Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.

Welcome back to our regular update on the trading systems currently in our portfolio. Today, we’re focusing on two trend following strategies that have performed exceptionally well in recent weeks on the Nasdaq index—the US tech market that offers plenty of opportunities for systematic traders like us.

Both strategies have delivered excellent results lately, demonstrating their ability to ride the wave of increased volatility that has recently returned to the equity markets. While both follow a trend following logic, they use different triggers to determine when to enter the market.

1) Intraday Trend Following Strategy on the Nasdaq: Breakouts of Highs and Lows

This first strategy operates within the regular trading session of the stock market (9:30 AM–3:30 PM exchange time), using the session’s current high and low—recorded before 9:30 AM—as the respective entry levels for long and short trades. Entries are further filtered through a combination of neutral and directional price patterns. The strategy closes all open positions five minutes before the session ends, unless a stop loss or take profit level is hit beforehand.

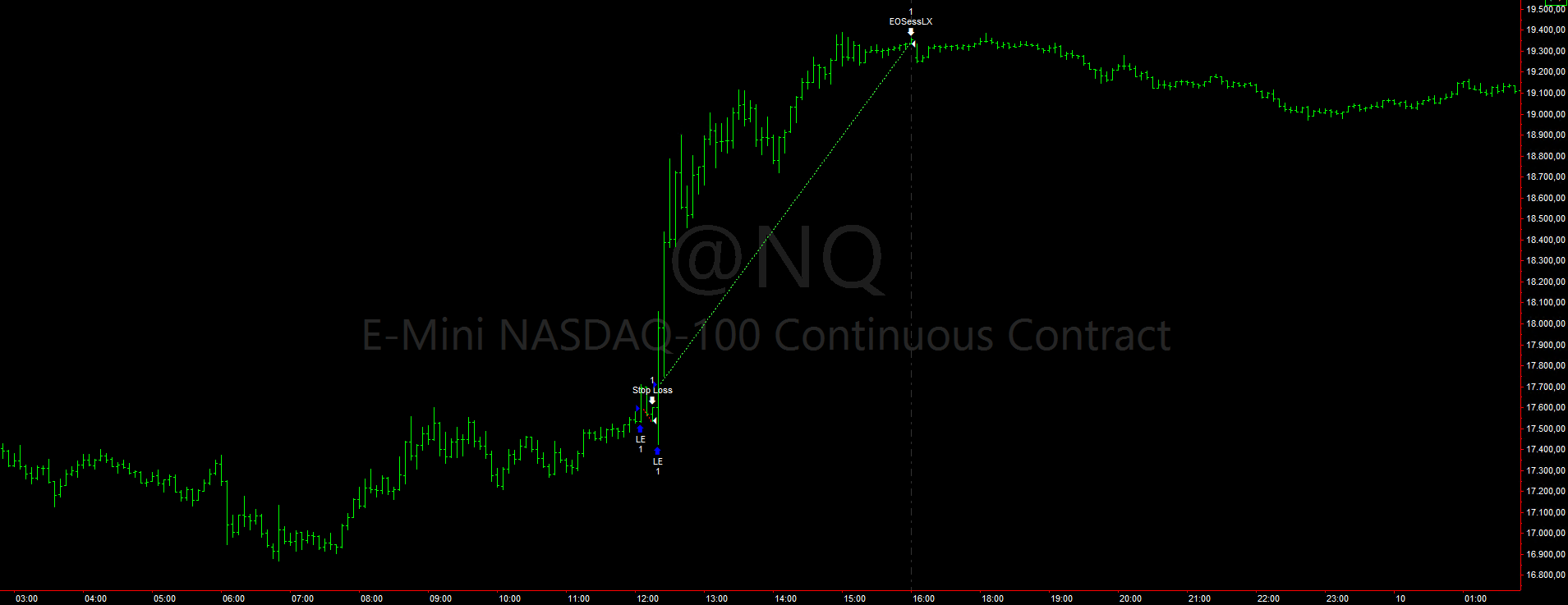

Figure 1 – Example of a trade executed by the intraday trend following strategy on the Nasdaq (NQ) future.

Figure 1 shows an example of a particularly successful trade executed on April 9, 2025, when the announcement of the suspension of tariffs imposed by Donald Trump triggered a strong market rebound—exactly the kind of volatility this type of strategy is designed to exploit.

As shown in Figure 2, the first few months of 2025—marked by a general rise in market volatility—have been especially favorable for this strategy, which generated an impressive $35,100 in profits in April alone.

Figure 2 – Monthly results from the start of 2025 for the intraday trend following strategy on the Nasdaq (NQ) future.

2) Multiday Trend Following Strategy on the Nasdaq Using Bollinger Bands

The second strategy operates on 120-minute bars and covers the full trading session of the Nasdaq futures market (from 5:00 PM to 4:00 PM the following day). It enters long positions only when the closing price of the most recent bar is higher than the upper Bollinger Band, calculated over the last 20 bars.

Positions are closed either after a maximum number of days or when a profitable bar opens and then closes below the average of recent closes.

Figure 3 – Example of a trade executed by the multiday trend following strategy on the Nasdaq (NQ) futures.

Figure 4 – Equity curve of the multiday trend following strategy on the Nasdaq (NQ) futures.

As shown in Figure 4, this strategy’s equity curve saw a sharp rise in the early months of 2025, thanks to several highly profitable trades (each with a take profit of over $7,000), allowing it to generate a total of $12,600 in April alone.

Conclusion: Profitable Systematic Strategies on the Nasdaq Future Even in Highly Volatile Conditions

In April, these two systematic strategies on the Nasdaq successfully capitalized on the volatility sparked by ongoing news about Trump’s shifting trade policies toward many other countries.

Together, these two trading systems generated nearly $50,000 on the E-Mini Nasdaq contract in just one month—equivalent to about $5,000 on the Micro E-Mini Nasdaq, a product that allows the strategy to be scaled even with smaller capital compared to the full-size contract.

Would you also like to learn how to develop profitable systematic strategies on the Nasdaq and other major markets?

Book a free call with one of our experts: you’ll discover how our trading method works, what the requirements are to apply it, and the next steps to start your journey.

Happy trading, and see you next time!

Transcription

Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.