Introduction

Hello and welcome to this brand-new video. Today we will take a detailed look at the results of our Strategy of the Month contest for February. We will discover the winning strategy, which you can already see on your screen, as well as a series of strategies from those you sent us that stood out among the others.

I’m one of the coaches at Unger Academy, and as always, I’ll also take this opportunity to give you some trading insights by analyzing these strategies, and we will examine their performance in detail. I also remind you that the Strategy of the Month is the monthly competition in which Unger Academy rewards the best strategies developed by our students applying the Unger Method.

And about our contests, I also have some big news starting from the beginning of this year. Indeed, to celebrate the beginning of the tenth year of activity of the Unger Academy, we’ve decided to double the prizes at stake. So, from January to June 2024, the prizes for this contest will increase from 1,000 euros to a whopping 2,000 euros per month in Amazon vouchers.

I also remind you that if you want to get the codes of the winning strategies in an open-source format, you can join the Unger Strategy Club, the latest service launched by our Academy. Besides offering the codes of the winning strategies and all those that have won in the past, by joining the Club you’ll get access to a monthly Live Masterclass, where you can receive advanced training, as well as trading insight videos that we publish monthly, in which we analyze the strategies of our portfolio to give you some more ideas to develop new trading systems.

Mean Reverting Strategy for the U.S. 30 Year T-Bond

Alright, with that said, I think we can start and immediately go to MultiCharts to see this month’s strategies. I will start not with the winner, which I will leave to the end, but with a strategy that works on the American thirty-year Treasury, more precisely the future on the American thirty-year treasury, whose ticker is US.

This is a mean-reverting strategy that aims to buy low and sell high based on price levels calculated using a customized session instead of the usual standard session.

This means that the high and low levels at which we will try to sell limit and buy limit are built by looking not so much at the standard trading hours but at synthetic sessions, to specifically search for the time range that gives us significant prices.

Developing strategies in this way is very difficult because overfitting or the lack of reasons to support these ideas could lead to problems during the out-of-sample phase.

But let’s take a detailed look at the performance of this system. We have a very interesting and consistent equity curve and an average trade of $326. The strategy is very good because it trades well both on the long and short side.

It is especially consistent in the last phase where, indeed, bonds have fallen quite a bit. The returns are very consistent.

We have no losing year. However, even if we are using limit orders, we must imagine that there could be slippage in terms of stop loss or market exits… So we see that 2013 and 2017 are a bit weak, but that’s absolutely acceptable for this type of underlying.

The exits of this system are mainly of two types: one concerning stop loss and take profit, and the other based on time. In fact, we will exit all still-open positions after about two trading weeks.

Trend Following Strategy for Crude Oil Futures

Let’s now move on to the second strategy that we received from our students. This is a strategy on Crude Oil and, unlike the previous one, it tries to ride the ongoing trend. So, we will buy when the price moves upwards and we’ll sell when the price moves downwards.

In this case, the time horizon is a bit smaller. In fact, we will close positions after just three trading sessions. The trend we ride with our positions will be measured based on the opening price of the current session.

So here, we will have an opening price to which we will add and subtract a portion of the range of the previous session, and at these levels, we will buy or sell if the price reaches that level.

There are also some filters. One of these is based on the ADX. We have talked a lot about it in our past videos. It’s a filter that we often use for this type of strategy, and we are happy that you too are able to achieve good results thanks to this filter.

Now let’s quickly go and look at the results of the strategy. We have a 2024 that hasn’t started particularly well, but this is more than normal since many of the strategies we also have in our portfolio on Crude Oil are not performing very well at this precise moment.

Let’s look at the average trade, which is, let me say, very good for this underlying asset. It’s almost 275 dollars and it’s certainly enough to widely cover all the costs of commissions and slippage.

The long and short sides are well balanced, which is very important in this case, as this is a symmetric strategy, that is, a strategy where the entry and exit conditions are the same for the long and the short part. And as you can see with the same logic, we manage to obtain excellent results in both directions of the system.

Winner: Trend-following Strategy for DAX

So, let’s close with the winning system, which was developed by our student Alessandro, whom we congratulate! Alessandro’s developed a strategy on the future of the DAX, the German stock index.

This strategy, like the previous one on Crude Oil, aims to ride the downward or upward movements of the underlying asset. This time, however, the trigger, so the entry price, is not calculated based on the sum of the range of the previous daily bar and the open of the current session, but rather from the highs and lows reached to a certain time in the current session.

So, we will have a standard session that starts at 8 am and then, after a certain period of time, so after X hours, we will calculate what the high and low levels reached in the current session are, and if the filters allow it, we will go long or short if these levels are exceeded.

Alessandro started from a template that we provide in Unger Academy. Let’s say that the source code was not modified, except for a temporal exit based on the number of bars in which we are in position. Indeed, after X bars, the strategy will close those positions that are still open, which are the ones that didn’t close in take profit or stop loss.

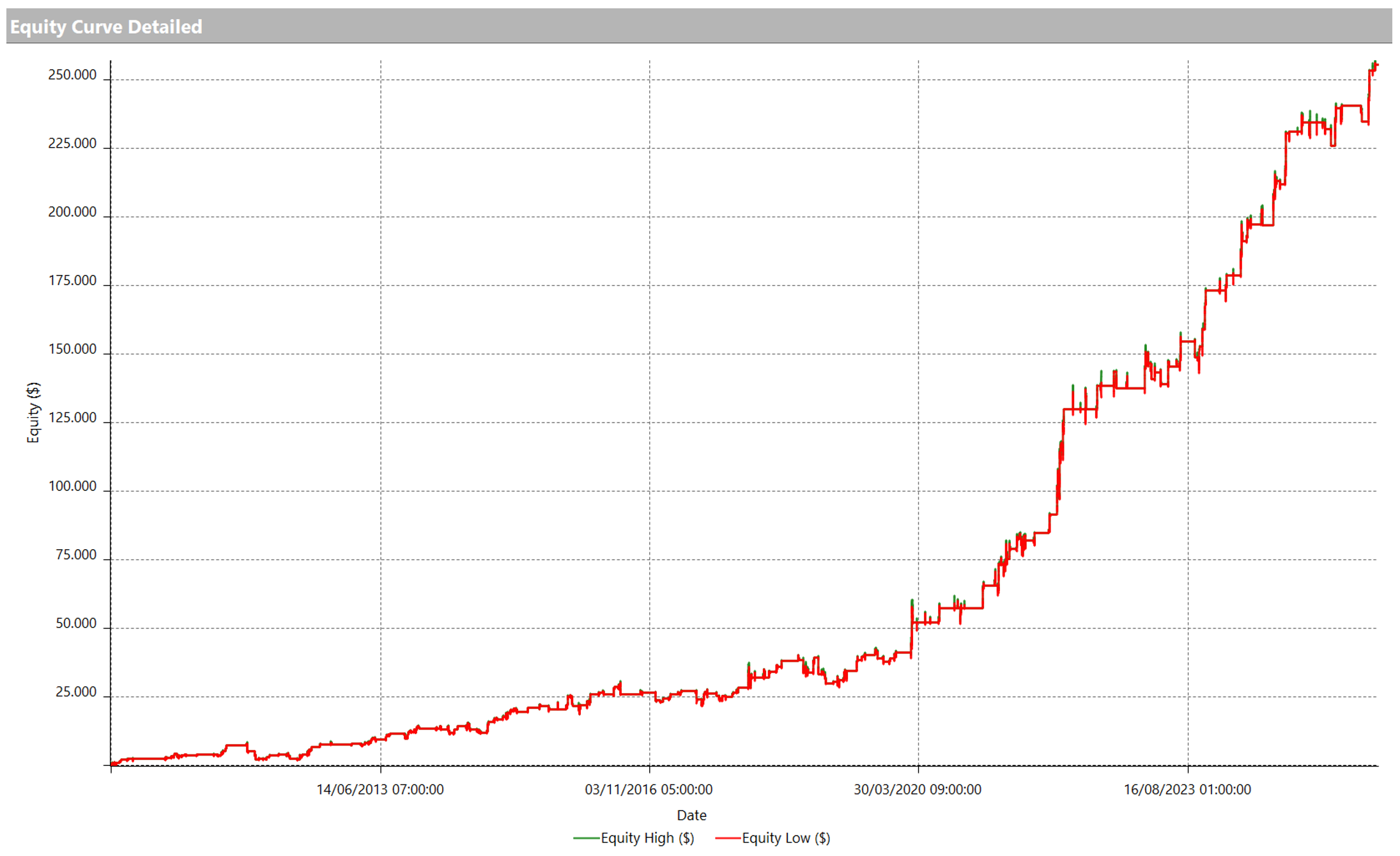

But let’s go and see the performance of the system, which is formidable both on the long and the short part. The system’s close-to-close drawdown seems to exceed 20,000, which might look like a pretty large number. Let’s go to see it more in detail… and yes, we are around 26,000. However, I assure you that this isn’t as large as it seems. The DAX is indeed a very large instrument, which means that we also need a very large average trades value.

Anyway, as you know, in the last few years, this instrument has been made much more accessible thanks to the advent of mini and micro futures, which are getting more and more liquid and increasingly used by retail investors like us.

So, this strategy, which seems apparently very large, could actually be easily used with much smaller capitals. But let’s briefly go and look at the Annual Period Analysis, to the strategy’s annual returns, and we see that we practically have no losing years.

Sure, there are some years with low average trades, like 2013, for example, but the strategy really shows a strong consistency in making profits. So congratulations, Alessandro, great job! And, of course, congratulations also to everybody who sent us strategies! They were all excellent, and this shows how well you have learned to use the Unger Method and how easily the method itself is transmitted.

Conclusion

Well, I hope this video has been useful, and if your goal is to develop strategies like those you saw today, you are definitely in the right place.

During your learning at the Academy, you too can participate in the contest reserved, I repeat, exclusively for our students, and win an Amazon voucher worth 2,000 euros. Finally, I remind you that if you want to get the code of the winning strategy, you can subscribe to the Unger Strategy Club. You can judge the contents of this service yourself at www.ungerclub.com.

For any other questions or information, I invite you to click on the link you find in the description, from which you can get a free presentation by Andrea Unger, the founder of Unger Academy, and also receive our best-selling book, The Unger Method, at home, covering only the shipping costs. Finally, you can also book a call with a member of our team to get a totally free strategic consultation.

Thank you all for following me up to here, and I’ll see you in the next video with new operational insights on systematic trading. Goodbye everyone and see you next time.