Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.

Welcome back to another edition of our regular overview of the systems in our portfolio. Today we’ll focus on two strategies: one is based on a multiday trend-following approach, and the other is a bias-breakout strategy based on hourly bars, both applied to RBOB Gasoline, a futures market within the energy sector.

Both strategies have demonstrated excellent performance recently and can be considered valuable diversification elements within our portfolio.

Strategy n. 1: Multiday Trend-Following with Price Channel

The first strategy places entry orders at the day’s extreme price levels. It operates on a 15-minute timeframe and generates entry signals when prices break above the previous session’s highs or below its lows.

Once entered, the position is held until the stop-loss level is reached or for a maximum duration of 4 days.

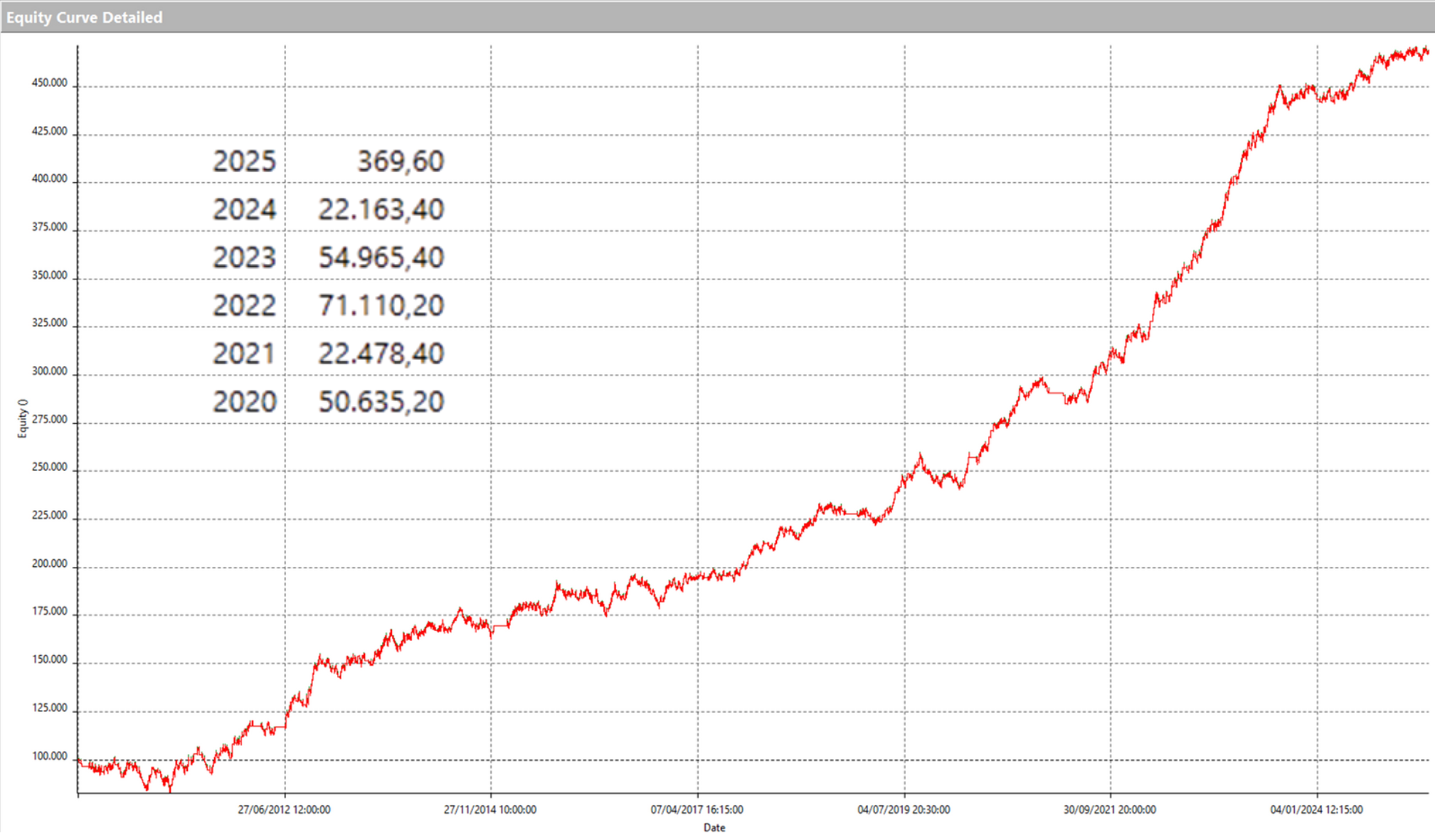

In 2024, the strategy generated profits exceeding $22,000, giving us good expectations for 2025, which began a couple of months ago.

The equity line shows consistent performance, although with a slightly different slope in recent years compared to the 2020–2023 period.

Figure 1 – Equity Line since 2010 and annual profit distribution from 2020 of the Multiday Trend-Following strategy with Price Channel.

Strategy n. 2: Multiday Trend-Following/Bias Breakout

The second strategy is hybrid—a mix between trend-following and bias logic, basing its entries on the previous bar’s highs and lows (60-minute bars) at specific times during the day, differing for long and short entries.

The core idea of this strategy is to trade long or short only during the statistically most favorable periods of the session and to place breakout orders to avoid entering the market in the absence of a clear trend.

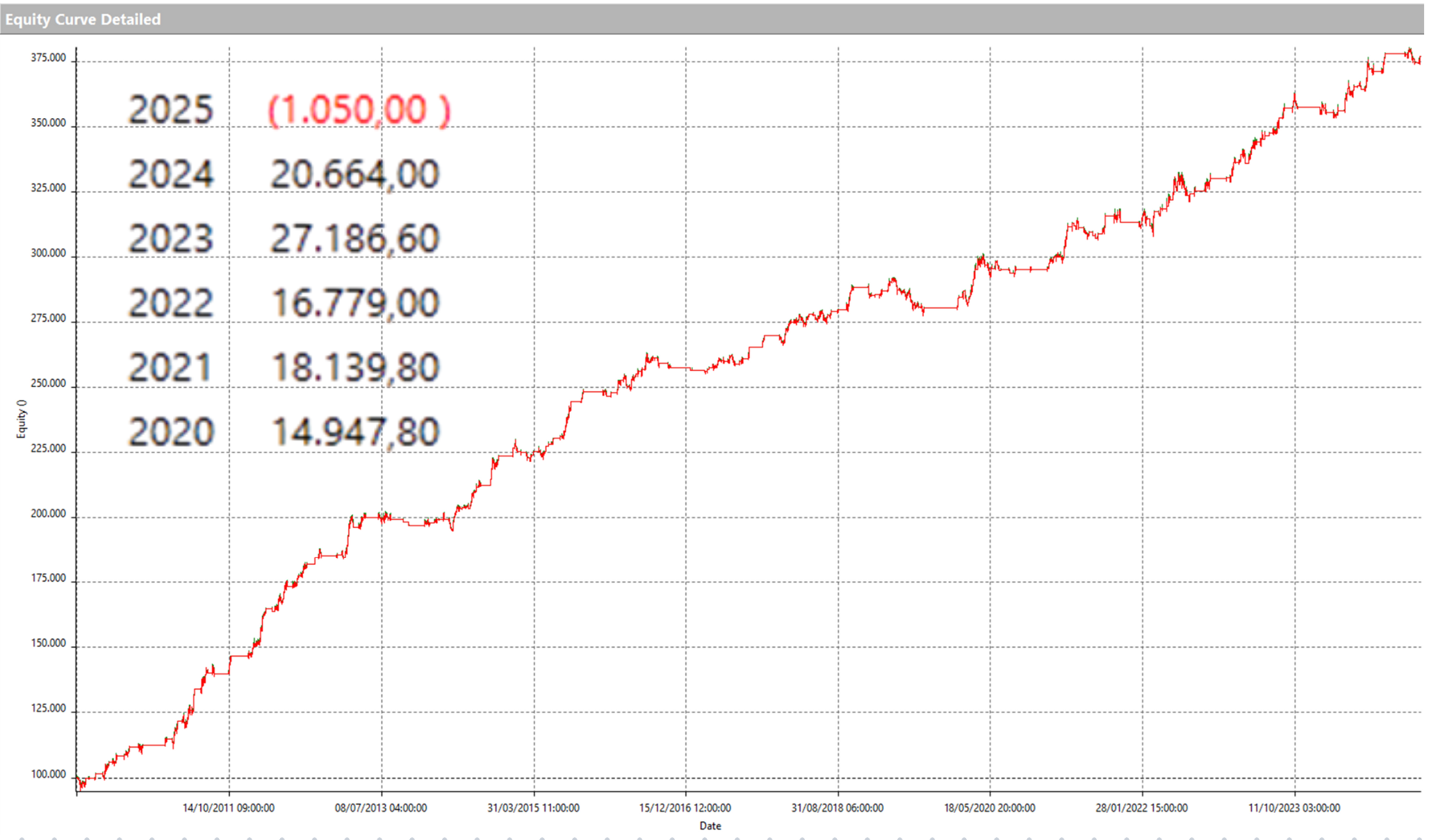

Once entered, the position is closed after approximately ten hours.

This strategy has consistently provided excellent results over the years, and 2024 was no exception, with profits exceeding $20,000. However, 2025 has started slower, although two months are undoubtedly insufficient to draw any definitive conclusions about this strategy’s annual performance.

Figure 2 – Equity Line since 2010 and annual profit distribution from 2020 of the Multiday Trend-Following/Bias Breakout strategy.

Conclusions on the Two Multiday Trend-Following Strategies on Gasoline

RBOB Gasoline is a highly volatile future, and while strongly correlated with energy markets like Crude Oil and Heating Oil, it nonetheless offers significant diversification potential.

However, we should emphasize that it is not easily accessible with small trading accounts. Indeed, the RBOB Gasoline future is among the riskiest futures available for several reasons, including:

•High contract value (there is no reliable micro-contract available)

•Low trading volume

•Reduced liquidity (especially during certain nighttime hours).

If your goal is to develop robust, thoroughly tested, and long-term efficient trading strategies, we encourage you to explore our methodology and book a free call with one of our experts!

Until next time, and happy trading!

Transcription

Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.