Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.

Welcome back to our regular overview of the systems in our portfolio. Today, we’re focusing on two strategies, both based on a bias approach and very similar to each other, that have performed exceptionally well in recent weeks on the DAX, Europe’s largest stock market index.

Both strategies have shown excellent results lately and can be considered very robust, having been coded several years ago.

Night Bias on the DAX: How the Strategies Work

The two strategies essentially follow the same logic: both are based on the idea that stock markets tend to rise more during nighttime hours than during the opening hours of the next trading session.

Each day, a long position is opened around 5:00–6:00 PM (Frankfurt exchange time), and positions are closed at the opening of the next day’s “cash” session, between 8:00 and 9:00 AM. In short, it’s a trade lasting just a few hours, but capable of delivering excellent returns.

Trump’s Tariffs on Pause: Two Incredible Trades

Recently, these two strategies captured an outstanding move that doesn’t happen often. Following news from the United States that Trump had paused the long-anticipated tariffs, stock markets—including the DAX—celebrated strongly.

During that time, the market surged by about +10%, and since both of our systematic DAX strategies were in position, we captured two trades worth 1,800 points each. On the full DAX futures contract, this equates to a profit of about €45,000 per strategy.

Since we had two such strategies active (differing slightly in their pattern recognition and day-of-week filters), the math is simple: €45,000 × 2 = €90,000.

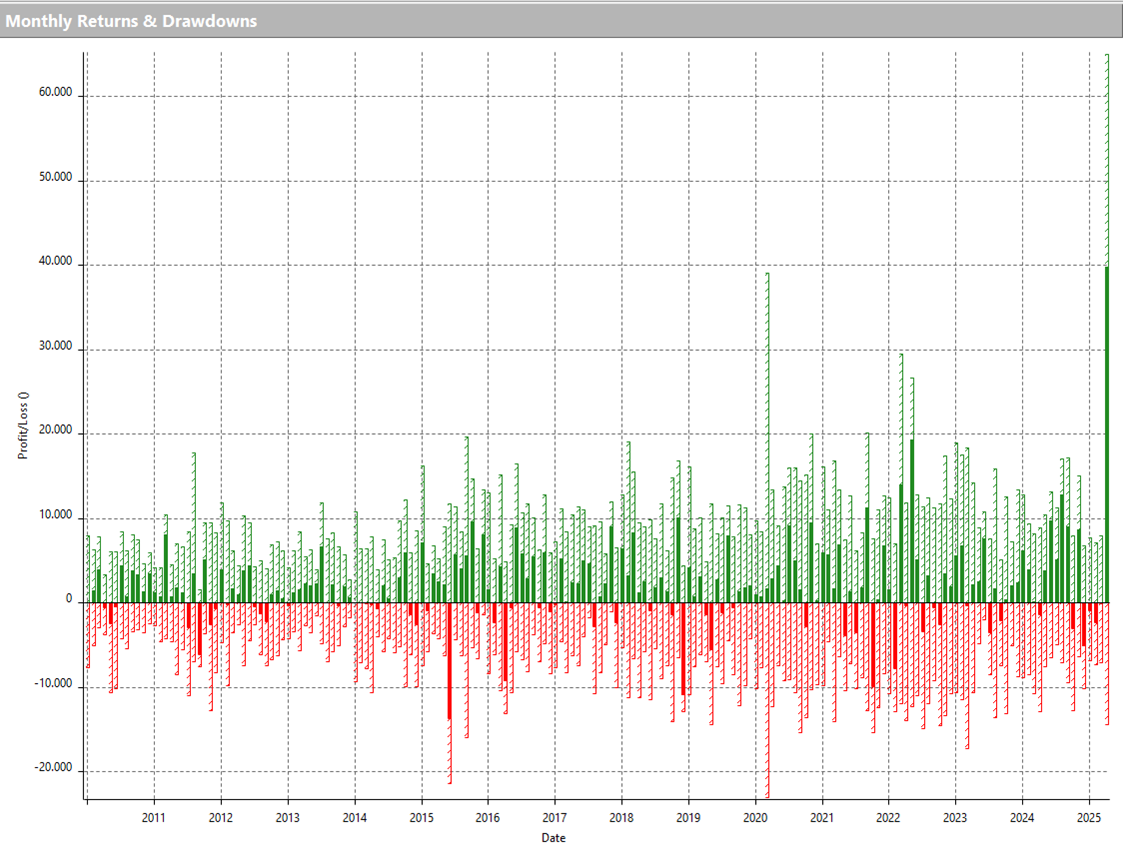

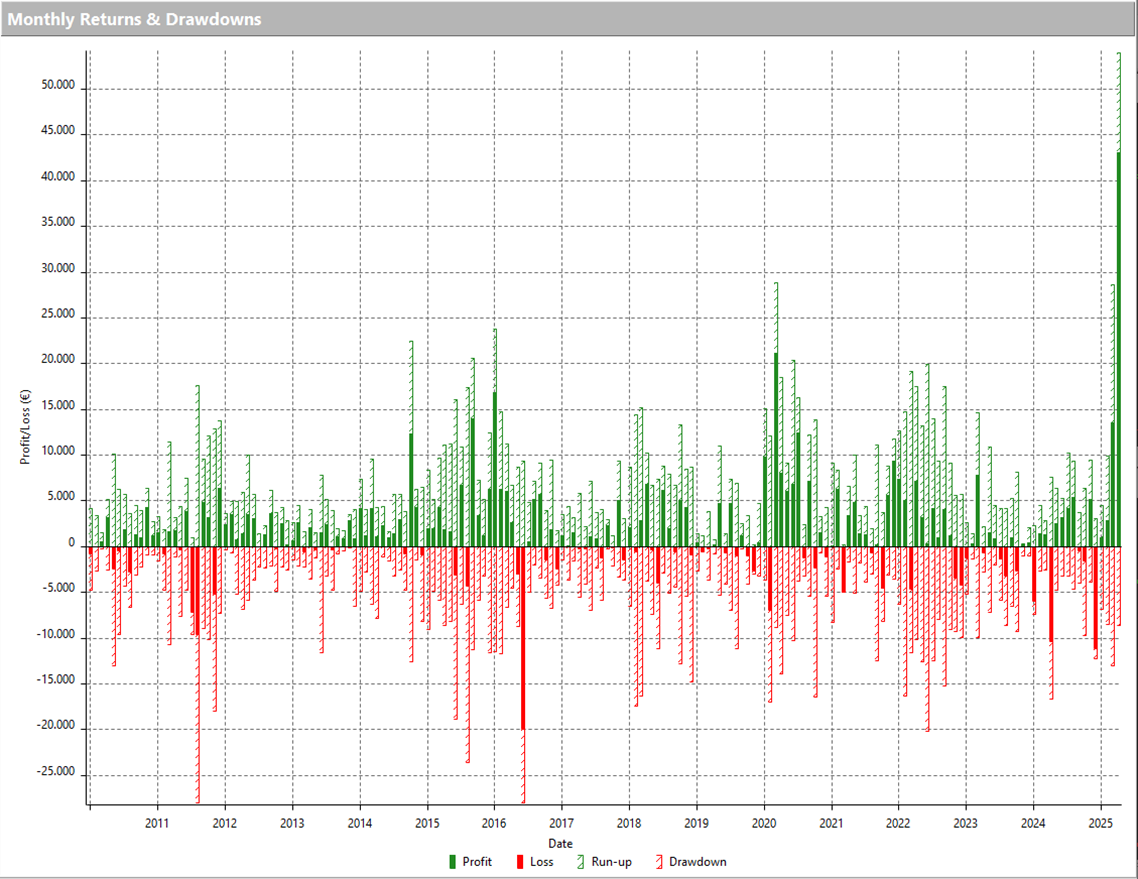

Following these two exceptional trades, we saw additional entries—some positive, some negative—which overall helped make April 2025 the best month ever for this particular trading logic!

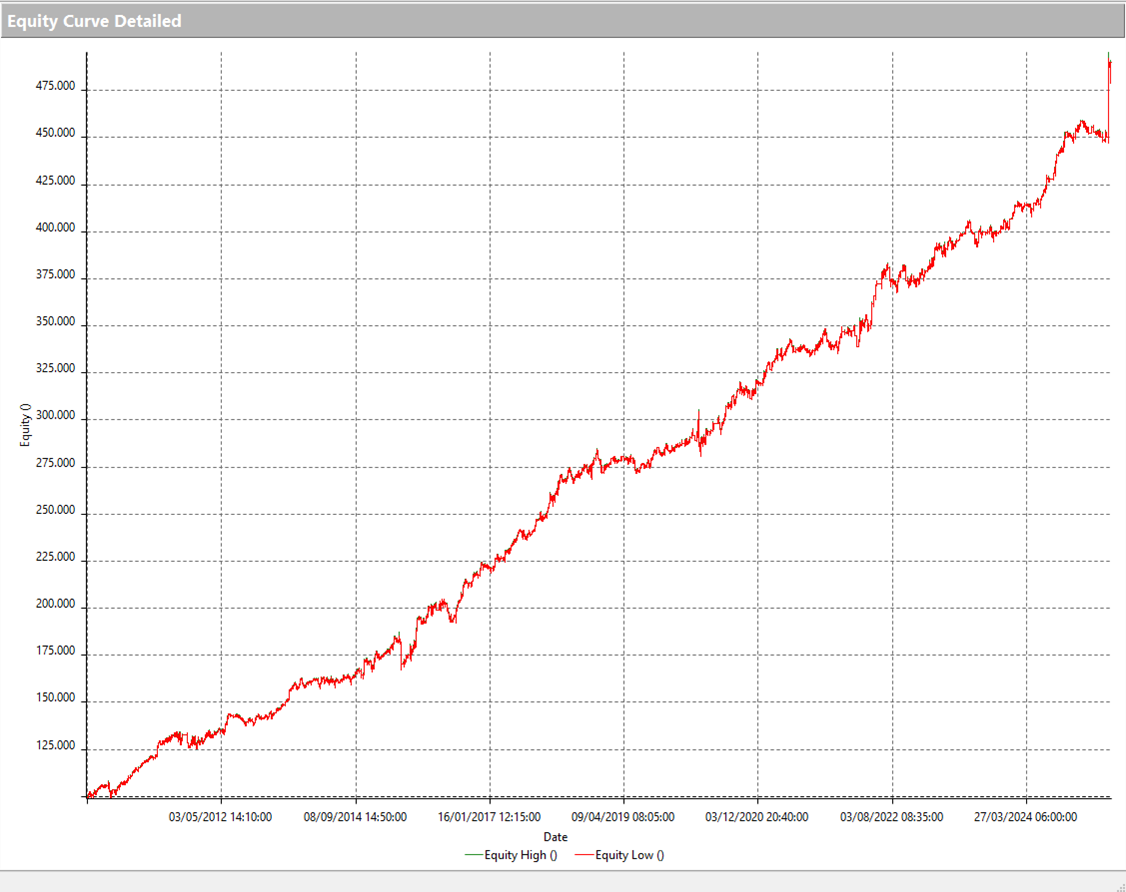

Figure 1 – Equity Curve of the First Systematic DAX Night Bias Trading Strategy (2010–2025).

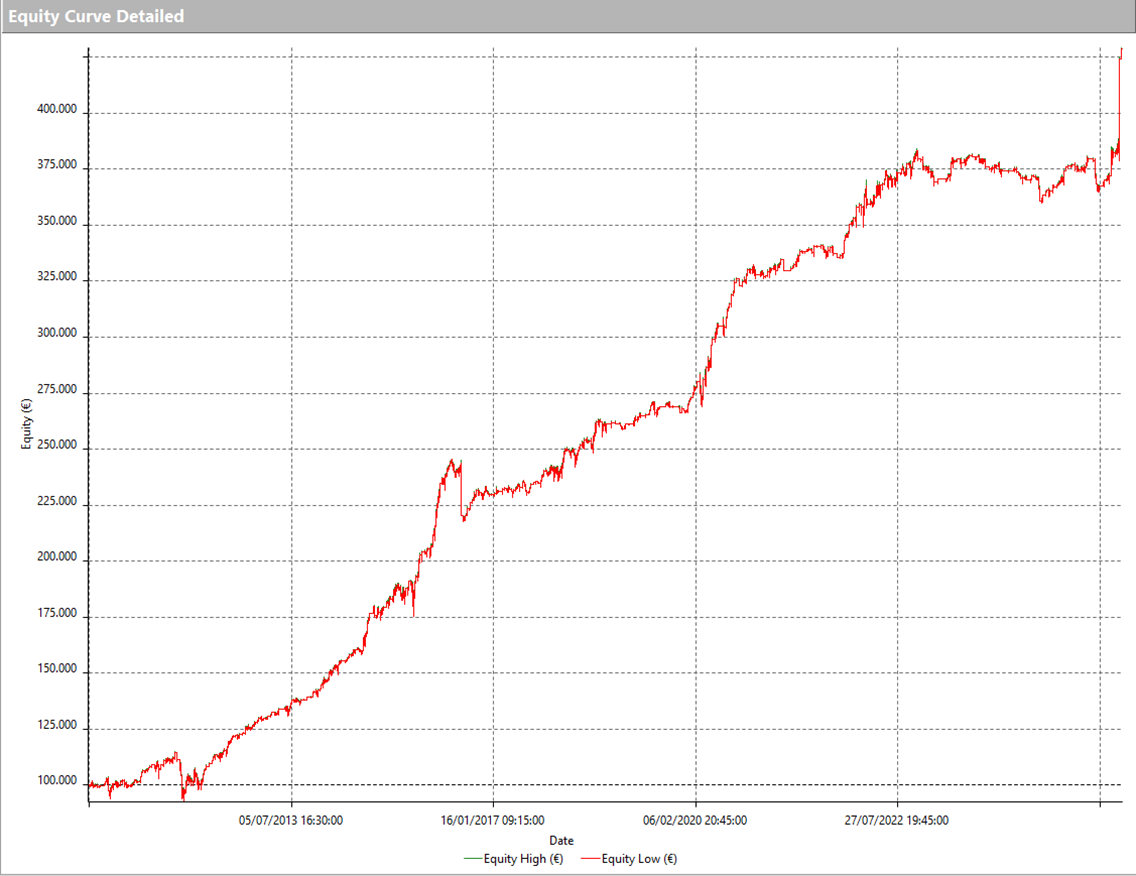

Figure 2 – Equity Curve of the Second Systematic DAX Night Bias Trading Strategy (2010–2025).

As you can see from Figures 1 and 2, the recent highly profitable trades caused a strong upward spike in the profit curves, breaking through previous all-time highs.

Figure 3 – Historical Monthly Performance of the First DAX Night Bias Trading Strategy.

Figure 4 – Historical Monthly Performance of the Second DAX Night Bias Trading Strategy.

How Our Systematic DAX Trading Strategies Made €90,000: Final Thoughts

In April, these two systematic DAX strategies took full advantage of the volatility sparked by the easing of Trump’s restrictive trade policies with many countries.

Together, the two systems generated around €90,000 in profit on the full DAX contract during the month, equivalent to about €16,000 on the MiniDAX and €3,200 on the MicroDAX. This demonstrates the scalability of these products, which nowadays can also be traded with smaller capital allocations.

These results clearly show the potential of systematic trading strategies applied to DAX futures, particularly when leveraging overnight bias patterns.

Would you also like to learn how to develop profitable systematic strategies for the DAX and other major markets?

Book a free call with one of our experts! You’ll discover how our trading method works, the requirements to apply it, and the next steps to start your journey.

Happy trading, and see you next time!

Transcription

Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.