Introduction

Hi and welcome back! As usual, today we’re going to be looking at the strategies in our portfolio that have performed the best over the last period.

In particular, this week, we’ll focus on two trading systems in the metals sector, one of the sectors that has performed best recently, along with the equity indexes.

One of the coaches at the Unger Academy here, where we work on developing automated trading strategies.

Specifically, here, we can see a strategy for Gold and another for Copper.

Both are part of our portfolio and belong to Andrea Unger’s personal database.

Just think that these two strategies have made over $25,000 in 2023 alone and $3,500 in the early months of 2024.

But now we come to today’s first strategy.

Gold Futures Bias Strategy

Let’s look at it, and it works on Gold futures.

As you can see, it’s a bias strategy that works on a 5-minute timeframe.

And what does this system do? Well, basically, the system looks at specific time frames of the day that have shown a well-defined and recurrent trend, precisely a bias, over the years.

So, orders are placed during those specific times of the day when specific patterns occur, that are part of a proprietary lists we use at Unger Academy.

Here we can see some examples. So we have three consecutive trades that were placed at a profit in February, gaining more than $2,500.

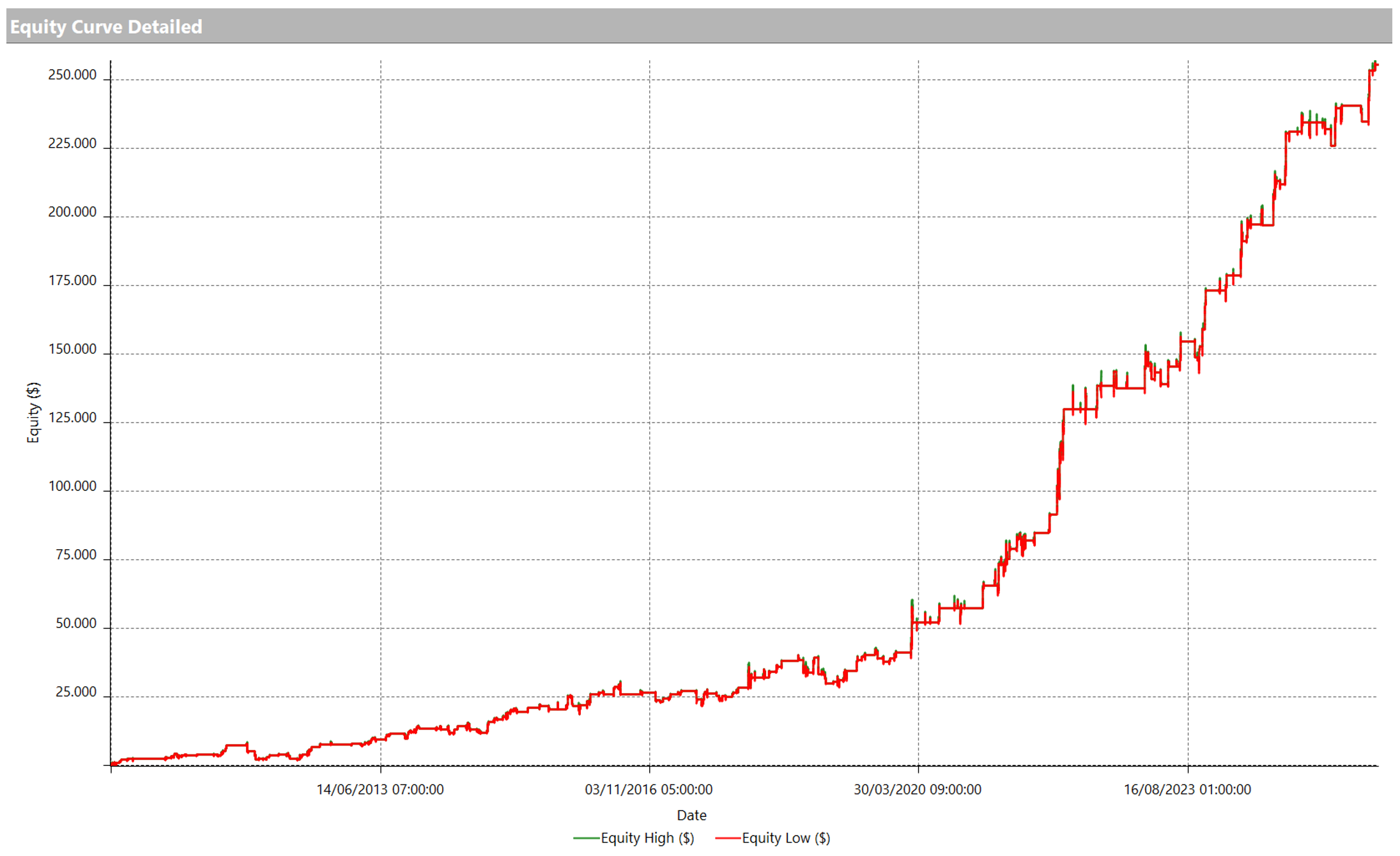

If we look at the Performance Report, we can see that we have a very regular and rising equity line.

We can see that all the performance years have been positive, and the average trade is also pretty substantial.

We have over $150 of value, that’s enough to absorb the costs of real trading.

Let’s keep in mind that this strategy was developed in January 2017.

And I would say that the subsequent performance in the out-of-sample period has confirmed the good performance we see in the in-sample period.

Reversal Strategy on Copper

Let’s now turn to the second strategy I want to show you today.

This strategy works with Copper futures within a 30-minute timeframe.

It is a mean-reverting type of trading system.

As you well know, my friends, mean-reverting systems do what?

They buy on downtrend excesses and sell on uptrend excesses, relying not on trend continuation but on retracements.

So, when an underlying asset makes an excessive upward or downward move, mean-reverting systems open new positions in the opposite direction, relying precisely on a market’s retracement.

The core model of the strategy is based on the Bollinger bands. So, what exactly does this system do?

It buys, so it opens a long position, when the market closes below the lower band and, vice versa, it sells, so it opens a short position, when the market closes above the upper band.

There are also some additional conditions and filters to make the trades even more profitable.

As you can see, the equity line is very interesting and has a fairly regular and consistent positive annual performance.

The average trade amounts to over $120.

Considering the instrument that we are trading, Copper, and the limited duration of the trades, I’d say that this is still a pretty good value that can certainly keep up with the costs of real trading.

At this point, that’s all for today! It’s time to say goodbye, I will see you in our next video! Bye-bye for now!