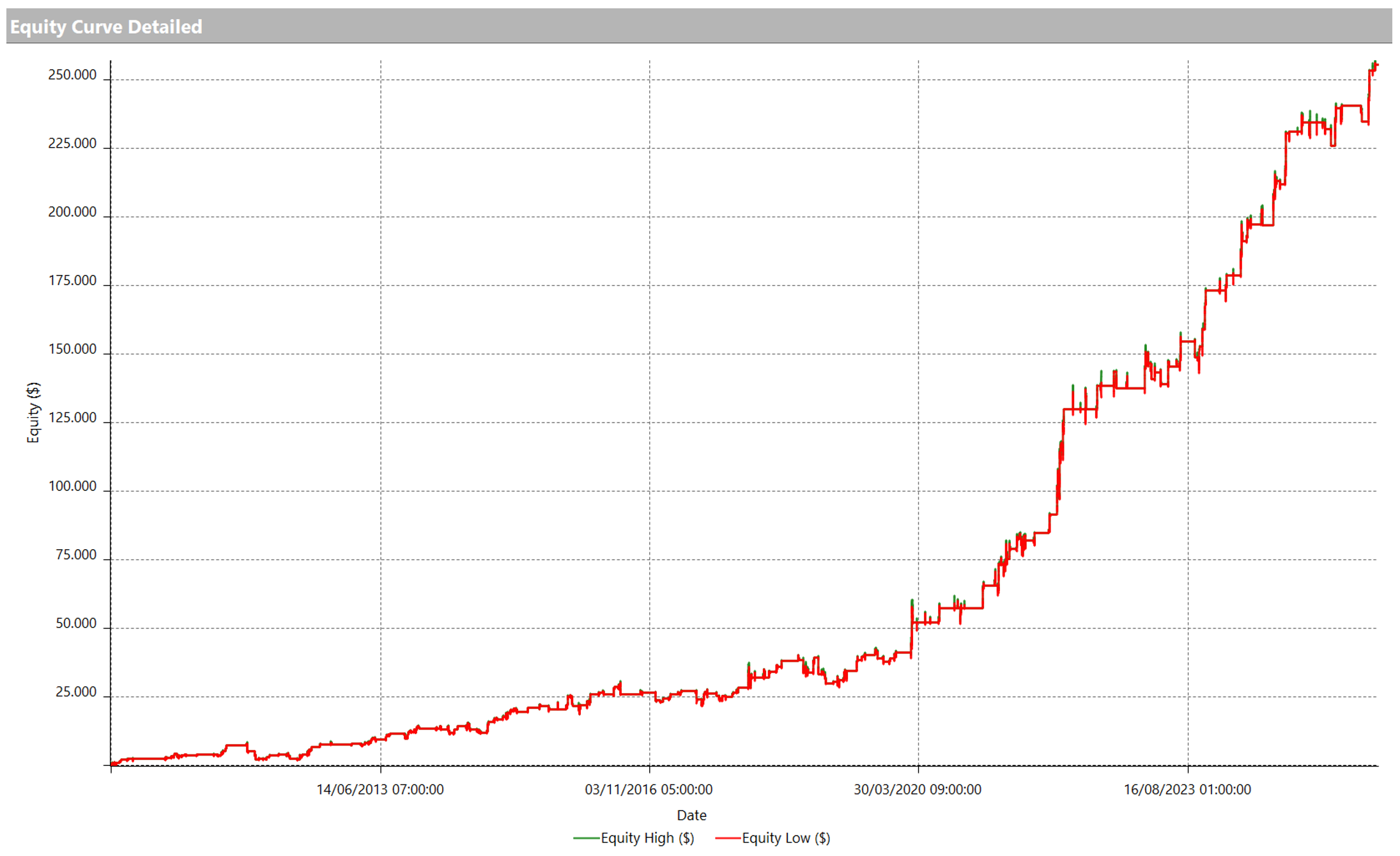

So, can we use the Martingale in trading? Yes, we can, but only if we keep it under control. So, if you want, you can add a regulated Martingale strategy to your portfolio. It will be one more diversification tool.

The most important thing is that you regulate it so that risk is always under control.

Stay tuned, we have more in store!

Ciao from Andrea Unger!