Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.

Welcome to this article, where we’ll dive into two fascinating trading strategies from our database. These strategies focus on the Gold Futures contract (@GC), one of the most prominent assets in the commodities market. Both have been out of sample since 2018, demonstrating their robustness over time.

In this piece, we’ll break down the core rules of these systems and analyze their performance. Our goal is to inspire and guide you in developing new trading systems for this exciting asset—an essential part of any systematic trader’s portfolio.

Strategy #1: Multiday Trend-Following on Gold Futures using the Supertrend Indicator

The first strategy operates on a 30-minute time frame and follows the standard 23-hour trading session, running from 6:00 PM to 5:00 PM (exchange time). It’s a trend-following system powered by the Supertrend indicator.

Developed in the 1970s by famed financial analyst Welles Wilder, the Supertrend indicator remains as popular as ever. It combines two key components: the mid-price (the average of the high and low prices for each bar) and the Average True Range (ATR).

Here’s how the strategy works: it opens a long position when the futures price breaks above the Supertrend level, while short entries follow the same logic in the opposite direction. To enhance effectiveness, all trades are filtered using our pattern libraries, ensuring that positions are opened under optimal conditions.

As a multiday strategy, it holds positions over several trading sessions.

Figure 1 – Trade examples from the trend-following strategy using the Supertrend indicator on Gold Futures.

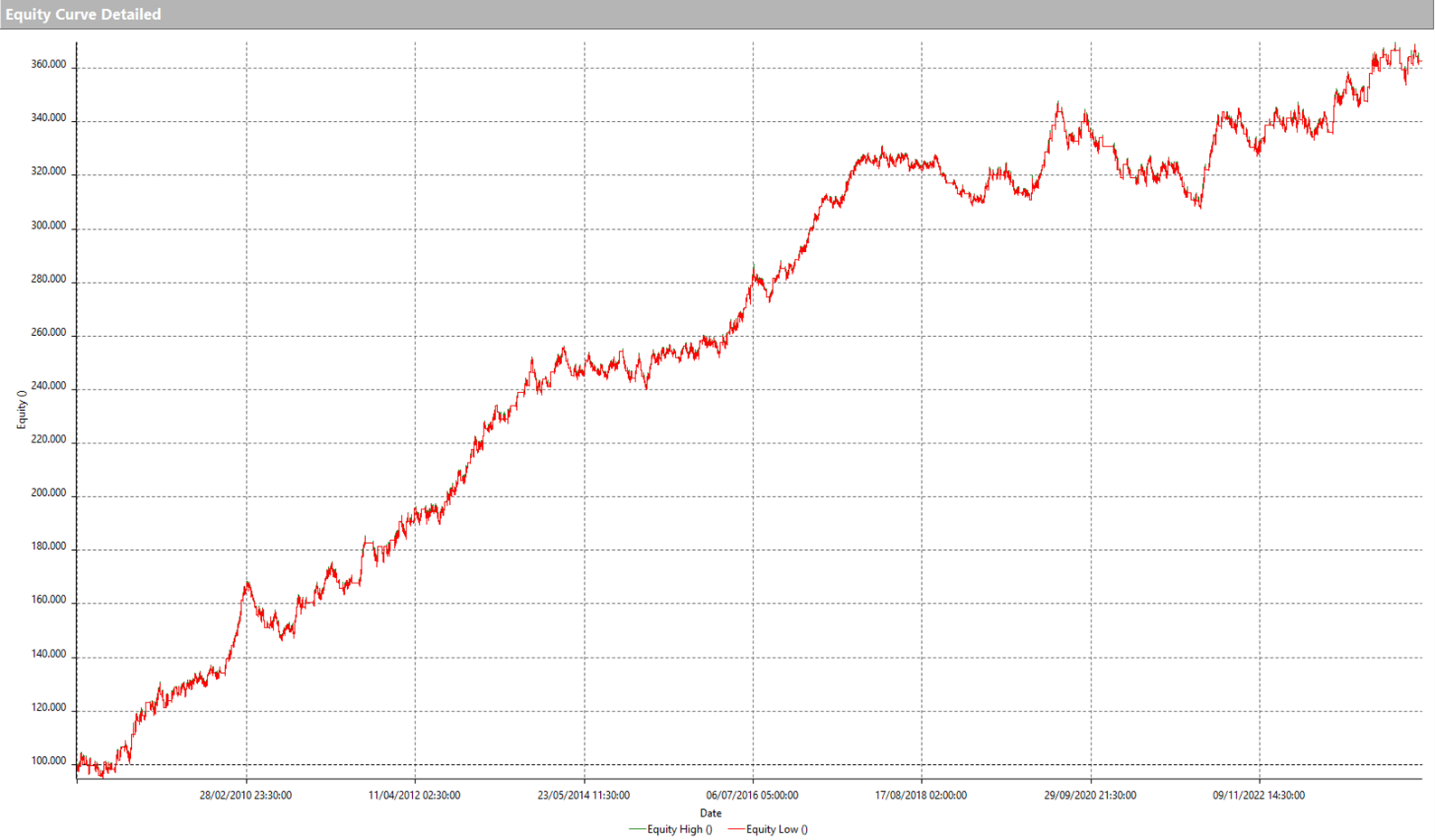

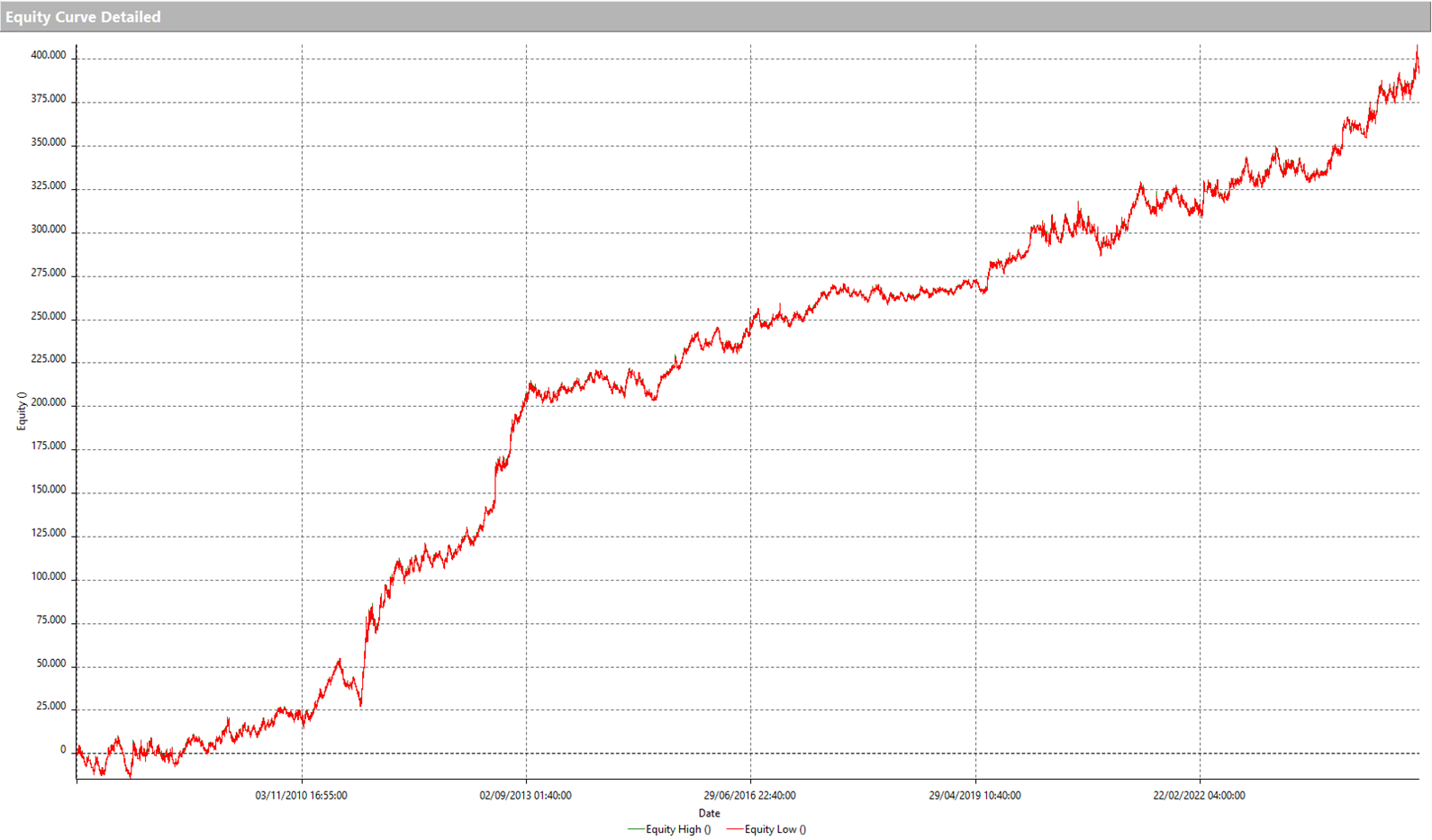

Let’s dive into the equity line of this system, showcasing its historical performance from 2010 to today. One thing stands out: the strategy has truly excelled over the past two years, particularly in taking advantage of the strong bullish trend in Gold on the long side.

Figure 2 – Equity line of the trend-following strategy on Gold Futures using the Supertrend indicator.

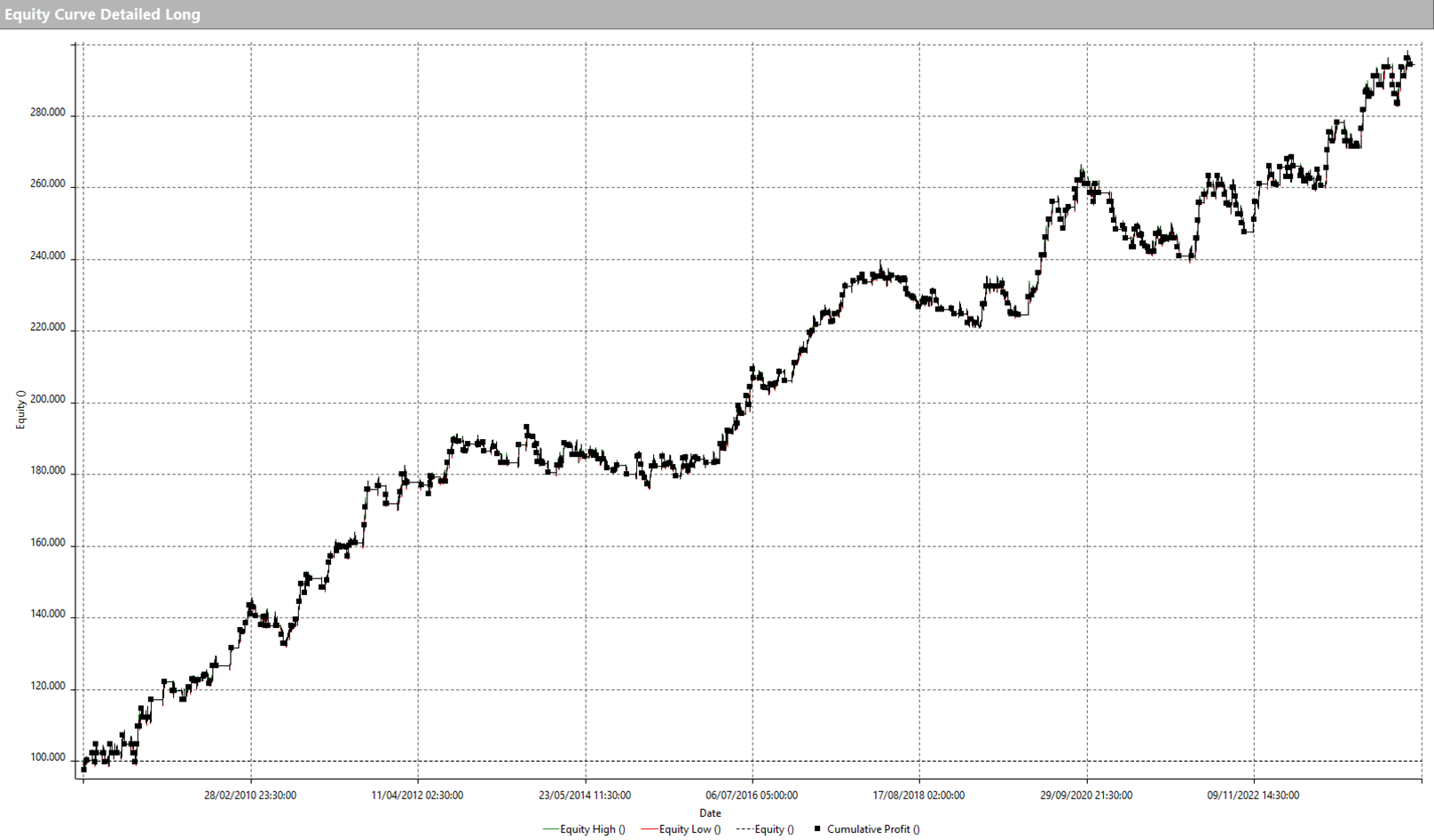

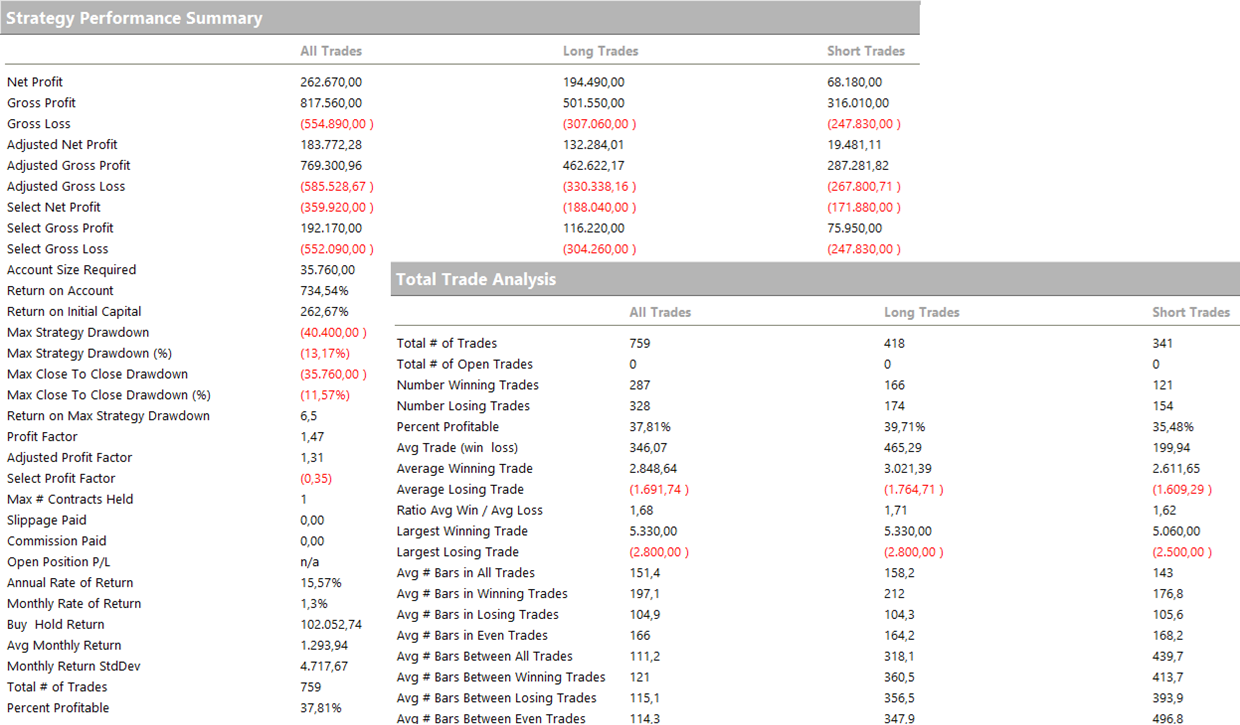

The long side of the strategy shines brightest, as evidenced by the charts and metrics below. Of the $262,670 total net profit generated since 2010, approximately $195,000 stems from long trades alone.

Figure 3 – LONG equity line of the strategy on Gold Futures.

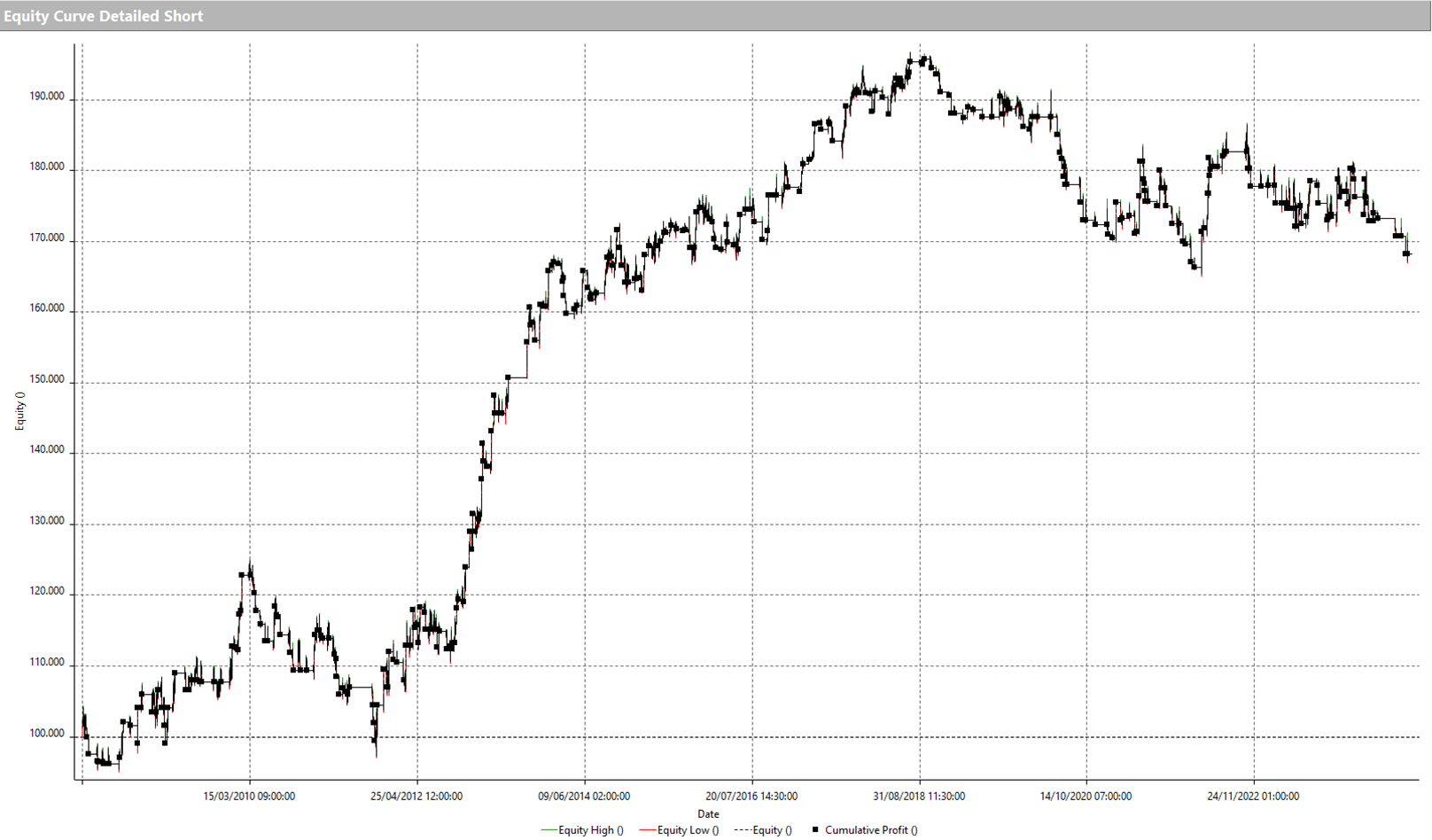

Figure 4 – SHORT equity line of the strategy on Gold Futures.

With an average trade exceeding $340, this system delivers not only strong returns but also comfortably covers operational costs.

And here’s a great tip: for traders seeking lower exposure, the micro Gold contract (MGC) offers a fantastic alternative, valued at just 1/10 of the standard contract (@GC).

Figure 5 – Performance and metrics of the trend-following strategy on Gold Futures with the Supertrend indicator.

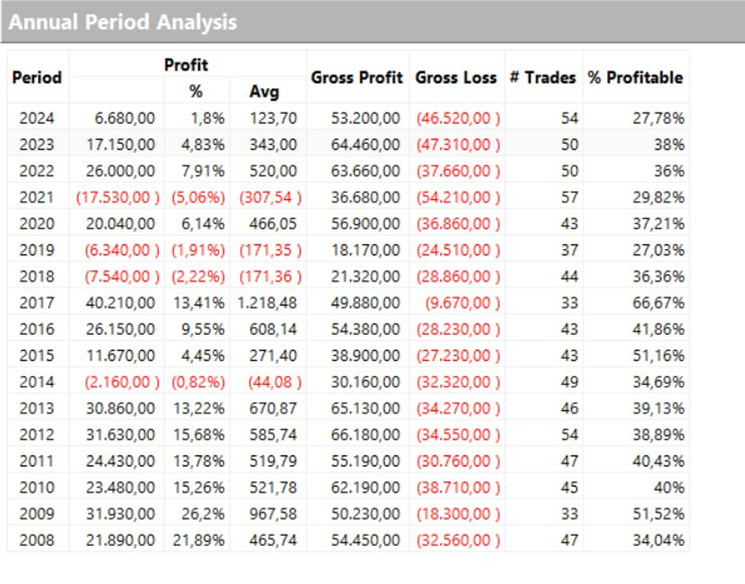

Here, we provide the annual breakdown of profits, showcasing outstanding performance, especially in recent years, with notable results beginning in 2022.

Figure 6 – Annual performance of the trend-following strategy on Gold Futures with the Supertrend indicator.

Strategy #2: Trend Following on Gold Futures Using High/Low Breakouts

Now let’s dive into the second strategy, which operates on a 5-minute time frame. Its logic is simple yet powerful, following the trend by leveraging breakouts of the session’s highs and lows—either upward or downward.

Figure 7 – Sample trades executed by the trend-following strategy based on high/low breakouts on Gold Futures.

This strategy trades far more frequently than the first one due to its setup. To enhance performance, operational filters based on specific patterns have been introduced. These filters help boost the average trade value and weed out less profitable trades, ensuring a more efficient system.

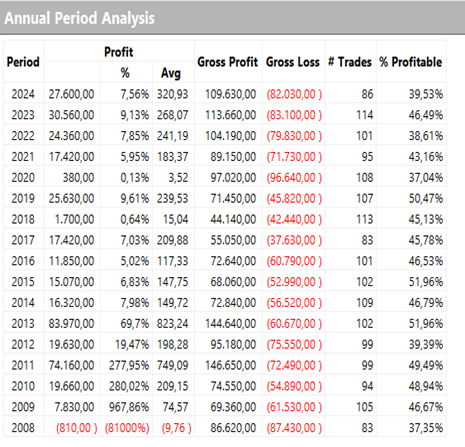

Now, let’s break down the performance starting with the equity line (Figure 7). The curve reflects a remarkably consistent trend over the years, with standout results in recent times. In fact, the equity line is currently at an all-time high. In 2023 alone, the strategy generated over $30,000 in profits, with almost $28,000 so far this year.

Figure 8 – Equity line for the trend-following strategy on Gold Futures using high/low breakouts.

Figure 9 – Annual performance of the trend-following strategy on Gold Futures using high/low breakouts.

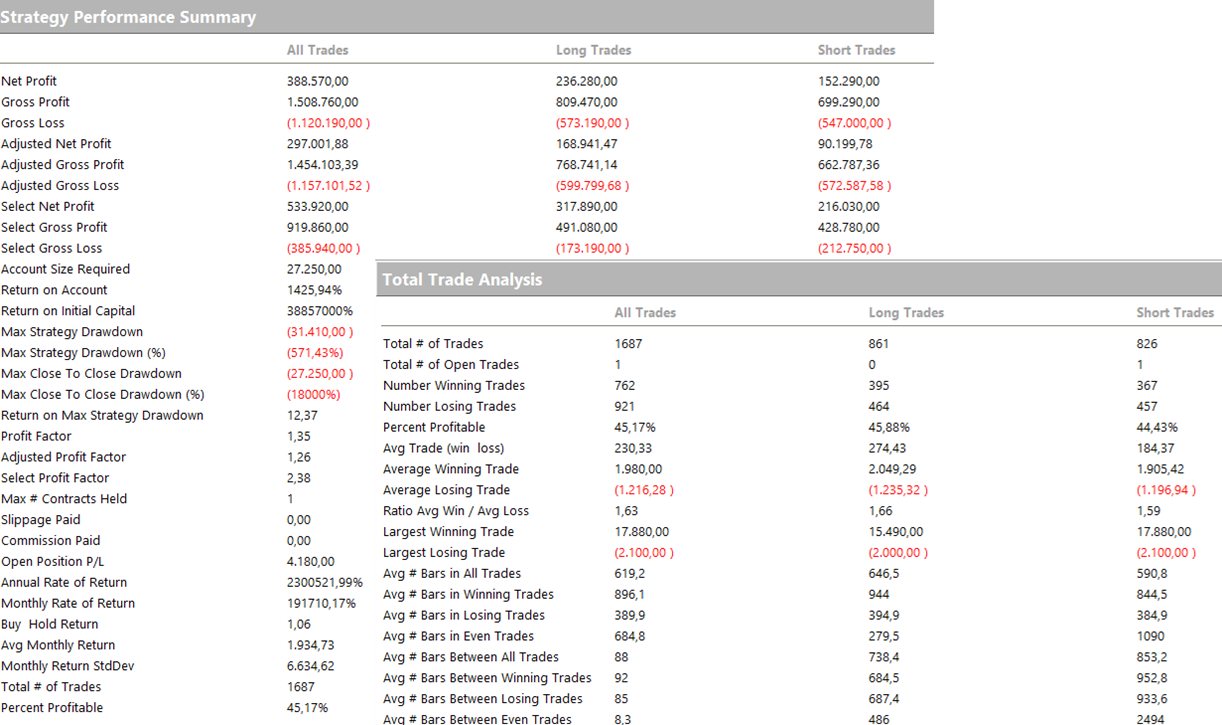

When we dig into the metrics, the numbers speak for themselves. From 2010 to today, this strategy has delivered a total net profit of about $388,000 with a maximum drawdown of -$31,410. This gives a robust "Return on Max Strategy Drawdown" of over 12. The average trade value is equally impressive at $230, comfortably covering operational costs.

Figure 10 – Performance metrics for the trend-following strategy on Gold Futures using high/low breakouts.

Final Thoughts on These Two Multiday Trend-Following Strategies for Gold Futures

In this article, we explored two compelling strategies for trading Gold Futures. The first relies on the Supertrend indicator, while the second focuses on a simple yet effective breakout of highs and lows. Both have demonstrated excellent performance, making them valuable tools for systematic traders working with such a key asset.

These findings highlight the importance of systematic, diversified approaches to achieve optimal trading results. With their proven performance and clear logic, these strategies offer a strong foundation for anyone looking to develop new trading systems.

Until next time, happy trading!

That’s a wrap for today. See you soon!

P.S.: Want to learn more about the Supertrend indicator? Check out our in-depth video here Supertrend Indicator: Easy Explanation + How to Use It in a Trading Strategy (Open-Source Code)

Transcription

Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.