Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.

In this article, we’ll analyze the performance of two standout strategies from our proprietary database. Both are designed to trade the most important equity future in Europe—the DAX future—and have been operating out-of-sample for several years now.

What’s particularly interesting is that, despite relying on opposite trading logics (Trend Following and Reversal), both strategies have performed remarkably well recently. This suggests they’re well aligned with the current price dynamics of the underlying asset, which seems to have regained the vigor of its best-performing years.

1) Multiday Trend Following Strategy on the DAX Future Using the Donchian Channel

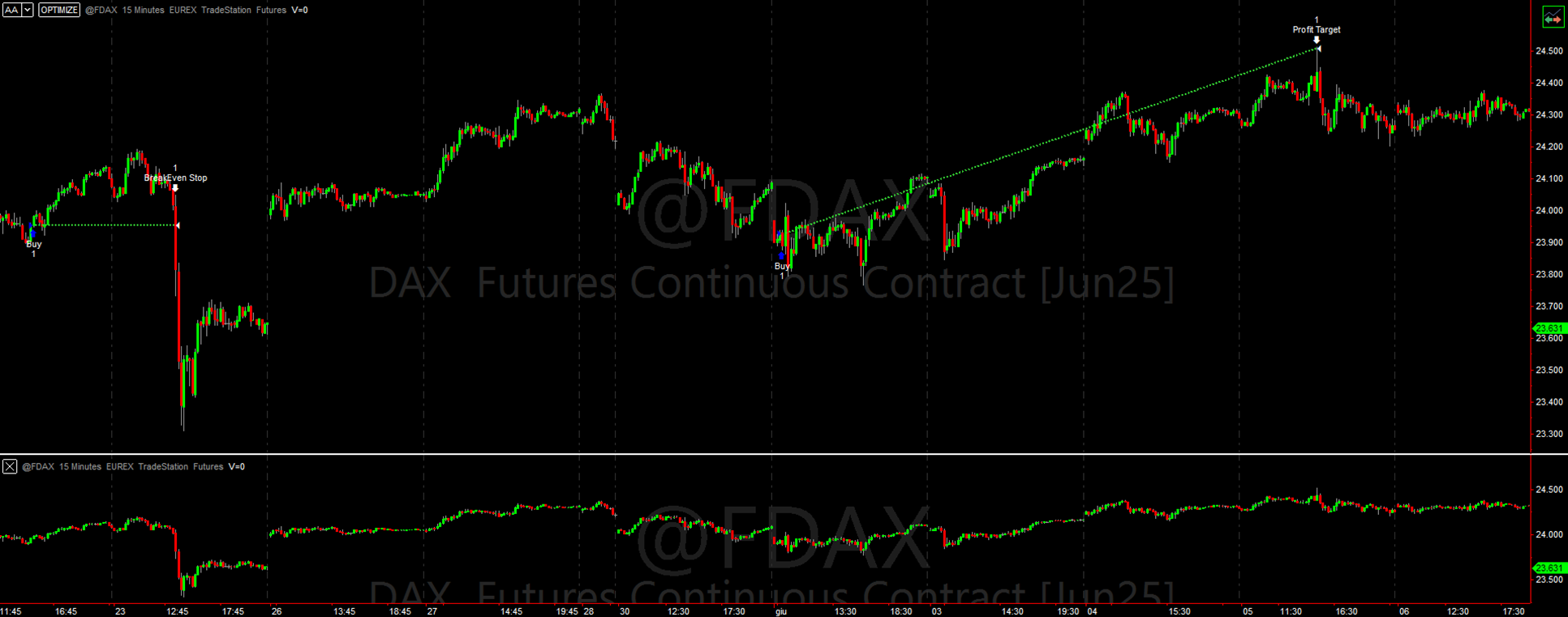

The first strategy operates on a 15-minute timeframe for both Data1 and Data2, using the classic trading session from 8:00 AM to 10:00 PM. It’s powered by a traditional n-period Donchian Channel calculated on Data2, which determines the entry levels.

Long trades are triggered by breakouts above the upper band of the channel, while short trades are entered when the price breaks below the lower band.

The system also integrates proprietary pattern filters to identify the most favorable trade setups. As mentioned, this is a multiday strategy, so positions can remain open across several sessions.

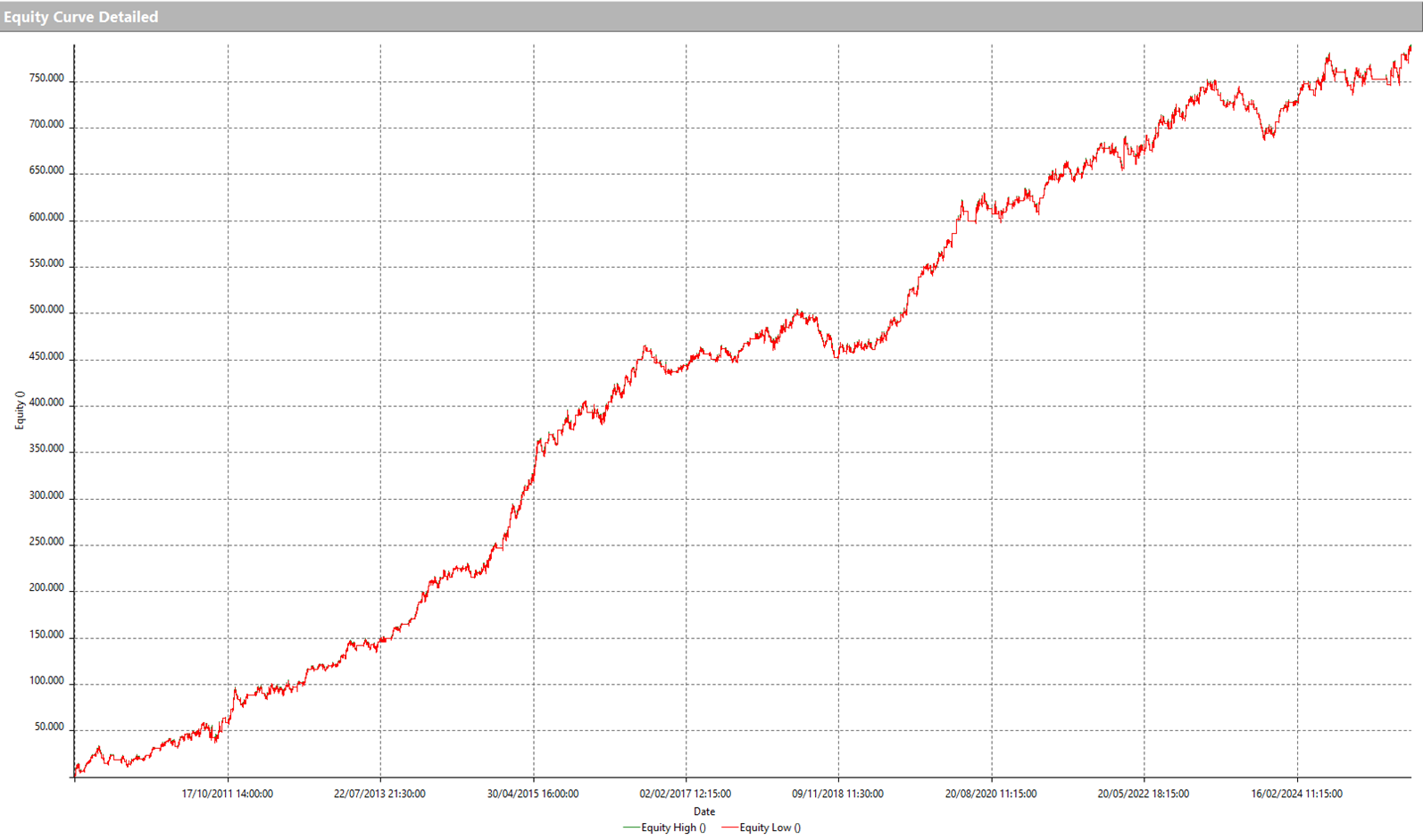

Figure 1 – Example trades executed by the multiday trend-following strategy on the DAX futures.

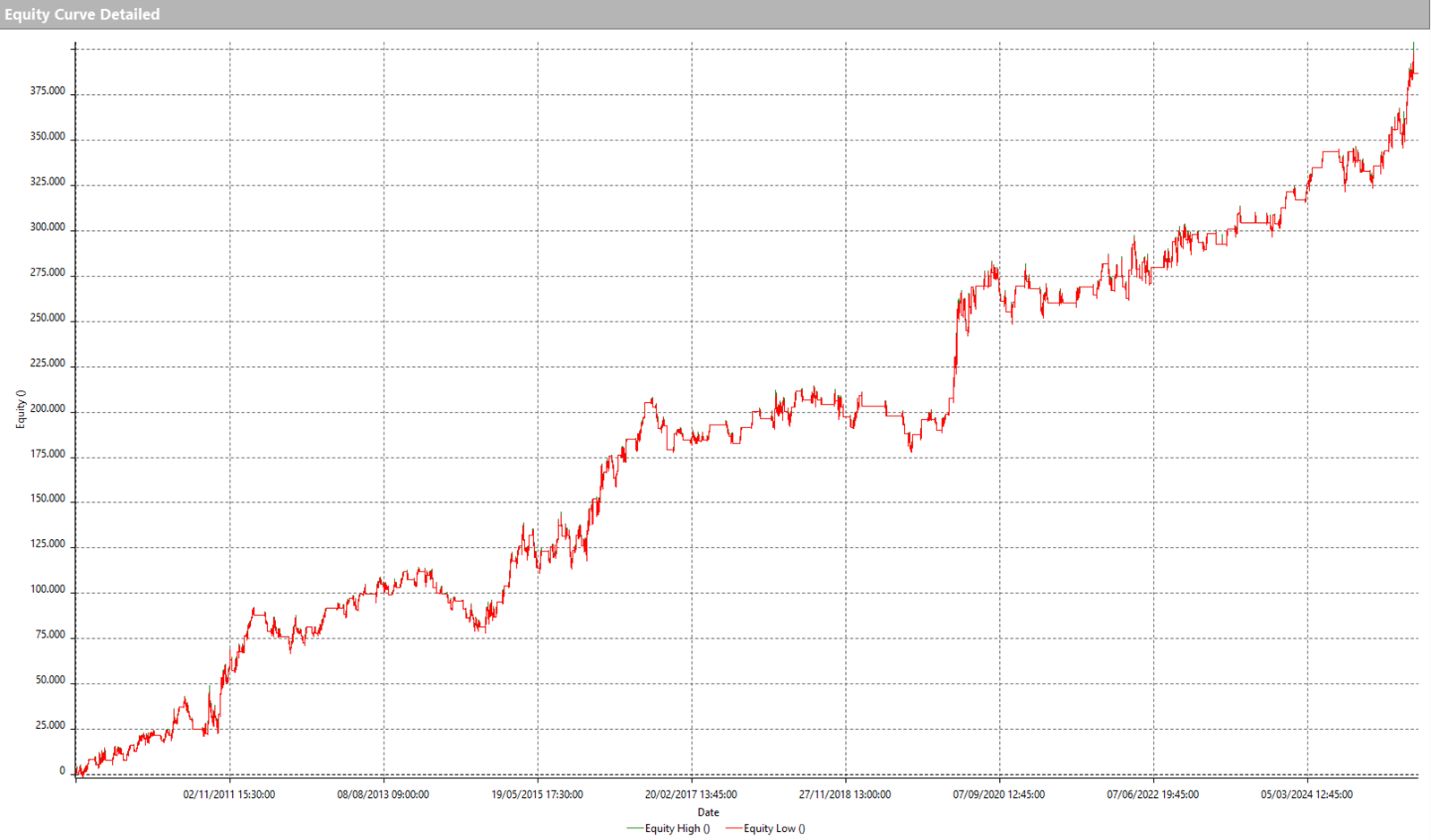

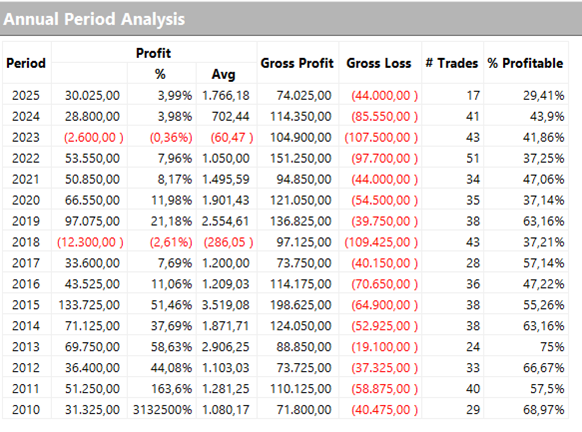

Below, you can see the strategy’s equity curve from 2010 to today. It’s clear that in the past year, performance has accelerated significantly, thanks to a favorable trend in the underlying asset. In fact, this system has already generated more than €50,000 in just under six months of trading in 2025, an impressive result by any standard.

Figure 2 – Equity curve of the multiday trend-following strategy on the DAX futures.

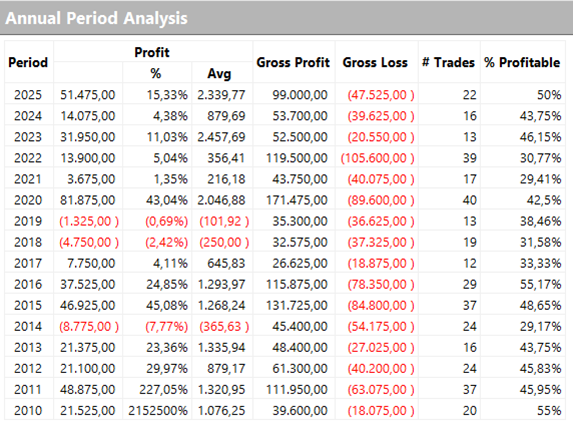

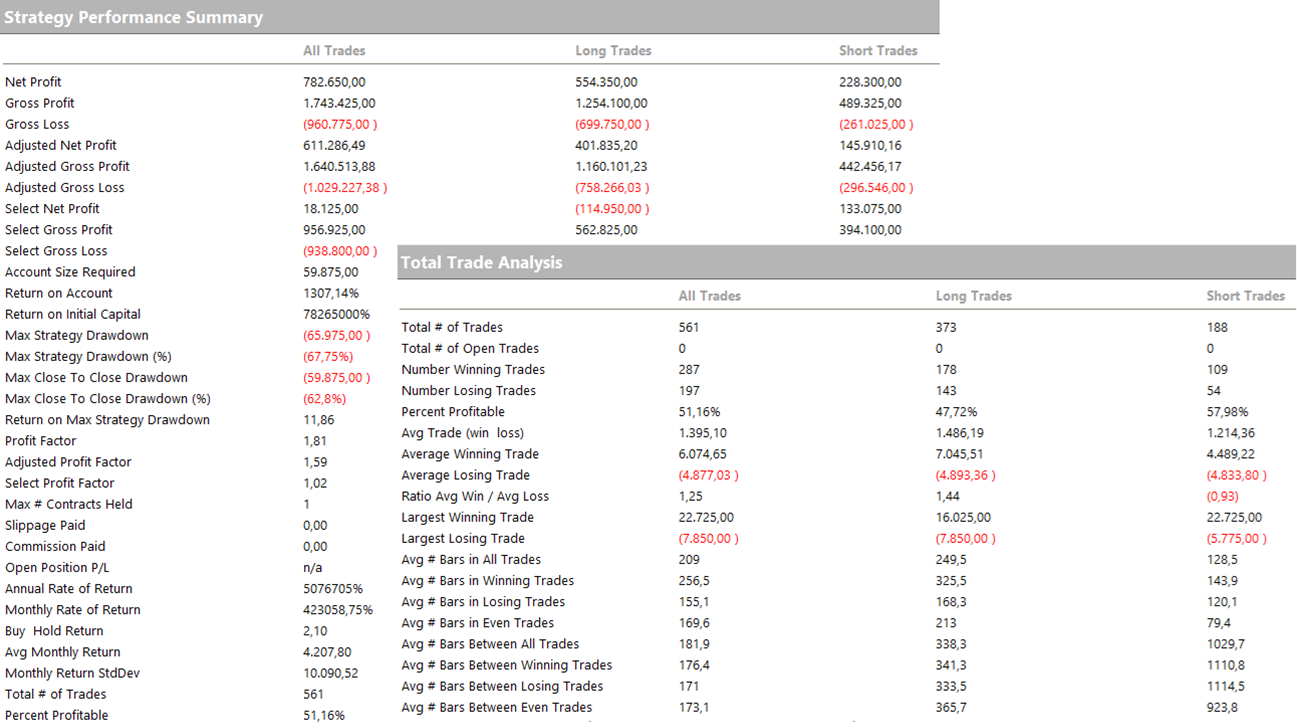

Figure 3 – Annual profit distribution of the multiday trend-following strategy on the DAX futures.

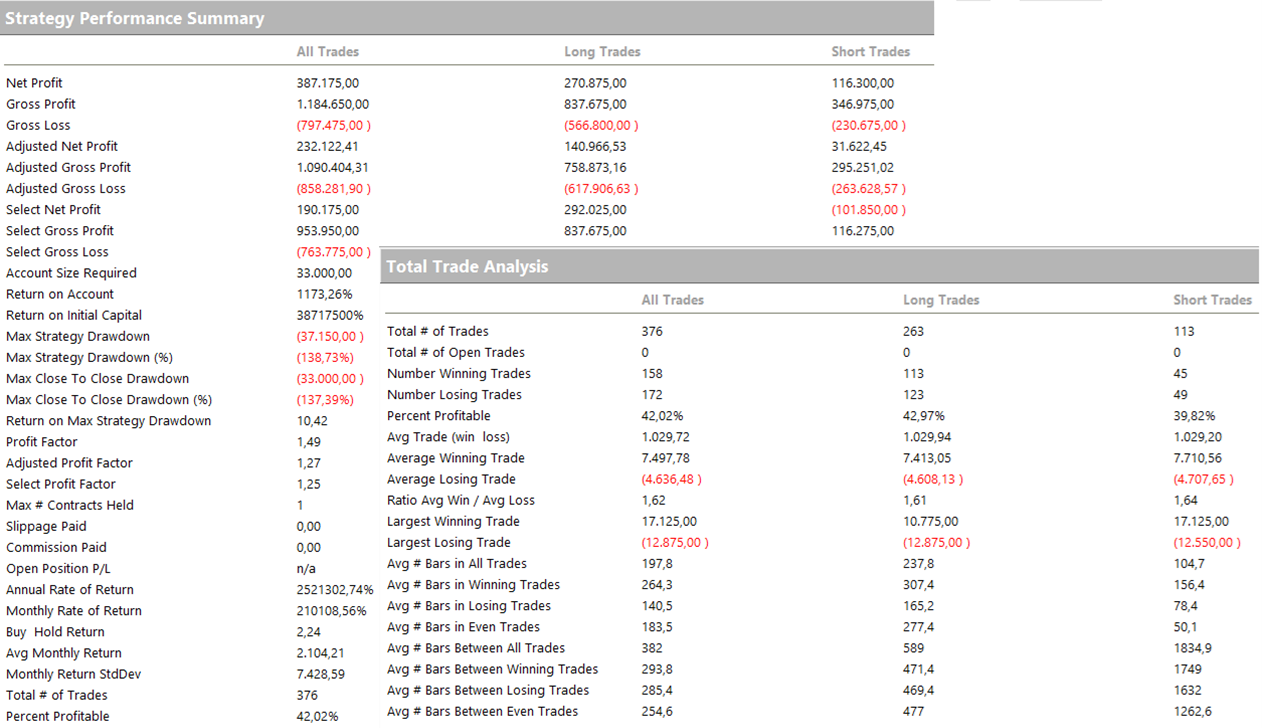

Now let’s look at the key performance metrics. The most notable is the high average trade value—over €1,000—thanks to the relatively low number of trades and their extended duration.

Figure 4 – Overall performance report of the multiday trend-following strategy on the DAX futures.

It’s worth noting that the DAX future is an exceptionally versatile instrument, which adapts well not only to Trend Following and Mean Reverting strategies, but also to bias-based systems, and it’s also suitable for a wide range of portfolio sizes.

There are three contract types available:

• The full-size DAX future (used in this article and in our portfolio reports)

• The mini-DAX, which is 1/5 the size of the full contract

• The micro-DAX, introduced more recently and equal to 1/25 of the full contract

All three have excellent liquidity, giving traders the flexibility to choose the contract size that best fits their capital.

2) Multiday Reversal Strategy on the DAX Future Using Bollinger Bands

The second strategy operates on the same timeframes as the first (15 minutes for both Data1 and Data2) but takes a mean-reverting approach, entering trades based on short-term price reversals following strong upward or downward moves.

These price extremes are identified using Bollinger Bands on Data2.

Here’s how the logic works:

• If the price breaks the lower band and then closes back above it, a long position is opened.

• Conversely, if the price breaks the upper band and then closes back below it, a short position is entered.

Figure 5 – Example trades executed by the multiday reversal strategy on the DAX futures.

As always, we’ve added several operational filters to improve the average trade value.

Looking at the equity curve, the strategy shows a strong and steady upward trend, even smoother than the previous strategy. Its 2025 performance is also excellent, with a net profit of €30,000.

Figure 6 – Profit curve of the multiday reversal strategy on the DAX futures.

Figure 7 – Annual profit distribution of the multiday reversal strategy on the DAX futures.

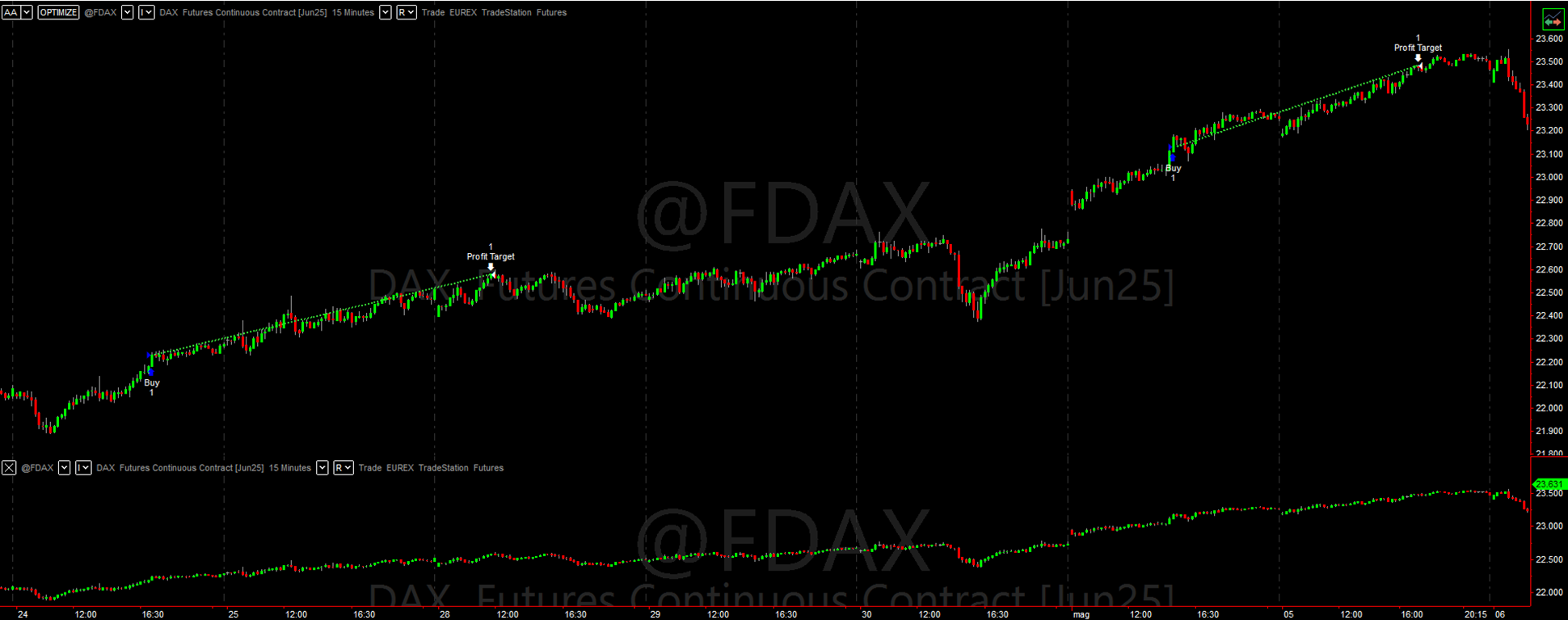

Let’s now dive into the Total Trade Analysis. This strategy executes more trades than the first one (561 vs. 376), with an average trade value of €1,395, well balanced between the long and short sides, and more than enough to cover live trading costs like slippage and commissions.

Also noteworthy is the total net profit: nearly €800,000, a truly remarkable figure given the large size of the standard DAX contract.

Figure 8 – Overall performance report of the multiday reversal strategy on the DAX futures.

Conclusion

We hope this article provided you with useful insights and inspiration for building your own strategies in this fascinating market.

Would you like to learn how to build automated strategies like these and start systematic trading on futures?

Book a free consultation with a Unger Academy® expert today.

In less than an hour, you’ll discover whether our algorithmic trading method is a good fit for you.

Happy trading, and see you next time!

Transcription

Need More Help? Book Your FREE Strategy Session With Our Team Today!

We’ll help you map out a plan to fix the problems in your trading and get you to the next level. Answer a few questions on our application and then choose a time that works for you.