Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.

Welcome back to a new update on the systems currently in our portfolio. Today, we’ll focus on a couple of strategies that trade the futures contract on the world’s most renowned stock index: the S&P 500.

We’ll provide a summary of each strategy’s core rules—particularly their entry logic and current performance metrics—with the goal of offering useful insights and inspiration for developing new trading systems on this instrument.

Given the heightened market volatility of recent months, it will be especially interesting to assess the current health of our systems in this context.

1) Multiday Breakout Trading Strategy on the S&P 500

Let’s begin with the first strategy. It operates exclusively on the long side and uses a 15-minute time frame. This is a classic breakout system that identifies key price levels based on the range of the previous trading session.

The position is closed after a certain number of bars unless it hits the predefined Stop Loss or Profit Target first. As is often the case, operational filters are applied—particularly some of the proprietary patterns from our internal libraries—to screen for the most profitable trades.

Figure 1 – Example trades executed by the multiday breakout strategy on the S&P 500 futures.

Below you can see the equity line covering the system’s entire trading history from 2010 to the present. It’s clear that this approach on the @ES future started to perform very well beginning in 2020—the year of the pandemic—thanks to a sharp increase in market volatility, which is essential for strategies like this.

Figure 2 – Equity line of the multiday breakout strategy on the S&P 500 futures (2010–2025).

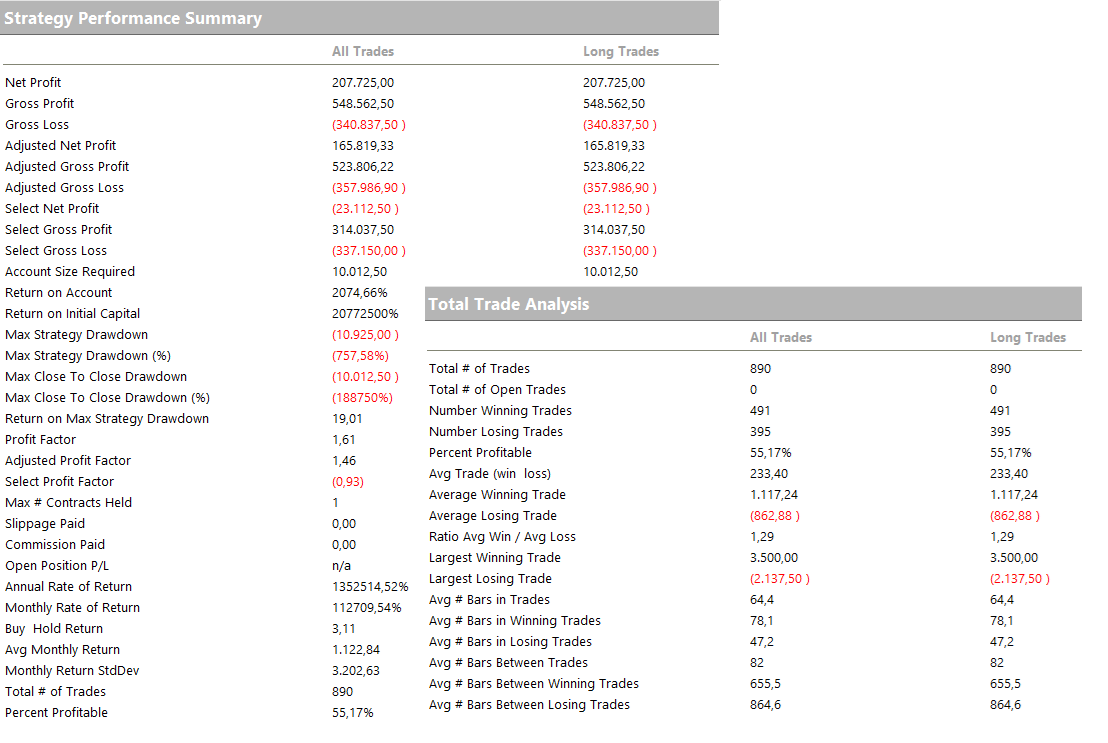

Next, we take a look at the strategy’s metrics. It shows a total net profit of over $200,000, with a very limited maximum drawdown of around $11,000. The average trade value stands at $230, which is an excellent figure given the characteristics of this market.

Figure 3 – Performance report of the multiday breakout strategy on the S&P 500 futures (2010–2025).

Looking at the annual performance, we can see that every year has been profitable except 2017, which historically experienced particularly low volatility. Even 2025, a year marked by significant declines in the underlying asset, has delivered positive results.

Figure 4 – Annual profit distribution of the multiday breakout strategy on the S&P 500 futures (2010–2025).

As always, it’s worth noting that this future, like others listed on the CME (the world’s largest regulated exchange), is also available in a micro version, with a contract size equal to 1/10 of the standard contract. This makes it more accessible to portfolios of all sizes.

2) Multiday Reversal Trading Strategy on the S&P 500 Using Bollinger Bands

Let’s move on to the second strategy, which also operates on a 15-minute time frame. This system follows a mean-reverting approach, entering countertrend positions using the well-known Bollinger Bands indicator to identify potential price reversal points.

Since it’s a multiday system, it can hold positions for multiple sessions, exiting either through traditional Stop Loss and Profit Target levels or via a more advanced trade management system that incorporates breakeven and trailing profit mechanisms.

Figure 5 – Example trades executed by the multiday reversal strategy on the S&P 500 futures.

When analyzing the detailed equity curve, we can observe a steadily rising trajectory, with the system delivering consistent and positive performance over time.

Figure 6 – Profit curve of the multiday reversal strategy on the S&P 500 futures (2010–2025).

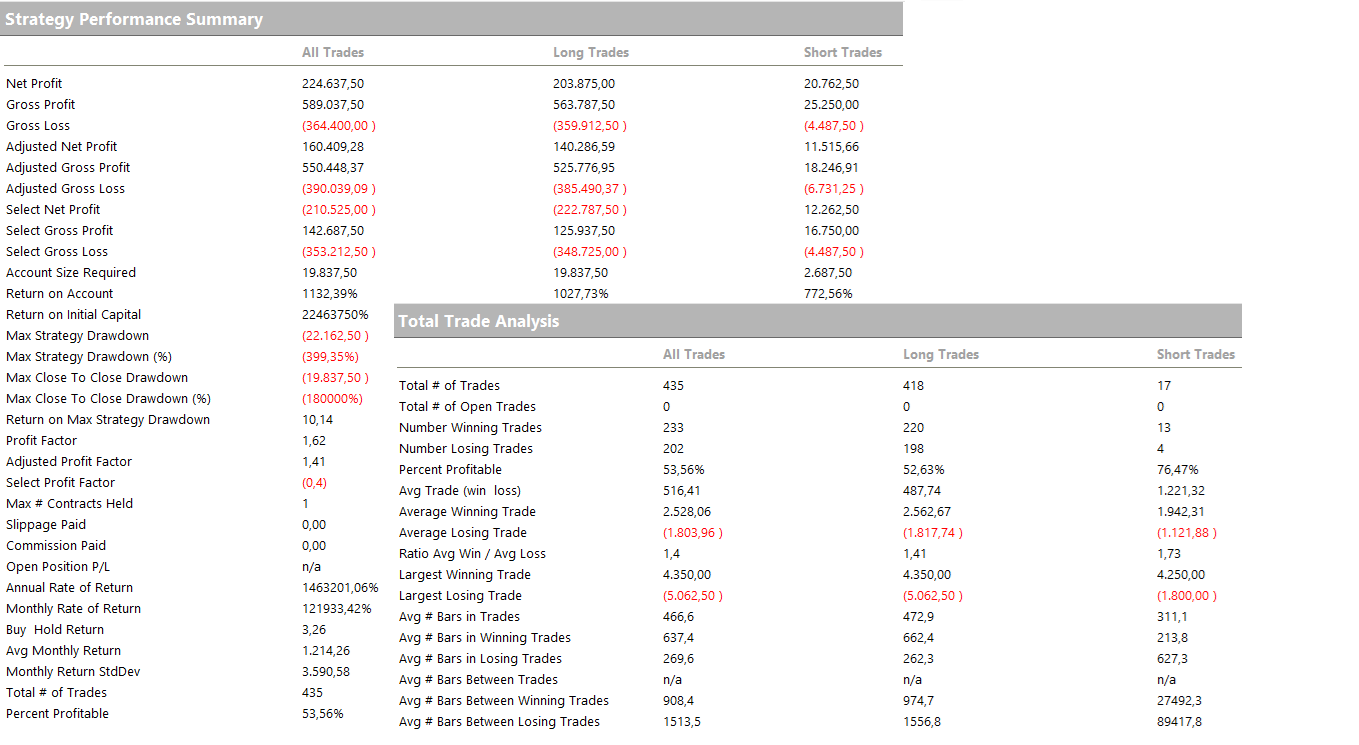

Let’s now take a look at the Strategy Performance Summary and the Total Trade Analysis. The system shows a total net profit of approximately $225,000. As expected for a countertrend strategy, the maximum drawdown is higher than in the previous strategy. Notably, the average trade value exceeds $500, which is a particularly strong result.

Figure 7 – Performance report of the multiday reversal strategy on the S&P 500 futures (2010–2025).

This strategy also delivered positive results in 2025, a year that proved challenging for many systems—especially those operating in a countertrend mode.

Figure 8 – Annual profit distribution of the multiday reversal strategy on the S&P 500 futures (2010–2025).

Conclusion: Proven Strategies and Ideas for Your Trading

We hope this article has helped you discover new ideas for your own systems by taking advantage of the inefficiencies the markets present!

Would you like to learn how to build automated strategies like these and start systematic trading on futures?

Book a free consultation with an Unger Academy® expert today.

In less than an hour, you’ll find out if our algorithmic trading method is the right fit for you.

Happy trading, and see you next time!

Transcription

Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.